Tracking the performance of smart contract platforms is crucial for investors, developers, and businesses looking to leverage blockchain technology. As smart contracts automate and secure transactions, understanding their performance can help stakeholders make informed decisions. This article explores various methods to track smart contract performance, market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Performance Metrics | Key metrics such as transaction speed, cost per transaction (gas fees), and scalability are essential for evaluating platform efficiency. |

| Real-Time Monitoring Tools | Tools like Circle’s Event Monitoring allow developers to track activities on smart contracts in real-time, enhancing responsiveness to unusual events. |

| Market Trends | The smart contract market is expected to grow significantly, with estimates predicting a CAGR of up to 78.12% from 2024 to 2032. |

| Interoperability | The ability of smart contracts to interact across different blockchain platforms increases their utility and adoption. |

| Regulatory Compliance | Understanding the evolving regulatory landscape is vital for ensuring that smart contracts operate within legal frameworks. |

| Security Audits | Regular audits are necessary to identify vulnerabilities and ensure the integrity of smart contract operations. |

Market Analysis and Trends

The smart contract platform market is experiencing rapid growth, driven by increasing adoption across various industries.

- Market Size: The global market was valued at approximately USD 1.21 billion in 2023 and is projected to reach around USD 218.59 billion by 2032, reflecting a staggering CAGR of 78.12% from 2024 onwards.

- Growth Drivers: Key factors contributing to this growth include rising consumer awareness of blockchain technology, the increasing need for automation in business processes, and the demand for decentralized finance (DeFi) solutions.

- Technological Advancements: Innovations such as layer-2 solutions and cross-chain technologies are addressing previous limitations related to network congestion and high transaction costs. These advancements enhance the scalability and efficiency of smart contract platforms.

- Industry Adoption: Industries such as finance, supply chain management, and real estate are increasingly integrating smart contracts into their operations. For instance, over 80% of supply chain professionals believe that blockchain technology will simplify processes significantly.

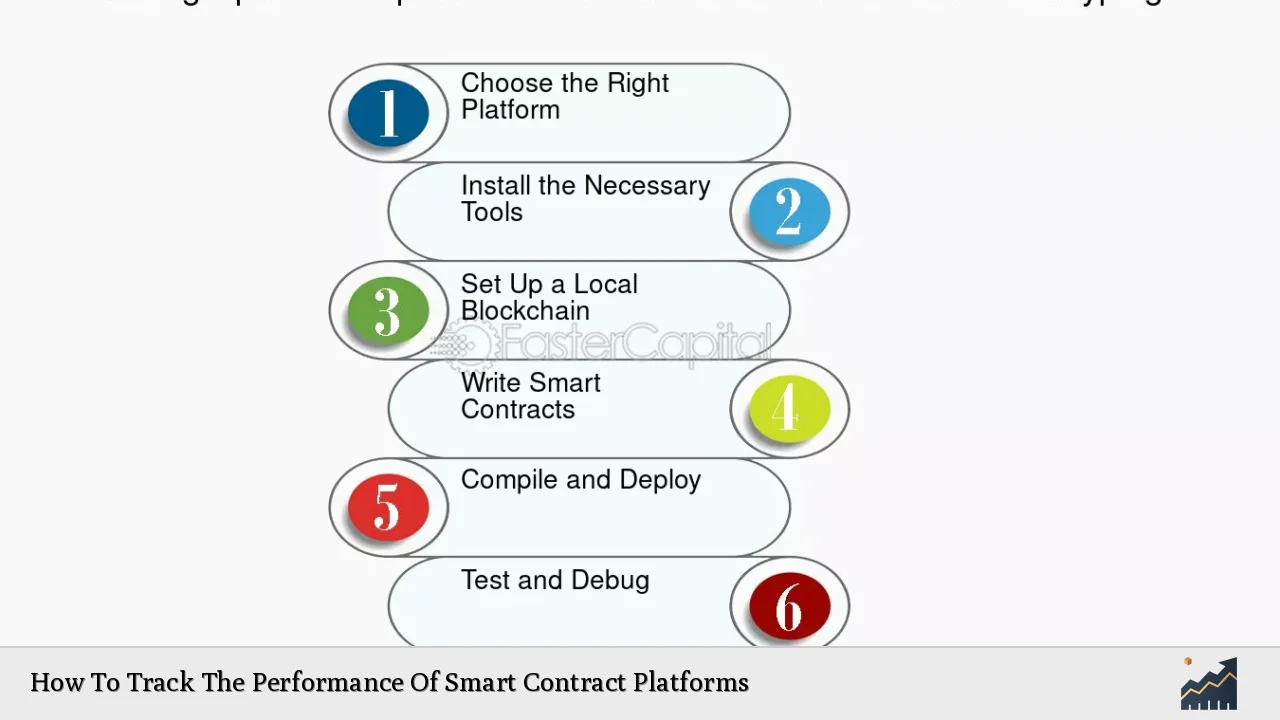

Implementation Strategies

To effectively track the performance of smart contract platforms, stakeholders can adopt several strategies:

- Define Key Performance Indicators (KPIs): Establish relevant KPIs such as transaction throughput, execution time, cost efficiency, and user engagement metrics.

