Investment strategies are essential frameworks that guide investors in making decisions about where, when, and how to allocate their resources in the financial markets. With numerous options available, understanding different strategies can help investors align their choices with their financial goals, risk tolerance, and market conditions. This article will explore various investment strategies, detailing their characteristics, advantages, and potential drawbacks.

| Investment Strategy | Description |

|---|---|

| Active Investing | Involves frequent buying and selling of securities to outperform the market. |

| Passive Investing | Focuses on long-term growth by investing in index funds or ETFs without frequent trading. |

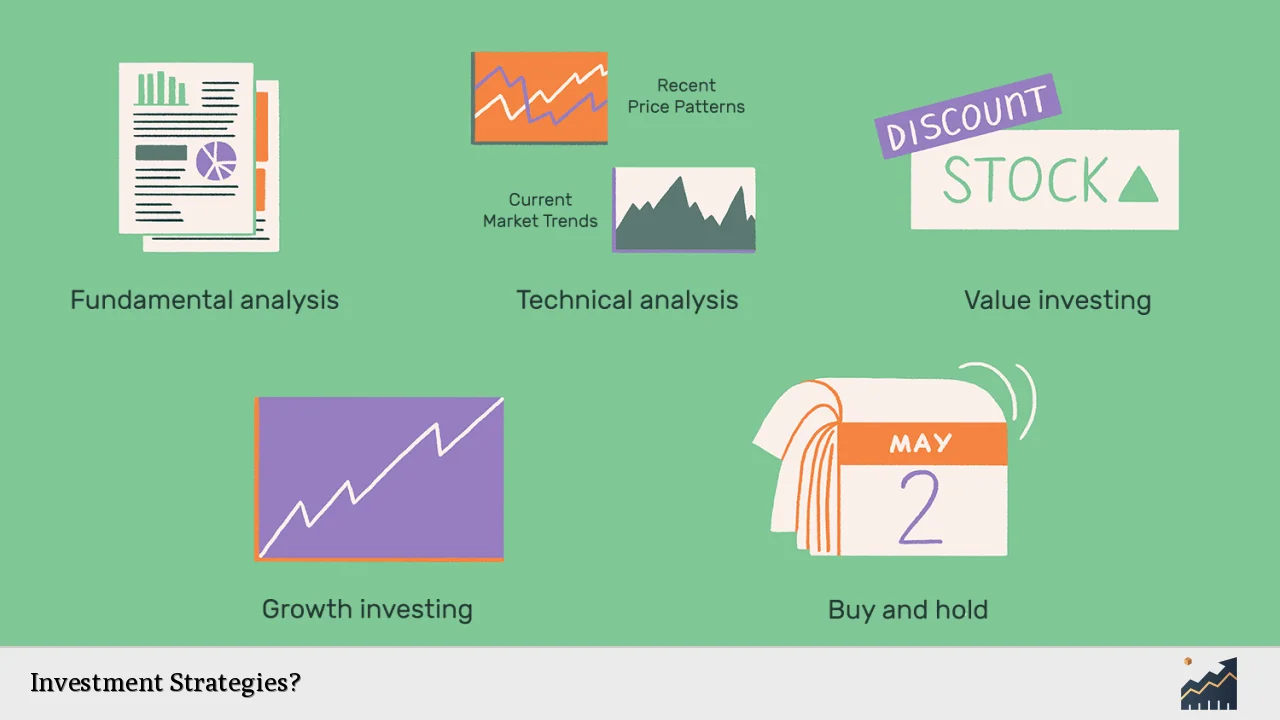

| Growth Investing | Targets companies expected to grow at an above-average rate compared to their industry. |

| Value Investing | Involves buying undervalued stocks with the expectation that their price will increase over time. |

| Income Investing | Prioritizes investments that generate regular income through dividends or interest payments. |

Active Investing

Active investing is a strategy where investors or fund managers make specific investment decisions in an attempt to outperform a benchmark index. This approach involves extensive research and analysis of market trends, economic indicators, and individual company performance. Active investors frequently buy and sell securities based on their predictions of market movements.

One of the key advantages of active investing is the potential for higher returns compared to passive strategies. Investors can capitalize on short-term price fluctuations and market inefficiencies. However, this strategy also comes with significant risks. The costs associated with frequent trading can erode profits, and there is no guarantee that an active manager will outperform the market.

Active investing requires a deep understanding of market dynamics and a willingness to stay informed about economic changes. Investors who choose this path should be prepared for a hands-on approach and must continuously monitor their investments.

Passive Investing

Passive investing is a strategy aimed at achieving long-term growth by investing in index funds or exchange-traded funds (ETFs) that replicate the performance of a specific market index. This approach requires minimal trading activity, allowing investors to hold onto their investments for extended periods.

