Investment income encompasses various forms of earnings derived from investments, and understanding its tax implications is crucial for effective financial planning. This article will explore what constitutes taxable investment income, the different types of investment income, how they are taxed, and the specific regulations that govern them. By clarifying these aspects, investors can better navigate their tax obligations and optimize their financial strategies.

| Type of Investment Income | Tax Treatment |

|---|---|

| Interest | Taxed as ordinary income |

| Dividends | Qualified dividends taxed at lower rates; non-qualified at ordinary rates |

| Capital Gains | Short-term gains taxed at ordinary rates; long-term gains at reduced rates |

| Rental Income | Taxed as ordinary income |

| Royalties | Taxed as ordinary income |

Understanding Investment Income

Investment income refers to any earnings generated from various forms of investments. This includes interest, dividends, capital gains, and other forms of income such as rental or royalty payments. Each type of investment income is subject to different tax treatments based on how it is earned and held.

Interest income is typically earned from savings accounts, bonds, or other interest-bearing assets. This type of income is generally taxed at ordinary income tax rates, which can range significantly depending on the taxpayer’s overall income level.

Dividends are payments made by corporations to their shareholders. These can be classified as either qualified or non-qualified dividends. Qualified dividends usually benefit from lower tax rates, while non-qualified dividends are taxed at the higher ordinary income rates.

Capital gains arise when an investment is sold for more than its purchase price. The tax treatment of capital gains depends on whether they are classified as short-term or long-term. Short-term capital gains (from assets held for one year or less) are taxed at ordinary income rates, while long-term capital gains (from assets held for more than one year) benefit from reduced tax rates.

Other forms of investment income include rental income, which is earned from leasing property, and royalties, which may come from intellectual property rights. Both types of income are taxed as ordinary income.

Types of Taxable Investment Income

Interest Income

Interest earned on savings accounts, certificates of deposit (CDs), bonds, and other interest-generating investments is considered taxable investment income. This interest must be reported in the year it is received or credited to the account.

- Interest from bank accounts is fully taxable.

- Interest from municipal bonds may be exempt from federal taxes but could be subject to state taxes.

Dividend Income

Dividends represent a share of a company’s profits distributed to shareholders. They can be categorized into:

- Qualified Dividends: These are typically taxed at a lower rate (0%, 15%, or 20%) if certain conditions are met.

- Non-Qualified Dividends: These dividends do not meet the requirements for lower tax rates and are taxed at ordinary income rates.

It’s important for investors to review their dividend statements to determine the nature of their dividends for accurate tax reporting.

Capital Gains

Capital gains occur when an asset is sold for more than its purchase price. The taxation depends on how long the asset was held:

- Short-Term Capital Gains: Assets sold within one year are taxed at ordinary income tax rates.

- Long-Term Capital Gains: Assets held for over one year benefit from preferential tax treatment with lower rates.

Investors should keep records of their purchase prices and sale prices to accurately calculate capital gains and losses.

Rental and Royalty Income

Income generated from renting property or receiving royalties from intellectual property is also taxable.

- Rental Income: This includes payments received for leasing out real estate. Expenses related to rental properties can often be deducted, reducing taxable rental income.

- Royalty Income: Payments received for the use of intellectual property (like patents or copyrights) are also considered taxable investment income.

Tax Implications for Different Investment Vehicles

Taxable Accounts

Investment earnings in taxable accounts are subject to taxation in the year they are realized. This includes interest, dividends, and capital gains realized upon selling investments.

- It’s essential to track all earnings accurately to report them correctly on tax returns.

Tax-Advantaged Accounts

Certain accounts like IRAs (Individual Retirement Accounts) or 401(k)s offer different tax treatments:

- Traditional IRAs: Taxes are deferred until withdrawals are made in retirement.

- Roth IRAs: Contributions are made with after-tax dollars, allowing qualified withdrawals to be tax-free.

Investors should consider these accounts when planning their investment strategies to optimize tax efficiency.

