Setting investment goals and strategies is a crucial step in managing your financial future. It helps you define what you want to achieve with your investments, whether it’s saving for retirement, funding a child’s education, or building wealth. By establishing clear objectives, you can create a tailored investment plan that aligns with your financial aspirations.

Investment goals can vary significantly from person to person. Some individuals may prioritize short-term gains, while others focus on long-term wealth accumulation. Understanding your unique financial situation and risk tolerance is essential to developing an effective investment strategy. This article will guide you through the process of setting your investment goals and formulating strategies to achieve them.

| Investment Goals | Strategies |

|---|---|

| Retirement Savings | Contribute to retirement accounts like 401(k)s or IRAs |

| Home Purchase | Save in a high-yield savings account or short-term bonds |

| Wealth Accumulation | Invest in stocks or mutual funds for long-term growth |

Defining Your Investment Objectives

The first step in setting investment goals is to define your objectives. Ask yourself what you want to achieve with your investments. Common objectives include:

- Saving for retirement

- Funding education expenses

- Buying a home

- Building an emergency fund

- Achieving financial independence

Each objective may require different strategies and time horizons. For instance, retirement savings typically involve long-term investments, while saving for a home might necessitate a more conservative approach.

It’s also essential to ensure that your goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. This framework helps clarify your intentions and provides a roadmap for tracking progress.

Assessing Your Risk Tolerance

Understanding your risk tolerance is vital when setting investment goals. Risk tolerance refers to how much volatility you can handle in your investments without losing sleep at night. Factors influencing risk tolerance include:

- Age: Younger investors can often take on more risk due to a longer time horizon.

- Financial situation: Those with stable incomes may afford to take more risks.

- Investment experience: Experienced investors might be more comfortable with volatile assets.

To assess your risk tolerance, consider taking a questionnaire or consulting with a financial advisor. This assessment will guide you in selecting appropriate investment vehicles that align with both your goals and comfort level.

Determining Your Time Horizon

Your time horizon is the length of time you plan to hold your investments before needing access to the funds. Different goals have varying time frames:

- Short-term goals (1-3 years): These might include saving for a vacation or a new car. Investments should be low-risk and easily accessible.

- Medium-term goals (3-10 years): Examples include saving for a wedding or down payment on a house. A balanced approach with moderate risk is advisable.

- Long-term goals (10+ years): This category typically includes retirement savings. Investors can afford to take on more risk for potentially higher returns.

Understanding your time horizon helps tailor your investment strategy accordingly.

