Transferring funds from your CPF Investment Account (CPFIS) back to your CPF Ordinary Account (CPF OA) is a straightforward process that enables you to manage your retirement savings effectively. This transfer is essential for individuals who want to consolidate their investments or ensure that their funds are earning the higher interest rates associated with the CPF OA. The CPF OA typically offers an interest rate of 2.5%, which can be more beneficial than some investment returns, depending on market conditions.

In this guide, we will explore the steps required to transfer your CPF investment back to your CPF OA, the methods available for doing so, and important considerations to keep in mind during the process.

| Step | Description |

|---|---|

| 1 | Log in to your internet banking platform. |

| 2 | Select ‘Refund to CPF Board’ under investment services. |

| 3 | Choose full or partial refund and verify details. |

| 4 | Submit your request and check account for confirmation. |

Understanding CPF Investment Scheme (CPFIS)

The CPF Investment Scheme (CPFIS) allows CPF members to invest their savings in various financial products, including stocks, bonds, and unit trusts. This scheme is designed to help members grow their retirement savings beyond the standard interest rates offered by the CPF accounts.

To participate in CPFIS, members must meet certain eligibility criteria:

- Be at least 18 years old.

- Have a minimum balance of $20,000 in their Ordinary Account.

- Be a Singapore citizen or permanent resident.

Investing through CPFIS can potentially yield higher returns, but it also comes with risks associated with market fluctuations. Therefore, understanding how to manage these investments and when to transfer funds back to your CPF OA is crucial for effective financial planning.

Steps to Transfer Funds from CPFIS to CPF OA

Transferring funds from your CPFIS back to your CPF OA involves several clear steps. Here’s a detailed breakdown of the process:

1. Log In: Start by logging into your bank’s internet banking platform where your CPF Investment Account is held.

2. Navigate to Investment Services: Once logged in, look for the ‘Invest’ tab or section. Under this tab, select ‘More Investment Services’ or a similar option that allows you to manage your investments.

