Section 80CCD of the Income Tax Act, 1961, provides significant tax benefits for individuals investing in specific retirement savings plans. This section is primarily aimed at encouraging long-term savings for retirement through contributions to pension schemes such as the National Pension System (NPS) and the Atal Pension Yojana (APY). Understanding the nuances of this section can help taxpayers optimize their investments and reduce their taxable income effectively.

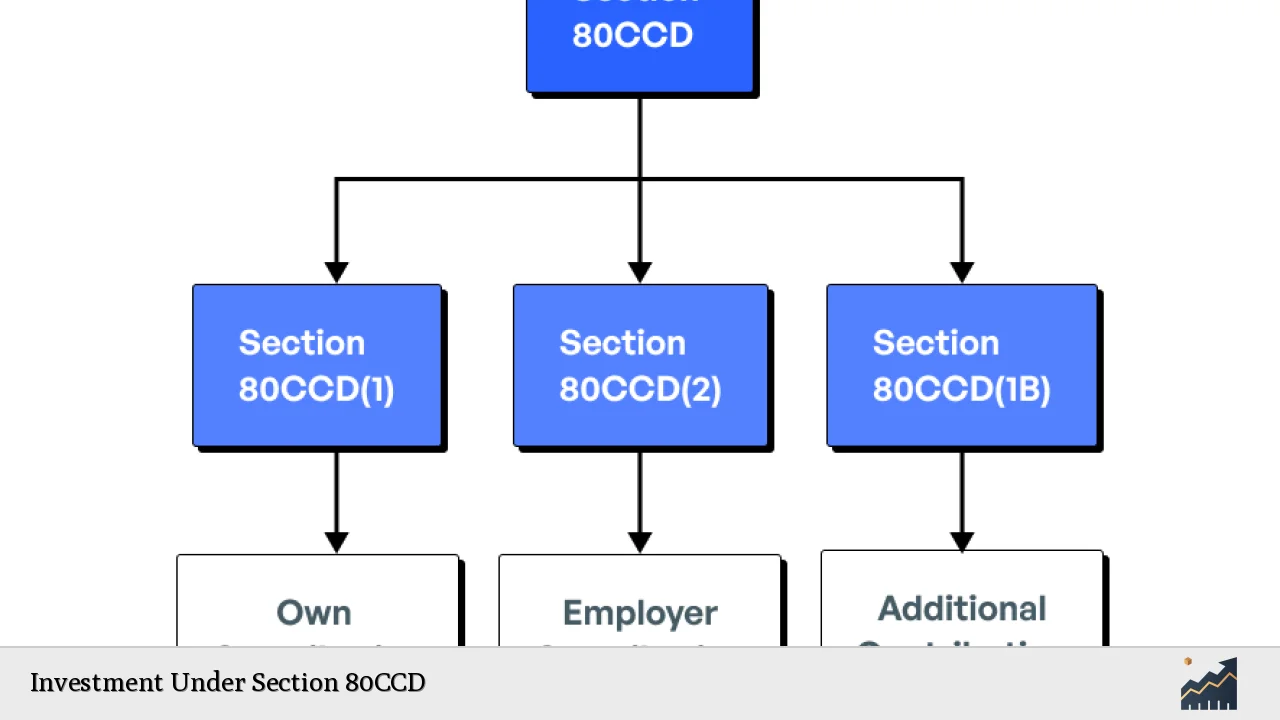

The tax deductions available under Section 80CCD are divided into different subsections, each catering to various types of contributions. The key subsections include 80CCD(1), 80CCD(1B), and 80CCD(2). Each subsection has distinct limits and eligibility criteria, making it essential for taxpayers to comprehend these details to maximize their tax benefits.

| Subsection | Details |

|---|---|

| 80CCD(1) | Tax deduction for self-contributions to NPS or APY up to Rs. 1.5 lakh. |

| 80CCD(1B) | Additional deduction for NPS contributions up to Rs. 50,000. |

| 80CCD(2) | Employer’s contribution to an employee’s NPS account, up to 10% of salary. |

Understanding Section 80CCD

Section 80CCD is designed to promote retirement savings among Indian citizens by providing tax incentives for contributions made towards recognized pension schemes. The primary focus is on the NPS, which is a government-backed scheme that allows individuals to invest in a mix of equity, corporate bonds, government securities, and alternative investment funds.

Individuals aged between 18 and 70 years can invest in the NPS, making it accessible for a wide range of contributors. The contributions made under this scheme not only help in building a retirement corpus but also provide substantial tax benefits under Section 80CCD.

