Predicting cryptocurrency trends has become an essential skill for investors looking to navigate the volatile digital asset landscape. With the rise of blockchain technology, investors can leverage on-chain data analysis to gain insights into market movements, investor sentiment, and potential price trajectories. This article explores various methods of predicting cryptocurrency trends using blockchain analysis, providing a comprehensive overview of market dynamics, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| On-Chain Analysis | Utilizes transaction data recorded on the blockchain to assess network activity and investor behavior, helping predict price movements. |

| Sentiment Analysis | Analyzes social media and news sentiment to gauge public perception and its impact on cryptocurrency prices. |

| Technical Indicators | Employs traditional financial metrics such as moving averages and RSI to identify potential entry and exit points in trading. |

| Machine Learning Models | Applies algorithms to historical data to forecast future price movements based on patterns and trends. |

| Market Metrics | Includes metrics such as active addresses, transaction volume, and miner activity to evaluate market health and investor interest. |

Market Analysis and Trends

The cryptocurrency market is characterized by rapid fluctuations influenced by various factors including technological advancements, regulatory changes, and macroeconomic conditions. In 2024, Bitcoin reached an all-time high of over $106,000, driven by increased institutional adoption and favorable regulatory developments. The total market capitalization of cryptocurrencies surged to approximately $3.47 trillion, reflecting growing investor confidence and participation in the space.

Key trends shaping the market include:

- Institutional Adoption: Major financial institutions are increasingly integrating cryptocurrencies into their portfolios. The approval of spot Bitcoin ETFs has made it easier for traditional investors to access digital assets.

- Technological Innovations: Advances in blockchain technology, such as decentralized finance (DeFi) applications and non-fungible tokens (NFTs), have expanded the use cases for cryptocurrencies beyond simple transactions.

- Regulatory Developments: As governments around the world establish clearer frameworks for cryptocurrency regulation, investor confidence is expected to grow. Recent rulings favoring major cryptocurrencies like XRP have positively impacted market sentiment.

- Market Sentiment: Social media platforms play a significant role in shaping public perception. Analyzing sentiment from platforms like Twitter can provide insights into potential price movements.

Implementation Strategies

To effectively predict cryptocurrency trends using blockchain analysis, investors can adopt several strategies:

- Utilizing On-Chain Data: Investors should track key on-chain metrics such as new addresses created, transaction volumes, and miner activity. For example, a spike in new addresses often correlates with bullish price movements.

- Sentiment Analysis Tools: Employing sentiment analysis tools can help investors gauge public mood towards specific cryptocurrencies. This involves analyzing data from social media platforms and news articles to identify bullish or bearish sentiments.

- Technical Analysis: Traditional technical analysis methods remain relevant in the crypto space. Investors can use indicators like moving averages and Relative Strength Index (RSI) to identify potential buying or selling opportunities.

