An investment memo is a critical document that outlines the rationale behind an investment decision, serving as a comprehensive guide for investors. It encapsulates the essential details of a business opportunity, providing insights into the market landscape, competitive positioning, and financial projections. Crafting an effective investment memo requires clarity, brevity, and a compelling narrative that resonates with potential investors. This guide aims to equip individual investors and finance professionals with the knowledge necessary to create high-quality investment memos that stand out in today’s competitive funding environment.

| Key Concept | Description/Impact |

|---|---|

| Purpose of the Memo | The investment memo should clearly articulate its objective, whether it is to seek funding, strategic partnerships, or project approvals. |

| Market Analysis | A detailed examination of the market landscape, including size, growth trends, and competitive dynamics. This section is crucial for demonstrating the potential return on investment. |

| Business Model | A clear explanation of how the business operates and generates revenue. This should include pricing strategies and customer acquisition plans. |

| Competitive Advantage | Identifying key competitors and outlining the unique selling propositions that differentiate the business from others in the market. |

| Financial Projections | Providing realistic financial forecasts that demonstrate expected growth and profitability over time. This section should include assumptions and potential risks. |

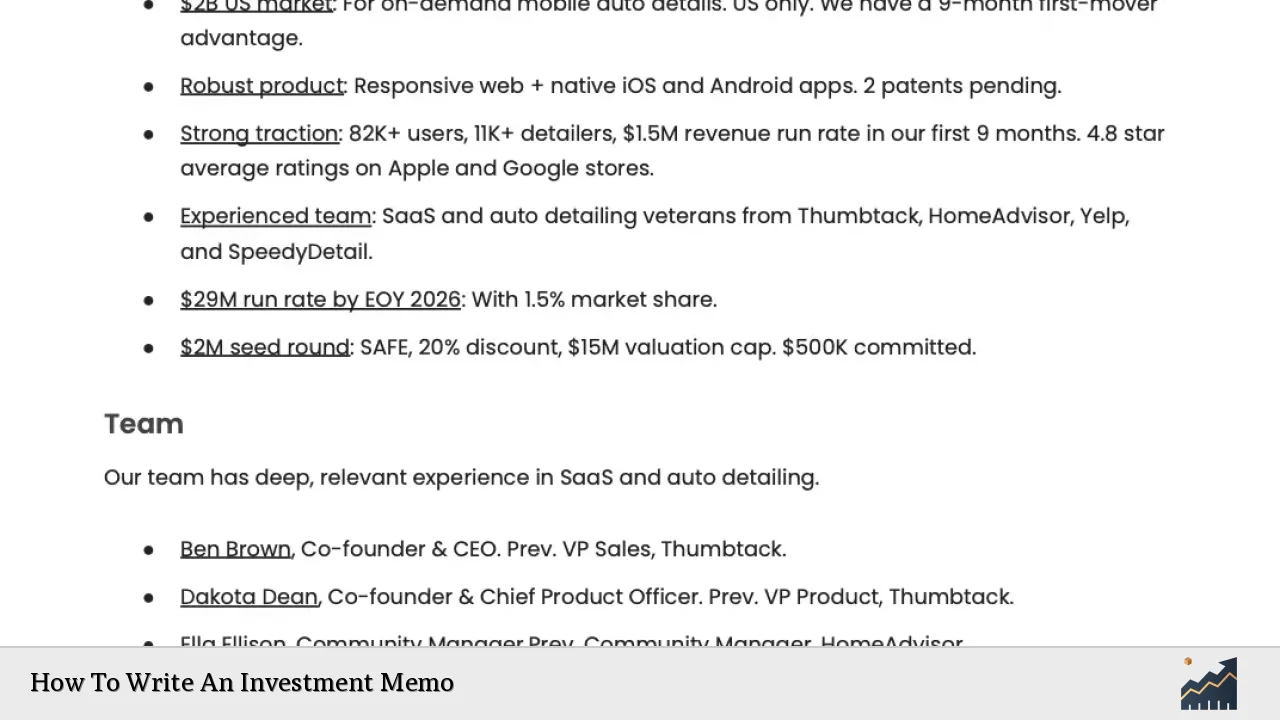

| Team Overview | A brief introduction to the founding team, highlighting their backgrounds, expertise, and roles within the company. |

| Risks and Mitigation Strategies | An honest assessment of potential risks associated with the investment and strategies for mitigating these risks. |

| Conclusion | A compelling summary that reiterates the investment opportunity’s key highlights and encourages investor engagement. |

Market Analysis and Trends

Understanding current market conditions is essential when writing an investment memo. As of late 2024, global equity markets have rebounded significantly, with total equity market capitalization reaching approximately USD 78.4 trillion, marking a nearly 10% increase from December 2023. The technology sector, particularly companies involved in artificial intelligence (AI), has seen substantial growth during this period.

