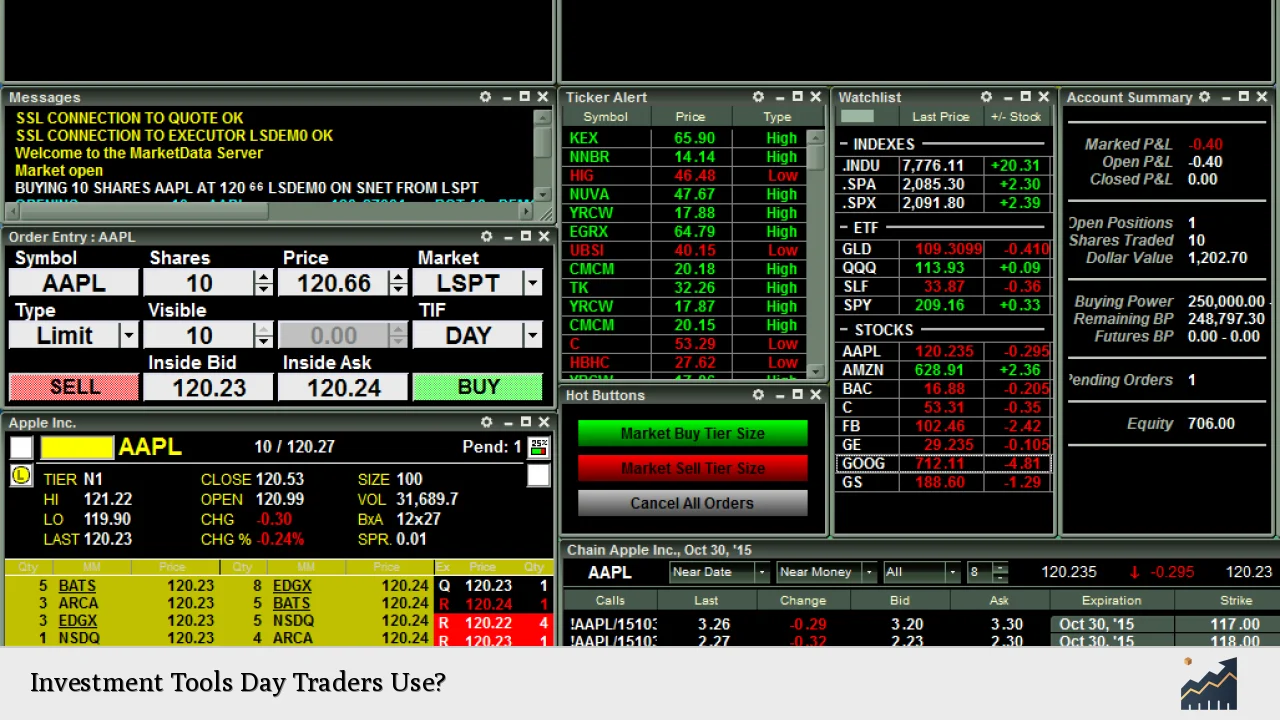

Day trading is a fast-paced trading strategy where traders buy and sell financial instruments within the same trading day. This approach requires a keen understanding of market movements, quick decision-making, and the right tools to optimize performance. The tools used by day traders are crucial for executing trades efficiently, analyzing market trends, and managing risks. In this article, we will explore the various investment tools that day traders utilize to enhance their trading strategies.

| Tool Type | Description |

|---|---|

| Online Brokers | Facilitate buying and selling of securities. |

| Charting Software | Visualize price movements and trends. |

| Stock Scanning Software | Identify potential stocks based on specific criteria. |

| Market Dashboards | Provide real-time information on market conditions. |

| Risk Management Tools | Help manage potential losses and set limits. |

Online Brokers

Online brokers are essential for day traders as they provide the platform for executing trades. Choosing the right broker can significantly impact trading success. Key features to consider include:

- Commission Rates: Many brokers offer low or zero commissions, which can save traders money on frequent trades.

- Execution Speed: Fast execution is critical in day trading, where every second counts.

- Trading Platform Features: Look for brokers that offer advanced tools, such as hotkeys for quick trades and direct market access.

Popular online brokers among day traders include Lightspeed Financial, Interactive Brokers, and Webull. These platforms cater specifically to active traders and often provide additional resources like educational materials and market analysis.

Charting Software

Charting software is vital for technical analysis in day trading. It allows traders to visualize price movements and identify trends that inform their trading decisions. Key functionalities of charting software include:

- Customizable Charts: Traders can customize timeframes, indicators, and chart types (e.g., candlestick, line).

