Sending money internationally has become increasingly convenient thanks to digital platforms like Wise (formerly TransferWise). Wise is renowned for its competitive exchange rates, transparency in fees, and user-friendly interface. This guide will explore how to send money using Wise, analyze current market trends, discuss implementation strategies, consider risks, review regulatory aspects, and provide a future outlook on the money transfer industry.

| Key Concept | Description/Impact |

|---|---|

| Wise Overview | A financial technology company that offers international money transfers at lower costs than traditional banks by using the mid-market exchange rate. |

| Market Growth | The global money transfer market is projected to grow from $31.41 billion in 2023 to $66.75 billion by 2028, driven by digital adoption and increased migration. |

| Transfer Process | Users can send money in three simple steps: register, choose the amount and recipient, and make a payment using various methods. |

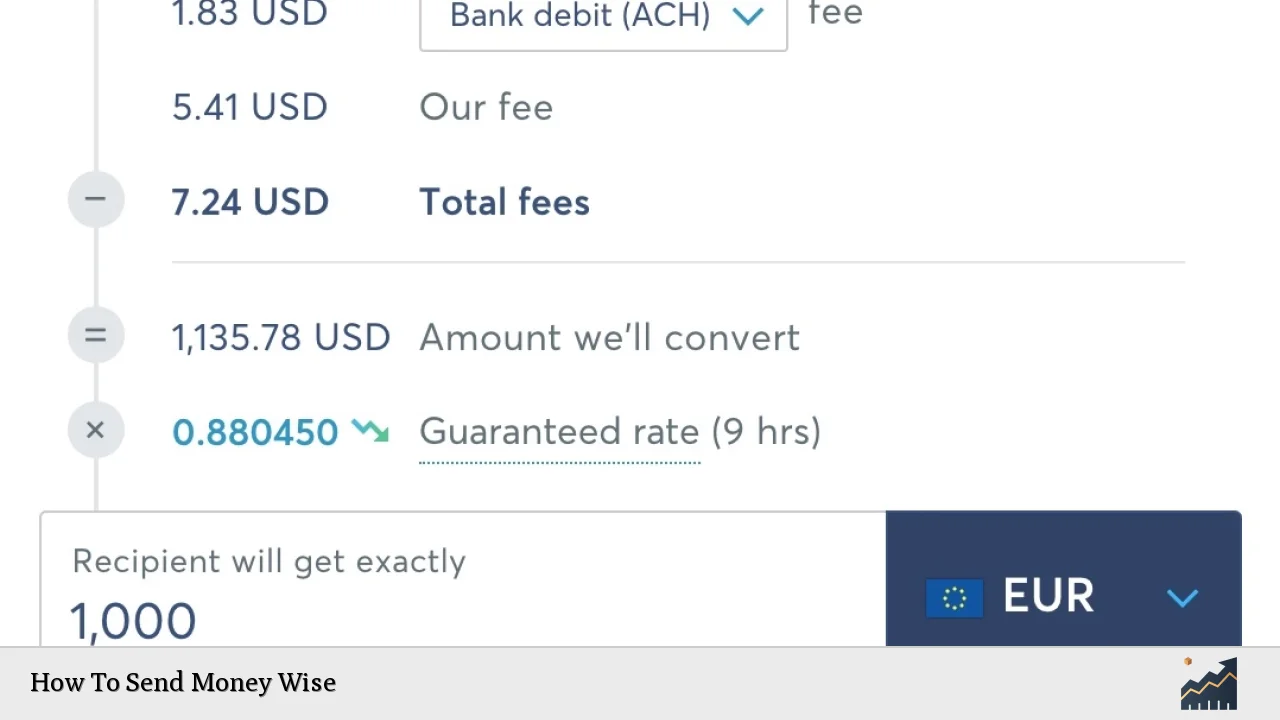

| Fees and Rates | Wise charges a small flat fee plus a percentage of the transfer amount, ensuring no hidden costs while offering competitive rates. |

| Security Measures | Wise employs advanced security protocols, including two-factor authentication and data encryption, to protect user information and transactions. |

| Regulatory Compliance | Wise operates under strict regulatory frameworks in multiple jurisdictions to ensure consumer protection and financial integrity. |

Market Analysis and Trends

The international money transfer market is undergoing significant changes driven by technology and consumer preferences. As of 2024, the digital remittances market is expected to reach a transaction value of approximately $255.40 billion, reflecting a growing trend towards online solutions for sending money internationally.

