DeFi flash loans represent a revolutionary financial tool within the decentralized finance (DeFi) ecosystem, allowing users to borrow assets without collateral, provided the loan is repaid within the same transaction. This mechanism operates through smart contracts, which automatically enforce the terms of the loan. Understanding flash loans is crucial for individual investors and finance professionals looking to navigate the rapidly evolving landscape of DeFi. This article delves into the mechanics of flash loans, their market implications, implementation strategies, associated risks, regulatory considerations, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Flash Loans | Uncollateralized loans that must be repaid within a single blockchain transaction. |

| Smart Contracts | Self-executing contracts that facilitate and enforce the terms of flash loans. |

| Arbitrage Opportunities | Flash loans are often used for arbitrage, allowing traders to profit from price discrepancies across exchanges. |

| Market Liquidity | Flash loans enhance liquidity by enabling rapid access to capital for various trading strategies. |

| Risks and Vulnerabilities | Flash loans can be exploited for malicious purposes, such as price manipulation and market attacks. |

| Regulatory Landscape | The evolving regulations surrounding DeFi and flash loans are critical for ensuring market integrity. |

| Future Trends | The integration of flash loans into broader financial products and services is expected to grow significantly. |

Market Analysis and Trends

The DeFi sector has seen explosive growth over the past few years, with flash loans emerging as a significant component. In 2023, the total value locked (TVL) in DeFi reached approximately $50 billion, with flash loans accounting for a notable portion of trading volume. The market for flash loans is projected to grow from $1.5 billion in 2023 to $3 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 40%.

Current Market Dynamics

- Increased Adoption: Platforms like Aave and dYdX have popularized flash loans, attracting both retail and institutional investors.

- Arbitrage Trading: Flash loans are predominantly used for arbitrage opportunities, where traders exploit price differences between exchanges. For instance, if a token trades at $10 on one exchange and $10.50 on another, a trader can borrow funds via a flash loan to capitalize on this discrepancy.

- Liquidity Provisioning: By facilitating instant access to capital, flash loans contribute to overall market liquidity. This is particularly important during volatile market conditions when liquidity can dry up quickly.

Market Statistics

| Year | Market Size (in billions) | Growth Rate (%) |

|---|---|---|

| 2023 | 1.5 | 25 |

| 2024 | 2.0 | 30 |

| 2025 | 3.0 | 40 |

Implementation Strategies

To effectively utilize flash loans, investors should consider several strategies:

- Arbitrage: As previously mentioned, this is the most common use case. Investors can borrow funds to purchase an asset at a lower price on one platform and sell it at a higher price on another.

- Collateral Swaps: Investors can use flash loans to swap collateral in different DeFi protocols without needing to liquidate their positions.

- Debt Refinancing: Flash loans can be employed to pay off existing debts at higher interest rates by borrowing at lower rates from other platforms.

