Setting up an investment account is a crucial step in managing your financial future. Whether you’re looking to invest for retirement, save for a major purchase, or grow your wealth, having the right investment account can make a significant difference. This guide will walk you through the process of setting up an investment account, covering everything from selecting the right type of account to funding it.

The first step in setting up an investment account is to determine your financial goals. Are you investing for retirement, saving for a home, or simply looking to grow your wealth? Understanding your objectives will help you choose the right type of account and investment strategy.

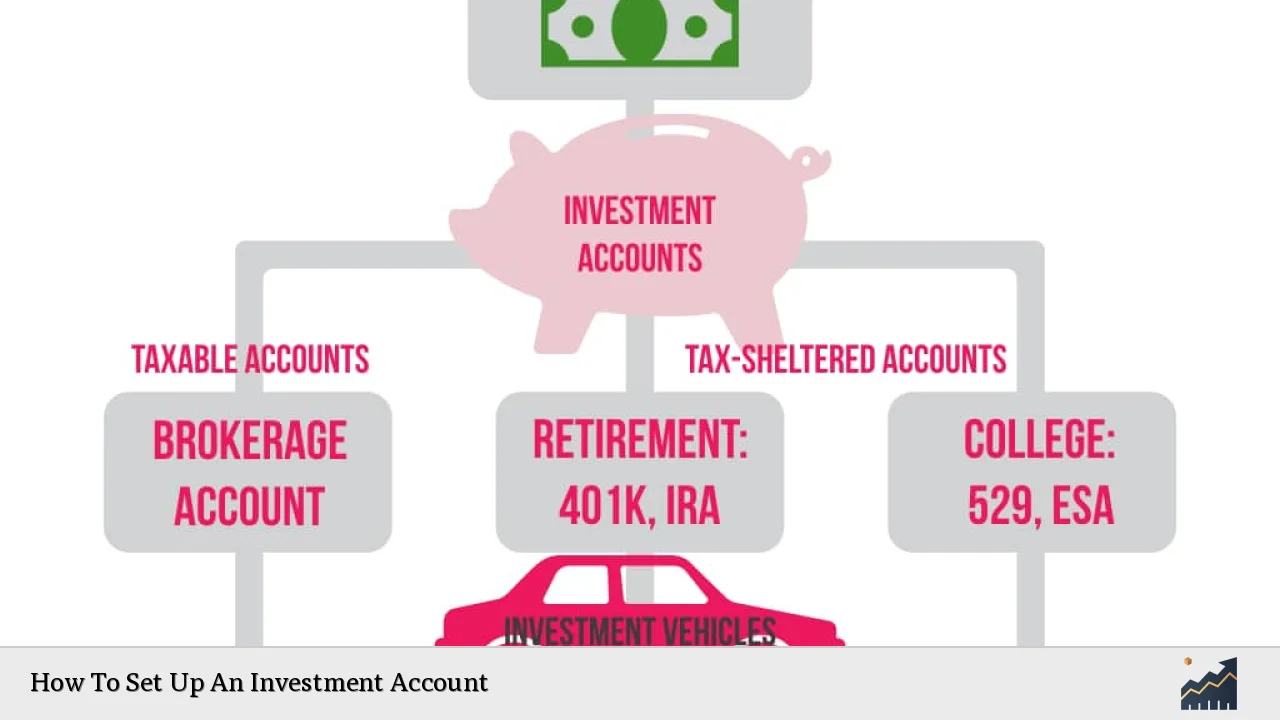

Next, you’ll need to decide on the type of investment account that suits your needs. Common options include brokerage accounts, retirement accounts (like IRAs), and education savings accounts. Each type has its own features and tax implications, so it’s essential to choose wisely.

Once you’ve identified your goals and chosen the right account type, the next step is to select a brokerage firm. Consider factors such as fees, available investment options, and customer service. After selecting a brokerage, you’ll complete an application process that typically requires personal information and financial details.

After your application is approved, you can fund your account. This may involve linking a bank account or transferring funds from another investment account. Once funded, you’re ready to start investing.

| Step | Description |

|---|---|

| Determine Financial Goals | Identify what you want to achieve with your investments. |

| Select Account Type | Choose between brokerage accounts, retirement accounts, etc. |

| Choose Brokerage Firm | Research and select a firm based on fees and services. |

| Complete Application | Fill out necessary forms with personal and financial information. |

| Fund Your Account | Link a bank account or transfer funds to start investing. |

Determine Your Financial Goals

Before opening an investment account, it is important to clearly define your financial goals. Different objectives require different strategies and types of accounts. For instance:

- If you are saving for retirement, consider tax-advantaged accounts like IRAs or 401(k)s.

