Starting an investment account for kids is a proactive way to instill financial literacy and responsibility from a young age. Teaching children about investing not only helps them understand money management but also sets them on a path toward financial independence. By introducing them to the world of investments early, you can help them develop essential skills that will benefit them throughout their lives.

There are several types of investment accounts available for children, including custodial accounts, Junior ISAs, and 529 plans. Each account type has its own features, benefits, and limitations. The key is to choose the one that aligns with your goals for your child’s financial future. In this guide, we will explore the steps to start an investment account for kids, the different types of accounts available, and tips on how to engage children in the investing process.

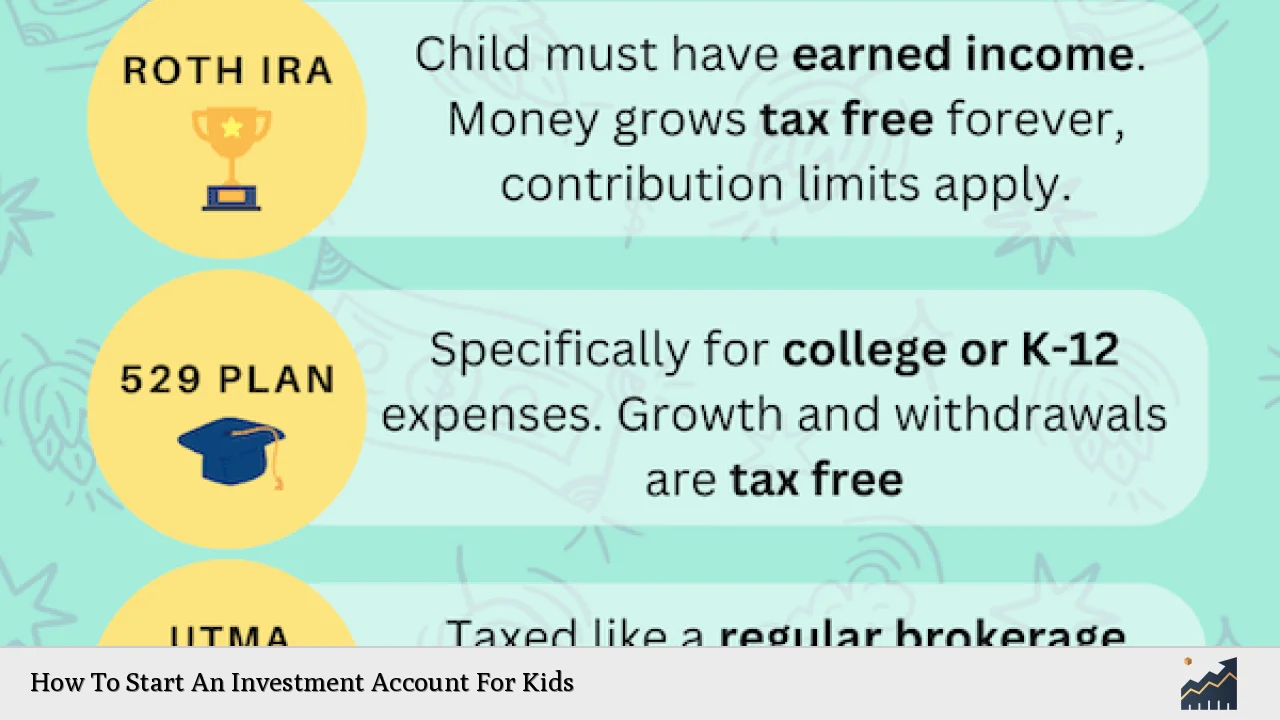

| Account Type | Key Features |

|---|---|

| Custodial Accounts | Managed by an adult until the child reaches adulthood; allows for a variety of investments. |

| Junior ISAs | Tax-free growth; funds cannot be accessed until the child turns 18. |

| 529 Plans | Tax advantages for education savings; funds must be used for qualified educational expenses. |

Understanding Investment Accounts for Kids

Investment accounts designed for children typically require a parent or guardian to manage them until the child reaches adulthood. These accounts can serve various purposes, such as saving for college or teaching children about investing. The most common types of investment accounts for kids include custodial accounts (UGMA/UTMA), Junior ISAs, and 529 plans.

