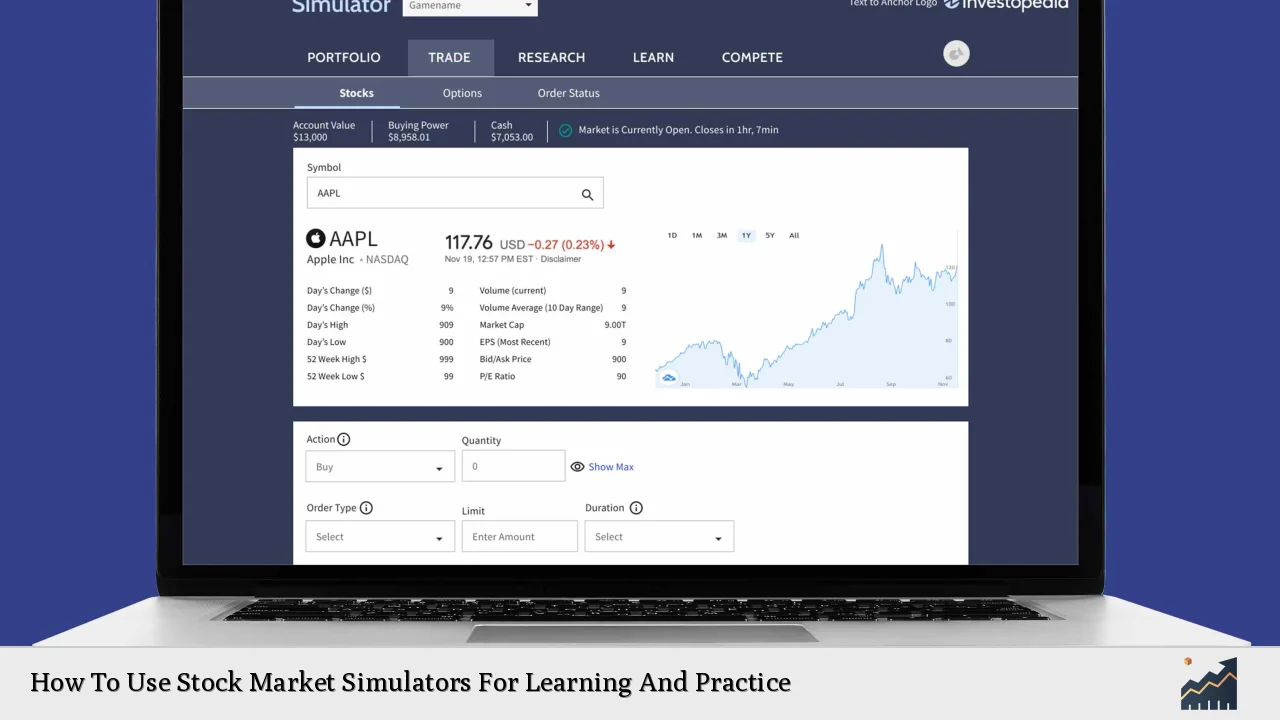

Stock market simulators are invaluable tools for both novice and experienced investors looking to enhance their trading skills without risking real money. These platforms provide a virtual environment that mimics real market conditions, allowing users to practice buying and selling stocks, test strategies, and gain confidence before entering the actual market. This comprehensive guide will explore the use of stock market simulators, their benefits, implementation strategies, and the current landscape of the stock market.

| Key Concept | Description/Impact |

|---|---|

| Stock Market Simulator | A digital tool that simulates real stock market conditions using virtual currency, allowing users to practice trading without financial risk. |

| Educational Tool | Simulators serve as a learning platform for beginners to understand market dynamics, investment strategies, and trading psychology. |

| Strategy Testing | Users can experiment with various trading strategies in real-time, analyzing outcomes without the fear of losing money. |

| Market Conditions | Simulators often provide real-time data and analytics, helping users adapt to changing market conditions effectively. |

| Confidence Building | By practicing in a risk-free environment, traders can build confidence in their decision-making skills before investing real capital. |

Market Analysis and Trends

The stock market is currently experiencing significant fluctuations due to various economic factors. As of December 2024, the S&P 500 index has risen approximately 27% since the beginning of the year, reflecting a robust recovery from previous downturns. This growth has been attributed to several key trends:

- Interest Rate Adjustments: The Federal Reserve’s recent policy shifts towards easing have led to lower interest rates, stimulating investment in equities. Markets are anticipating further rate cuts as inflation stabilizes.

