Decentralized Finance (DeFi) has emerged as a transformative force in the financial landscape, offering innovative solutions that bypass traditional banking systems. As individual investors and finance professionals increasingly engage with DeFi, tracking market performance becomes essential for informed decision-making. This article explores various methodologies for monitoring DeFi market performance, including key indicators, market analysis tools, and emerging trends.

| Key Concept | Description/Impact |

|---|---|

| Total Value Locked (TVL) | TVL represents the total capital held within DeFi protocols, serving as a primary metric for assessing market health and liquidity. As of January 2024, TVL in DeFi platforms reached approximately USD 55.95 billion, indicating significant growth from USD 9.1 billion in July 2020. |

| Decentralized Finance Resilience Index (DRI) | The DRI measures the ability of the DeFi market to withstand shocks and recover from downturns. It is constructed using indicators such as TVL, active addresses, and trading volumes, providing insights into market stability. |

| On-Chain Activity Metrics | Metrics such as transaction volume and unique address growth are critical for understanding user engagement and network activity within DeFi platforms. |

| Market Sentiment Analysis | Sentiment analysis tools gauge investor attitudes towards specific DeFi projects or the market as a whole, influencing trading decisions and market dynamics. |

| Regulatory Developments | Monitoring regulatory changes is crucial as they can significantly impact DeFi operations and investor confidence. Awareness of evolving regulations helps mitigate risks associated with compliance. |

Market Analysis and Trends

The DeFi market has witnessed remarkable growth over the past few years, with projections estimating it will reach USD 78.47 billion by 2029, growing at a CAGR of 10.98% from 2024 to 2029. This growth is driven by increasing adoption of blockchain technology across various sectors and the democratization of financial services.

Current Market Statistics

- Total Value Locked (TVL): Approximately USD 55.95 billion as of January 2024.

- Market Capitalization: The DeFi market cap peaked at USD 3,082.4 million in July 2021.

- User Engagement: MetaMask has over 30 million users, highlighting the growing interest in decentralized applications.

Key Trends

- Institutional Participation: The entry of institutional investors into the DeFi space is reshaping the landscape, increasing liquidity and stability.

- Integration with Traditional Finance: Partnerships between DeFi platforms and traditional financial institutions are becoming more common, enhancing accessibility to decentralized services.

- Real-World Asset Tokenization: The trend towards tokenizing real-world assets on blockchain networks is gaining momentum, providing new investment opportunities.

Implementation Strategies

To effectively track performance in the DeFi markets, investors should consider implementing the following strategies:

