Wise, formerly known as TransferWise, has revolutionized the way individuals and businesses send money internationally. With its user-friendly platform and competitive fees, Wise allows users to transfer funds across borders efficiently and transparently. This article delves into the mechanics of sending money through Wise, exploring market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Mid-Market Exchange Rate | Wise uses the mid-market exchange rate for currency conversions, ensuring users avoid hidden fees that traditional banks often impose. |

| Transfer Speed | Approximately 63% of transfers complete instantly, with 83% processed within an hour, enhancing user experience. |

| Regulatory Compliance | Wise operates under strict regulatory frameworks across 65 jurisdictions to ensure safe and legal transactions. |

| User Growth | Wise’s active customer base has grown significantly, reflecting its increasing popularity in the digital money transfer market. |

Market Analysis and Trends

The global money transfer services market is experiencing rapid growth. In 2023, the market size reached approximately $31.41 billion and is projected to grow to $36.49 billion in 2024, reflecting a compound annual growth rate (CAGR) of 16.2%. This growth is driven by several factors:

- Digital Transformation: The shift towards digital transactions is accelerating, with more consumers opting for online platforms for their financial needs. In 2022, U.S. consumers spent $65.2 billion using mobile payment services like Google Pay.

- Competitive Landscape: Digital challengers like Wise are outpacing traditional players such as Western Union and MoneyGram in revenue growth. Wise’s revenue has been bolstered by its ability to offer lower fees and a better user experience.

- Regulatory Changes: Recent regulations aimed at improving anti-money laundering (AML) practices have affected how companies operate within this space. Wise has faced scrutiny but continues to adapt its compliance measures effectively.

Implementation Strategies

Sending money through Wise involves a straightforward process that can be broken down into several steps:

- Create an Account: Users must register for a free account on the Wise platform or app using their email or social media accounts.

- Select Transfer Amount: Users specify how much they wish to send and select the recipient’s currency.

- Add Recipient Details: Users can either choose an existing recipient or add a new one by entering their bank details.

- Verify Identity: For certain transactions, especially larger amounts or specific currencies, users may need to verify their identity by uploading identification documents.

