Understanding investment is crucial for anyone looking to grow their wealth and secure their financial future. Investments can take many forms, including stocks, bonds, real estate, and mutual funds. Each type of investment has its own risk and return profile, making it essential for investors to understand their options and align them with their financial goals. This article will explore the fundamentals of investing, the various types of investment vehicles available, and practical steps to get started.

Investing is essentially the act of allocating resources, usually money, in order to generate income or profit. The main goal of investing is to increase the value of your money over time through various means. This can include capital appreciation, where the value of an asset increases, or income generation through dividends or interest payments.

Understanding the basic principles of investing can help you make informed decisions that align with your financial goals. Whether you are saving for retirement, a major purchase, or simply looking to grow your wealth, having a solid foundation in investment principles is essential.

| Investment Type | Description |

|---|---|

| Stocks | Ownership shares in a company that can appreciate in value. |

| Bonds | Loans made to corporations or governments that pay interest over time. |

| Mutual Funds | Pools of money from multiple investors used to invest in a diversified portfolio. |

| Real Estate | Property investments that can generate rental income and appreciate in value. |

Understanding Different Types of Investments

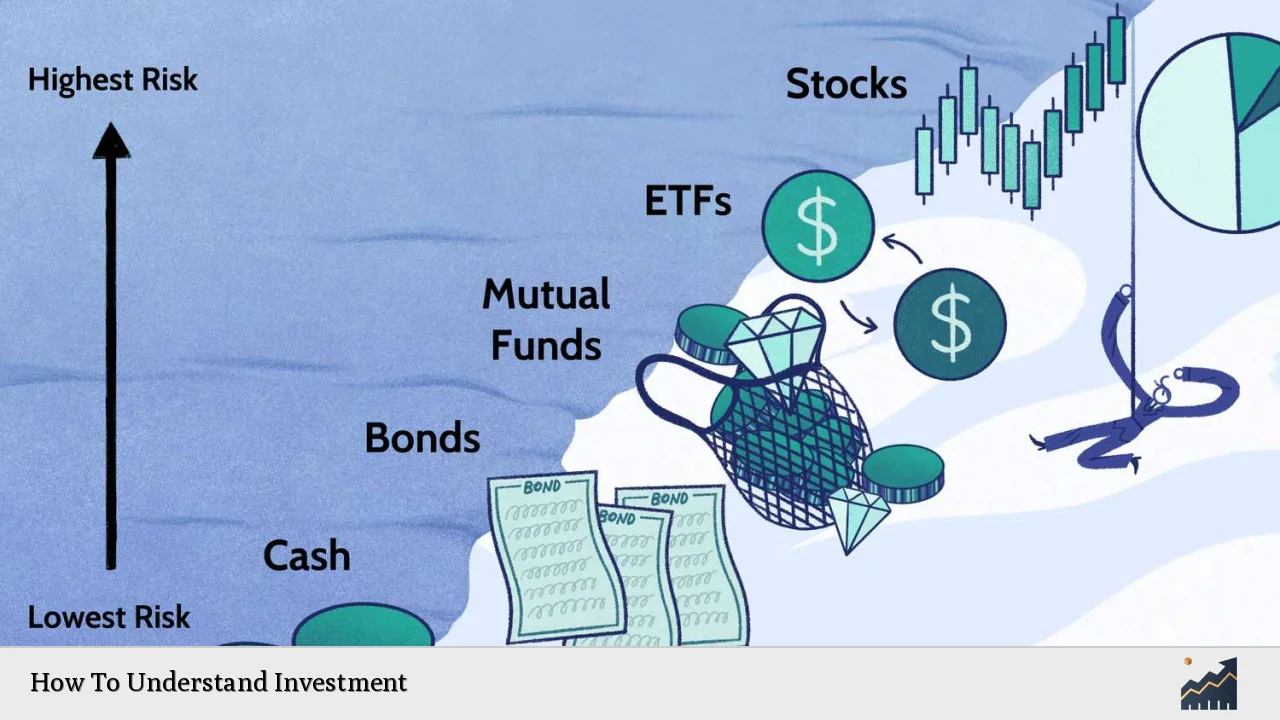

Investments come in various forms, each with unique characteristics and potential returns. It’s crucial to understand these differences to make informed choices.

- Stocks: When you buy stocks, you purchase ownership in a company. Stocks can provide high returns but come with higher risks due to market volatility. Investors can benefit from capital appreciation and dividends.