- Technological Advancements: The rise of technology stocks continues to dominate market performance. Companies in sectors such as AI and renewable energy are attracting substantial investor interest.

- Global Economic Recovery: Post-pandemic recovery efforts are driving economic growth globally, with increased consumer spending and corporate earnings contributing positively to market sentiment.

These trends highlight the importance of understanding market dynamics through practical experience gained via stock market simulators.

Implementation Strategies

To maximize the benefits of stock market simulators, investors should consider the following strategies:

- Select the Right Simulator: Choose a simulator that closely mimics real-market conditions. Popular options include eToro for its user-friendly interface and TradeStation for its advanced features.

- Set Clear Goals: Define what you want to achieve with your practice sessions—whether it’s mastering day trading techniques or developing long-term investment strategies.

- Diversify Your Portfolio: Use simulators to create a diversified virtual portfolio that includes stocks from various sectors. This helps in understanding how different assets react under varying market conditions.

- Analyze Performance: Regularly review your trades and portfolio performance. Most simulators offer analytical tools that provide insights into your trading patterns and areas for improvement.

- Engage with Educational Resources: Many simulators come with integrated educational materials. Utilize these resources to deepen your understanding of trading concepts and strategies.

Risk Considerations

While stock market simulators provide a safe learning environment, it’s essential to recognize potential limitations:

- Emotional Detachment: Trading with virtual money may not replicate the emotional stress associated with real trading. Investors should be aware that their reactions may differ when actual capital is at stake.

- Market Conditions Simulation: Some simulators may not accurately reflect all aspects of real-world trading, such as slippage or liquidity issues during volatile periods.

- Overconfidence Risk: Success in simulations can lead to overconfidence when transitioning to real trading. It’s crucial to maintain a disciplined approach and manage risks effectively.

Regulatory Aspects

Understanding the regulatory framework governing securities is vital for any trader. Key regulations include:

- Securities Exchange Act of 1934: This act established the SEC, which regulates securities markets to protect investors and maintain fair practices.

- Dodd-Frank Act: Implemented post-financial crisis, this act aims to reduce systemic risk in the financial system by increasing transparency and accountability among financial institutions.

- MiFID II: A European regulation that enhances investor protection and promotes transparency in financial markets.

Familiarity with these regulations is crucial for traders using simulators as they prepare for compliance when they start trading with real funds.

Future Outlook

The future of stock market simulators looks promising as technology continues to evolve. Key developments include:

- Integration of AI and Machine Learning: Advanced algorithms will enhance simulation realism by analyzing vast amounts of data to predict market trends more accurately.

- Mobile Accessibility: With increasing smartphone usage, more simulators will offer mobile-friendly platforms, allowing users to practice trading on-the-go.

- Gamification Elements: Incorporating game-like features will make learning more engaging for users, especially younger investors who prefer interactive experiences.

These advancements will likely attract more individuals to utilize simulators as part of their investment education journey.

Frequently Asked Questions About How To Use Stock Market Simulators For Learning And Practice

- What is a stock market simulator?

A stock market simulator is a digital platform that allows users to practice buying and selling stocks using virtual currency in a simulated environment that mimics real-world markets. - How do I choose the best stock simulator?

Select a simulator based on realism, user interface, educational resources available, and whether it offers features like real-time data analysis. - Can I test different investment strategies?

Yes, stock simulators allow you to experiment with various strategies such as day trading or long-term investing without financial risk. - Are there any risks associated with using simulators?

While they are risk-free financially, users may develop overconfidence or fail to experience emotional stress associated with real trading. - How can I track my performance on a simulator?

Most simulators provide analytical tools that allow you to monitor your trades, analyze performance metrics, and identify areas for improvement. - Do I need prior knowledge to use a stock simulator?

No prior knowledge is necessary; however, having basic understanding can enhance your learning experience. - Is there any cost associated with using stock simulators?

Many stock simulators are free; however, some may offer premium features at an additional cost. - How can I transition from using a simulator to real trading?

Start by gradually investing small amounts in real markets while applying what you’ve learned through simulation practice.

In conclusion, stock market simulators serve as an essential resource for individuals looking to enhance their investing skills in a risk-free environment. By understanding current market trends, implementing effective strategies, considering regulatory aspects, and preparing for future advancements in technology, users can significantly improve their readiness for actual trading.