Custodial accounts allow parents to invest on behalf of their children. These accounts can hold stocks, bonds, and mutual funds, and the assets belong to the child. Once they reach the age of majority (usually 18 or 21), they gain full control over the account. This type of account is ideal for teaching children about investing while allowing them to benefit from any gains.

Junior ISAs are tax-efficient savings accounts available in some countries. They allow parents or guardians to save money on behalf of their child, with tax-free growth until the child turns 18. At that point, they can access the funds without penalties. This option is particularly popular among parents looking to save for their child’s future education.

529 plans are specifically designed for education savings in the United States. These plans offer tax advantages when saving for qualified educational expenses. Contributions grow tax-free, and withdrawals used for education costs are also tax-free. This makes them an excellent choice if your primary goal is to fund your child’s college education.

Steps to Open an Investment Account for Kids

Opening an investment account for your child involves several straightforward steps. Here’s a detailed guide to help you navigate the process:

1. Decide on the Account Type: Determine which type of investment account best suits your goals. Consider factors such as tax implications, accessibility of funds, and investment options available.

2. Choose a Brokerage: Research various brokerage firms that offer custodial accounts or Junior ISAs. Look for firms with low fees, user-friendly platforms, and educational resources that can help teach your child about investing.

3. Gather Necessary Information: You will need personal information such as Social Security numbers (for both you and your child), dates of birth, and contact information when opening the account.

4. Complete the Application: Most brokers allow you to open an account online quickly. Fill out the application form with accurate information and submit it.

5. Fund the Account: After opening the account, you’ll need to fund it before making any investments. You can link another bank account or transfer funds directly from your existing brokerage account.

6. Start Investing: Once funded, you can begin investing in various assets like stocks, bonds, or mutual funds based on your child’s interests and risk tolerance.

7. Monitor and Educate: Regularly review the account’s performance with your child and discuss investment strategies and market trends to enhance their understanding of investing.

Choosing the Right Investments

Once you’ve opened an investment account for your child, it’s time to decide what to invest in. Here are some strategies to consider:

- Start with Familiar Brands: Encourage your child to invest in companies they know and love—like favorite toy manufacturers or tech companies—this can make investing more relatable and exciting.

- Diversify with Index Funds: Consider building a diversified portfolio using index funds or exchange-traded funds (ETFs). These funds pool money from many investors to buy a broad range of stocks or bonds, reducing risk through diversification.

- Teach About Risk: Discuss the concept of risk versus reward with your child. Explain how higher potential returns often come with higher risks and help them understand that investments can fluctuate in value.

- Set Investment Goals: Help your child set short-term and long-term investment goals based on their interests—whether saving for a new video game or planning ahead for college expenses.

Engaging Children in Investing

Teaching kids about investing should be an interactive experience that fosters curiosity and understanding. Here are some tips on how to keep them engaged:

- Use Simulators: Consider using stock market simulators that allow kids to practice trading without real money. This hands-on approach can make learning fun while providing valuable experience.

- Discuss Market Trends: Encourage discussions about current events affecting markets—such as technology advancements or environmental issues—to help them connect real-world events with their investments.

- Celebrate Milestones: Acknowledge when their investments perform well or reach certain milestones; this positive reinforcement can motivate them to stay involved in managing their portfolio.

- Encourage Questions: Create an open environment where your child feels comfortable asking questions about investing concepts they don’t understand.

FAQs About How To Start An Investment Account For Kids

- What is a custodial account?

A custodial account is managed by an adult on behalf of a minor until they reach adulthood. - Can I open an investment account without my child’s consent?

Yes, parents can open custodial accounts without needing explicit consent from their children. - What types of investments can I make?

You can invest in stocks, bonds, mutual funds, ETFs, and other securities within these accounts. - Are there tax implications for children’s investment accounts?

Yes, earnings may be taxed at the child’s rate; however, there are specific thresholds that apply. - How can I teach my child about investing?

Involve them in discussions about their investments and use educational tools like simulators or games.

Starting an investment account for kids is not just about building wealth; it’s about equipping them with knowledge that will empower them throughout life. By following these steps and engaging actively in their financial education, you set a foundation that encourages responsible financial habits while fostering a sense of ownership over their financial future.