An investment thesis is a structured framework that guides an investor’s strategy and decision-making process. It articulates the rationale behind selecting specific investments and serves as a roadmap for evaluating potential opportunities and risks. A well-crafted investment thesis is essential for both individual investors and finance professionals, as it helps to clarify investment goals, assess market conditions, and navigate the complexities of financial markets.

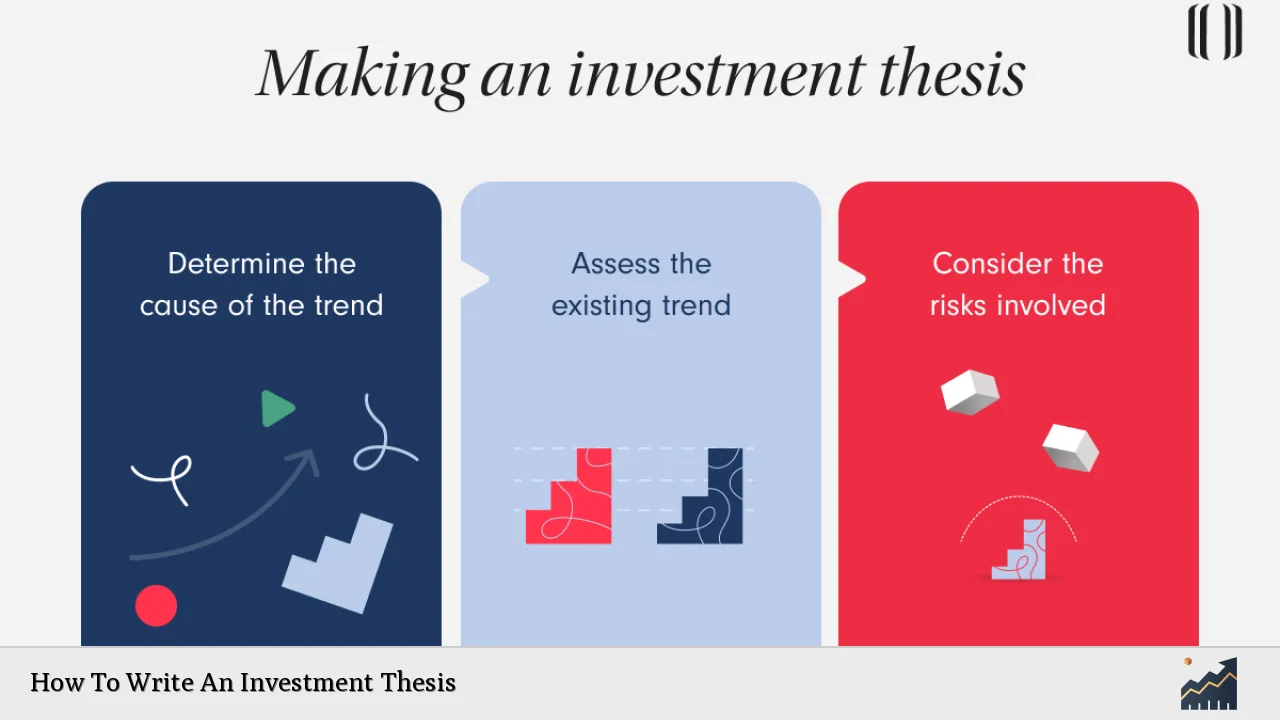

The process of writing an investment thesis involves thorough research, analysis, and a clear understanding of the investment landscape. This guide will delve into the key components of an investment thesis, current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks to equip investors with the necessary tools to create compelling investment theses.

| Key Concept | Description/Impact |

|---|---|

| Investment Thesis Definition | A structured argument supporting an investment decision based on research and analysis. |

| Market Analysis | Understanding current trends and economic indicators that influence investment opportunities. |

| Implementation Strategies | Methods for executing the investment thesis through portfolio construction and asset allocation. |

| Risk Management | Identifying potential downsides and developing strategies to mitigate risks associated with investments. |

| Regulatory Compliance | Navigating legal frameworks and ensuring adherence to financial regulations affecting investments. |

| Future Outlook | Anticipating market changes and adjusting the investment thesis accordingly. |

Market Analysis and Trends

To create a robust investment thesis, it is vital to conduct a comprehensive market analysis. This includes understanding macroeconomic indicators, sector-specific trends, and emerging technologies that could impact investment performance.