The main benefit of passive investing is its low cost. Since these funds do not require active management, they typically have lower fees than actively managed funds. Additionally, passive investing reduces the emotional stress associated with trying to time the market or make frequent trades.

However, passive investing may not capitalize on short-term opportunities as effectively as active strategies. Investors may miss out on potential gains during volatile periods. Despite these limitations, many investors favor passive strategies for their simplicity and effectiveness in building wealth over time.

Growth Investing

Growth investing focuses on identifying companies that exhibit strong potential for growth in earnings and revenue. Investors using this strategy typically seek out stocks in sectors such as technology or healthcare that are expected to expand rapidly.

The advantage of growth investing lies in its potential for substantial returns if the selected companies succeed in achieving their growth targets. Growth stocks often outperform the broader market during bull markets due to increased investor interest.

However, growth investing carries inherent risks as well. Companies may fail to meet growth expectations, leading to significant losses for investors. Furthermore, growth stocks often do not pay dividends, meaning investors must rely solely on capital appreciation for returns.

Investors should conduct thorough research into a company’s fundamentals and market position before committing capital to growth stocks.

Value Investing

Value investing is a strategy centered around purchasing undervalued stocks that are trading below their intrinsic value. Investors employing this strategy believe that the market has mispriced certain securities and that these stocks will eventually correct themselves over time.

The primary benefit of value investing is the opportunity to buy quality companies at discounted prices. This approach can lead to substantial returns when the stock price rises as the market recognizes its true value.

However, value investing requires patience and discipline. Stocks may remain undervalued for extended periods, testing an investor’s resolve. Additionally, there is a risk that a stock may be undervalued for valid reasons related to poor company performance or unfavorable industry conditions.

Successful value investors often rely on fundamental analysis to identify potential opportunities within the market.

Income Investing

Income investing focuses on generating regular income through dividends or interest payments from investments such as stocks, bonds, or real estate investment trusts (REITs). This strategy is particularly appealing to retirees or those seeking steady cash flow without relying solely on capital appreciation.

The key advantage of income investing is its ability to provide consistent returns regardless of market conditions. Dividend-paying stocks can offer stability during downturns while generating income for investors.

On the downside, income investments may not provide significant capital appreciation compared to growth-oriented strategies. Additionally, relying heavily on dividends can expose investors to risks if companies cut or eliminate dividend payments during challenging economic times.

Investors interested in this strategy should focus on companies with strong financials and a history of reliable dividend payments.

Momentum Investing

Momentum investing capitalizes on existing trends in stock prices by buying securities that are trending upward and selling those that are declining. This strategy relies heavily on technical analysis and short-term price movements rather than long-term fundamentals.

The main appeal of momentum investing is its potential for quick profits during strong trends. Investors can benefit from rapid price increases by entering positions early in an upward trend.

However, momentum investing also carries risks associated with volatility and sudden reversals in price trends. It requires constant monitoring of market conditions and can lead to significant losses if trends shift unexpectedly.

Investors should be cautious when employing momentum strategies and consider setting stop-loss orders to manage risk effectively.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where an investor consistently invests a fixed amount of money at regular intervals regardless of market conditions. This approach helps mitigate the impact of volatility by averaging out the purchase price over time.

The benefit of dollar-cost averaging is its simplicity; it encourages disciplined saving and reduces emotional decision-making related to timing the market. By consistently investing over time, investors can take advantage of lower prices during downturns while maintaining exposure during upswings.

Nonetheless, DCA does not guarantee profits or protect against losses in declining markets. Investors may still experience losses if they continue to invest during prolonged downturns without adjusting their strategy accordingly.

Dollar-cost averaging works best for long-term investors who prioritize consistency over short-term gains.

FAQs About Investment Strategies

- What are common investment strategies?

Common investment strategies include active investing, passive investing, growth investing, value investing, income investing, momentum investing, and dollar-cost averaging. - How do I choose an investment strategy?

Choosing an investment strategy depends on your financial goals, risk tolerance, time horizon, and personal preferences. - Is active investing better than passive investing?

Active investing has the potential for higher returns but comes with higher risks and costs; passive investing offers lower costs but may miss short-term opportunities. - What is dollar-cost averaging?

Dollar-cost averaging involves consistently investing a fixed amount at regular intervals regardless of market conditions. - Can I combine different investment strategies?

Yes, many investors successfully combine multiple strategies based on their individual goals and risk profiles.

In conclusion, understanding various investment strategies allows individuals to make informed decisions aligned with their financial objectives. Each strategy has unique characteristics that cater to different risk tolerances and investment horizons. By evaluating personal circumstances and conducting thorough research, investors can develop a tailored approach that maximizes their chances of achieving financial success.