Investing in an Individual Retirement Account (IRA) for the previous tax year can be a smart financial move, offering potential tax advantages and boosting your retirement savings. The IRS allows contributions to IRAs for the previous tax year up until the tax filing deadline, typically April 15th of the current year. This extended contribution period provides a valuable opportunity to maximize your retirement savings and potentially reduce your tax liability for the previous year.

Understanding the rules and benefits of contributing to an IRA for the previous year is crucial for making informed financial decisions. Whether you’re looking to take advantage of tax deductions, catch up on missed contributions, or simply maximize your retirement savings, investing in an IRA for last year can be a strategic move.

| Contribution Deadline | Maximum Contribution (2023) |

|---|---|

| April 15, 2024 | $6,500 (Under 50), $7,500 (50 and older) |

Benefits of Investing in an IRA for Last Year

Contributing to an IRA for the previous tax year offers several advantages. First and foremost, it provides an extended opportunity to maximize your retirement savings. If you didn’t reach the contribution limit during the calendar year, you have additional time to make up for it. This can be particularly beneficial if you receive a year-end bonus or have extra funds available after the new year.

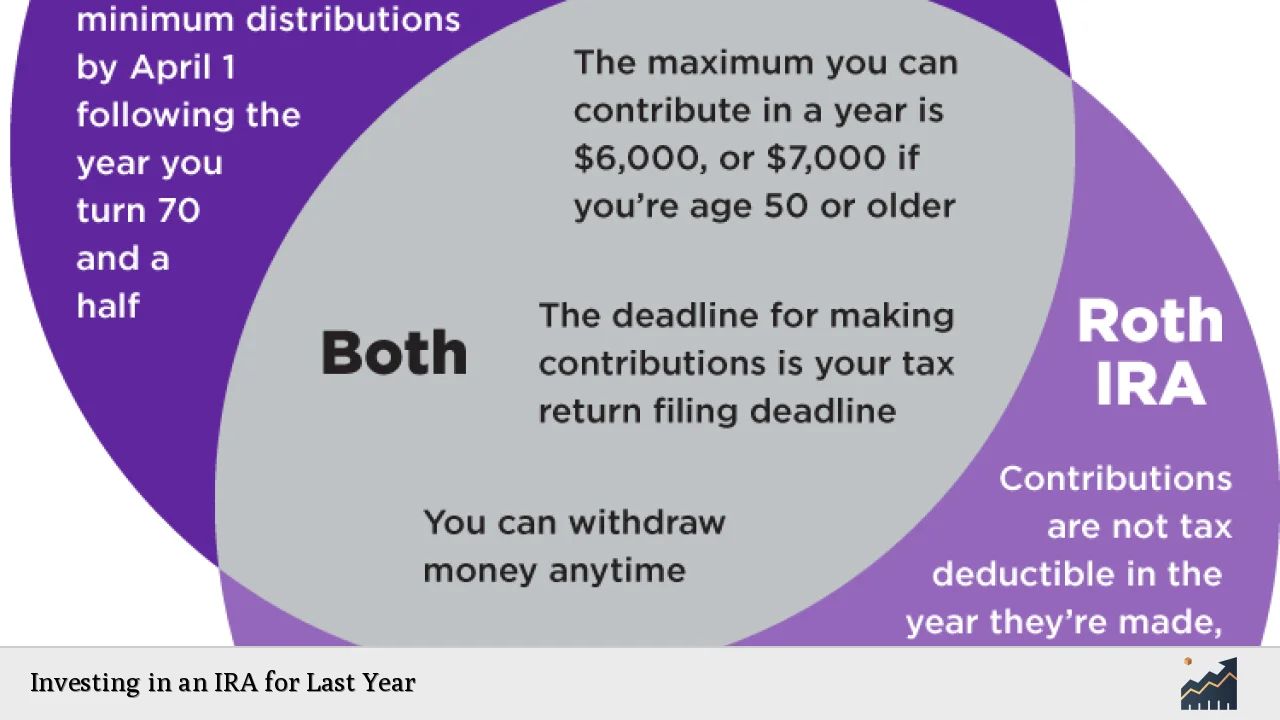

One of the most significant benefits is the potential tax advantage. For traditional IRAs, contributions may be tax-deductible, reducing your taxable income for the previous year. This can result in a lower tax bill or a larger refund when you file your taxes. Even if you’ve already filed your taxes for the previous year, you can still make a contribution and file an amended return to claim the deduction.

For Roth IRAs, while contributions are not tax-deductible, they grow tax-free, and qualified withdrawals in retirement are also tax-free. By maximizing your Roth IRA contributions for the previous year, you’re increasing the amount of money that can grow tax-free over time.

Another advantage is the power of compound interest. By investing earlier, even if it’s for the previous year, you’re giving your money more time to grow. This can have a significant impact on your retirement savings over the long term. Even a few extra months of investment growth can make a difference due to the compounding effect.

