Decentralized Finance (DeFi) is revolutionizing the insurance landscape by providing innovative solutions for risk management and coverage. Unlike traditional insurance, which often involves intermediaries and lengthy claim processes, DeFi insurance leverages blockchain technology and smart contracts to create a more efficient, transparent, and accessible system. This article explores the various ways individuals and businesses can utilize DeFi for insurance and risk hedging, examining market trends, implementation strategies, regulatory considerations, and future outlook.

| Key Concept | Description/Impact |

|---|---|

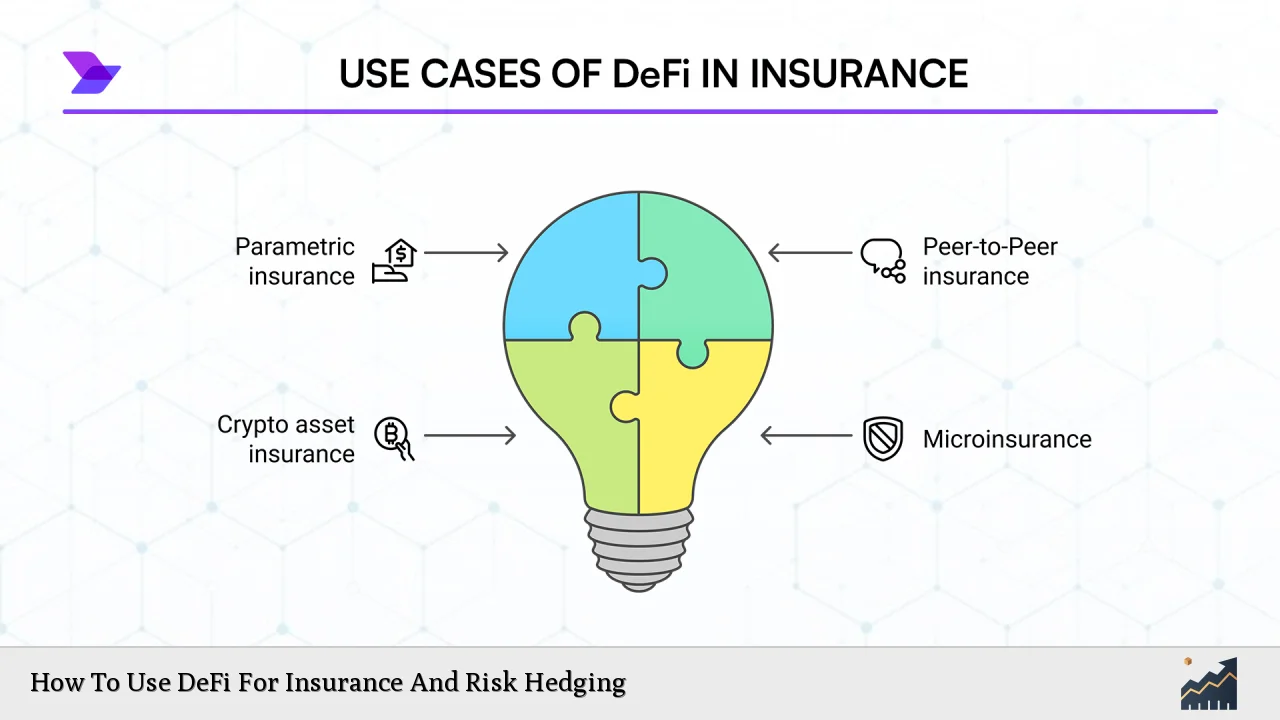

| Decentralized Insurance Models | Insurance coverage provided through decentralized platforms that pool resources from multiple participants, allowing for shared risk and reduced costs. |

| Smart Contracts | Automated contracts that execute terms of the insurance policy without the need for intermediaries, ensuring faster claims processing and payouts. |

| Parametric Insurance | A type of insurance that pays out based on predefined parameters (e.g., weather events), eliminating the need for claims adjustments. |

| Liquidity Protection | Insurance solutions that safeguard against liquidity crises in DeFi protocols, ensuring stability during market fluctuations. |

| Risk Pools | Collective funds contributed by participants to cover potential losses from specific risks, enhancing community trust and engagement. |

| Regulatory Compliance | Adhering to evolving regulations surrounding DeFi insurance to ensure legal protection and operational sustainability. |

Market Analysis and Trends

The DeFi insurance market is witnessing significant growth as it addresses unique risks associated with decentralized finance. As of 2024, the market is projected to reach approximately $46.61 billion, with a compound annual growth rate (CAGR) of 10.98% through 2029. This growth is driven by increasing demand for decentralized solutions that offer transparency, lower costs, and faster claim processing times.

Key trends influencing this market include:

- Increased Adoption of Blockchain Technology: As blockchain technology matures, its integration into insurance processes has become more seamless, improving efficiency and security.

