Preparing for an SEC securities investigation is crucial for firms and individuals involved in the financial markets. Given the increasing scrutiny by regulatory bodies, understanding the nuances of SEC investigations and how to navigate them effectively can significantly impact the outcomes for those under investigation. This guide provides a comprehensive overview of the steps to take, the strategies to implement, and the considerations to keep in mind when preparing for an SEC investigation.

| Key Concept | Description/Impact |

|---|---|

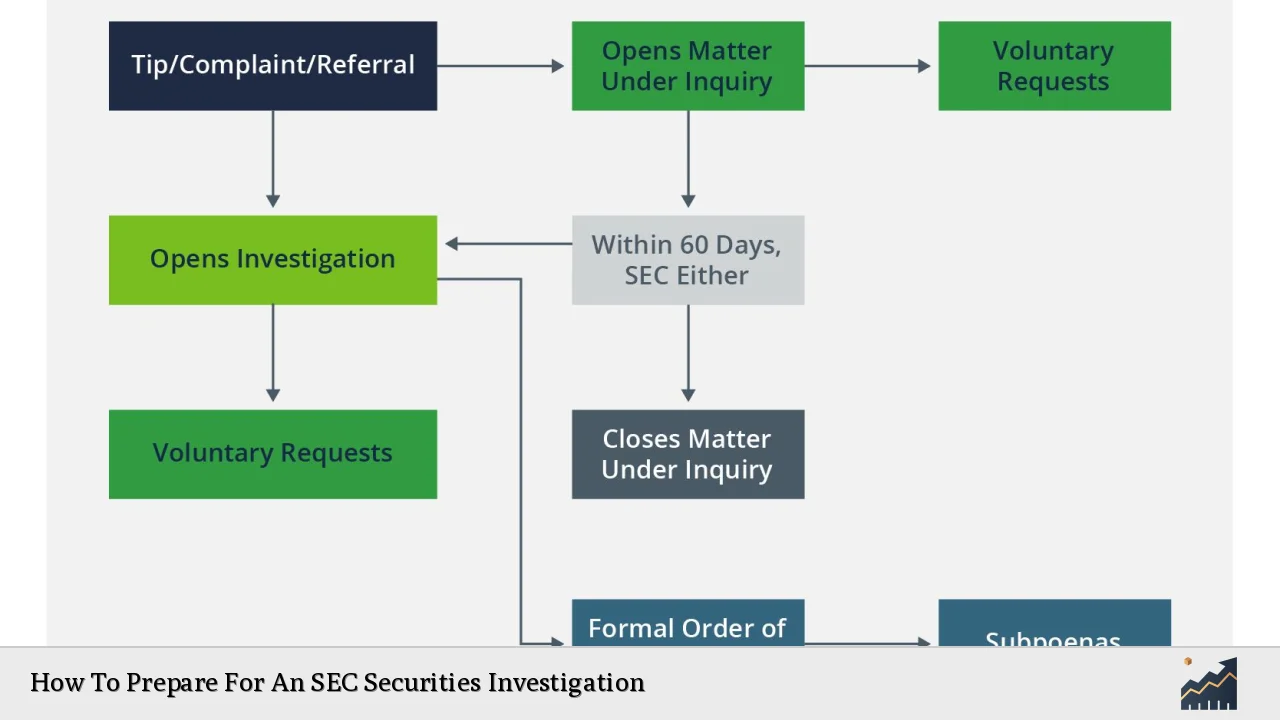

| Understanding SEC Investigations | SEC investigations can be informal or formal, starting with data collection without subpoenas. The process may escalate if violations are suspected. |

| Proactive Compliance | Maintaining a robust compliance program is essential. Regular updates and training can prevent issues before they arise. |

| Hiring Legal Counsel | Engaging an experienced securities attorney immediately upon notification of an investigation is critical for effective navigation of the process. |

| Documentation Preparedness | Proper recordkeeping and documentation are vital. Firms should maintain organized records to facilitate quick responses to SEC requests. |

| Mock Investigations | Conducting mock examinations helps identify potential weaknesses in compliance programs and prepares staff for actual inquiries. |

| Cooperation with the SEC | Prompt and transparent communication with the SEC can influence the investigation’s outcome positively. |

| Current Enforcement Trends | The SEC’s focus has shifted towards high-impact enforcement actions, particularly in areas like cybersecurity and fraud related to new technologies. |

Market Analysis and Trends

The landscape of SEC investigations is evolving, particularly as enforcement actions have increased in complexity and scope. In fiscal year 2024, the SEC filed 583 total enforcement actions, which marked a 26% decrease from the previous year; however, the financial remedies obtained reached a historic high of approximately $8.2 billion. This indicates a shift towards more significant penalties rather than a higher number of cases.