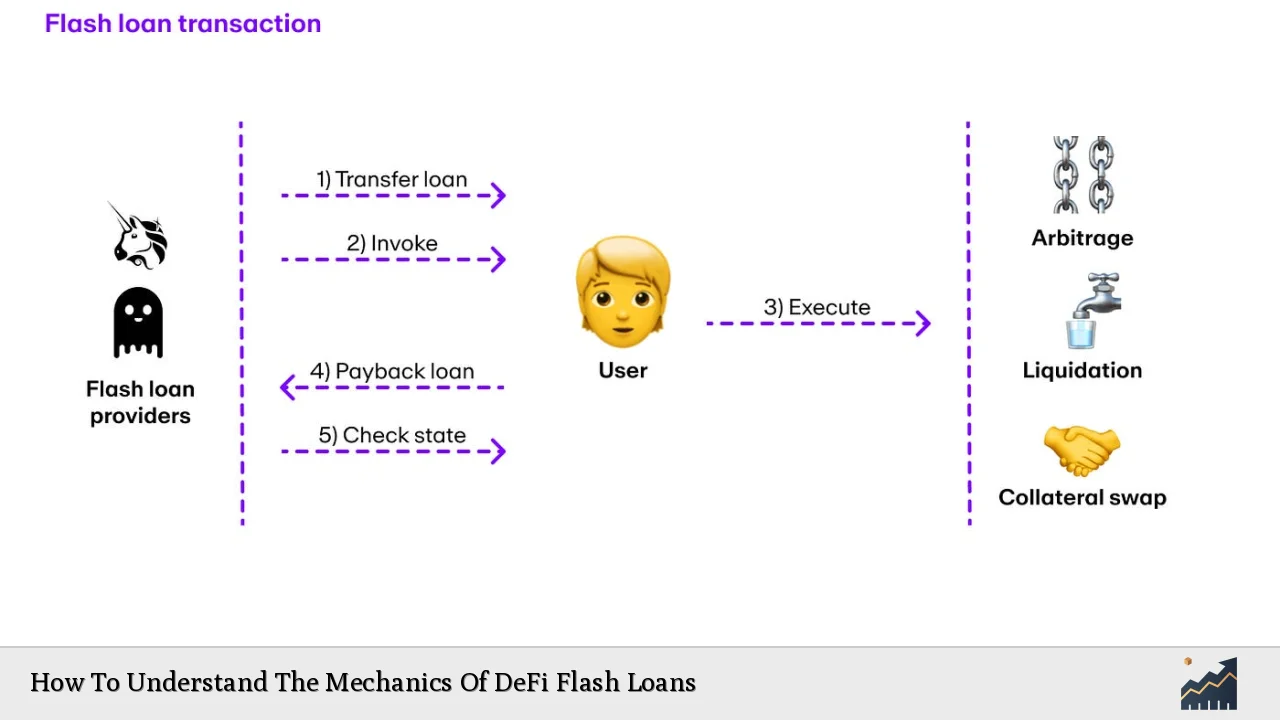

Step-by-Step Process

- Borrow: Initiate a request for a flash loan via a smart contract.

- Utilize: Use the borrowed funds for trading or other financial operations.

- Repay: Return the loan amount plus any applicable fees before the transaction concludes.

This entire process occurs within a single blockchain transaction block, emphasizing the speed and efficiency of flash loans.

Risk Considerations

While flash loans offer unique opportunities, they also come with significant risks:

- Smart Contract Vulnerabilities: Flaws in smart contract code can lead to substantial financial losses. These vulnerabilities have been exploited in various high-profile attacks.

- Market Volatility: Rapid changes in asset prices can impact the success of transactions executed via flash loans.

- Technical Failures: Issues with blockchain networks or smart contracts can disrupt transactions, leading to potential losses.

Notable Risks

- Flash Loan Attacks: Malicious actors can exploit flash loans to manipulate prices or drain liquidity pools. For example, attackers have used flash loans to execute complex strategies that result in significant financial gains at the expense of other users.

- Regulatory Risks: As regulators worldwide begin to scrutinize DeFi activities more closely, compliance with evolving regulations will be crucial for participants in this space.

Regulatory Aspects

The regulatory landscape surrounding DeFi and flash loans is still developing. Key considerations include:

- Compliance Requirements: As governments seek to regulate cryptocurrencies and DeFi platforms, understanding compliance requirements will be essential for users engaging in flash loan transactions.

- Consumer Protection: Regulatory bodies are increasingly focused on protecting consumers from potential fraud and market manipulation associated with unregulated financial products like flash loans.

Global Perspectives

Different jurisdictions are taking varied approaches toward regulating DeFi:

- In the European Union, there is an ongoing discussion about implementing comprehensive regulations for DeFi activities.

- In contrast, some countries have adopted a more permissive stance towards cryptocurrency innovations but remain vigilant about potential risks associated with unregulated lending practices.

Future Outlook

The future of DeFi flash loans appears promising as they continue to integrate into various financial services:

- Innovative Use Cases: Developers are exploring new applications for flash loans beyond traditional arbitrage, including automated trading systems and decentralized insurance products.

- Market Growth: The anticipated growth in the DeFi sector will likely drive further innovation in flash loan offerings and their integration into existing financial frameworks.

Key Trends to Watch

- Increased collaboration between traditional finance institutions and DeFi platforms could lead to hybrid models that leverage the benefits of both sectors.

- The development of advanced security protocols aimed at mitigating risks associated with smart contracts will be critical as adoption increases.

Frequently Asked Questions About How To Understand The Mechanics Of DeFi Flash Loans

- What are DeFi flash loans?

DeFi flash loans are uncollateralized loans that allow users to borrow funds without providing collateral as long as they repay them within the same transaction. - How do I use a flash loan?

To use a flash loan, you initiate a request through a smart contract, utilize the funds for trading or other purposes, and repay the loan before the transaction ends. - What risks are associated with flash loans?

The primary risks include vulnerabilities in smart contracts that can lead to losses during attacks or failures due to market volatility. - Can anyone access flash loans?

Yes, anyone with knowledge of how to interact with smart contracts can access flash loans; however, understanding their mechanics is crucial for successful utilization. - What is an example of using a flash loan?

A common example includes borrowing funds to exploit price differences across exchanges (arbitrage), buying low on one platform and selling high on another. - Are there any regulatory concerns regarding flash loans?

Yes, as regulatory scrutiny increases globally around cryptocurrencies and DeFi practices, it’s essential for users to stay informed about compliance requirements. - What does the future hold for DeFi flash loans?

The future looks bright with ongoing integration into various financial products and services expected alongside significant market growth. - How do I mitigate risks when using flash loans?

You can mitigate risks by thoroughly understanding smart contract interactions, staying updated on market conditions, and utilizing security protocols designed for DeFi transactions.

In conclusion, understanding the mechanics of DeFi flash loans requires an appreciation of their innovative nature within decentralized finance. As this sector continues to evolve rapidly, individual investors and finance professionals must stay informed about trends, risks, regulatory developments, and strategic implementations related to these unique financial instruments.