Lastly, contributing to an IRA for the previous year can help you catch up on retirement savings if you fell short of your goals. Life events, unexpected expenses, or simply forgetting to contribute can happen. The ability to make prior-year contributions provides a valuable second chance to stay on track with your retirement savings plan.

How to Invest in an IRA for Last Year

Investing in an IRA for the previous year is a straightforward process, but it’s important to follow the correct steps to ensure your contribution is properly credited. Here’s a guide on how to make a prior-year IRA contribution:

1. Check your eligibility: Ensure you’re eligible to contribute based on your income and whether you’re covered by an employer-sponsored retirement plan.

2. Choose your IRA type: Decide between a traditional IRA or a Roth IRA based on your tax situation and long-term financial goals.

3. Open an account: If you don’t already have an IRA, open one with a reputable financial institution or brokerage firm.

4. Make your contribution: Contribute funds before the tax filing deadline (usually April 15th of the following year).

5. Specify the tax year: Clearly indicate that the contribution is for the previous tax year. Most institutions will ask you to specify this when making the contribution.

6. Keep records: Maintain documentation of your contribution, including the amount and the specified tax year.

7. Report on your tax return: Include the contribution information on your tax return for the appropriate year.

When making your contribution, it’s crucial to communicate clearly with your financial institution that the contribution is for the previous tax year. Most institutions have systems in place to handle prior-year contributions, but it’s always best to double-check and ensure your contribution is correctly designated.

If you’ve already filed your taxes for the previous year and then decide to make an IRA contribution, you may need to file an amended tax return to claim any applicable deductions or credits. Consult with a tax professional to understand the implications and process for your specific situation.

Investment Options for Your IRA

Once you’ve made your contribution, it’s important to consider how to invest the funds within your IRA. IRAs offer a wide range of investment options, allowing you to create a diversified portfolio tailored to your risk tolerance and financial goals.

Common investment options for IRAs include:

- Stocks: Individual company shares offer potential for growth but come with higher risk.

- Bonds: Fixed-income securities provide stability and regular interest payments.

- Mutual Funds: Professionally managed portfolios of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks on exchanges.

- Real Estate Investment Trusts (REITs): Provide exposure to real estate markets without direct property ownership.

- Certificates of Deposit (CDs): Offer guaranteed returns but typically with lower yields.

When selecting investments for your IRA, consider factors such as your risk tolerance, investment timeline, and overall financial strategy. It’s often beneficial to diversify your investments to spread risk and potentially increase returns.

For those new to investing or unsure about managing their own portfolio, target-date funds can be an excellent option. These funds automatically adjust their asset allocation as you approach retirement, becoming more conservative over time.

Remember that the investment choices you make within your IRA can have a significant impact on your retirement savings over time. It’s wise to regularly review and rebalance your portfolio to ensure it remains aligned with your goals and risk tolerance.

Considerations and Limitations

While investing in an IRA for the previous year can be advantageous, there are several important considerations and limitations to keep in mind:

1. Contribution limits: The IRS sets annual contribution limits for IRAs. For the 2023 tax year, the limit is $6,500 for individuals under 50 and $7,500 for those 50 and older.

2. Income restrictions: Roth IRA contributions are subject to income limits. High earners may be restricted or ineligible to contribute directly to a Roth IRA.

3. Deduction phase-outs: The deductibility of traditional IRA contributions may be limited if you or your spouse are covered by an employer-sponsored retirement plan and your income exceeds certain thresholds.

4. Penalties for early withdrawal: Withdrawals from traditional IRAs before age 59½ may be subject to a 10% early withdrawal penalty, in addition to regular income taxes.

5. Required Minimum Distributions (RMDs): Traditional IRAs are subject to RMDs starting at age 73, while Roth IRAs do not have RMDs during the owner’s lifetime.

6. Contribution deadlines: While you have until the tax filing deadline to make contributions for the previous year, missing this deadline means losing the opportunity for that tax year.

7. Over-contribution penalties: Contributing more than the allowed amount can result in penalties. It’s crucial to track your contributions carefully.

8. Tax implications: Consider how IRA contributions and eventual withdrawals will affect your overall tax situation, both now and in retirement.

Before making any decisions about investing in an IRA for the previous year, it’s advisable to consult with a financial advisor or tax professional. They can help you navigate the complexities of retirement planning and ensure you’re making the most of your IRA contributions while staying compliant with IRS regulations.

FAQs About Investing in an IRA for Last Year

- Can I still contribute to my IRA for last year if I’ve already filed my taxes?

Yes, you can contribute until the tax filing deadline and file an amended return if necessary. - How do I specify that my IRA contribution is for the previous tax year?

Inform your financial institution when making the contribution and ensure it’s properly documented. - What if I contribute too much to my IRA for last year?

Excess contributions should be withdrawn promptly to avoid penalties from the IRS. - Can I contribute to both a traditional and Roth IRA for the same tax year?

Yes, but your total contributions cannot exceed the annual limit set by the IRS. - Is it better to contribute for last year or save for this year’s IRA?

If possible, maximize contributions for both years to optimize your retirement savings and potential tax benefits.