Selecting a mutual fund for investment can be a daunting task, especially for new investors. With thousands of funds available, each with different strategies, risks, and potential returns, making the right choice is essential to achieving your financial goals. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers. This allows individual investors to access a variety of investment opportunities without needing extensive knowledge or experience.

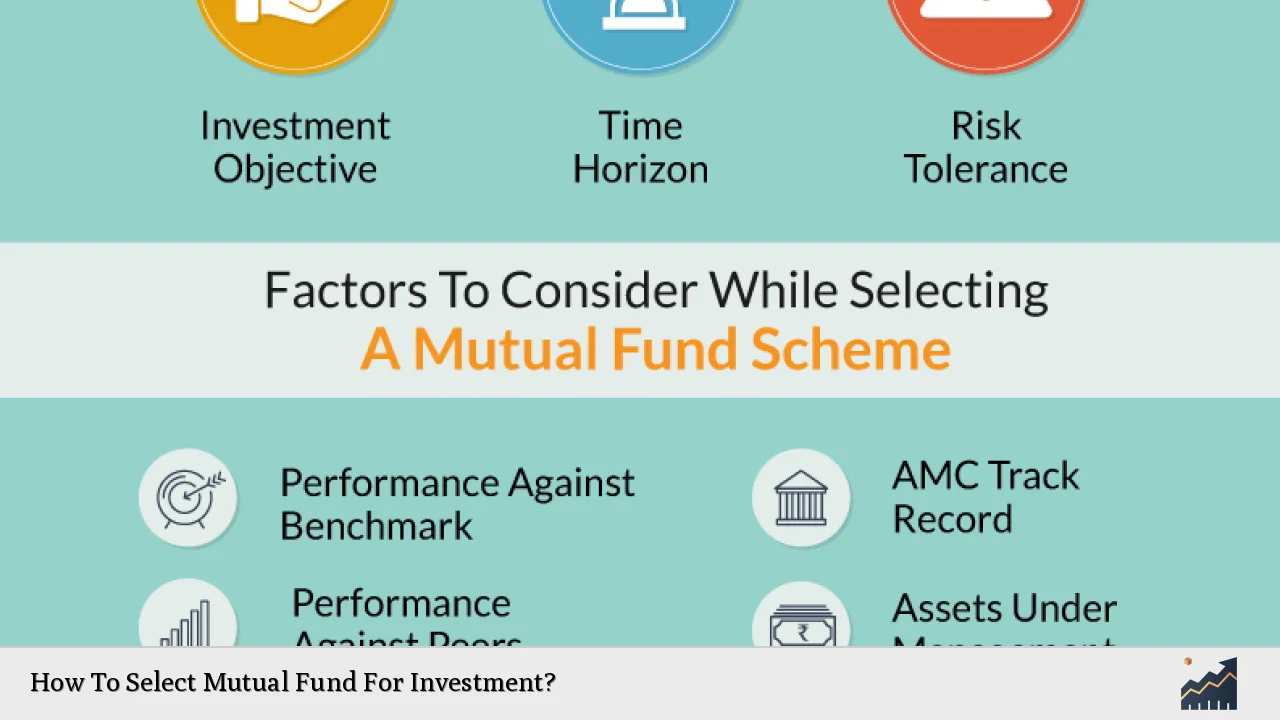

When selecting a mutual fund, it’s crucial to align your choice with your financial objectives, risk tolerance, and investment horizon. Understanding these factors will help you narrow down your options and find the funds that best suit your needs. The selection process involves evaluating various aspects of the funds, including their performance history, management team, fees, and investment strategy.

| Key Factors | Description |

|---|---|

| Investment Goals | Define what you want to achieve with your investments. |

| Risk Tolerance | Assess how much risk you are willing to take. |

| Time Horizon | Determine how long you plan to invest. |

Understand Your Investment Goals

Before diving into mutual fund selection, it’s vital to clarify your investment goals. Are you saving for retirement, a child’s education, or perhaps a major purchase? Each goal will have a different time frame and risk profile associated with it.

- If you’re investing for long-term goals (over 10 years), you may consider equity funds that have the potential for higher returns but come with increased volatility.

- For medium-term goals (3-10 years), balanced or hybrid funds that mix equities and bonds may be more suitable.

- If your goal is short-term (less than 3 years), conservative options like money market funds or short-term bond funds could be appropriate.

