Recurring investments are a powerful tool for building wealth over time, and Fidelity offers a user-friendly platform to implement this strategy. By automating regular contributions to your investment portfolio, you can take advantage of dollar-cost averaging, reduce the impact of market volatility, and stay committed to your long-term financial goals. This comprehensive guide will walk you through the process of setting up recurring investments in Fidelity, exploring the benefits, strategies, and considerations to help you make informed decisions about your financial future.

| Key Concept | Description/Impact |

|---|---|

| Dollar-Cost Averaging | Investing a fixed amount regularly, regardless of market conditions, potentially reducing the impact of volatility |

| Automated Investing | Setting up automatic contributions to maintain discipline and consistency in your investment strategy |

| Diversification | Spreading investments across various assets to manage risk and potentially enhance returns |

| Compounding Returns | Reinvesting earnings to generate additional returns over time, potentially accelerating wealth accumulation |

Market Analysis and Trends

The financial landscape in 2024 continues to evolve, with recurring investments gaining popularity among individual investors. According to recent market data, automated investment plans have seen a 15% increase in adoption over the past year. This trend is driven by several factors, including:

- Increased awareness of the benefits of long-term investing

- Growing interest in passive investment strategies

- Advancements in financial technology making automated investing more accessible

- Economic uncertainties prompting investors to seek consistent investment approaches

Fidelity, as one of the leading investment platforms, has responded to this trend by enhancing its recurring investment features. The platform now offers a wider range of investment options for automated contributions, including individual stocks, ETFs, mutual funds, and even fractional shares, allowing investors to build diversified portfolios with smaller, regular investments.

Implementation Strategies

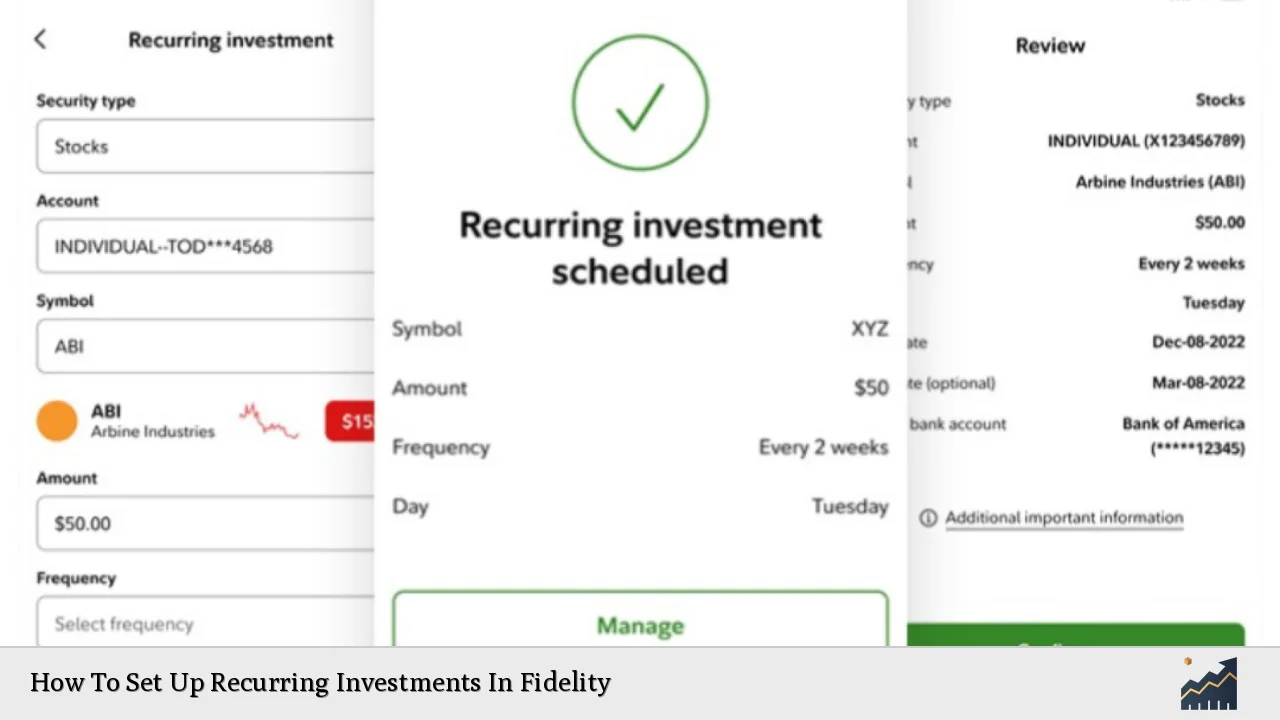

Setting up recurring investments in Fidelity is a straightforward process that can be completed in a few simple steps:

1. Log into Your Fidelity Account

Start by logging into your Fidelity account through their website or mobile app. If you don’t have an account, you’ll need to create one before proceeding.

