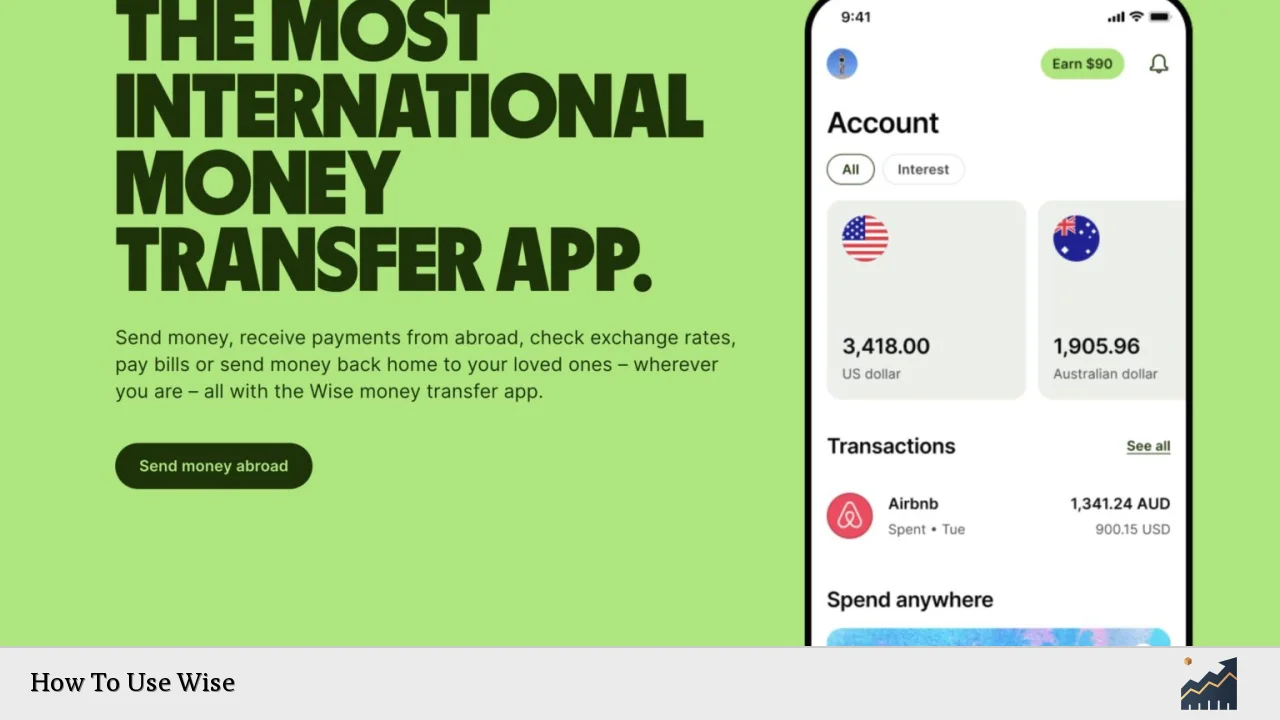

Wise, formerly known as TransferWise, has revolutionized the way individuals and businesses manage their international money transfers and multi-currency accounts. With a focus on transparency, low fees, and ease of use, Wise has become a preferred choice for millions around the globe. This guide provides a comprehensive overview of how to effectively utilize Wise for your financial needs, covering market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Multi-Currency Accounts | Wise allows users to hold and manage funds in over 50 currencies, facilitating easy conversions and transfers without high fees. |

| Transparent Fees | Wise operates on a low-cost model with no hidden fees, charging only for the services used, which typically results in lower costs compared to traditional banks. |

| Instant Transfers | Over 50% of Wise’s international transfers are instant, with 90% arriving within 24 hours, enhancing user convenience. |

| Investment Options | Users can invest their balances in assets such as stocks through Wise’s investment feature, which tracks major global indices. |

| Regulatory Compliance | Wise is regulated by multiple authorities worldwide, ensuring a secure and compliant platform for users. |

Market Analysis and Trends

The international money transfer market has seen significant growth over the past few years. As of 2024, Wise processed £118.5 billion in transactions, marking a 13.4% increase from the previous year. The company’s customer base has expanded to 12.8 million active users, reflecting a growing demand for cost-effective and efficient cross-border payment solutions.

Key Market Trends

- Digital Transformation: The shift towards digital banking solutions continues to rise as consumers seek faster and more convenient ways to manage their finances.

- Increased Competition: Fintech companies like Wise are challenging traditional banking institutions by offering lower fees and better exchange rates.

- Regulatory Changes: As regulations evolve globally, companies like Wise must adapt to maintain compliance while providing innovative services.

Implementation Strategies

To make the most out of Wise’s offerings, users should consider the following strategies:

- Setting Up an Account: Create a personal or business account on Wise’s platform. The process is straightforward and requires minimal documentation.

- Utilizing Multi-Currency Features: Take advantage of Wise’s ability to hold multiple currencies. This feature is particularly beneficial for frequent travelers or businesses dealing with international clients.

- Investing Wisely: Users can opt to invest their funds in index-tracking funds managed by reputable firms like BlackRock. This allows for potential growth while maintaining liquidity.

- Monitoring Exchange Rates: Use Wise’s tools to track real-time exchange rates and plan transfers when rates are favorable.

Risk Considerations

While Wise offers many advantages, users should be aware of potential risks:

- Market Volatility: Currency values can fluctuate significantly, impacting the amount received during transfers.

- Investment Risks: Investing in stocks or funds carries inherent risks. Users should assess their risk tolerance before committing funds.

- Regulatory Risks: Changes in financial regulations could affect how Wise operates or the services it offers.

Regulatory Aspects

Wise operates under strict regulatory frameworks across various jurisdictions. Key points include:

- Compliance with Financial Authorities: Wise is regulated by entities such as the Financial Conduct Authority (FCA) in the UK and similar bodies worldwide, ensuring customer protection.

- Adherence to Anti-Money Laundering (AML) Laws: To prevent illicit activities, Wise implements robust AML procedures that may require additional verification for certain transactions.

- Data Protection Regulations: Compliance with GDPR in Europe ensures that user data is handled securely and transparently.

Future Outlook

The future of Wise looks promising as it continues to innovate and expand its services. Key predictions include:

- Continued Customer Growth: With an expected CAGR of 15-20% in underlying income over the next few years, Wise aims to attract more users by enhancing its service offerings.

- Expansion into New Markets: As global demand for digital payment solutions grows, Wise plans to enter new markets while improving existing services.

- Technological Advancements: Investment in technology will likely lead to faster transactions and enhanced user experiences through improved app functionalities.

Frequently Asked Questions About How To Use Wise

- What fees does Wise charge?

Wise charges low transaction fees based on the amount being sent and the currencies involved. There are no hidden fees. - How long do transfers take?

Over 50% of transfers are instant; 90% arrive within 24 hours. - Is my money safe with Wise?

Yes, Wise is regulated by multiple financial authorities globally and employs strong security measures. - Can I invest my money using Wise?

Yes, you can choose to hold some of your balance in investments such as index funds. - How do I track my transfers?

You can track your transfer status through the Wise app or website at any time. - What currencies can I hold in my Wise account?

You can hold over 50 different currencies in your account. - Can businesses use Wise?

Yes, Wise offers tailored accounts for businesses that need to manage international payments efficiently. - How does Wise compare to traditional banks?

Wise typically offers lower fees and better exchange rates than traditional banks for international transactions.

By understanding how to effectively use Wise’s features and staying informed about market trends and regulatory changes, users can maximize their financial management capabilities while minimizing costs associated with international transactions.