- Utilize Real-Time Monitoring Tools: Implement tools like Circle’s Event Monitoring or other blockchain analytics platforms that provide insights into transaction volumes, contract interactions, and potential anomalies.

- Conduct Comparative Analysis: Regularly compare the performance of different smart contract platforms based on established KPIs. This can help identify which platforms offer better scalability or lower costs.

- Engage in Continuous Improvement: Use insights gained from monitoring tools to refine and optimize smart contract deployments. Regular updates and audits can help maintain security and performance standards.

Risk Considerations

Investing in or developing on smart contract platforms comes with inherent risks that must be managed:

- Security Vulnerabilities: Smart contracts are susceptible to bugs and exploits. Regular security audits are essential to identify potential vulnerabilities before they can be exploited.

- Market Volatility: The cryptocurrency market is known for its volatility. Investors should be prepared for significant fluctuations in the value of tokens associated with smart contract platforms.

- Regulatory Risks: As governments worldwide develop regulations surrounding blockchain technology, compliance becomes critical. Non-compliance could lead to legal challenges or operational disruptions.

- Scalability Issues: As usage increases, some platforms may struggle with transaction speeds or costs. Understanding a platform’s capacity to scale is vital for long-term viability.

Regulatory Aspects

The regulatory landscape for smart contracts is evolving rapidly:

- Compliance Requirements: Stakeholders must stay informed about local regulations governing blockchain technology and cryptocurrencies. This includes understanding anti-money laundering (AML) laws and know your customer (KYC) requirements.

- Global Variations: Different countries have varying approaches to regulating blockchain technologies. Investors should consider these differences when engaging with international markets.

- Future Regulations: As the use of smart contracts grows, regulatory bodies are likely to introduce more comprehensive frameworks governing their use. Staying ahead of these changes will be essential for compliance.

Future Outlook

The future of smart contract platforms looks promising:

- Integration with AI: The merging of artificial intelligence with smart contracts is expected to enhance their functionality by automating decision-making processes based on real-time data analysis.

- Increased Interoperability: Future developments will likely focus on improving interoperability between different blockchain networks, enabling seamless transactions across various platforms.

- Sustainability Initiatives: As environmental concerns rise regarding energy consumption in blockchain operations, there may be a shift towards more sustainable practices within the industry.

- Wider Adoption in Traditional Finance: Traditional financial institutions are beginning to explore the integration of smart contracts into their operations, potentially leading to hybrid systems that combine traditional finance with decentralized solutions.

Frequently Asked Questions About How To Track The Performance Of Smart Contract Platforms

- What are the key metrics for tracking smart contract performance?

Key metrics include transaction speed, gas fees (cost per transaction), scalability (ability to handle increased load), and security incidents. - How can I monitor my smart contracts in real-time?

You can use tools like Circle’s Event Monitoring or blockchain analytics platforms that provide dashboards for tracking transactions and events. - What risks should I consider when using smart contracts?

Risks include security vulnerabilities, market volatility, regulatory compliance issues, and potential scalability challenges. - How do regulations affect smart contracts?

Regulations vary by region but generally require compliance with financial laws such as AML and KYC. Non-compliance can lead to legal issues. - What is the future outlook for smart contracts?

The future includes greater integration with AI, improved interoperability between blockchains, sustainability initiatives, and wider adoption in traditional finance. - How do I conduct a comparative analysis of different platforms?

You can analyze performance metrics such as transaction costs, speed, user engagement rates, and security features across various platforms. - Why is security auditing important?

Security audits help identify vulnerabilities in smart contracts before deployment or during operation, reducing the risk of exploits or failures. - What tools are available for monitoring smart contract activity?

A variety of tools exist including blockchain explorers (like Etherscan), analytics platforms (like Dune Analytics), and specific monitoring services offered by companies like Circle.

This comprehensive guide provides a foundation for understanding how to effectively track the performance of smart contract platforms while considering market dynamics and future trends. By leveraging appropriate tools and strategies while remaining aware of risks and regulatory requirements, stakeholders can maximize their engagement with this transformative technology.