- Current Market Statistics: As of mid-2024, global equities reached an all-time high of USD 78.4 trillion, reflecting a nearly 10% increase from December 2023. The technology sector, particularly companies involved in artificial intelligence, has been a significant driver of this growth.

- Economic Indicators: Key indicators such as interest rates, inflation rates, and employment figures play crucial roles in shaping market conditions. For instance, recent trends show that central banks are beginning to lower interest rates in response to economic pressures, which may create new opportunities for investors seeking yield.

- Sector Trends: The rise of sustainable investing has gained momentum as investors increasingly prioritize environmental, social, and governance (ESG) factors. This shift presents unique opportunities in sectors like renewable energy and sustainable agriculture.

Implementation Strategies

Once the market analysis is complete, investors need to formulate implementation strategies that align with their investment thesis.

- Portfolio Construction: Diversifying investments across various asset classes can help manage risk while maximizing returns. Investors should consider their risk tolerance when determining asset allocation.

- Valuation Models: Utilizing valuation techniques such as discounted cash flow (DCF) analysis or price-to-earnings (P/E) ratios can provide insights into whether an asset is undervalued or overvalued based on projected earnings.

- Monitoring Performance: Regularly reviewing the performance of investments against the assumptions outlined in the thesis is crucial. Adjustments may be necessary based on new data or changing market conditions.

Risk Considerations

Identifying potential risks is a critical component of any investment thesis. Investors should consider both systematic and unsystematic risks:

- Market Risk: Economic downturns or geopolitical events can negatively impact overall market performance.

- Operational Risk: Issues within a company’s management or operational processes can affect profitability.

- Regulatory Risk: Changes in laws or regulations can impact specific industries or sectors significantly.

To mitigate these risks, investors should develop contingency plans that outline how they will respond if their initial assumptions prove incorrect.

Regulatory Aspects

Understanding regulatory requirements is essential for compliance and risk management:

- Securities Regulations: Investors must be aware of regulations set forth by bodies like the Securities and Exchange Commission (SEC) in the U.S., which govern trading practices and disclosures.

- International Regulations: For global investments, understanding foreign regulations is crucial as they can vary significantly by country.

Staying informed about upcoming regulatory changes can help investors adapt their strategies proactively rather than reactively.

Future Outlook

The future outlook for investments hinges on various factors:

- Technological Advancements: Innovations such as artificial intelligence are reshaping industries and creating new investment opportunities.

- Economic Recovery: As economies recover from recent downturns, sectors such as travel and hospitality may present attractive growth opportunities.

- Investor Sentiment: Understanding shifts in investor sentiment can provide insights into market trends and potential bubbles or corrections.

Regularly revisiting the assumptions in your investment thesis will allow you to adapt to changing circumstances effectively.

Frequently Asked Questions About How To Write An Investment Thesis

- What is an investment thesis?

An investment thesis is a structured proposal that outlines the rationale behind an investment decision based on thorough research and analysis. - Why is it important to have an investment thesis?

An investment thesis helps clarify goals, assess risks, and guide decision-making processes in investing. - What are common components of an investment thesis?

A typical investment thesis includes the target asset, market trends supporting the investment, potential risks involved, expected returns, and alignment with overall financial goals. - How do I conduct market analysis for my thesis?

Market analysis involves researching economic indicators, sector trends, competitive landscapes, and historical performance data relevant to your target investments. - What strategies should I implement after writing my thesis?

After writing your thesis, implement strategies like portfolio diversification, regular performance monitoring, and using valuation models to guide your investments. - How can I mitigate risks associated with my investments?

You can mitigate risks by diversifying your portfolio, setting stop-loss orders, conducting thorough due diligence on potential investments, and staying informed about market conditions. - What role do regulations play in my investment strategy?

Regulations ensure compliance with legal standards governing trading practices; understanding them helps avoid penalties and informs strategic decisions. - How often should I update my investment thesis?

Your investment thesis should be updated regularly or whenever significant changes occur in market conditions or your personal financial situation.

In conclusion, writing an effective investment thesis requires careful consideration of various factors including market analysis, implementation strategies, risk management principles, regulatory compliance, and future outlooks. By following these guidelines and maintaining a disciplined approach to investing, individuals can enhance their chances of achieving their financial objectives while navigating the complexities of today’s financial landscape.