Key Trends

- Increased Financial Remedies: The rise in financial penalties suggests that while fewer cases are being pursued, those that are tend to involve substantial violations that warrant serious consequences.

- Shift in Focus Areas: The SEC has intensified its scrutiny on emerging risks such as cybersecurity threats and fraudulent activities related to artificial intelligence, requiring firms to adapt their compliance frameworks accordingly.

- Self-Reporting Culture: There is a growing trend among market participants to self-report violations, which can lead to more favorable outcomes during investigations. Companies that demonstrate proactive compliance are often viewed more favorably by regulators.

Implementation Strategies

To effectively prepare for an SEC investigation, firms should adopt a multi-faceted approach:

Establish Robust Compliance Programs

- Culture of Compliance: Foster an organizational culture that prioritizes ethical behavior and compliance with regulations. This includes regular training and updates on compliance policies.

- Regular Risk Assessments: Conduct assessments to identify potential compliance risks within the organization. This proactive approach allows firms to address issues before they escalate.

Documentation Practices

- Comprehensive Recordkeeping: Maintain meticulous records of all transactions, communications, and compliance efforts. Organized documentation can streamline responses during investigations.

- Preemptive Mock Audits: Implement mock audits to simulate an SEC examination process. This helps staff become familiar with potential questions and prepares them for actual inquiries.

Engage Legal Expertise

- Hire Experienced Counsel: Upon learning of an investigation, promptly engage a qualified securities attorney who specializes in SEC matters. Their expertise can guide firms through complex legal landscapes and negotiations.

Risk Considerations

Understanding the risks associated with SEC investigations is essential for effective preparation:

- Potential Consequences: Violations can lead to severe penalties, including fines, sanctions, or even criminal charges against individuals involved.

- Reputational Damage: Investigations can tarnish a firm’s reputation, affecting investor trust and business relationships.

- Operational Disruptions: The investigation process can divert resources and focus away from core business operations.

Regulatory Aspects

The regulatory environment surrounding SEC investigations is complex and requires ongoing vigilance:

Key Regulations

- Securities Exchange Act of 1934: Governs trading practices and requires companies to disclose material information.

- Investment Advisers Act of 1940: Regulates investment advisers and mandates adherence to fiduciary standards.

Recent Developments

In fiscal year 2024, there was a notable increase in whistleblower tips received by the SEC, highlighting the importance of internal reporting mechanisms within firms. Companies are encouraged to establish clear channels for employees to report concerns without fear of retaliation.

Future Outlook

As regulatory scrutiny intensifies, firms must remain agile in their compliance efforts:

- Adapting to New Technologies: Firms should continuously update their compliance programs to address emerging technologies and associated risks, such as those related to AI and digital assets.

- Increased Collaboration with Regulators: Building strong relationships with regulators through transparency and cooperation will be crucial in navigating future investigations successfully.

Frequently Asked Questions About How To Prepare For An SEC Securities Investigation

- What should I do if I learn I’m under investigation?

Immediately hire an experienced securities attorney who can guide you through the process. - How important is documentation during an investigation?

Proper documentation is critical; it facilitates quick responses and demonstrates your commitment to compliance. - Can I conduct my own internal investigation?

Yes, conducting an internal review can help identify issues before they escalate into formal investigations. - What are common triggers for SEC investigations?

Common triggers include whistleblower complaints, irregular trading patterns, or significant market events. - How can I improve my firm’s compliance culture?

Promote ongoing training, establish clear policies, and encourage open communication regarding compliance issues. - What role does self-reporting play in investigations?

Self-reporting can lead to reduced penalties if done proactively before an investigation begins. - Are there specific areas of focus for current SEC investigations?

The SEC is focusing on cybersecurity threats, fraud involving new technologies, and traditional areas like financial reporting accuracy. - What happens after an investigation concludes?

The outcome may vary from no action taken to penalties or required changes in business practices depending on findings.

In conclusion, preparing for an SEC securities investigation involves understanding regulatory expectations, maintaining robust compliance practices, engaging legal counsel early on, and fostering a culture that prioritizes ethical conduct. By adopting these strategies, firms can navigate potential investigations more effectively while minimizing risks associated with regulatory scrutiny.