Key Trends

- Digital Transformation: The increasing adoption of smartphones and internet connectivity has made digital platforms like Wise more accessible. This shift is particularly significant in emerging markets where traditional banking infrastructure may be lacking.

- Cost Efficiency: Consumers are increasingly looking for cost-effective ways to send money abroad. Wise’s model of using the mid-market exchange rate without hefty markups has positioned it favorably against traditional banks that often charge higher fees.

- Regulatory Developments: Governments worldwide are tightening regulations around money transfers to enhance consumer protection. Compliance with these regulations is crucial for companies operating in this space.

- Emerging Markets: Regions such as Asia-Pacific are experiencing rapid growth in mobile banking and cashless payments, presenting lucrative opportunities for companies like Wise to expand their services.

Implementation Strategies

To effectively use Wise for sending money internationally, follow these steps:

- Create an Account: Register for free on the Wise platform using your email or social media accounts.

- Initiate a Transfer:

- Enter the amount you wish to send.

- Select the recipient’s country and currency.

- Choose your payment method (bank transfer, debit/credit card).

- Verify Identity: For larger transfers or certain currencies, you may need to verify your identity by uploading a government-issued ID.

- Complete the Transfer: Pay for your transfer. Wise will handle the conversion at the mid-market rate and notify both you and your recipient once the transaction is complete.

- Track Your Transfer: Use the tracking feature in your account to monitor the status of your transfer until it reaches the recipient.

Risk Considerations

While sending money via Wise is generally safe, there are inherent risks involved:

- Exchange Rate Fluctuations: Currency values can change rapidly; thus, the amount received may vary if there are delays in processing.

- Fraud Risks: Always ensure that you are sending money to trusted recipients. Scammers often exploit online platforms.

- Regulatory Risks: Changes in regulations can affect how transfers are processed or what fees are applicable.

To mitigate these risks, always double-check recipient details and stay informed about any regulatory changes that may impact international transfers.

Regulatory Aspects

Wise operates under stringent regulations across different countries to ensure compliance with financial laws:

- Consumer Protection Laws: Regulations such as the Electronic Fund Transfer Act (EFTA) in the U.S. require transparency regarding fees and exchange rates.

- Anti-Money Laundering (AML) Regulations: These require companies like Wise to verify customer identities and report suspicious activities to prevent financial crimes.

- Data Protection Regulations: Compliance with data protection laws ensures that user information is securely handled and stored.

Understanding these regulations helps consumers make informed decisions when using services like Wise for international money transfers.

Future Outlook

The future of international money transfers looks promising as digital solutions continue to gain traction:

- Increased Digital Adoption: With a projected annual growth rate of 16.2%, the digital remittances market will likely see further adoption as more users prefer online solutions over traditional methods.

- Technological Innovations: Advances in blockchain technology and artificial intelligence will enhance security measures and improve user experiences in money transfers.

- Market Expansion: Companies like Wise will continue targeting emerging markets where demand for efficient and affordable remittance services is high.

- Focus on Customer Experience: As competition intensifies, companies will need to prioritize customer service and satisfaction through personalized solutions and seamless transaction processes.

Frequently Asked Questions About How To Send Money Wise

- What is Wise?

Wise is an online platform that allows users to send money internationally at lower costs than traditional banks by using real exchange rates. - How do I send money using Wise?

Create an account, enter the amount you wish to send, add recipient details, verify your identity if necessary, and complete your payment. - Are there any fees associated with sending money through Wise?

Yes, Wise charges a small flat fee plus a percentage of the transfer amount based on currency conversion. - How long does it take for my transfer to reach its destination?

The transfer time varies depending on the currencies involved but typically ranges from minutes to a few days. - Is my money safe with Wise?

Yes, Wise uses advanced security measures including encryption and two-factor authentication to protect user data and transactions. - Can I cancel my transfer once it’s been initiated?

You can cancel your transfer if it hasn’t been completed yet; however, once it’s processed, it cannot be reversed. - What happens if my recipient doesn’t receive the funds?

If there are issues with delivery, you can contact Wise’s customer support for assistance in tracking or resolving any problems. - Is Wise available globally?

Wise operates in over 80 countries worldwide, allowing users to send money across various currencies efficiently.

By understanding how to utilize platforms like Wise effectively, individuals can navigate international money transfers with greater ease while maximizing cost-efficiency and security.