- For short-term savings or specific purchases, a standard brokerage account might be more suitable.

- If you are planning for education expenses, look into 529 plans or custodial accounts.

Understanding your timeline is also crucial. Are you investing for the long term (10 years or more) or the short term (less than five years)? Your timeline will influence the types of investments you choose and how aggressive your strategy should be.

Additionally, assess your risk tolerance. Are you comfortable with high-risk investments that may offer higher returns, or do you prefer safer options with lower potential gains? This assessment will help guide your investment choices.

Choose the Right Type of Investment Account

Once you’ve established your financial goals and risk tolerance, it’s time to choose the right type of investment account. Here are some common options:

- Brokerage Accounts: These are flexible accounts that allow you to buy and sell various investments like stocks, bonds, ETFs, and mutual funds. There are cash accounts (where you pay in full) and margin accounts (which allow borrowing against investments).

- Retirement Accounts: Accounts like IRAs and 401(k)s offer tax advantages for retirement savings. Contributions may be tax-deductible, and investments grow tax-deferred until withdrawal.

- Education Savings Accounts: These accounts help save for educational expenses. Options include 529 plans that offer tax benefits when used for qualified education costs.

Each type of account has its own rules regarding contributions, withdrawals, and tax implications. Be sure to consider these factors when making your choice.

Select a Brokerage Firm

Choosing the right brokerage firm is critical to successfully managing your investments. Here are some factors to consider:

- Fees: Look into trading commissions, management fees, and any other costs associated with maintaining the account. Lower fees can significantly impact long-term returns.

- Investment Options: Ensure the broker offers a wide range of investment products that align with your goals. Some brokers specialize in certain areas like stocks or mutual funds.

- Customer Service: Evaluate the quality of customer support provided by the brokerage firm. Good customer service can be invaluable when you have questions or need assistance.

- User Experience: Consider how easy it is to navigate the broker’s platform. A user-friendly interface can enhance your investing experience.

Researching multiple firms will help you find one that meets your needs effectively.

Complete the Application Process

After selecting a brokerage firm, you’ll need to complete an application process to open your investment account. This typically involves:

- Providing personal information such as name, address, Social Security number, and date of birth.

- Disclosing financial information including income level and net worth.

- Answering questions about your investment experience and risk tolerance.

Most applications can be completed online in just a few minutes. Once submitted, the brokerage will review your application and notify you of its approval status.

Fund Your Investment Account

Once your application is approved, it’s time to fund your investment account. Here’s how:

- Linking Your Bank Account: Most brokerages allow you to link a checking or savings account for easy transfers. You’ll need bank details such as routing numbers and account numbers.

- Transferring Funds: If you’re moving money from another investment account or rolling over retirement funds from an old employer plan, follow the specific instructions provided by both institutions.

- Setting Up Recurring Transfers: Consider establishing automatic transfers from your bank account into your investment account on a regular basis (e.g., monthly). This strategy helps build savings over time without requiring constant attention.

It’s essential to ensure that sufficient funds are available in your linked bank account to avoid overdraft fees during transfers.

Start Investing

After funding your investment account, you’re ready to start investing! Here are some tips:

- Diversify Your Portfolio: Spread investments across different asset classes (stocks, bonds, real estate) to mitigate risk.

- Stay Informed: Keep up with market trends and economic news that may affect your investments.

- Review Regularly: Periodically assess your portfolio’s performance against your goals and make adjustments as needed.

Investing requires patience and discipline; focus on long-term growth rather than short-term fluctuations in market prices.

FAQs About How To Set Up An Investment Account

- What documents do I need to open an investment account?

You typically need identification documents like a driver’s license or passport and financial information such as Social Security number. - Can I open an investment account online?

Yes, most brokerages allow you to open an investment account online quickly. - Is there a minimum amount required to open an investment account?

Many brokers have no minimum deposit requirements; however, some may require initial funding. - What types of investments can I hold in my account?

You can hold various assets including stocks, bonds, ETFs, mutual funds, and more depending on the type of account. - How long does it take to set up an investment account?

The setup process usually takes about 10-15 minutes if all required information is readily available.

Setting up an investment account is an empowering step towards achieving financial independence. By following these steps carefully—defining goals, choosing the right type of account and broker—you’ll be well on your way to making informed investments that align with your financial aspirations.