Investing at a young age is one of the smartest financial decisions you can make. By starting early, you harness the power of compound interest and give your money more time to grow. Whether you’re a teenager or in your early twenties, beginning your investment journey now can set you up for long-term financial success. This guide will walk you through the essential steps to start investing young, providing you with the knowledge and tools to build a strong financial future.

Starting to invest early offers numerous advantages. You have more time to recover from market downturns, can afford to take on more risk for potentially higher returns, and benefit from the magic of compounding. Additionally, developing good financial habits at a young age can lead to better money management skills throughout your life.

| Benefits of Investing Young | Challenges to Overcome |

|---|---|

| More time for compound growth | Limited income and savings |

| Higher risk tolerance | Lack of financial knowledge |

| Learning opportunity | Emotional decision-making |

| Building long-term wealth | Balancing current expenses |

Understanding the Basics of Investing

Before diving into the world of investing, it’s crucial to understand some fundamental concepts. Investing involves putting your money into financial assets with the expectation of generating returns over time. These assets can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more.

One of the most important principles to grasp is diversification. This strategy involves spreading your investments across different asset classes to reduce risk. By not putting all your eggs in one basket, you can potentially minimize losses if one particular investment performs poorly.

Another key concept is risk tolerance. This refers to your ability to withstand fluctuations in the value of your investments. Generally, younger investors can afford to take on more risk because they have more time to recover from market downturns. However, it’s essential to assess your personal comfort level with risk and invest accordingly.

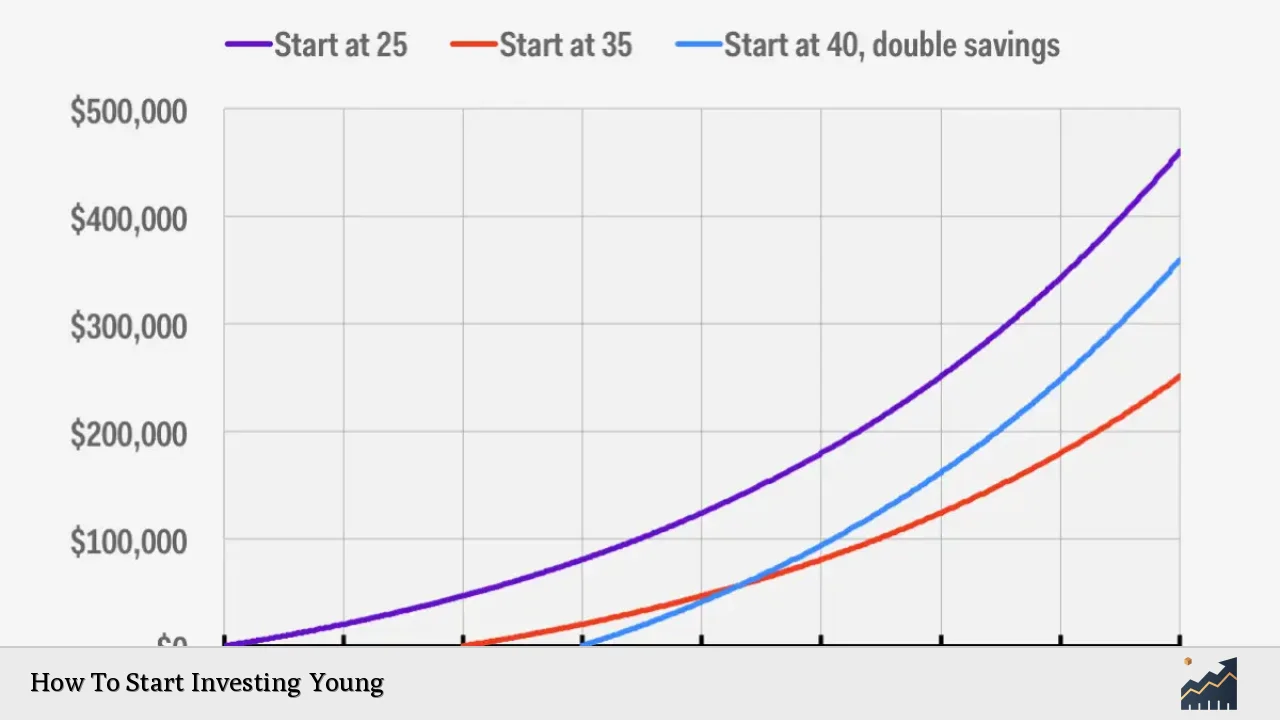

Compound interest is perhaps the most powerful force in investing, especially for young people. It’s the process by which your investment returns generate their own returns over time. The earlier you start investing, the more you can benefit from this exponential growth.

Understanding these basics will help you make informed decisions as you begin your investment journey. Remember, investing is a long-term game, and patience is key to success.

Setting Financial Goals

Before you start investing, it’s important to define your financial goals. Having clear objectives will help guide your investment decisions and keep you motivated. Your goals might include saving for college, buying a house, or building a retirement nest egg.

Start by categorizing your goals into short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) objectives. This categorization will help you determine the appropriate investment strategy for each goal. For example:

- Short-term goals might be best served by more conservative investments like high-yield savings accounts or certificates of deposit (CDs).

