Setting up a Wise account is a straightforward process that enables individuals and businesses to manage their money across borders efficiently. Wise, formerly known as TransferWise, is a fintech company specializing in low-cost international money transfers and multi-currency accounts. With its transparent fee structure and real exchange rate, Wise has become a popular choice for those looking to send money internationally or hold multiple currencies. This guide will provide a detailed overview of how to set up a Wise account, along with insights into market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Registration Process | Users can register via the Wise website or mobile app by providing an email address and choosing between personal or business accounts. |

| Identity Verification | To comply with regulations, users must verify their identity by uploading documents such as a passport or driver’s license. |

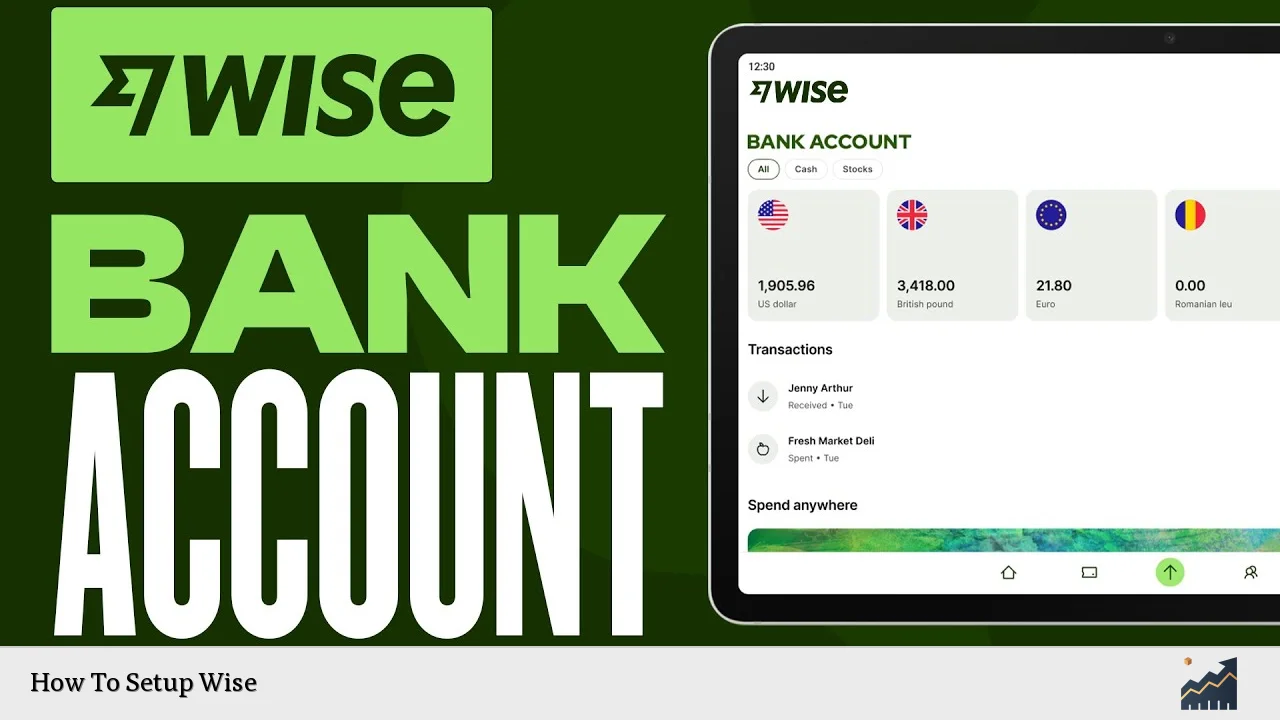

| Currency Balances | Wise allows users to hold multiple currencies in their accounts, making it easier to manage international transactions. |

| Fees and Exchange Rates | Wise uses the mid-market exchange rate and charges low fees, which are transparent and displayed upfront. |

| Debit Card Options | Users can order a Wise debit card for spending in different currencies without incurring high conversion fees. |

| Market Reach | Wise operates in over 160 countries and supports more than 40 currencies, catering to a global customer base. |

Market Analysis and Trends

The digital payments landscape has evolved significantly in recent years, with increasing demand for efficient cross-border money transfer solutions. According to Wise’s latest annual report, the company facilitated £118.5 billion in currency transfers in FY2024, marking a 13% increase from the previous year. This growth reflects a broader trend in the fintech sector where consumers are seeking alternatives to traditional banking services that often come with high fees and poor exchange rates.

