Establishing a real estate investment company requires careful planning and strategic structuring to maximize profitability while minimizing risks. The right structure not only protects personal assets but also optimizes tax benefits, enhances operational efficiency, and positions the company for growth in a competitive market. This guide will explore various structural options, market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks for real estate investment companies.

| Key Concept | Description/Impact |

|---|---|

| Limited Liability Company (LLC) | Offers personal liability protection, allowing profits to pass through to personal income without double taxation. Ideal for small to medium-sized real estate investments. |

| Corporation (C-Corp/S-Corp) | Provides strong liability protection and allows for raising capital through share sales. However, C-Corps face double taxation on earnings. |

| Limited Partnership (LP) | Involves general partners managing the business and limited partners providing capital without management responsibilities. Useful for attracting passive investors. |

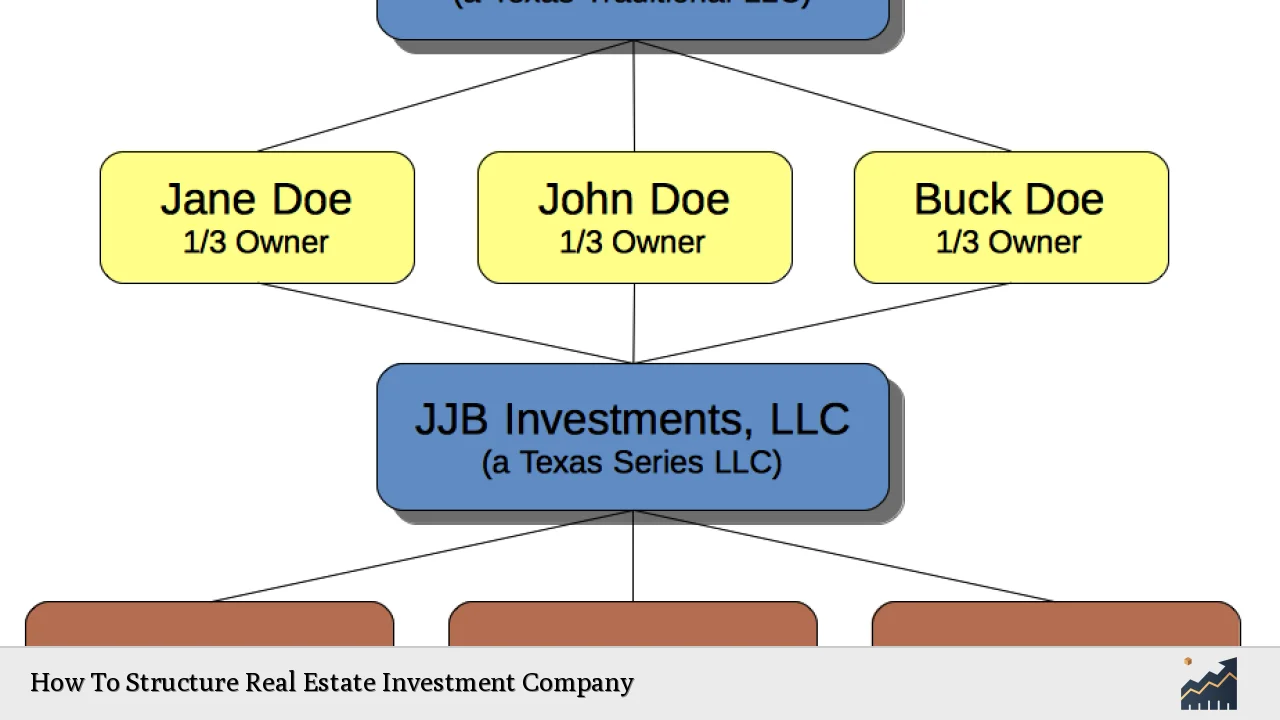

| Series LLC | Allows multiple properties to be held under one umbrella LLC while maintaining separate liability protections for each property. Cost-effective for managing multiple investments. |

| Holding Company Structure | A three-tier structure involving a holding company, property management company, and real estate operating companies to optimize tax benefits and liability protection. |

Market Analysis and Trends

The real estate market is experiencing significant changes driven by economic factors, demographic shifts, and technological advancements. According to recent reports, the global real estate market size is projected to grow from $4,016.66 billion in 2023 to $4,314.99 billion in 2024, reflecting a compound annual growth rate (CAGR) of 7.4%.