Utilize Performance Tracking Tools

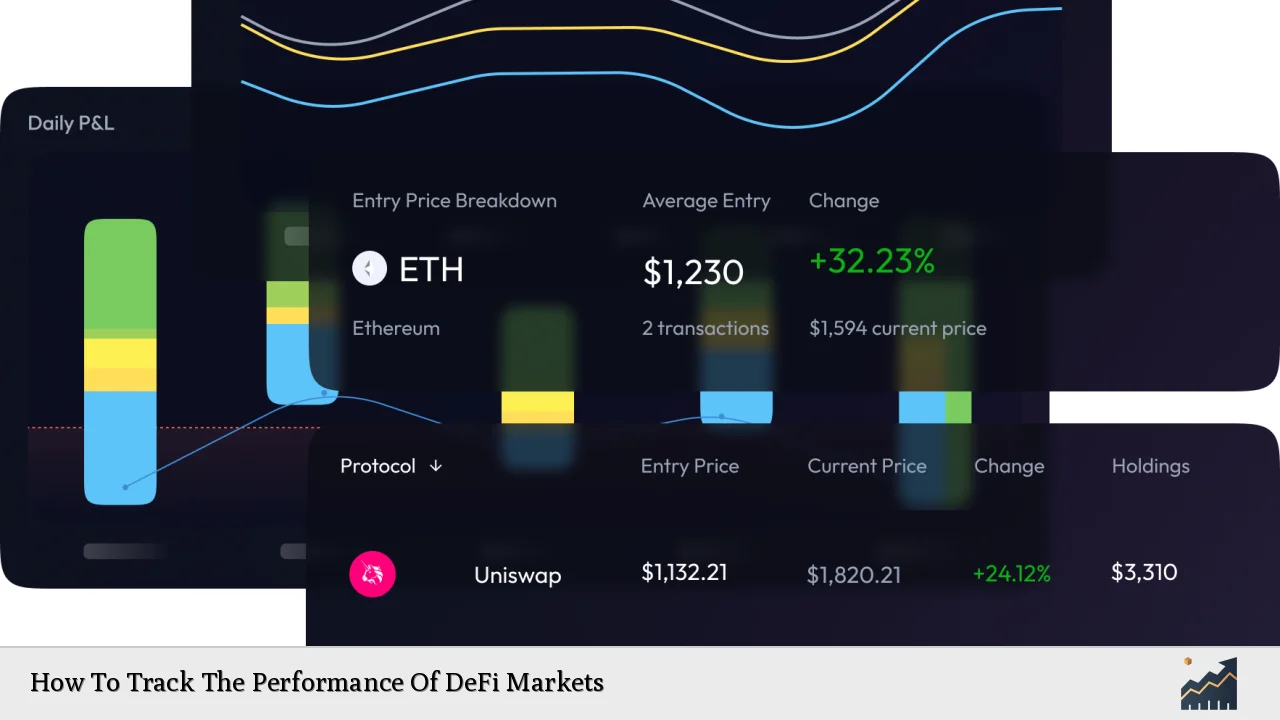

- DeFi Trackers: Platforms like CoinStats and Merlin provide comprehensive dashboards that allow users to monitor their portfolios in real-time. These tools aggregate data across multiple wallets and exchanges, offering insights into profit/loss metrics and transaction volumes.

Analyze Key Performance Indicators (KPIs)

Investors should focus on several KPIs to gauge project viability:

- Liquidity Metrics: Assess liquidity ratios to evaluate how easily assets can be converted to cash without affecting their price.

- Yield Farming Returns: Monitor returns from yield farming activities to identify profitable opportunities.

- Impermanent Loss Calculations: Understand potential losses incurred when providing liquidity to decentralized exchanges.

Conduct Regular Market Research

Staying informed about market trends through reports from investment research firms and financial journals is crucial. Regularly reviewing academic papers on DeFi resilience can provide insights into long-term sustainability.

Risk Considerations

Investing in DeFi carries inherent risks that must be carefully managed:

Smart Contract Vulnerabilities

DeFi protocols are often susceptible to exploits due to bugs in smart contracts. Investors should conduct thorough audits of projects before engaging.

Regulatory Risks

The lack of clear regulatory frameworks poses challenges for investors. Keeping abreast of developments from regulatory bodies like the SEC can help mitigate compliance risks.

Market Volatility

The cryptocurrency markets are notoriously volatile. Implementing risk management strategies such as stop-loss orders can help protect investments during downturns.

Regulatory Aspects

The regulatory landscape surrounding DeFi is evolving rapidly:

Current Regulatory Environment

Governments worldwide are beginning to establish guidelines for DeFi operations. This includes addressing issues related to anti-money laundering (AML) and know your customer (KYC) regulations.

Future Regulatory Trends

As regulators gain a better understanding of blockchain technology, we can expect more comprehensive frameworks that will influence how DeFi projects operate globally.

Future Outlook

The future of DeFi looks promising but is contingent upon several factors:

Continued Innovation

The development of new protocols and applications will likely drive further adoption. Innovations such as decentralized insurance platforms could expand the utility of DeFi services.

Integration with Traditional Finance

As traditional financial institutions increasingly explore partnerships with DeFi platforms, we may see greater acceptance and integration of decentralized solutions into mainstream finance.

Global Adoption Trends

Regions like North America are leading in DeFi adoption; however, emerging markets may present untapped opportunities for growth due to their limited access to traditional banking services.

Frequently Asked Questions About How To Track The Performance Of DeFi Markets

- What is Total Value Locked (TVL) in DeFi?

TVL refers to the total capital held within all DeFi protocols at any given time, serving as a key indicator of market health. - How can I track my DeFi investments?

You can use performance tracking tools like CoinStats or Merlin that aggregate data from multiple wallets and exchanges. - What are some key metrics to monitor in DeFi?

Important metrics include TVL, yield farming returns, impermanent loss calculations, transaction volumes, and unique address growth. - Are there risks associated with investing in DeFi?

Yes, risks include smart contract vulnerabilities, regulatory uncertainties, and high market volatility. - How does regulation affect the DeFi market?

Regulation can impact how projects operate by enforcing compliance standards which may enhance investor confidence but could also limit innovation. - What trends should I watch for in the future of DeFi?

Key trends include increased institutional participation, real-world asset tokenization, and ongoing innovations in decentralized applications. - How does market sentiment influence DeFi investments?

Market sentiment can significantly affect trading volumes and price movements; tools that analyze sentiment can help investors gauge potential market shifts. - What role do decentralized exchanges play in the DeFi ecosystem?

Decentralized exchanges (DEXs) facilitate peer-to-peer trading without intermediaries, enhancing privacy and reducing costs compared to traditional exchanges.

In conclusion, tracking the performance of DeFi markets requires a multifaceted approach involving robust analytical tools, awareness of regulatory developments, and an understanding of key performance indicators. As the landscape continues to evolve rapidly, staying informed will empower investors to navigate this dynamic environment effectively while maximizing their investment potential.