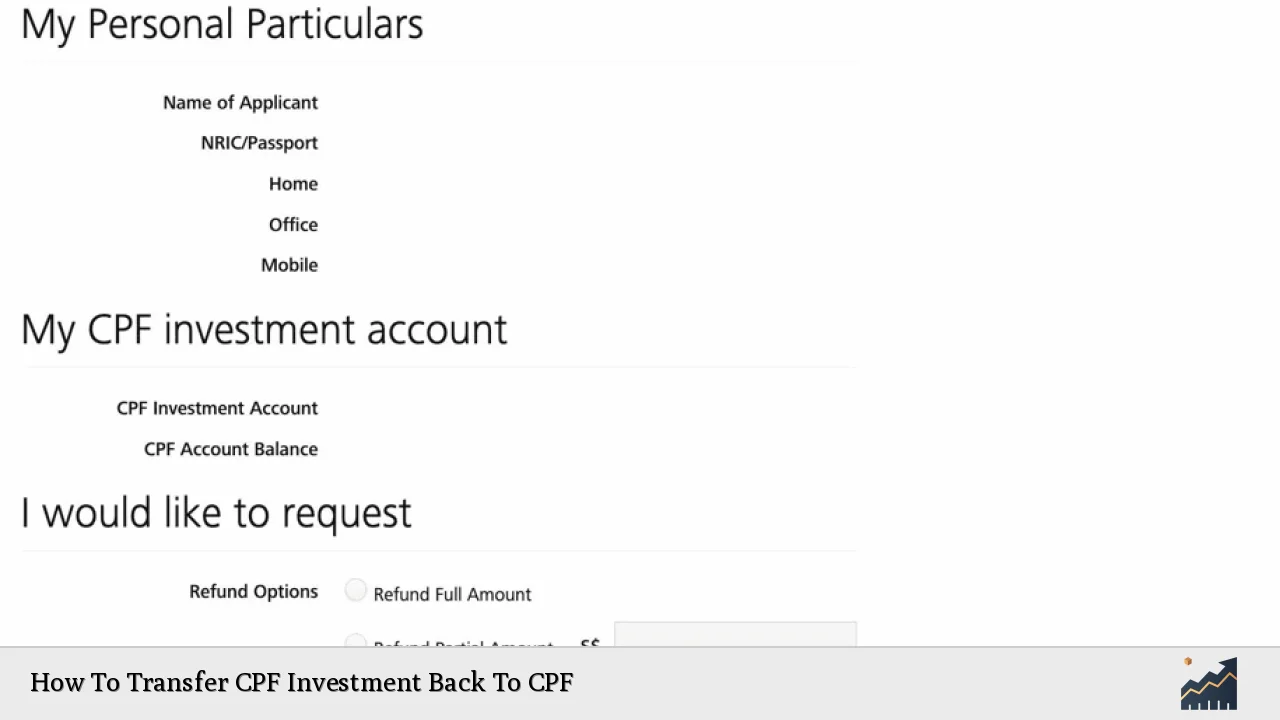

3. Select Refund Option: Choose the option labeled ‘Refund to CPF Board’. You will typically have the choice between a full refund of all available funds or a partial refund where you specify an amount.

4. Verify Details: Carefully review your personal particulars, account details, and the amount you wish to transfer back to ensure everything is correct.

5. Submit Request: After verifying all information, submit your request. It’s advisable to print out or save the completion page as it contains a Transaction Reference Number for future inquiries.

6. Check Your Account: After submission, monitor your CPF OA account statement over the next few days to confirm that the funds have been credited successfully.

The entire process usually takes about 3 business days, and there are no service charges associated with this transfer.

Alternative Methods for Transferring Funds

While online banking is the most convenient method for transferring funds back to your CPF OA, there are alternative options available:

- ATM Transfers: Some banks allow you to initiate transfers using ATMs equipped with investment services. Follow on-screen prompts similar to those found in online banking.

- Branch Visit: You can also visit your bank branch directly and request assistance from a customer service representative in transferring funds from your CPFIS account back to your CPF OA.

These alternatives can be useful if you encounter issues with online banking or prefer face-to-face assistance.

Important Considerations When Transferring Funds

When transferring funds from your CPFIS back to your CPF OA, consider the following important factors:

- Interest Rates: Funds transferred back into the CPF OA start earning interest immediately at the current rate of 2.5% per annum. This can be significantly higher than potential returns from some investments within the CPFIS.

- Investment Strategy: Before transferring funds, assess whether remaining invested is more beneficial based on current market conditions and your financial goals.

- Inactivity Policy: If there are no transactions in your CPFIS account for two consecutive months, your agent bank will automatically transfer any cash balance back into your CPF OA at the end of that period.

- Documentation: Keep records of all transactions and confirmations related to fund transfers for future reference and financial planning purposes.

FAQs About Transferring CPF Investment Back To CPF

FAQs About How To Transfer CPF Investment Back To CPF

- What is the purpose of transferring funds from CPFIS back to my OA?

The purpose is typically to consolidate savings and earn higher interest rates available in the Ordinary Account. - How long does it take for transferred funds to reflect in my OA?

It generally takes about 3 business days for transferred funds to appear in your Ordinary Account. - Are there any fees associated with this transfer?

No, there are no service charges for transferring funds from your investment account back to your Ordinary Account. - Can I transfer only part of my investment balance?

Yes, you have the option to select either a full or partial refund when initiating the transfer. - What happens if I do not transfer my funds after selling investments?

If you do not initiate a transfer after selling investments, the cash will remain in your investment account until you decide otherwise.

Transferring funds from your CPF Investment Account back into your Ordinary Account is an essential step in managing retirement savings effectively. By following these outlined steps and considering important factors such as interest rates and investment strategies, you can make informed decisions that align with your financial goals.