Key market trends include:

- High Demand for Rentals: As home prices remain elevated and mortgage rates fluctuate, more individuals are opting for rental properties over home purchases. This trend is expected to continue into 2024 as affordability challenges persist.

- Technological Integration: The adoption of PropTech solutions is transforming property management and investment strategies. Investors are increasingly utilizing data analytics and AI to enhance decision-making processes.

- Sustainability Focus: There is a growing emphasis on eco-friendly investments and sustainable building practices. Investors are prioritizing properties that meet environmental standards as part of their long-term strategies.

- Urbanization and Infrastructure Investment: Urbanization continues to drive demand for residential and commercial properties in metropolitan areas. Investments in infrastructure are expected to support this growth trajectory.

Implementation Strategies

When structuring a real estate investment company, several strategies can be employed:

- Define Your Investment Strategy: Determine whether you will focus on residential, commercial, or mixed-use properties. This decision will influence your business structure and operational approach.

- Choose the Right Legal Structure: Most investors opt for an LLC due to its liability protection and favorable tax treatment. However, depending on your investment goals, other structures like LPs or corporations may be more suitable.

- Develop a Comprehensive Business Plan: A well-crafted business plan should outline your investment strategy, financial projections, marketing approach, and operational plan. This document is crucial for securing funding from investors or lenders.

- Build a Strong Team: Assemble a team of professionals including real estate agents, property managers, accountants, and legal advisors who can provide expertise in their respective fields.

Risk Considerations

Investing in real estate carries inherent risks that must be managed effectively:

- Market Volatility: Economic downturns can lead to decreased property values and rental income. Diversifying your portfolio across different asset types can mitigate this risk.

- Financing Risks: High-interest rates can impact cash flow and profitability. Investors should consider fixed-rate financing options or explore alternative funding sources like private equity or crowdfunding.

- Regulatory Changes: Real estate regulations can vary significantly by location and may change over time. Staying informed about local laws and compliance requirements is essential for minimizing legal risks.

- Operational Risks: Issues such as property damage or tenant disputes can affect profitability. Implementing robust property management practices can help address these challenges proactively.

Regulatory Aspects

Understanding the regulatory environment is crucial when establishing a real estate investment company:

- Licensing Requirements: Depending on your location, you may need specific licenses to operate as a real estate investor or property manager.

- Tax Implications: Different structures have varying tax obligations. For instance, LLCs benefit from pass-through taxation while corporations may face double taxation on profits.

- Compliance with Fair Housing Laws: Ensure that all rental practices comply with federal and state fair housing laws to avoid legal issues.

Future Outlook

The future of real estate investment companies appears promising but requires adaptability:

- Continued Growth in Rental Markets: With ongoing economic uncertainties leading many potential buyers to rent instead of purchase homes, rental markets are expected to thrive.

- Technological Advancements: The integration of AI and data analytics will likely continue reshaping how properties are managed and marketed.

- Focus on Sustainability: As environmental concerns become more prominent, investments in sustainable properties will likely yield higher returns as consumer preferences shift toward greener options.

Frequently Asked Questions About How To Structure Real Estate Investment Company

- What is the best legal structure for a real estate investment company?

The best legal structure often depends on individual circumstances but LLCs are popular due to their liability protection and tax advantages. - How do I protect my personal assets when investing in real estate?

Using an LLC or corporation can shield personal assets from business liabilities. - What are the tax benefits of forming an LLC for real estate investments?

An LLC allows profits to pass through directly to members’ personal income without facing corporate taxes. - How many properties should I hold under one LLC?

This depends on your risk tolerance; holding multiple properties under one LLC increases risk exposure if one property faces legal issues. - Can I change my business structure later?

Yes, but it may involve additional costs and complexities; consulting with legal professionals is advisable. - What role does technology play in modern real estate investing?

Technology enhances efficiency through better data analysis, property management solutions, and marketing strategies. - What are some common mistakes new investors make when structuring their companies?

Common mistakes include not seeking professional advice on legal structures and failing to create a comprehensive business plan. - How can I ensure compliance with local regulations?

Regularly consult with legal experts familiar with local real estate laws and stay updated on regulatory changes.

In conclusion, structuring a real estate investment company involves strategic planning that encompasses market analysis, risk management, regulatory compliance, and future forecasting. By choosing the appropriate business structure and implementing effective strategies, investors can position themselves for success in an evolving market landscape.