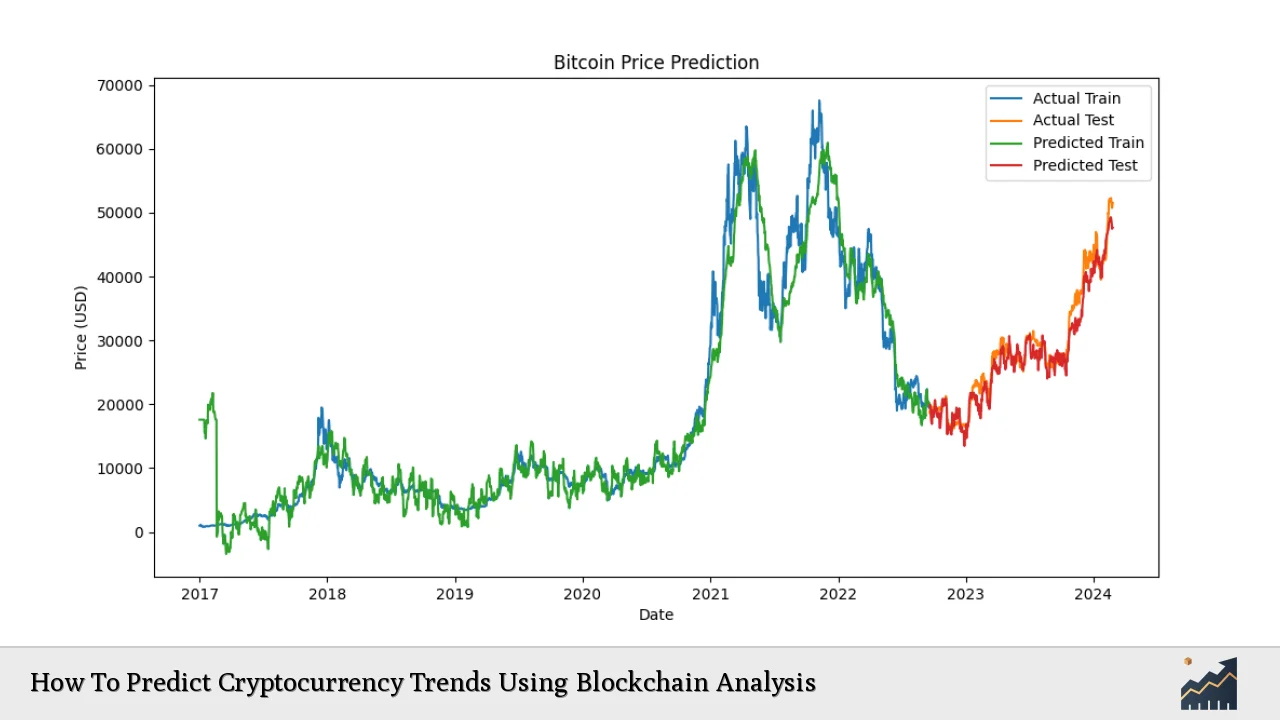

- Machine Learning Applications: Advanced investors may consider employing machine learning models that analyze historical price data alongside on-chain metrics to forecast future price movements. Techniques such as Long Short-Term Memory (LSTM) networks have shown promise in predicting Bitcoin prices based on historical trends.

Risk Considerations

Investing in cryptocurrencies involves inherent risks due to their volatile nature. Key risks include:

- Market Volatility: Cryptocurrency prices can experience extreme fluctuations within short periods. Investors should be prepared for sudden price drops or surges.

- Regulatory Risks: Changes in regulatory frameworks can significantly impact market dynamics. Investors should stay informed about potential regulatory developments that could affect their investments.

- Technological Risks: The reliance on technology means that vulnerabilities or failures in blockchain networks can lead to losses. Security measures must be prioritized when investing in digital assets.

- Liquidity Risks: Some cryptocurrencies may have lower liquidity compared to others, making it difficult to execute trades without affecting the price significantly.

Regulatory Aspects

The regulatory landscape for cryptocurrencies is evolving rapidly. In 2024, significant strides have been made towards establishing clearer guidelines for digital assets. Key points include:

- SEC Regulations: The U.S. Securities and Exchange Commission (SEC) has been actively involved in regulating cryptocurrency offerings. Recent rulings have clarified which tokens qualify as securities.

- Global Regulatory Trends: Countries are competing to create crypto-friendly environments. This trend is likely to continue as more nations recognize the potential economic benefits of embracing blockchain technology.

- Compliance Requirements: Investors must ensure compliance with local regulations when trading or investing in cryptocurrencies. This includes adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) policies.

Future Outlook

The future of cryptocurrency investment appears promising as technological advancements continue to shape the landscape. Key factors influencing future trends include:

- Increased Institutional Participation: As more institutions adopt cryptocurrencies as part of their investment strategies, market stability is expected to improve.

- Technological Advancements: Innovations in blockchain technology will likely introduce new applications and improve existing ones, enhancing user experience and security.

- Regulatory Clarity: Continued efforts towards establishing clear regulations will foster a more secure environment for investors, potentially attracting more participants into the market.

As we move forward into 2025, understanding how to predict cryptocurrency trends using blockchain analysis will be crucial for investors aiming to capitalize on this dynamic market.

Frequently Asked Questions About How To Predict Cryptocurrency Trends Using Blockchain Analysis

- What is blockchain analysis?

Blockchain analysis involves examining transaction data recorded on the blockchain to gain insights into market behavior and investor sentiment. - How can on-chain metrics predict price movements?

On-chain metrics such as active addresses or transaction volumes often correlate with price changes; spikes in these metrics can indicate increased interest or activity around a cryptocurrency. - What role does sentiment analysis play?

Sentiment analysis gauges public perception through social media and news outlets; positive sentiment may lead to increased buying pressure while negative sentiment could result in selling pressure. - Are there any risks associated with using blockchain analysis?

Yes, risks include market volatility, regulatory changes, technological vulnerabilities, and liquidity issues that could affect investment outcomes. - How important is regulatory compliance?

Regulatory compliance is crucial as it ensures that investors adhere to legal requirements which can protect them from potential legal issues. - What tools are available for analyzing cryptocurrency trends?

A variety of tools exist including trading platforms that offer technical analysis features, sentiment analysis software, and machine learning models for predictive analytics. - Can machine learning improve prediction accuracy?

Yes, machine learning models can analyze vast amounts of historical data and identify patterns that may not be apparent through traditional analysis methods. - What is the future outlook for cryptocurrency investments?

The future appears bright with increasing institutional adoption, technological advancements, and improving regulatory clarity expected to drive growth in the sector.

Investors should approach cryptocurrency investments with caution while leveraging blockchain analysis tools for informed decision-making. Understanding market dynamics through comprehensive analysis will be key in navigating this ever-evolving landscape effectively.