Understanding investment strategies involves a deep dive into the art of risk analysis, which is essential for both novice and seasoned investors. Risk analysis is not merely about avoiding losses; it’s about strategically navigating uncertainties to maximize potential returns. This comprehensive guide explores market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks in investment strategies.

| Key Concept | Description/Impact |

|---|---|

| Risk Assessment | The process of identifying and evaluating risks to make informed investment decisions. Effective risk assessment helps investors align their portfolios with their risk tolerance and financial goals. |

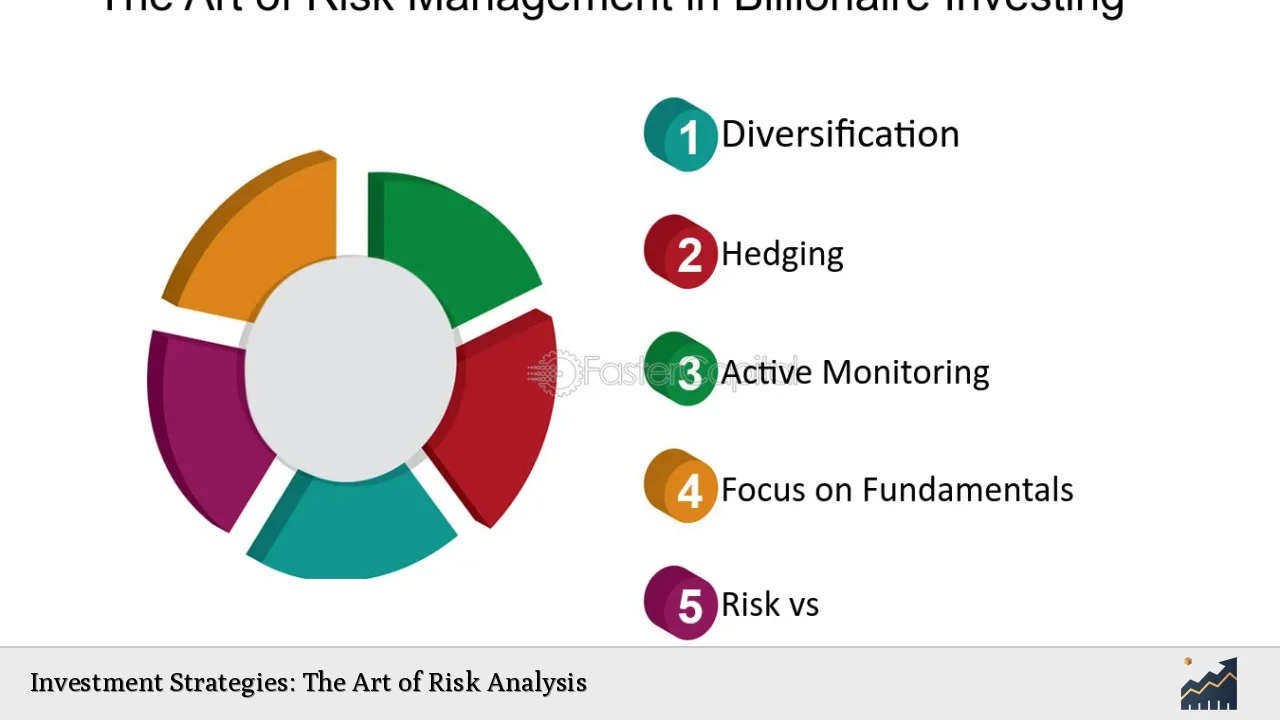

| Diversification | A fundamental strategy that involves spreading investments across various asset classes to minimize risk. Diversification reduces the impact of poor performance in any single investment. |

| Market Volatility | The degree of variation in trading prices over time. Understanding volatility is crucial for managing risks and capitalizing on market opportunities. |

| Regulatory Compliance | Adhering to laws and regulations governing financial markets. Compliance is essential to avoid legal penalties and maintain investor trust. |

| Behavioral Finance | A field that examines the psychological factors influencing investor behavior. Understanding these biases can improve decision-making processes. |

Market Analysis and Trends

The current investment landscape is shaped by several key trends that investors must navigate:

- Economic Recovery: As global economies recover post-pandemic, growth rates are expected to stabilize around 2% in the U.S. by 2025, influenced by policy changes and inflation control measures.

- Sector Rotation: Recent trends indicate a shift from technology stocks to sectors like healthcare and real estate, driven by changing investor sentiment and market dynamics.

