Health Savings Accounts (HSAs) are increasingly recognized as powerful financial tools, not only for managing healthcare costs but also for investing and growing wealth. An HSA allows individuals to save money tax-free for qualified medical expenses while providing significant investment opportunities. This article explores how to effectively use an HSA as an investment vehicle, detailing its benefits, investment strategies, and practical steps to maximize its potential.

| Feature | Description |

|---|---|

| Triple Tax Advantage | Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified expenses are tax-free. |

Understanding the Basics of HSAs

An HSA is a tax-advantaged savings account designed for individuals with high-deductible health plans (HDHPs). To qualify for an HSA, you must meet specific criteria: you must be covered by an HDHP, cannot be enrolled in Medicare or Medicaid, and cannot be claimed as a dependent on someone else’s tax return. As of 2023, the minimum deductible for HDHPs is $1,500 for individuals and $3,000 for families.

HSAs offer a triple tax advantage that makes them unique compared to other retirement accounts. Contributions made to an HSA are tax-deductible, which reduces your taxable income. Additionally, any interest or investment earnings grow tax-free. Finally, withdrawals for qualified medical expenses are also tax-free.

The funds in an HSA roll over from year to year, meaning you do not lose any unspent money at the end of the year. This feature allows you to accumulate savings over time, making HSAs particularly appealing for long-term financial planning.

Benefits of Using HSAs for Investment

Investing through an HSA can significantly enhance your financial strategy. Here are some key benefits:

- Tax-Free Growth: Unlike traditional investment accounts where capital gains and dividends are taxed, HSAs allow your investments to grow without incurring taxes.

- Flexibility: You can use HSA funds at any time for qualified medical expenses without penalties. This flexibility allows you to invest aggressively while ensuring you have access to funds when needed.

- Retirement Savings: Many people treat their HSAs as additional retirement accounts. After age 65, you can withdraw funds for non-medical expenses without penalties (though regular income tax will apply).

- Portability: HSAs are not tied to your employer. If you change jobs or retire, your HSA remains with you.

These advantages make HSAs not just a means of paying for healthcare but a strategic tool for building wealth over time.

How to Start Investing Your HSA Funds

Investing your HSA funds involves several steps that can help maximize returns while managing risks effectively:

Choose the Right HSA Provider

Selecting an appropriate HSA provider is crucial. Look for one that offers:

- Low fees: Minimize costs associated with account maintenance and transactions.

- Investment options: Ensure the provider allows investments in stocks, bonds, mutual funds, or ETFs.

- No minimum thresholds: Some providers require a minimum balance before allowing investments; choose one that does not impose such restrictions.

