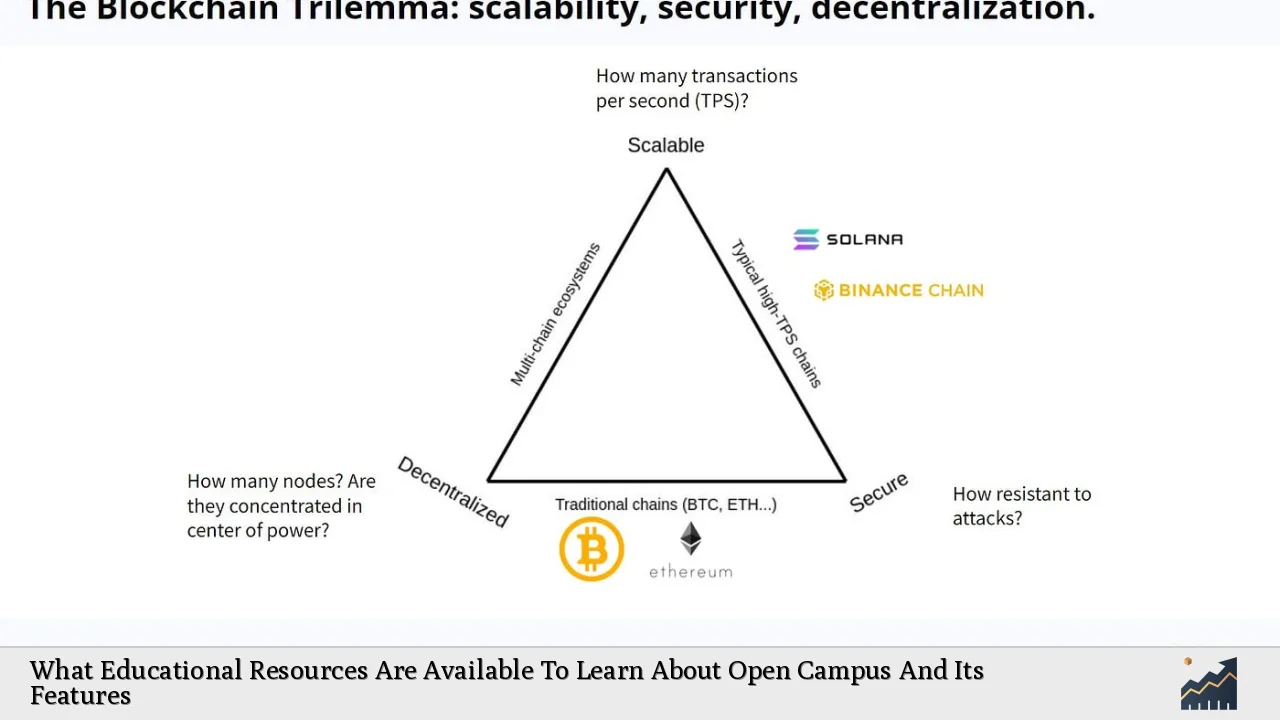

The blockchain trilemma, a concept popularized by Ethereum’s co-founder Vitalik Buterin, posits that decentralized networks can only optimize two out of three key attributes: scalability, security, and decentralization. As Layer 1 (L1) blockchains evolve, they face increasing pressure to find solutions that allow them to balance these three elements effectively. This article explores the current landscape of Layer 1 blockchains, examining market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook to provide a comprehensive understanding of how to tackle the blockchain trilemma.

| Key Concept | Description/Impact |

|---|---|

| Scalability | The ability of a blockchain to handle an increasing number of transactions without sacrificing performance or incurring high fees. |

| Security | Ensuring the network is resilient against attacks and that transactions are immutable. |

| Decentralization | Distributing control across many participants to avoid central points of failure or control. |

| Layer 1 Solutions | Innovative approaches within the blockchain architecture itself aimed at improving scalability while maintaining security and decentralization. |

| Layer 2 Solutions | Off-chain solutions that enhance scalability by processing transactions outside the main blockchain while ensuring security through the underlying L1 network. |

Market Analysis and Trends

The global blockchain technology market is projected to grow significantly, with estimates suggesting it will expand from approximately USD 26.91 billion in 2024 to USD 1,879.30 billion by 2034, reflecting a compound annual growth rate (CAGR) of 52.9%. This rapid growth is driven by increasing demand for decentralized solutions across various sectors, including finance, supply chain management, and healthcare.

Current Trends

- Rise of Layer 1 Blockchains: Newer L1 blockchains like Solana and Avalanche are gaining traction due to their innovative consensus mechanisms and focus on scalability without sacrificing decentralization.

