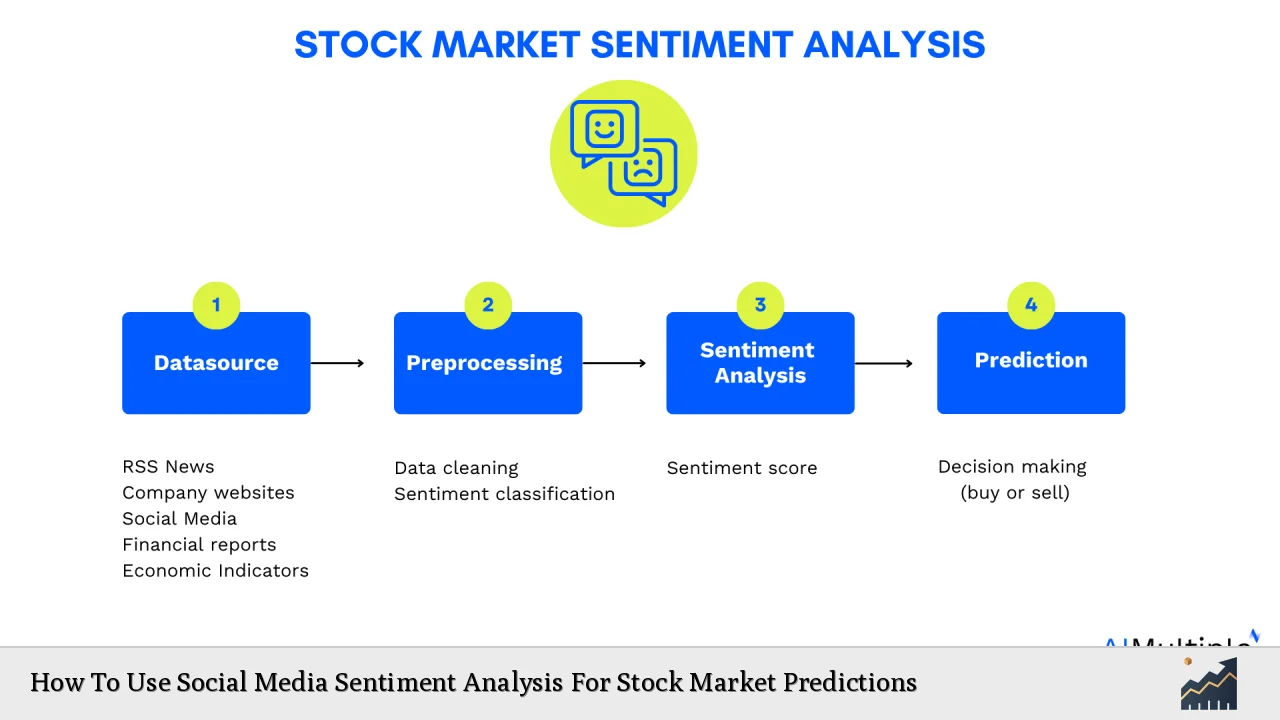

In recent years, the integration of social media sentiment analysis into stock market predictions has gained significant traction among investors and financial analysts. This approach leverages the vast amount of data generated on social media platforms to gauge public sentiment towards specific stocks or the market as a whole. By analyzing this sentiment, investors can potentially predict stock price movements more accurately, enhancing their investment strategies. This article explores the methodologies, tools, and implications of using social media sentiment analysis for stock market predictions.

| Key Concept | Description/Impact |

|---|---|

| Sentiment Analysis | The process of determining the emotional tone behind a series of words, used to understand attitudes, opinions, and emotions expressed in online content. |

| Market Sentiment | The overall attitude of investors toward a particular security or financial market, often influenced by news and social media discussions. |

| Natural Language Processing (NLP) | A branch of artificial intelligence that helps computers understand, interpret, and manipulate human language, crucial for analyzing social media data. |

| Machine Learning Models | Algorithms that improve automatically through experience; used to analyze historical data and predict future stock movements based on sentiment. |

| Twitter as a Data Source | Twitter is a key platform for real-time sentiment analysis due to its rapid dissemination of information and user engagement with financial topics. |

| Correlation with Stock Prices | Research indicates a strong correlation between social media sentiment and stock price movements, suggesting that positive or negative sentiments can lead to corresponding price changes. |

Market Analysis and Trends

The landscape of stock market predictions has evolved significantly with the advent of technology. Traditional methods relied heavily on historical price data and fundamental analysis. However, recent studies have shown that incorporating social media sentiment can enhance predictive accuracy. For instance, a study demonstrated that models integrating sentiment analysis achieved an average performance improvement of 2.07% over those relying solely on historical prices. Furthermore, during periods where predictions are typically challenging, such as high volatility markets, sentiment analysis showed an even greater advantage.