Additional Taxes on Investment Income

In addition to regular taxes on investment earnings, some investors may be subject to additional taxes based on their overall income levels:

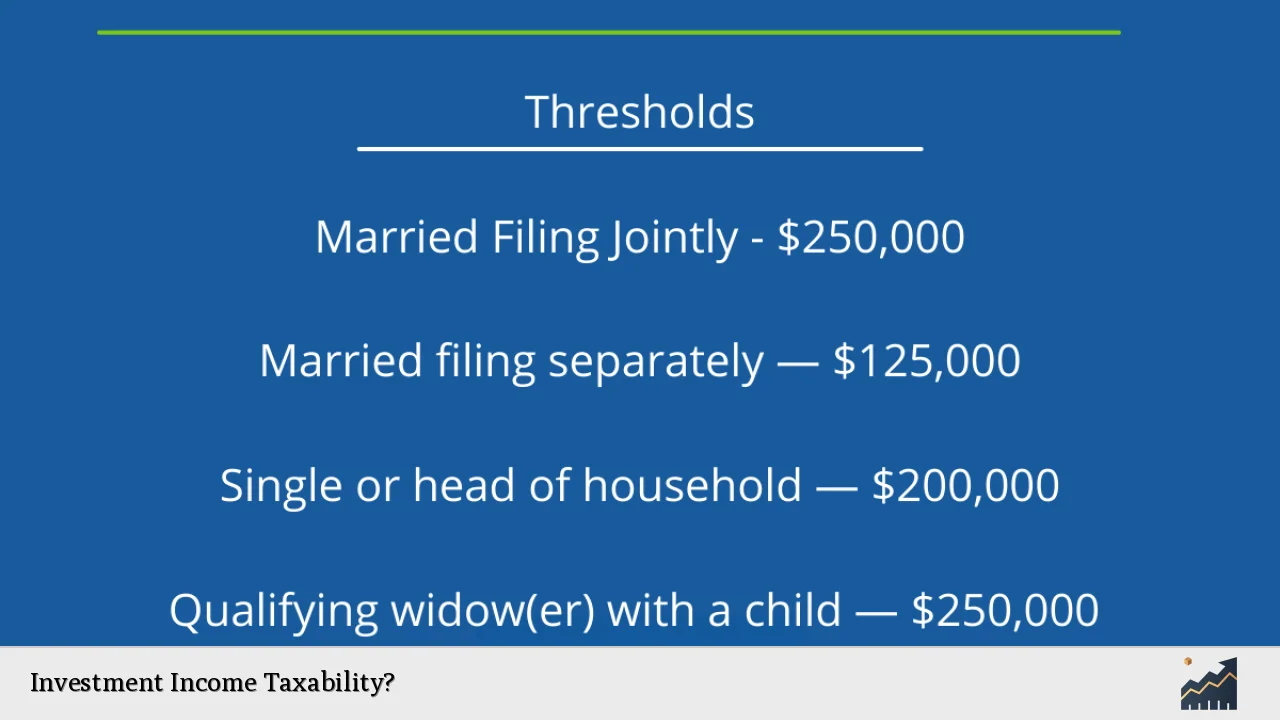

- The Net Investment Income Tax (NIIT) imposes an additional 3.8% tax on individuals whose modified adjusted gross income exceeds certain thresholds ($200,000 for single filers and $250,000 for married couples filing jointly). This applies to net investment income, including capital gains, dividends, and interest.

Understanding these thresholds can help investors plan their investment strategies effectively while minimizing potential additional taxes.

Reporting Investment Income

Investors must report all forms of taxable investment income on their annual tax returns. Here’s a breakdown of how different types of investment incomes should be reported:

- Interest Income: Reported on Schedule B if it exceeds $1,500.

- Dividend Income: Reported on Form 1099-DIV; qualified dividends should be noted separately.

- Capital Gains: Reported on Schedule D; it’s crucial to differentiate between short-term and long-term gains.

Investors should ensure they receive all necessary forms from financial institutions by early February each year to facilitate accurate reporting.

FAQs About Investment Income Taxability

- What types of investment income are taxable?

Interest, dividends, capital gains, rental income, and royalties are all considered taxable investment incomes. - How is interest income taxed?

Interest income is generally taxed at ordinary income rates. - Are all dividends taxed the same?

No, qualified dividends are taxed at lower capital gains rates while non-qualified dividends are taxed at ordinary rates. - What is the Net Investment Income Tax?

The NIIT is an additional 3.8% tax applied to certain high-income earners’ net investment incomes. - Do I need to report my investment losses?

Yes, you can report capital losses which may offset capital gains on your tax return.

Understanding what constitutes taxable investment income is essential for investors aiming to manage their finances effectively. By being aware of the various types of taxable incomes and their respective treatments, individuals can optimize their financial strategies while ensuring compliance with tax regulations.