The rise of cryptocurrency has transformed the financial landscape, attracting millions of investors seeking high returns. However, this burgeoning market also presents significant risks, primarily due to the proliferation of scams and fraudulent schemes. Understanding how to identify and avoid these scams is crucial for protecting your investments. This article will explore the current market trends, implementation strategies for safeguarding against fraud, risk considerations, regulatory aspects, and future outlook on cryptocurrency scams.

| Key Concept | Description/Impact |

|---|---|

| Phishing Scams | Phishing remains one of the most prevalent forms of cryptocurrency fraud, where scammers impersonate legitimate services to steal sensitive information like private keys. |

| Ponzi Schemes | These scams promise high returns through investments in non-existent projects, relying on new investors’ funds to pay earlier investors. |

| Fake Exchanges and Wallets | Scammers create counterfeit platforms that mimic legitimate exchanges or wallets to steal deposits from unsuspecting users. |

| Investment Scams | Often characterized by promises of guaranteed returns and pressure tactics, these scams exploit investor trust to siphon funds. |

| Pig Butchering | A sophisticated scam where fraudsters build relationships with victims over time before convincing them to invest in fake projects. |

| Rug Pulls | Developers abandon a project after attracting significant investment, leaving investors with worthless tokens. |

| Regulatory Gaps | The lack of comprehensive regulation in the cryptocurrency space makes it easier for scammers to operate without consequence. |

Market Analysis and Trends

The cryptocurrency market has seen exponential growth over the past decade, with a market capitalization exceeding $1 trillion as of late 2024. However, this growth has been accompanied by an alarming increase in scams. In 2023 alone, losses from cryptocurrency-related frauds reached approximately $5.6 billion, a 45% increase from 2022. The Federal Trade Commission reported that investment scams accounted for 46% of all crypto-related frauds in the first half of 2024.

Recent trends indicate a shift in scam tactics:

- Pig Butchering: This method has emerged as a leading scam type in 2024, generating over $101 million in revenue through targeted social engineering tactics.

- Phishing Attacks: These attacks have escalated, with reports indicating that over 300,000 individuals fell victim to phishing schemes in recent years.

- Fake Platforms: The rise of counterfeit exchanges and wallets continues to pose significant risks for investors. Scammers often create websites that closely resemble legitimate platforms but are designed solely to steal funds.