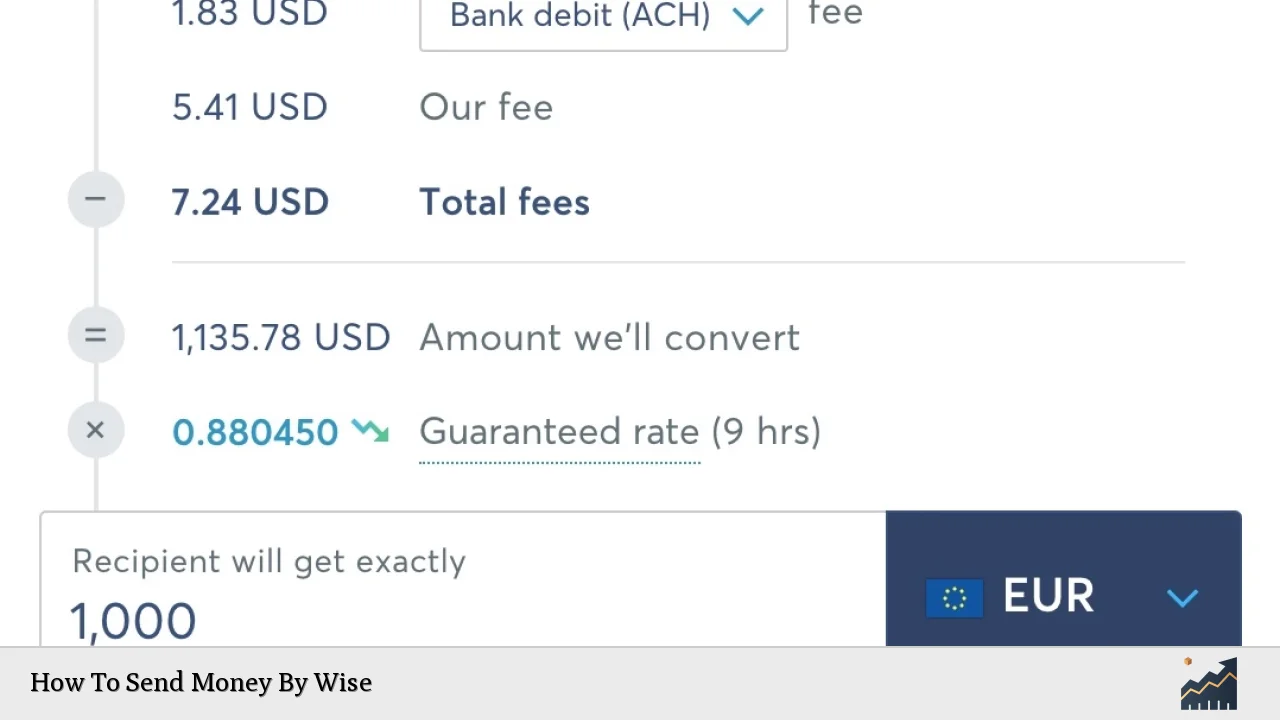

- Choose Payment Method: Wise allows various payment options including bank transfers and debit/credit cards. Generally, bank transfers are the most cost-effective method.

- Confirm Transfer: After reviewing all details for accuracy, users confirm the transfer. They will receive notifications about the transaction status via email or app notifications.

Risk Considerations

While Wise offers numerous benefits for international money transfers, users should be aware of potential risks:

- Exchange Rate Fluctuations: Currency values can change rapidly; thus, the amount received may differ from what was initially calculated if there is a delay in processing.

- Fraud Risks: As with any online financial service, users must ensure they are sending money to trusted recipients to avoid scams.

- Regulatory Compliance: Non-compliance with local laws can lead to delays or issues with transfers. Wise adheres to stringent regulations but users should also ensure they understand their local requirements.

Regulatory Aspects

Wise operates under various regulatory frameworks globally, which ensures that it maintains high standards of security and compliance:

- Anti-Money Laundering (AML) Regulations: Wise has implemented robust AML practices in response to regulatory scrutiny in Europe and other regions.

- Licensing Requirements: The company holds licenses across 65 jurisdictions, which helps it navigate different regulatory environments effectively.

- Consumer Protection Laws: Compliance with consumer protection regulations ensures that users’ rights are safeguarded during transactions.

Future Outlook

The future of international money transfers appears bright for platforms like Wise:

- Continued Growth: The global market for money transfer services is expected to reach $66.75 billion by 2028, driven by increased digital transaction adoption and innovations in technology.

- Technological Advancements: Innovations such as blockchain technology may further enhance transaction speed and security in the coming years.

- Market Expansion: Wise continues to expand its services into new markets while enhancing its infrastructure to support faster transactions globally.

In summary, Wise stands out as a leading option for international money transfers due to its competitive pricing model, user-friendly interface, and commitment to compliance with regulatory standards.

Frequently Asked Questions About How To Send Money By Wise

- What is Wise?

Wise is an international money transfer service that allows users to send money across borders at lower costs compared to traditional banks. - How long does it take for a transfer to complete?

Most transfers are completed instantly or within a few hours; however, some may take longer depending on the payment method used. - Are there fees associated with sending money via Wise?

Yes, Wise charges a fee based on the amount sent and the currencies involved; however, these fees are typically lower than those charged by banks. - Can I send money without verifying my identity?

For smaller amounts or specific currencies, you might not need verification; however, larger transactions typically require identity verification. - What payment methods does Wise accept?

Wise accepts several payment methods including bank transfers and debit/credit cards. - Is my money safe with Wise?

Yes, Wise employs strong security measures and complies with financial regulations across different jurisdictions to protect users’ funds. - Can I track my transfer?

Yes, users can track their transfers through the Wise app or website once initiated. - What currencies can I send using Wise?

Wise supports over 40 currencies for international transfers.

This comprehensive guide provides insights into sending money through Wise while addressing key aspects such as market trends and regulatory considerations essential for individuals looking to utilize this service effectively.