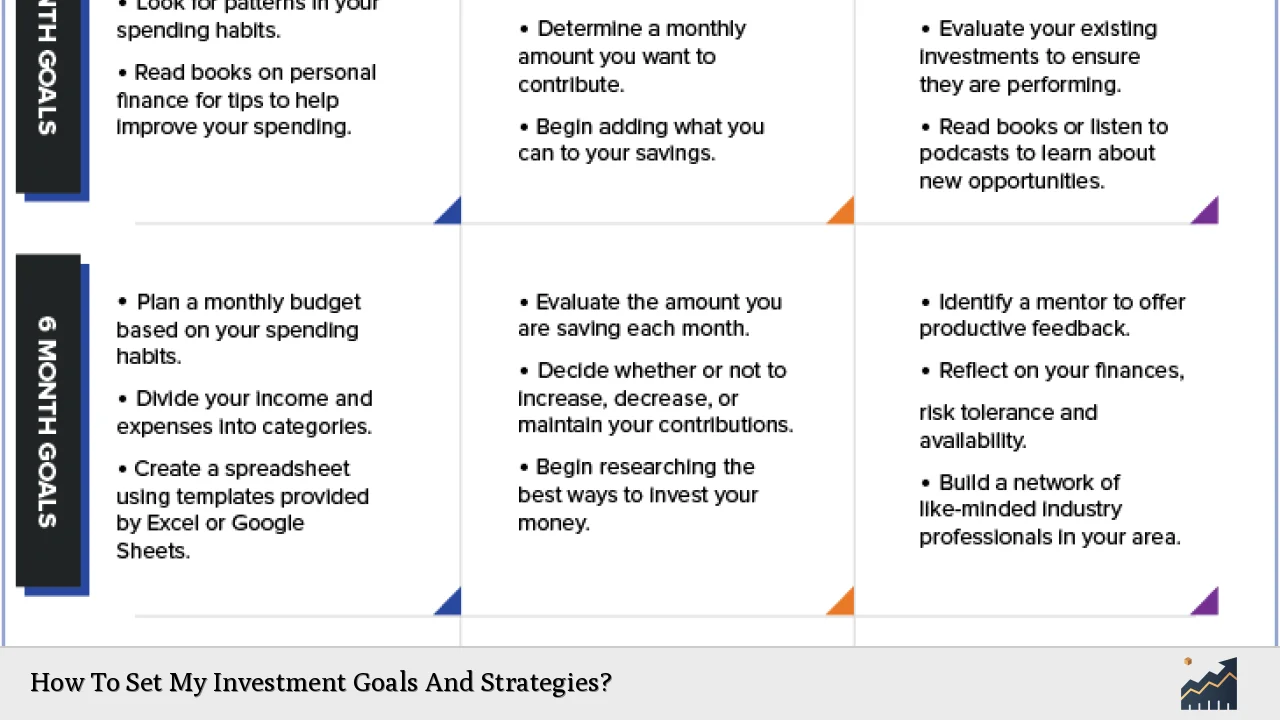

Creating an Investment Strategy

Once you’ve defined your objectives, assessed your risk tolerance, and determined your time horizon, the next step is to create an investment strategy. Here are some key components:

- Diversification: Spread investments across various asset classes (stocks, bonds, real estate) to reduce risk.

- Asset Allocation: Decide how much of your portfolio will be allocated to each asset class based on your goals and risk tolerance.

- Regular Contributions: Commit to regularly investing a portion of your income into your chosen investment vehicles.

A well-defined strategy not only helps manage risk but also enhances the potential for achieving your financial goals.

Building Your Investment Portfolio

With an established strategy, it’s time to build your investment portfolio. Consider the following steps:

- Select Investment Vehicles: Choose from stocks, bonds, mutual funds, ETFs, or real estate based on your strategy and objectives.

- Research Investments: Conduct thorough research on potential investments to understand their risks and returns.

- Monitor Performance: Regularly review the performance of your portfolio against your goals and make adjustments as needed.

Building a diversified portfolio tailored to your specific needs can significantly increase the likelihood of meeting your investment objectives.

Regularly Reviewing Your Goals

Investment landscapes change over time due to market fluctuations and personal circumstances. Therefore, it’s crucial to review your investment goals periodically—at least once a year. During these reviews:

- Assess whether you’re on track to meet your goals.

- Reevaluate your risk tolerance as life circumstances change (e.g., marriage, children).

- Adjust asset allocation if market conditions shift significantly.

Regular reviews ensure that you remain aligned with both market dynamics and personal financial changes.

Utilizing Professional Advice

If you’re unsure about setting investment goals or creating strategies, consider seeking help from a financial advisor. A professional can provide personalized guidance based on:

- Your financial situation

- Investment objectives

- Risk tolerance

They can help craft an investment plan tailored specifically for you and assist in navigating complex markets.

FAQs About Setting Investment Goals And Strategies

- What are the main types of investment goals?

Main types include retirement savings, education funding, wealth accumulation, and emergency funds. - How do I determine my risk tolerance?

You can assess it through questionnaires or by consulting with financial professionals. - What is the SMART criteria?

SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. - How often should I review my investment goals?

You should review them at least once a year or whenever significant life changes occur. - Can I change my investment strategy over time?

Yes, adjusting strategies based on performance and changing circumstances is essential.

By following these guidelines for setting investment goals and strategies, you can create a clear path toward achieving your financial aspirations. Whether you’re saving for retirement or planning for significant life events, having well-defined objectives will help keep you focused and motivated throughout your investing journey.