- Increased Investment: Venture capital investment in blockchain technology has surged, with significant funding directed toward projects that aim to solve the trilemma.

- Adoption of Decentralized Finance (DeFi): The DeFi sector continues to expand rapidly, necessitating more scalable and secure L1 solutions that can handle high transaction volumes without compromising user experience.

Implementation Strategies

To address the blockchain trilemma effectively, several strategies can be employed:

Layer 1 Innovations

- Sharding: This technique involves splitting the blockchain into smaller partitions (shards) that can process transactions independently, thus enhancing scalability while maintaining decentralization.

- New Consensus Mechanisms: Transitioning from Proof of Work (PoW) to Proof of Stake (PoS) or hybrid models can improve energy efficiency and scalability. For instance, Ethereum’s shift towards PoS aims to increase transaction throughput while reducing environmental impact.

Layer 2 Solutions

- State Channels: These allow transactions to occur off-chain while still leveraging the security of the main blockchain for final settlement. This approach significantly reduces congestion on the primary network.

- Sidechains: Independent blockchains linked to the main chain can process transactions and then report back to the main chain for finality. This allows for specialized chains tailored for specific use cases without overloading the primary network.

Risk Considerations

While striving for a balance between scalability, security, and decentralization, several risks must be considered:

- Centralization Risks: As some L1 solutions prioritize speed and efficiency, they may inadvertently centralize control among a few participants or validators.

- Security Vulnerabilities: New implementations may introduce unforeseen vulnerabilities. For instance, sharding can complicate consensus mechanisms and expose shards to targeted attacks if not designed properly.

- Regulatory Risks: As governments worldwide begin to establish clearer regulations surrounding cryptocurrencies and blockchains, projects must navigate compliance challenges that could impact their operational models.

Regulatory Aspects

Regulatory scrutiny is intensifying globally as governments seek to understand and manage the implications of blockchain technologies:

- Compliance Requirements: Blockchain projects must ensure they comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. This compliance is crucial for gaining legitimacy in traditional financial markets.

- Impact on Innovation: While regulation can provide a framework for safe operations, overly stringent rules may stifle innovation within the blockchain space.

Future Outlook

The future of Layer 1 blockchains hinges on their ability to innovate continuously while addressing the trilemma:

- Interoperability Solutions: Future developments may focus on creating interoperable networks that allow different blockchains to communicate seamlessly. This could enhance scalability by enabling users to transact across multiple platforms without friction.

- Enhanced User Experience: As competition increases among L1 solutions, user experience will become a critical differentiator. Projects focused on simplifying interfaces and improving transaction speeds are likely to gain market share.

- Sustainability Initiatives: With growing environmental concerns surrounding crypto mining practices, there is an increasing push towards sustainable practices within blockchain development. Projects adopting eco-friendly consensus mechanisms will likely attract more users and investors.

Frequently Asked Questions About How To Solve The Trilemma Of Scalability Security And Decentralization In Layer 1 Blockchains

- What is the blockchain trilemma?

The blockchain trilemma refers to the challenge of achieving scalability, security, and decentralization simultaneously in blockchain networks. - How do Layer 1 solutions address scalability?

Layer 1 solutions implement architectural changes like sharding or new consensus mechanisms (e.g., PoS) to enhance transaction throughput while maintaining security. - What role do Layer 2 solutions play?

Layer 2 solutions operate off-chain to handle transactions efficiently while still relying on the security guarantees provided by Layer 1 blockchains. - What are some risks associated with achieving this balance?

The primary risks include potential centralization of control among validators, new security vulnerabilities introduced by innovative technologies, and regulatory challenges. - How important is regulatory compliance?

Regulatory compliance is crucial for gaining legitimacy in traditional markets and ensuring long-term viability of blockchain projects. - What does the future hold for Layer 1 blockchains?

The future will likely see increased focus on interoperability between different blockchains, enhanced user experiences, and sustainable practices in development. - Are there any successful examples of L1 blockchains solving this trilemma?

Projects like Solana and Avalanche have made significant strides in balancing these three aspects through innovative technologies. - How can investors assess which L1 projects are worth investing in?

Investors should evaluate factors such as technological innovation, market adoption rates, regulatory compliance efforts, and overall project sustainability.

This comprehensive analysis highlights that while solving the trilemma remains a formidable challenge for Layer 1 blockchains, ongoing innovations in technology and governance structures present promising pathways forward. By strategically implementing both Layer 1 and Layer 2 solutions while remaining vigilant about risks and regulatory landscapes, developers can create robust ecosystems capable of supporting widespread adoption.