Fund Your HSA

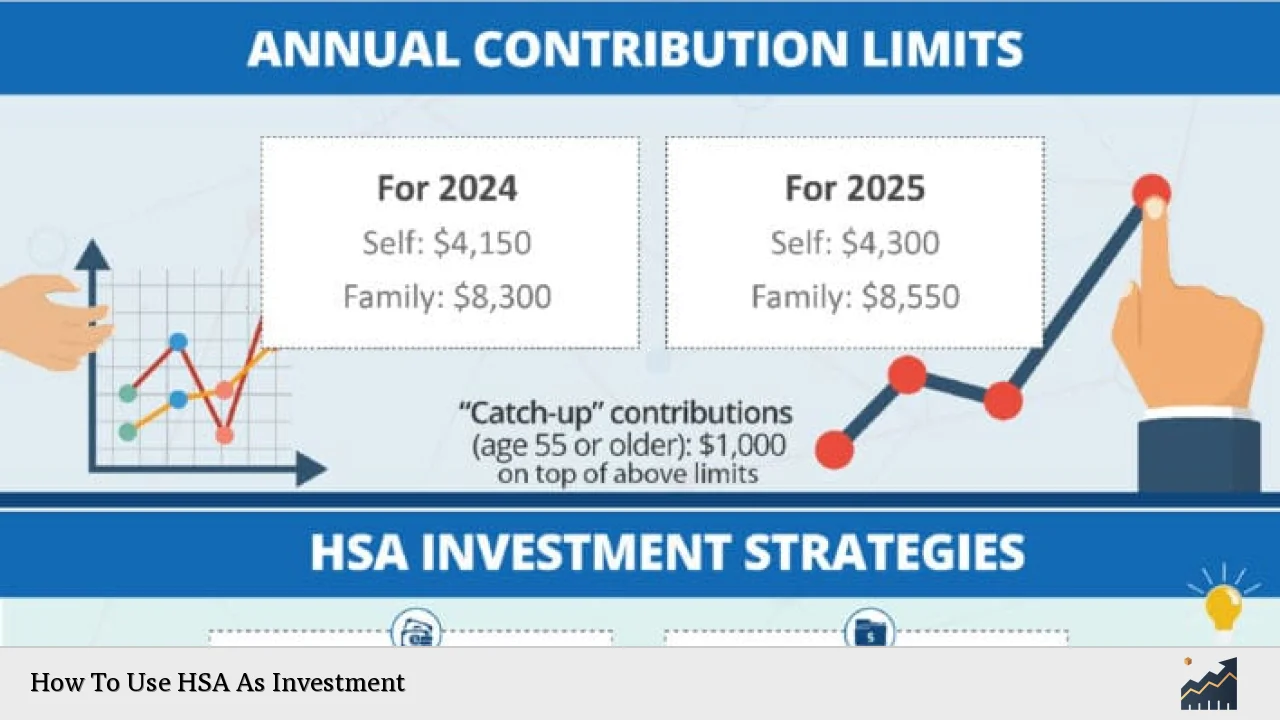

To start investing, you need to contribute funds to your HSA. The IRS sets annual contribution limits; as of 2023, the limit is $3,850 for individuals and $7,750 for families. If you’re over 55, you can contribute an additional $1,000 as a catch-up contribution.

Set Up Investment Accounts

Once your HSA is funded:

- Access the investment platform: Log into your HSA account and navigate to the investment section.

- Choose your investments: Depending on your risk tolerance and time horizon, select from available options like mutual funds or ETFs.

Develop an Investment Strategy

Your investment strategy should align with your overall financial goals:

- Risk assessment: Determine how much risk you are willing to take based on your age and financial situation.

- Diversification: Spread investments across different asset classes (stocks, bonds) to reduce risk.

- Long-term focus: Consider investing in growth-oriented assets if you do not anticipate needing the funds in the near term.

Monitor Your Investments

Regularly review your investment performance:

- Rebalance your portfolio: Adjust your investments periodically to maintain your desired asset allocation.

- Stay informed: Keep up with market trends and economic indicators that may impact your investments.

Investment Options Available in HSAs

HSAs offer various investment options that can cater to different risk appetites and financial goals:

Stocks and ETFs

Investing in individual stocks or exchange-traded funds (ETFs) can provide high growth potential but comes with increased risk. It’s essential to research companies thoroughly before investing.

Mutual Funds

Mutual funds allow investors to pool their money together to invest in diversified portfolios managed by professionals. They can be a good choice for those seeking diversification without having to pick individual stocks.

Bonds

For those with lower risk tolerance or who expect short-term medical expenses, bonds or bond funds may be suitable. They typically provide more stability compared to stocks.

Money Market Funds

These funds invest in short-term debt securities and provide liquidity with lower returns. They are ideal for those who may need quick access to cash for medical expenses.

Common Mistakes When Investing with HSAs

To make the most of your HSA investments, avoid these common pitfalls:

- Neglecting contributions: Regularly contribute up to the annual limit each year to maximize tax benefits.

- Ignoring fees: Be aware of any fees associated with your HSA provider that could eat into your investment returns.

- Overlooking qualified expenses: Ensure that withdrawals are made only for qualified medical expenses to avoid taxes and penalties.

FAQs About How To Use HSA As Investment

- What types of accounts qualify as HSAs?

Only accounts linked to high-deductible health plans qualify as HSAs. - Can I invest all my HSA funds?

You can invest excess funds after meeting any required minimum balance set by your provider. - Are there penalties for withdrawing from my HSA?

Withdrawals for non-qualified expenses before age 65 incur taxes and a 20% penalty. - How do I choose investments within my HSA?

Select investments based on your risk tolerance and time horizon while considering diversification. - Can I use my HSA after retirement?

Yes, you can use it tax-free for qualified medical expenses even after retirement.

Using an HSA as an investment vehicle provides significant benefits that can enhance both healthcare funding and long-term wealth accumulation. By understanding how HSAs work and implementing effective investment strategies, individuals can leverage this powerful tool to secure their financial future while managing healthcare costs effectively.