- Medium-term goals could involve a mix of stocks and bonds to balance growth potential with stability.

- Long-term goals, such as retirement, can typically withstand more risk, allowing for a higher allocation to stocks or growth-oriented investments.

Remember to make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of a vague goal like “save money,” set a specific target like “save $10,000 for a down payment on a house in 5 years.”

Regularly review and adjust your goals as your life circumstances change. Your investment strategy should evolve alongside your objectives to ensure you’re always on track to meet your financial aspirations.

Choosing the Right Investment Accounts

Selecting the appropriate investment accounts is crucial for young investors. The type of account you choose can have significant implications for taxes, accessibility, and long-term growth potential. Here are some options to consider:

Custodial Accounts

If you’re under 18, a custodial account managed by a parent or guardian is an excellent way to start investing. These accounts, such as UGMA (Uniform Gift to Minors Act) or UTMA (Uniform Transfer to Minors Act), allow minors to own securities. The adult manages the account until the minor reaches the age of majority, typically 18 or 21, depending on the state.

Roth IRA

For young investors with earned income, a Roth IRA can be an ideal choice. Contributions are made with after-tax dollars, but the money grows tax-free, and withdrawals in retirement are also tax-free. This can be especially beneficial for young people who are likely in a lower tax bracket now than they will be in retirement.

529 College Savings Plan

If saving for education is a priority, a 529 plan offers tax advantages for college savings. Contributions grow tax-free, and withdrawals for qualified education expenses are also tax-free at the federal level and often at the state level as well.

Taxable Brokerage Account

A standard brokerage account offers flexibility and no contribution limits. While it doesn’t come with the tax advantages of retirement accounts, it allows you to invest in a wide range of securities and access your money at any time without penalties.

When choosing an account, consider factors such as fees, investment options, and user interface. Many brokerages now offer commission-free trading and educational resources tailored to young investors. Take advantage of these tools to build your knowledge and confidence as you start investing.

Building a Diversified Portfolio

Creating a well-diversified portfolio is essential for managing risk and maximizing potential returns. As a young investor, you have the advantage of time, which allows you to take on more risk in pursuit of higher returns. However, it’s still important to spread your investments across different asset classes.

A common starting point for young investors is a portfolio heavily weighted towards stocks, which historically have provided the highest long-term returns. A typical allocation might be:

- 70-80% stocks: For long-term growth potential

- 20-30% bonds: To provide some stability and income

- 0-10% cash: For liquidity and short-term needs

Within these broad categories, further diversification is important. For stocks, consider a mix of:

- Large-cap, mid-cap, and small-cap companies

- Domestic and international stocks

- Growth and value stocks

For bonds, you might include a combination of government and corporate bonds with varying maturities.

One of the easiest ways to achieve diversification is through index funds or ETFs. These investment vehicles allow you to own a slice of hundreds or thousands of companies with a single purchase. They also typically have lower fees than actively managed funds, which can significantly impact your returns over time.

As you build your portfolio, keep in mind the importance of rebalancing. Over time, some investments will grow faster than others, potentially skewing your desired asset allocation. Regularly reviewing and adjusting your portfolio helps maintain your target risk level and keeps your investments aligned with your goals.

Developing Good Investment Habits

Success in investing isn’t just about picking the right stocks or funds; it’s about developing good habits that will serve you well throughout your financial life. Here are some key practices to cultivate:

- Automate your investments: Set up automatic transfers from your paycheck or bank account to your investment accounts. This “pay yourself first” approach ensures you’re consistently investing before you have a chance to spend the money elsewhere.

- Dollar-cost averaging: Instead of trying to time the market, invest a fixed amount regularly. This strategy helps smooth out the impact of market volatility over time.

- Reinvest dividends: When you receive dividends from your investments, reinvest them rather than taking them as cash. This allows you to benefit from compound growth.

- Stay informed: Keep learning about investing and personal finance. Read books, follow reputable financial news sources, and consider taking online courses to expand your knowledge.

- Avoid emotional decisions: Don’t let fear or greed drive your investment choices. Stick to your long-term plan and avoid making rash decisions based on short-term market movements.

- Live below your means: The more you can save and invest now, the more financial freedom you’ll have in the future. Look for ways to reduce expenses and increase your savings rate.

- Monitor your investments: Regularly review your portfolio performance, but avoid obsessing over daily fluctuations. Annual or semi-annual reviews are usually sufficient for long-term investors.

By cultivating these habits early, you’ll be well-positioned for long-term financial success. Remember, investing is a marathon, not a sprint. Consistency and patience are key to achieving your financial goals.

FAQs About How To Start Investing Young

- How much money do I need to start investing?

You can start with as little as $50 or $100 with many online brokers or investment apps. - What’s the best investment for beginners?

Low-cost index funds or ETFs are often recommended for their simplicity and broad diversification. - Is it safe to invest in stocks as a young person?

While stocks carry risk, they historically offer the best long-term returns, making them suitable for young investors. - Should I pay off debt before investing?

It’s generally wise to pay off high-interest debt first, but you can often invest while paying off low-interest debt. - How often should I check my investments?

For long-term investing, reviewing your portfolio quarterly or semi-annually is usually sufficient.