Key trends influencing the market include:

- Increased Globalization: As businesses expand internationally, the need for cost-effective payment solutions has surged.

- Consumer Preference for Transparency: Users are increasingly favoring platforms that offer clear pricing structures without hidden fees.

- Technological Advancements: Innovations in technology have enabled faster transactions and improved user experiences.

- Regulatory Changes: Stricter regulations on financial transactions have prompted companies like Wise to enhance their compliance measures while maintaining user accessibility.

Implementation Strategies

Setting up a Wise account involves several key steps:

- Visit the Wise Website or App: Users can start by navigating to the Wise homepage or downloading the mobile app.

- Register for an Account:

- Click on the “Register” button.

- Enter an email address or sign up using existing social media accounts (Google, Facebook, Apple).

- Select Account Type: Choose between a personal or business account based on your needs.

- Verify Your Identity:

- Upload required documents (passport, national ID).

- Complete identity verification through prompts on the platform.

- Set Up Currency Balances:

- Open balances in various currencies as needed.

- Users can receive local bank details for certain currencies.

- Order a Debit Card (Optional):

- Navigate to the card section of your account.

- Provide delivery details and pay any associated fees.

- Make Your First Transfer:

- Input the amount you wish to send or receive.

- Review fees and estimated delivery times before confirming the transaction.

These steps ensure that users can quickly start utilizing Wise’s services for their international money transfer needs.

Risk Considerations

While Wise offers numerous benefits, potential users should be aware of certain risks:

- Regulatory Compliance: As with any financial service, compliance with local regulations is crucial. Users must ensure they provide accurate information during setup to avoid delays or account restrictions.

- Currency Fluctuations: Holding multiple currencies exposes users to exchange rate volatility. It is essential to monitor market conditions when converting funds.

- Fraud Risks: Although Wise employs robust security measures, users should remain vigilant against phishing attempts and unauthorized access to their accounts.

- Dependence on Technology: Users rely on internet connectivity and platform stability. Any technical issues could impact access to funds or transaction capabilities.

Regulatory Aspects

Wise operates under stringent regulatory frameworks across different jurisdictions. Key regulatory considerations include:

- KYC (Know Your Customer): Compliance with KYC regulations requires users to verify their identities before conducting transactions.

- Data Protection: Wise adheres to data protection laws such as GDPR in Europe to safeguard user information.

- Licensing Requirements: The company holds various licenses globally, allowing it to operate legally within different markets while ensuring customer funds are protected according to local laws.

Future Outlook

The future of Wise appears promising as it continues to expand its services and customer base. With increasing adoption of digital payment solutions globally, Wise is well-positioned for growth:

- Market Expansion: Plans to enter new markets and enhance existing services will likely attract more users seeking efficient cross-border payment options.

- Product Development: Ongoing investments in technology will improve user experience and introduce new features that cater to evolving customer needs.

- Sustainability Focus: As global awareness of sustainability increases, Wise may explore eco-friendly initiatives within its operations and service offerings.

Overall, Wise’s commitment to transparency and low-cost services positions it favorably within the competitive fintech landscape.

Frequently Asked Questions About How To Setup Wise

- What documents do I need to set up my Wise account?

You will need a valid form of identification such as a passport or driver’s license for identity verification. - Is there a fee for opening a Wise account?

No, there are no fees associated with opening a Wise account; however, transaction fees apply when sending money. - Can I hold multiple currencies in my Wise account?

Yes, you can open balances in multiple currencies within your Wise account. - How long does it take to verify my identity?

The verification process typically takes a few minutes but may vary depending on document submission volume. - Are there any limits on how much I can send?

Limits vary based on your account type and verification status; check your account settings for specifics. - Can I use my Wise debit card internationally?

Yes, the Wise debit card can be used internationally without incurring high conversion fees. - What should I do if I encounter issues during setup?

If you face difficulties during setup, contact Wise’s customer support for assistance. - Is my money safe with Wise?

Wise employs strong security measures and complies with financial regulations to protect customer funds.

By following this comprehensive guide on how to set up a Wise account, individuals and businesses can leverage the benefits of efficient international money transfers while being aware of associated risks and regulatory requirements.