Implementation Strategies

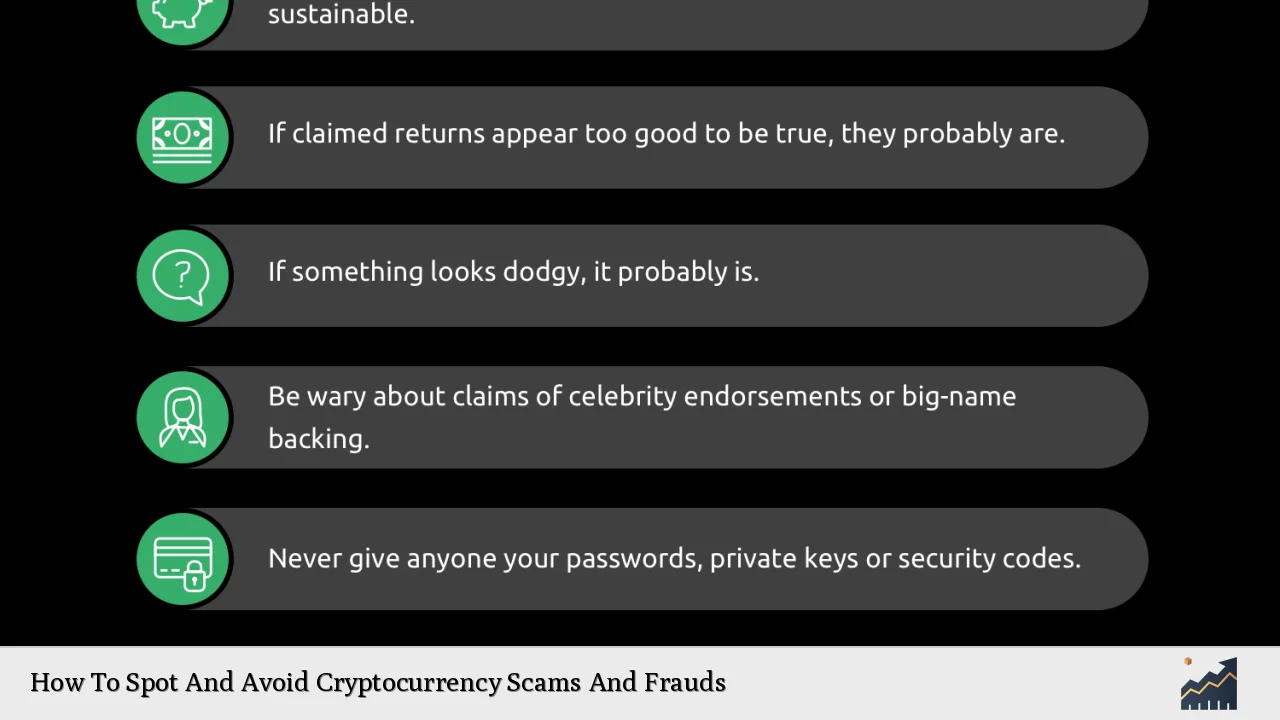

To safeguard against cryptocurrency scams, investors should adopt several proactive strategies:

- Conduct Thorough Research: Before investing in any cryptocurrency or platform, verify its legitimacy. Look for user reviews and check for transparency regarding the team behind the project.

- Use Reputable Exchanges: Stick to well-known exchanges that comply with regulatory standards and have robust security measures in place.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second form of verification when accessing accounts.

- Be Wary of Unsolicited Offers: Avoid engaging with unsolicited messages on social media or email that promise high returns or urge immediate investment.

- Educate Yourself on Common Scams: Familiarize yourself with different types of scams such as Ponzi schemes, rug pulls, and phishing attacks to recognize red flags.

Risk Considerations

Investing in cryptocurrencies is inherently risky due to their volatility and the potential for fraud. Key risks include:

- Market Volatility: Cryptocurrency prices can fluctuate dramatically within short periods, leading to substantial financial losses.

- Regulatory Risks: The evolving regulatory landscape can impact the legality and operation of certain cryptocurrencies and platforms.

- Technological Vulnerabilities: Weaknesses in smart contracts or exchange security can be exploited by hackers, leading to theft or loss of funds.

Investors should assess their risk tolerance carefully and consider diversifying their portfolios to mitigate potential losses.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies is complex and varies significantly by jurisdiction. In the United States, agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have begun implementing stricter regulations aimed at combating fraud. However, many scams continue to exploit gaps in regulation due to the decentralized nature of cryptocurrencies.

Regulatory bodies are increasingly focusing on:

- KYC (Know Your Customer) Requirements: These regulations require platforms to verify user identities to prevent fraudulent activities.

- AML (Anti-Money Laundering) Compliance: Financial institutions are mandated to implement measures that prevent money laundering through cryptocurrencies.

Despite these efforts, enforcement remains challenging due to the global nature of cryptocurrency transactions.

Future Outlook

As cryptocurrencies continue to evolve, so too will the tactics employed by scammers. The future landscape may see:

- Increased Regulation: Governments worldwide are likely to introduce more comprehensive regulations aimed at protecting investors and reducing fraud.

- Technological Innovations: Advances in blockchain technology may provide better tools for identifying fraudulent activities through enhanced transparency and traceability.

- Growing Awareness: As education around cryptocurrency scams improves among investors, there may be a decline in successful scams due to increased vigilance.

Investors must remain informed about emerging trends and adapt their strategies accordingly.

Frequently Asked Questions About How To Spot And Avoid Cryptocurrency Scams And Frauds

- What are common signs of a cryptocurrency scam?

Common signs include promises of guaranteed returns, pressure tactics urging immediate investment, unsolicited offers via email or social media, and lack of transparency about the project or team. - How can I protect my investments from scams?

Use reputable exchanges, enable two-factor authentication on your accounts, conduct thorough research before investing, and be cautious about unsolicited offers. - What should I do if I suspect I’ve been scammed?

If you believe you’ve been scammed, report it immediately to local authorities and organizations like the FBI’s Internet Crime Complaint Center (IC3). - Are all cryptocurrencies at risk for scams?

No, while many cryptocurrencies are legitimate, the decentralized nature of the market makes it susceptible to fraudulent activities. Always do your due diligence. - What role does regulation play in preventing crypto fraud?

Regulation helps establish standards for transparency and accountability among crypto platforms but enforcement can be challenging due to jurisdictional issues. - Can I recover lost funds from a crypto scam?

Recovering funds lost in a scam can be difficult; however, reporting the incident may help authorities track down perpetrators. - What is “pig butchering” in crypto scams?

Pig butchering is a scam where fraudsters build relationships with victims over time before convincing them to invest large sums into fake projects. - How prevalent are phishing attacks in the crypto space?

Phishing attacks are extremely common; reports indicate that hundreds of thousands have fallen victim in recent years due to these deceptive tactics.

In conclusion, staying informed about the various types of cryptocurrency scams and implementing robust protective measures is essential for any investor looking to navigate this complex landscape safely.