Current Market Trends

- Increased Use of AI: The integration of artificial intelligence in analyzing social media data allows for more sophisticated insights into market trends.

- Real-Time Data Processing: Investors are increasingly relying on real-time data from platforms like Twitter to make quick trading decisions.

- Growing Importance of Retail Investors: The rise of retail investors using social media platforms for trading advice has made sentiment analysis more relevant than ever.

Implementation Strategies

To effectively utilize social media sentiment analysis for stock market predictions, investors should consider the following strategies:

- Select Appropriate Tools: Utilize sentiment analysis tools such as NetBase Quid or Awario that can process large volumes of social media data and provide insights into public sentiment.

- Integrate Multiple Data Sources: Combine social media sentiment with traditional financial metrics to create a more comprehensive predictive model.

- Monitor Key Events: Pay attention to significant news events or announcements that may influence public sentiment and subsequently affect stock prices.

- Utilize Machine Learning: Implement machine learning algorithms that can learn from historical data and adapt to new information from social media.

Recommended Tools

- NetBase Quid: Offers extensive social media analytics capabilities.

- Awario: Provides real-time monitoring and sentiment analysis across various platforms.

- Brandwatch: Specializes in audience insights and market research through sentiment tracking.

Risk Considerations

While using social media sentiment analysis can provide valuable insights, several risks must be considered:

- Data Noise: Social media data can be noisy and may contain irrelevant information that could lead to inaccurate predictions.

- Overreliance on Sentiment: Investors should not rely solely on sentiment analysis; it should complement other analytical methods.

- Market Manipulation Risks: Be cautious of potential manipulation through coordinated campaigns on social media that may distort true market sentiment.

Regulatory Aspects

As the use of social media in investment strategies grows, regulatory bodies are beginning to take notice. The SEC has emphasized the importance of transparency in trading practices influenced by social media sentiments. Investors should ensure compliance with regulations regarding insider trading and market manipulation when using these tools.

Compliance Guidelines

- Ensure all trading practices adhere to SEC regulations.

- Disclose any reliance on social media information in investment strategies if required by law.

Future Outlook

The future of using social media sentiment analysis in stock market predictions looks promising. As technology advances, the accuracy and reliability of these analyses are expected to improve significantly. Furthermore, with the increasing influence of retail investors on markets, understanding public sentiment will become even more critical for investment success.

Emerging Trends

- Enhanced AI Capabilities: Continued advancements in AI will lead to better interpretation of complex sentiments expressed online.

- Integration with Other Technologies: Combining sentiment analysis with blockchain technology could enhance transparency in trading practices.

Frequently Asked Questions About How To Use Social Media Sentiment Analysis For Stock Market Predictions

- What is social media sentiment analysis?

It is the process of analyzing online conversations to gauge public opinion about a particular topic or entity, such as stocks. - How does it impact stock predictions?

By analyzing sentiments expressed on social media platforms like Twitter, investors can gain insights into potential stock price movements. - What tools are best for conducting sentiment analysis?

Tools like NetBase Quid, Awario, and Brandwatch are recommended for their robust analytics capabilities. - Is there a risk in relying solely on sentiment analysis?

Yes, it is important to combine sentiment analysis with traditional financial metrics to avoid misleading conclusions. - How accurate are predictions based on sentiment analysis?

While they can enhance predictive accuracy significantly, results may vary based on market conditions and data quality. - What role does AI play in this process?

AI helps process large volumes of unstructured data from social media quickly and accurately, improving prediction models. - Are there regulatory concerns with using this method?

Yes, investors must comply with regulations regarding transparency and avoid practices that could be seen as market manipulation. - What is the future outlook for this investment strategy?

The integration of advanced technologies is expected to enhance the effectiveness of using social media sentiments in predicting stock movements.

In conclusion, leveraging social media sentiment analysis represents a significant advancement in stock market prediction methodologies. By integrating these insights with traditional financial analyses and remaining aware of associated risks and regulatory considerations, investors can enhance their decision-making processes in an increasingly complex market environment.