2. Navigate to the Recurring Investments Section

Once logged in, navigate to the “Accounts & Trade” tab and select “Account Features.” Look for the “Recurring Transfers” or “Automatic Investments” option.

3. Choose Your Investment

Select the type of investment you want to make recurring contributions to. Fidelity offers options for stocks, ETFs, mutual funds, and more. You can also choose to invest in multiple securities.

4. Set Up Your Schedule

Determine the frequency of your investments (e.g., weekly, bi-weekly, monthly) and the amount you wish to invest each time. Fidelity allows for flexible scheduling to fit your financial situation.

5. Choose Your Funding Source

Select the account from which you want to fund your recurring investments. This can be your Fidelity account’s core position or an external bank account.

6. Review and Confirm

Review all the details of your recurring investment plan and confirm the setup. Make sure to double-check the investment choices, amounts, and schedule.

Pro Tip: Consider aligning your recurring investments with your pay schedule to ensure consistent contributions without straining your budget.

Risk Considerations

While recurring investments can be an effective strategy for long-term wealth building, it’s important to consider the associated risks:

- Market Volatility: Even with dollar-cost averaging, your investments are subject to market fluctuations.

- Overinvestment: Ensure that your recurring investments don’t compromise your emergency fund or other financial obligations.

- Lack of Flexibility: Automated investing may reduce your ability to react quickly to changing market conditions or personal financial situations.

- Fees: Be aware of any transaction fees or account maintenance costs associated with frequent trading.

To mitigate these risks, regularly review your investment strategy, maintain a diversified portfolio, and adjust your recurring investment plan as needed to align with your changing financial goals and circumstances.

Regulatory Aspects

When setting up recurring investments, it’s crucial to be aware of the regulatory framework that governs investment activities:

- SEC Regulations: The Securities and Exchange Commission oversees investment activities to protect investors. Familiarize yourself with relevant regulations, especially those pertaining to mutual funds and ETFs.

- Tax Implications: Recurring investments can have tax consequences, particularly if you’re investing in taxable accounts. Consult with a tax professional to understand how your investment strategy may impact your tax situation.

- FINRA Guidelines: The Financial Industry Regulatory Authority provides guidelines for brokers and investment advisors. Ensure that your investment activities comply with these guidelines.

Fidelity, as a regulated financial institution, adheres to these regulatory requirements. However, it’s always advisable to stay informed about your rights and responsibilities as an investor.

Future Outlook

The future of recurring investments looks promising, with several trends shaping the landscape:

- AI-Driven Optimization: Advanced algorithms may soon offer personalized recommendations for optimizing recurring investment strategies based on individual financial goals and risk tolerance.

- Increased Integration: Expect to see better integration between recurring investments and other financial tools, such as budgeting apps and financial planning software.

- Expanded Asset Classes: The range of assets available for recurring investments is likely to grow, potentially including alternative investments and cryptocurrency options.

- Enhanced Customization: Future platforms may offer more granular control over recurring investments, allowing for dynamic adjustments based on market conditions or personal financial milestones.

As these trends develop, Fidelity is likely to continue enhancing its recurring investment features to meet evolving investor needs and preferences.

Frequently Asked Questions About How To Set Up Recurring Investments In Fidelity

- What is the minimum amount I can invest through Fidelity’s recurring investment plan?

Fidelity allows recurring investments starting as low as $10 for mutual funds and $1 for stocks and ETFs, making it accessible for investors with various budget constraints. - Can I change or cancel my recurring investment plan at any time?

Yes, Fidelity provides flexibility to modify or cancel your recurring investment plan at any time through your online account or by contacting customer support. - Are there any fees associated with setting up recurring investments in Fidelity?

Fidelity does not charge additional fees for setting up recurring investments. However, standard trading fees and expense ratios for the chosen investments still apply. - Can I set up recurring investments for my retirement accounts?

Absolutely. Fidelity allows you to set up recurring investments for various account types, including IRAs and 401(k)s, subject to annual contribution limits. - How does dollar-cost averaging work with recurring investments?

Dollar-cost averaging involves investing a fixed amount regularly, regardless of market prices. This strategy can potentially lower the average cost per share over time by buying more shares when prices are low and fewer when prices are high. - What happens if my scheduled investment falls on a weekend or holiday?

If your scheduled investment date falls on a non-trading day, Fidelity will process the transaction on the next available trading day. - Can I set up recurring investments for multiple securities simultaneously?

Yes, Fidelity allows you to set up recurring investments for multiple stocks, ETFs, or mutual funds within the same account, enabling diversification through automated investing.

By leveraging Fidelity’s recurring investment features, you can create a disciplined approach to building your investment portfolio over time. Remember to regularly review and adjust your strategy as needed to ensure it aligns with your evolving financial goals and market conditions. While recurring investments can be a powerful tool for long-term wealth creation, it’s always advisable to consult with a financial advisor to tailor a strategy that best fits your individual circumstances and objectives.