The section is divided into three parts:

- 80CCD(1): This part allows individuals to claim deductions on their own contributions to the NPS or APY. The maximum deduction allowed is 10% of the salary (for salaried individuals) or 20% of gross income (for self-employed individuals), subject to an overall limit of Rs. 1.5 lakh.

- 80CCD(1B): This subsection provides an additional deduction specifically for investments made in the NPS. Taxpayers can claim an extra deduction of up to Rs. 50,000, which is over and above the limit set in Section 80CCD(1).

- 80CCD(2): This part pertains to employer contributions towards an employee’s NPS account. Employers can deduct up to 10% of the employee’s salary (including basic pay and dearness allowance), which is beneficial for both parties.

Contributions Eligible Under Section 80CCD

To avail of deductions under Section 80CCD, specific types of contributions are eligible:

- National Pension System (NPS): This is the primary investment vehicle under Section 80CCD. Contributions made into a Tier-I account of the NPS qualify for tax deductions.

- Atal Pension Yojana (APY): Contributions made towards APY also qualify for deductions under this section.

It’s important to note that only contributions made towards the Tier-I account are eligible for tax benefits. Contributions to Tier-II accounts do not qualify under Section 80CCD.

Tax Benefits Under Each Subsection

Understanding the tax benefits associated with each subsection is crucial for effective financial planning:

Benefits of Section 80CCD(1)

Under this provision, individuals can claim deductions based on their contributions:

- For salaried individuals, the maximum deduction is limited to 10% of their salary (basic pay + dearness allowance).

- Self-employed individuals can claim deductions up to 20% of their gross income.

This deduction helps reduce taxable income significantly, potentially lowering the overall tax liability.

Benefits of Section 80CCD(1B)

This subsection offers an additional layer of tax relief:

- An additional deduction of up to Rs. 50,000 can be claimed by individuals contributing to the NPS.

This means that if an individual has already claimed deductions under Section 80CCD(1), they can still benefit from this extra deduction, leading to a total possible deduction of Rs. 2 lakh when combining both sections.

Benefits of Section 80CCD(2)

Employer contributions are treated differently:

- Employers can deduct contributions made on behalf of employees up to 10% of their salary.

This provision not only incentivizes employers to contribute towards their employees’ retirement but also allows employees to benefit from additional tax deductions without impacting their own contribution limits.

Key Considerations When Investing Under Section 80CCD

When considering investments under Section 80CCD, there are several critical factors that taxpayers should keep in mind:

- Investment Limits: Be aware that while you can contribute more than the specified limits, only amounts within those limits will qualify for tax deductions.

- Age Requirement: Individuals must be between 18 and 70 years old to invest in NPS and claim deductions under this section.

- Long-Term Commitment: The investments in NPS are intended for long-term retirement planning; premature withdrawals may lead to penalties or reduced benefits.

- Documentation: Maintain proper documentation and receipts for all contributions made towards NPS or APY, as these will be required when claiming deductions during tax filing.

Common Misconceptions About Section 80CCD

Several misconceptions exist regarding Section 80CCD that can lead to confusion among taxpayers:

- Is Section 80CCD included in Section 80C? No, while both sections provide tax benefits, they operate independently. The total limit for deductions under both sections combined cannot exceed Rs. 2 lakh, with specific limits outlined for each section.

- Can I claim deductions on Tier-II accounts? No, only contributions made towards Tier-I accounts qualify for deductions under Section 80CCD; Tier-II accounts do not offer any tax benefits.

Conclusion

Section 80CCD serves as an essential tool for promoting retirement savings among individuals in India. By understanding its provisions and maximizing eligible contributions, taxpayers can significantly reduce their taxable income while securing their financial future through effective retirement planning.

Investing in schemes like the National Pension System not only provides immediate tax benefits but also ensures a stable income post-retirement. Therefore, it is crucial for individuals to assess their financial goals and consider leveraging these provisions effectively.

FAQs About Investment Under Section 80CCD

- What is Section 80CCD?

Section 80CCD provides tax deductions on contributions made towards retirement plans like NPS and APY. - How much can I claim under Section 80CCD?

You can claim a maximum deduction of Rs. 2 lakh by combining Sections 80CCD(1) and (1B). - Who is eligible for deductions under Section 80CCD?

Both salaried and self-employed individuals aged between 18 and 70 years are eligible. - Can I claim deductions on Tier-II NPS accounts?

No, only Tier-I account contributions qualify for deductions under Section 80CCD. - What happens if I withdraw from my NPS account prematurely?

Premature withdrawals may incur penalties and affect your overall retirement corpus.