Key trends influencing investment decisions include:

- Rise of Clean Energy: Global energy investments are projected to exceed USD 3 trillion in 2024, with significant allocations towards clean energy technologies.

- Emerging Market Opportunities: Investment in emerging markets remains robust but uneven. For instance, while India and Brazil are witnessing increased private equity activity, other regions lag behind.

- Tech Sector Dominance: The technology sector continues to attract significant investor interest due to its growth potential and innovation.

These trends should be reflected in the investment memo’s market analysis section to provide context for the proposed investment.

Implementation Strategies

When detailing implementation strategies in an investment memo, it is crucial to outline how the business plans to execute its vision effectively. This includes:

- Customer Acquisition: Describe how the company intends to attract and retain customers through marketing strategies and sales channels.

- Product Development: Provide insights into product roadmap milestones that align with market needs.

- Operational Efficiency: Discuss plans for scaling operations while maintaining quality and reducing costs.

These elements help investors understand how the business will achieve its projected growth.

Risk Considerations

Investors are keenly aware of risks associated with any investment opportunity. An effective investment memo should include:

- Market Risks: Changes in market conditions or consumer preferences can impact business performance.

- Financial Risks: Highlight potential issues related to cash flow management or funding shortfalls.

- Regulatory Risks: Discuss any legal or compliance challenges that could affect operations.

By addressing these risks upfront and outlining mitigation strategies, you enhance credibility with potential investors.

Regulatory Aspects

Investment memos must consider relevant regulatory frameworks that govern the industry in which the business operates. This includes:

- Compliance Requirements: Outline necessary licenses or permits needed for operation.

- Reporting Obligations: Discuss any financial reporting requirements mandated by regulatory bodies such as the SEC.

Understanding these aspects not only demonstrates thorough due diligence but also reassures investors about legal compliance.

Future Outlook

The future outlook section of an investment memo should provide a forward-looking perspective based on current trends. Key points may include:

- Projected Growth Rates: Use data-driven projections to illustrate expected growth trajectories.

- Market Expansion Opportunities: Identify potential new markets or customer segments that could be targeted for expansion.

- Technological Advancements: Discuss how ongoing innovations may create new opportunities or disrupt existing markets.

By providing a comprehensive future outlook, you can help investors visualize long-term value creation.

Frequently Asked Questions About How To Write An Investment Memo

- What is an investment memo?

An investment memo is a document that outlines key details about an investment opportunity, including market analysis, financial projections, risks, and strategic plans. - Why is an investment memo important?

An investment memo serves as a critical tool for communicating essential information to investors, helping them make informed decisions about potential investments. - What key sections should be included in an investment memo?

The key sections typically include purpose, market analysis, business model, competitive advantage, financial projections, team overview, risks and mitigation strategies, and conclusion. - How long should an investment memo be?

An effective investment memo is usually concise—typically between 2 to 5 pages—focusing on clarity and impact rather than length. - What common mistakes should be avoided when writing an investment memo?

Avoid vague language, excessive jargon, neglecting financial details or risk assessments, and failing to tell a compelling story about the business opportunity. - How can visuals enhance an investment memo?

Visual aids such as charts and graphs can help simplify complex information and make key data points more memorable for investors. - Is it necessary to include financial projections?

Yes, including realistic financial projections is crucial as they demonstrate expected growth and profitability potential to investors. - When should I seek professional advice regarding my investment memo?

If you’re unsure about your financial projections or risk assessments or need assistance tailoring your memo for specific investors or funds, seeking professional advice can be beneficial.

In conclusion, writing a high-quality investment memo involves thorough research, clear communication of strategic insights, and addressing potential investor concerns. By following these guidelines and incorporating current market data and trends into your memos, you can significantly enhance your chances of securing funding.