- Technical Indicators: Tools like moving averages, Bollinger Bands, and Relative Strength Index (RSI) help analyze price trends.

- Drawing Tools: Features that allow users to draw trend lines and support/resistance levels enhance analytical capabilities.

Popular charting software options include eSignal, TC2000, and TradingView. These platforms provide comprehensive tools to help traders make informed decisions based on historical data.

Stock Scanning Software

Stock scanning software helps traders identify stocks that meet specific criteria for potential trades. This tool is crucial for filtering through thousands of stocks to find those with favorable conditions for trading. Features of stock scanning software include:

- Predefined Filters: Traders can use filters like volume spikes, price changes, or specific patterns (e.g., bull flags) to locate potential trades.

- Real-Time Updates: Many scanners provide real-time data to ensure traders have the latest information when making decisions.

- Customizable Searches: Users can create custom scans based on their trading strategies or preferences.

Warrior Trading Scanners are widely used among day traders for their effectiveness in identifying high-potential stocks quickly.

Market Dashboards

A market dashboard consolidates essential information into a single view, allowing day traders to monitor multiple aspects of the market simultaneously. Key features include:

- Real-Time Data: Dashboards provide live updates on stock prices, indices, and market news.

- Customizable Layouts: Traders can tailor their dashboards to display the most relevant information for their strategies.

- Alerts and Notifications: Many dashboards allow users to set alerts for specific price levels or news events that could impact their trades.

Using a market dashboard helps traders stay informed about market conditions without needing to switch between multiple sources of information.

Risk Management Tools

Effective risk management is crucial in day trading due to the inherent volatility of markets. Risk management tools assist traders in minimizing losses while maximizing potential gains. Important tools include:

- Stop-Loss Orders: Automatically sell a security when it reaches a certain price to limit losses.

- Position Size Calculators: Help determine how much capital to allocate per trade based on risk tolerance.

- Risk/Reward Ratio Calculators: Allow traders to evaluate potential profits against possible losses before entering a trade.

Implementing these tools can significantly improve a trader's ability to manage risk effectively while pursuing profitable opportunities.

Economic Calendars

An economic calendar is an essential tool for day traders as it provides information about upcoming economic events that could impact the markets. Key features include:

- Event Listings: Displays scheduled economic reports (e.g., unemployment rates, GDP releases) that may influence market movements.

- Impact Ratings: Events are often rated by their expected impact on the markets (high, medium, low), helping traders prioritize which events to monitor closely.

- Historical Data: Many calendars provide past data related to economic events, allowing traders to analyze how similar events affected markets previously.

Staying informed about economic events can help day traders anticipate price movements and adjust their strategies accordingly.

News Feeds

Access to real-time news feeds is critical for day traders as market sentiment can shift rapidly based on news developments. Important aspects of news feeds include:

- Timeliness: Traders need up-to-the-minute news updates to react quickly to market changes.

- Relevance: News feeds should focus on financial markets, economic indicators, and geopolitical events that could impact stock prices.

- Customization Options: Many platforms allow users to tailor news feeds based on specific stocks or sectors they are interested in tracking.

Utilizing reliable news sources helps traders make informed decisions based on current events affecting the markets.

Trading Journals

Maintaining a trading journal is an invaluable practice for day traders looking to improve their performance over time. A trading journal allows users to document:

- Trade Details: Record entry and exit points, position sizes, and outcomes of each trade for future reference.

- Emotional Reflections: Note emotional states during trades (e.g., fear or greed) which can impact decision-making processes.

- Performance Analysis: Analyze patterns in successful versus unsuccessful trades to identify strengths and weaknesses in strategies.

Regularly reviewing a trading journal helps traders refine their approaches and develop more effective strategies over time.

FAQs About Investment Tools Day Traders Use

- What are the essential tools for day trading?

The essential tools include online brokers, charting software, stock scanning software, market dashboards, and risk management tools. - How does charting software help day traders?

Charting software helps visualize price movements and identify trends using various technical indicators. - Why do day traders need stock scanning software?

Stock scanning software allows day traders to quickly identify stocks that meet specific criteria for potential trades. - What role does an economic calendar play in day trading?

An economic calendar informs traders about upcoming economic events that could affect market conditions. - How important is risk management in day trading?

Risk management is crucial as it helps minimize losses while maximizing potential gains through effective strategies.

In conclusion, utilizing the right investment tools is vital for success in day trading. By leveraging online brokers, charting software, stock scanning tools, market dashboards, risk management resources, economic calendars, news feeds, and trading journals, day traders can enhance their decision-making processes and improve overall performance in the competitive landscape of financial markets.