- Emergence of Parametric Insurance Models: These models simplify claims processes by automatically triggering payouts based on specific conditions rather than requiring traditional claims submissions.

- Focus on Cybersecurity: With the rise in cyber threats targeting DeFi platforms, specialized insurance products are being developed to protect against hacking and data breaches.

- Collaborative Ecosystems: DeFi insurance platforms are fostering community-driven approaches where users can share risks and benefits through pooled resources.

Implementation Strategies

To effectively utilize DeFi for insurance and risk hedging, individuals and businesses should consider the following strategies:

- Choosing the Right Platform: Select a reputable DeFi insurance platform such as Nexus Mutual or InsurAce that aligns with your coverage needs. Evaluate their offerings based on coverage types, user reviews, and payout histories.

- Participating in Risk Pools: Engage as a liquidity provider by contributing to risk pools. This not only offers potential returns through premiums but also enhances community resilience against shared risks.

- Leveraging Smart Contracts: Utilize smart contracts to automate policy execution and claims processing. This reduces administrative burdens and accelerates payouts during claims events.

- Customizing Coverage: Tailor insurance products to meet specific needs by selecting coverage types that address unique risks associated with your assets or operations.

- Monitoring Regulatory Changes: Stay informed about regulatory developments impacting DeFi insurance to ensure compliance and mitigate legal risks.

Risk Considerations

While DeFi offers innovative solutions for insurance, it also presents unique risks that users must navigate:

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to significant losses. Conduct thorough audits before participating in any protocol.

- Market Volatility: The inherent volatility of cryptocurrencies can affect the value of insured assets. Users should be prepared for fluctuations in asset values.

- Regulatory Uncertainty: The evolving regulatory landscape poses challenges for DeFi insurance providers. It’s essential to understand how regulations may impact coverage options.

- Liquidity Risks: In times of market stress, liquidity may dry up, affecting the ability to claim or redeem policies. Ensure adequate liquidity management practices are in place.

Regulatory Aspects

As DeFi continues to grow, regulatory bodies are increasingly scrutinizing its operations. Key considerations include:

- Compliance with Local Regulations: Different jurisdictions have varying regulations regarding digital assets and decentralized finance. Ensure adherence to local laws governing cryptocurrency transactions and insurance practices.

- Consumer Protection Laws: Regulatory frameworks may impose requirements aimed at protecting consumers from fraud or mismanagement within DeFi platforms.

- Tax Implications: Understanding how taxes apply to transactions within DeFi is crucial for compliance. Consult with tax professionals familiar with cryptocurrency regulations.

Future Outlook

The future of DeFi insurance looks promising as technological advancements continue to reshape the landscape. Key developments expected include:

- Integration of AI in Risk Assessment: Artificial intelligence will play a pivotal role in enhancing risk assessment models, allowing for more accurate pricing of premiums based on real-time data analysis.

- Expansion of Coverage Options: As the DeFi ecosystem evolves, new types of coverage will emerge addressing niche markets such as non-fungible tokens (NFTs) or decentralized autonomous organizations (DAOs).

- Increased Collaboration Between Traditional Insurers and DeFi Platforms: Partnerships between traditional insurers and DeFi projects may lead to hybrid models that combine the strengths of both sectors while addressing regulatory challenges.

- Enhanced User Education: As awareness grows regarding the benefits of DeFi insurance, educational initiatives will help users understand how to effectively engage with these products.

Frequently Asked Questions About How To Use DeFi For Insurance And Risk Hedging

- What is DeFi insurance?

DeFi insurance refers to decentralized platforms that provide coverage against various risks associated with digital assets using blockchain technology. - How does smart contract automation work in DeFi insurance?

Smart contracts automatically execute policy terms when predefined conditions are met, eliminating delays typically associated with claims processing. - What types of risks can be insured in DeFi?

Common risks include smart contract failures, cybersecurity incidents, liquidity crises, and specific events like stablecoin depegging. - Are there any regulatory concerns with DeFi insurance?

The regulatory landscape for DeFi is evolving; compliance with local laws regarding digital assets is crucial for all participants. - How can I participate in a risk pool?

You can participate by contributing funds to a decentralized pool on a chosen platform; this allows you to share risks while potentially earning premiums. - What should I consider before purchasing DeFi insurance?

Evaluate platform reputation, understand coverage details, assess potential risks involved in smart contracts, and stay informed about regulatory implications. - Is there a minimum investment required for DeFi insurance?

Minimum investments vary by platform; some may allow small contributions while others might require larger amounts depending on coverage options. - Can I customize my DeFi insurance policy?

Yes, many platforms allow users to tailor their policies based on specific needs such as coverage amount and duration.

In conclusion, utilizing DeFi for insurance and risk hedging represents a transformative opportunity for individuals seeking innovative ways to protect their digital assets. By understanding market trends, implementing effective strategies, considering potential risks, adhering to regulatory standards, and anticipating future developments, investors can navigate this evolving landscape with confidence.