- Bonds: Bonds are debt securities issued by corporations or governments. When you purchase a bond, you are effectively lending money in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are generally considered safer than stocks but offer lower returns.

- Mutual Funds: These are investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks and bonds. Mutual funds are managed by professional fund managers and provide investors with diversification and professional management.

- Real Estate: Investing in real estate involves purchasing properties for rental income or resale at a higher price. Real estate can provide significant returns but requires substantial capital and involves ongoing management responsibilities.

Understanding these investment types allows investors to build a diversified portfolio that aligns with their risk tolerance and financial objectives.

The Importance of Risk Assessment

Before diving into investments, assessing your risk tolerance is essential. Risk tolerance refers to how much risk an investor is willing to take when investing their money. Factors influencing risk tolerance include age, financial situation, investment goals, and personal comfort with market fluctuations.

- Risk Tolerance Levels:

- Conservative: Prefers lower-risk investments such as bonds or stable mutual funds.

- Moderate: Comfortable with some risk; may invest in a mix of stocks and bonds.

- Aggressive: Willing to take significant risks for potentially higher returns; likely invests heavily in stocks.

Assessing your risk tolerance helps tailor your investment strategy accordingly. It ensures that you do not take on more risk than you are comfortable with, which can lead to stress and poor decision-making during market downturns.

Setting Financial Goals

Establishing clear financial goals is vital for successful investing. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Common investment goals include:

- Saving for retirement

- Purchasing a home

- Funding education

- Building wealth for future generations

By defining your goals, you can determine how much money you need to invest and what types of investments will help you achieve those goals within your desired time frame.

Creating an Investment Strategy

An effective investment strategy outlines how you plan to achieve your financial goals through various investment vehicles. Here are steps to create a solid strategy:

1. Determine Your Time Horizon: Understand when you will need the money you’ve invested. Short-term goals may require more conservative investments, while long-term goals can afford more aggressive strategies.

2. Choose an Asset Allocation: Asset allocation refers to how you distribute your investments among different asset classes (stocks, bonds, real estate). A well-balanced portfolio mitigates risk while maximizing potential returns.

3. Diversify Your Portfolio: Diversification involves spreading investments across various asset classes and sectors to reduce risk. This way, if one investment performs poorly, others may perform well enough to offset losses.

4. Regularly Review Your Portfolio: Market conditions change over time; thus, it’s important to review your investments periodically. Adjust your portfolio as needed based on performance and changes in your financial situation or goals.

5. Stay Informed: Continuously educate yourself about market trends and economic factors that may impact your investments. Knowledge empowers better decision-making.

Getting Started with Investing

Starting your investment journey can seem daunting but breaking it down into manageable steps makes it easier:

- Open an Investment Account: Choose between brokerage accounts or retirement accounts like IRAs or 401(k)s based on your needs.

- Start Small: You don’t need a lot of money to begin investing; many platforms allow for small initial investments or fractional shares.

- Consider Low-Cost Options: Look into index funds or ETFs that offer diversification at lower fees compared to actively managed funds.

- Automate Your Investments: Set up automatic contributions from your bank account into your investment account; this builds consistency without requiring active management.

- Be Patient: Investing is a long-term endeavor; avoid making impulsive decisions based on short-term market fluctuations.

The Role of Financial Advisors

For those who feel overwhelmed by the complexities of investing, consulting a financial advisor can be beneficial. Advisors provide personalized guidance based on individual financial situations and goals.

- Benefits of Working with an Advisor:

- Tailored investment strategies

- Help with retirement planning

- Ongoing portfolio management

- Access to exclusive investment opportunities

However, it’s essential to choose an advisor who aligns with your values and understands your financial objectives.

FAQs About Investment

- What is the best way to start investing?

Start by defining your financial goals and choosing an appropriate investment account. - How much money do I need to start investing?

You can start investing with small amounts thanks to low minimums offered by many platforms. - What is diversification?

Diversification involves spreading investments across various asset classes to reduce risk. - How often should I review my investments?

You should review your investments at least annually or whenever there are significant life changes. - What are mutual funds?

Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals.

In conclusion, understanding investment involves grasping different types of assets available, assessing personal risk tolerance, setting clear financial goals, creating an effective strategy, and being patient throughout the process. By following these steps and continuously educating yourself about the market, you can build a robust investment portfolio that aligns with your long-term financial aspirations.