- Interest Rates: With expectations of Federal Reserve rate cuts in 2024, investors are advised to adjust their portfolios accordingly, favoring sectors that benefit from lower borrowing costs.

- Geopolitical Factors: Ongoing geopolitical tensions and trade policies significantly affect market conditions, creating both risks and opportunities for investors.

These trends highlight the importance of continuous market analysis to adapt investment strategies effectively.

Implementation Strategies

To effectively implement risk analysis in investment strategies, consider the following approaches:

- Asset Allocation: Determine the right mix of asset classes (stocks, bonds, real estate) based on individual risk tolerance and investment goals.

- Active Management: Engage in active portfolio management to respond swiftly to market changes, thereby mitigating risks associated with passive investing.

- Use of Technology: Leverage advanced analytical tools and AI-driven platforms for data analysis and predictive modeling to enhance decision-making processes.

- Regular Review: Conduct periodic reviews of investment portfolios to assess performance against benchmarks and make necessary adjustments based on evolving market conditions.

Risk Considerations

Investors must be aware of various risks that can impact their portfolios:

- Market Risk: The potential for losses due to fluctuations in market prices. Investors should employ strategies like diversification to mitigate this risk.

- Credit Risk: The risk that a borrower will default on a loan. Assessing the creditworthiness of securities is crucial for fixed-income investments.

- Liquidity Risk: The risk of being unable to quickly buy or sell investments without significantly affecting their price. Investors should ensure adequate liquidity in their portfolios.

- Regulatory Risk: Changes in laws or regulations can affect investment returns. Staying informed about regulatory developments is essential for compliance and strategic planning.

Regulatory Aspects

The regulatory environment surrounding investments is constantly evolving. Key considerations include:

- Compliance Requirements: Investment firms must adhere to stringent regulations set by bodies like the SEC, which include enhanced disclosure requirements and suitability assessments for retail investors.

- Impact of New Regulations: The Retail Investment Strategy Directive aims to improve transparency and protect retail investors by imposing stricter governance on financial products.

- Proactive Risk Management: Firms should adopt proactive compliance strategies to mitigate regulatory risks, including regular audits and updates to internal policies as regulations change.

Understanding these regulatory aspects helps investors navigate potential pitfalls while ensuring compliance with legal standards.

Future Outlook

Looking ahead, several factors will shape investment strategies:

- Technological Advancements: The rise of AI and machine learning will continue transforming investment analysis, enabling more precise decision-making based on vast datasets.

- Sustainable Investing: Growing awareness of environmental, social, and governance (ESG) factors will influence investment choices as more investors seek sustainable options.

- Global Economic Dynamics: Investors must remain vigilant about global economic shifts, including trade relations and monetary policies that could impact market stability.

By staying informed about these trends and adapting strategies accordingly, investors can position themselves for long-term success in an increasingly complex financial landscape.

Frequently Asked Questions About Investment Strategies: The Art of Risk Analysis

- What is risk analysis in investing?

Risk analysis involves assessing potential risks associated with investments to make informed decisions that align with an investor’s financial goals. - How can diversification reduce investment risk?

Diversification spreads investments across various asset classes, minimizing the impact of poor performance in any single area. - What are the key components of effective risk management?

Effective risk management includes thorough risk assessment, diversification strategies, regular portfolio reviews, and adherence to regulatory requirements. - How do interest rates affect investment strategies?

Changes in interest rates can influence borrowing costs and consumer spending, impacting overall market performance and sector attractiveness. - What role does behavioral finance play in investing?

Behavioral finance examines psychological influences on investor behavior, helping individuals recognize biases that may affect decision-making. - Why is regulatory compliance important for investors?

Compliance ensures adherence to laws governing financial markets, protecting investors from legal penalties while maintaining trust in financial institutions. - What trends should investors watch for in the coming years?

Investors should monitor technological advancements, sustainable investing practices, and global economic shifts that could impact market conditions. - How often should I review my investment portfolio?

A periodic review—at least annually or after significant market changes—is recommended to assess performance against goals and make necessary adjustments.

In conclusion, mastering the art of risk analysis within investment strategies requires a comprehensive understanding of market dynamics, effective implementation techniques, awareness of risks, adherence to regulatory standards, and foresight into future trends. By integrating these elements into their approach, investors can navigate complexities while optimizing their potential for returns.