Understanding your goals will guide you in selecting the right type of mutual fund that aligns with your financial aspirations.

Assess Your Risk Tolerance

Your risk tolerance is another critical factor when selecting a mutual fund. It reflects how comfortable you are with fluctuations in your investment’s value. Generally, investors fall into three categories:

- Conservative: Prefer low-risk investments that provide stable returns. Suitable options include bond funds or balanced funds.

- Moderate: Willing to accept some risk for potential growth. A mix of equity and bond funds may be appropriate.

- Aggressive: Comfortable with high volatility for the chance of significant returns. Equity funds or sector-specific funds might be ideal.

Assessing your risk tolerance involves considering your financial situation, investment experience, and emotional response to market fluctuations. This understanding will help you choose funds that match your comfort level.

Evaluate Fund Performance History

When selecting a mutual fund, examining its performance history is crucial. While past performance does not guarantee future results, it can provide insights into how well the fund has been managed.

- Look at the fund’s returns over various time frames—1 year, 3 years, 5 years, and even 10 years.

- Compare these returns against relevant benchmarks (e.g., S&P 500 for equity funds) to gauge how well the fund performs relative to its peers.

- Consistency in performance is key; a fund that shows steady growth is often preferable to one with erratic returns.

However, be cautious about chasing past performance alone; focus on whether the fund’s strategy aligns with your investment goals and risk tolerance.

Review the Fund Manager’s Track Record

The expertise of the fund manager plays a significant role in a mutual fund’s success. A skilled manager can navigate market fluctuations and make informed decisions that benefit investors.

- Research the manager’s experience and track record in managing similar funds.

- Look for consistency in their management style and whether they have successfully navigated various market conditions.

A strong management team can enhance your confidence in the fund’s ability to meet its objectives.

Examine Fees and Expenses

Understanding the fees and expenses associated with mutual funds is essential as they can significantly impact your overall returns. Common fees include:

- Expense Ratios: Annual fees charged by the fund for management and operational costs.

- Sales Loads: Charges incurred when buying (front-end load) or selling (back-end load) shares of the fund.

Lower-cost funds typically outperform higher-cost ones over time due to compounding effects. Therefore, consider both the expense ratio and any sales loads when evaluating potential investments.

Consider Fund Type and Strategy

Different types of mutual funds cater to various investment strategies and asset classes. Familiarizing yourself with these options can help narrow down your choices:

- Equity Funds: Invest primarily in stocks; suitable for long-term growth but come with higher risk.

- Bond Funds: Focus on fixed-income securities; generally lower risk than equity but with lower potential returns.

- Balanced Funds: Combine stocks and bonds; offer moderate risk and return potential.

- Index Funds: Aim to replicate the performance of a specific index; typically have lower fees due to passive management.

Choosing a fund type that aligns with your investment strategy is crucial in achieving your financial goals.

Diversification Benefits

One of the primary advantages of investing in mutual funds is diversification, which helps mitigate risk by spreading investments across various assets.

- Ensure that the mutual fund you select provides adequate diversification within its portfolio.

- Consider how it fits into your overall investment strategy—having multiple types of assets can reduce exposure to any single investment’s poor performance.

Diversification helps protect against volatility while aiming for steady growth over time.

Monitor Your Investments Regularly

After selecting a mutual fund, it’s essential to monitor its performance regularly.

- Keep track of how well it meets your expectations regarding returns and risk levels.

- Be prepared to reassess if there are significant changes in market conditions or if the fund underperforms consistently compared to its benchmark.

Regular monitoring ensures that your investments remain aligned with your financial goals over time.

FAQs About How To Select Mutual Fund For Investment

- What factors should I consider when choosing a mutual fund?

You should consider your investment goals, risk tolerance, time horizon, fees, and past performance. - How important is a fund’s past performance?

While past performance can provide insights into management effectiveness, it does not guarantee future results. - What types of mutual funds are available?

Common types include equity funds, bond funds, balanced funds, and index funds. - How do fees affect my investment returns?

Higher fees can significantly reduce overall returns over time due to compounding effects. - Should I diversify my investments within mutual funds?

Yes, diversification helps reduce risk by spreading investments across various assets.

Selecting the right mutual fund involves careful consideration of various factors tailored to individual needs. By understanding your goals and evaluating potential investments based on performance history, management expertise, fees, and diversification benefits, you can make informed decisions that align with your financial aspirations.