Participating in smart contract platform governance is an essential aspect of engaging with decentralized applications (dApps) and decentralized autonomous organizations (DAOs). As blockchain technology evolves, the governance of smart contracts becomes increasingly significant, impacting decision-making processes, resource allocation, and overall project direction. This guide provides a comprehensive overview of how individuals can effectively participate in smart contract platform governance, including market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Decentralized Governance | Decentralized governance allows stakeholders to participate in decision-making processes through voting mechanisms encoded in smart contracts, promoting transparency and community engagement. |

| Token-Based Voting | Many platforms utilize a token-based voting system where users hold tokens that represent their voting power, aligning incentives with the success of the platform. |

| Proposal Submission | Participants can submit proposals for changes or improvements to the platform, fostering innovation and responsiveness to community needs. |

| Quorum Requirements | Governance systems often establish quorum requirements to ensure that a minimum number of votes are cast for decisions to be valid, enhancing legitimacy. |

| Dispute Resolution Mechanisms | Effective governance includes established procedures for resolving disputes that may arise during the execution of smart contracts. |

Market Analysis and Trends

The smart contract market is experiencing rapid growth, driven by increasing adoption across various sectors including finance, supply chain management, and legal services. As of 2023, the market was valued at approximately USD 1.83 billion and is projected to reach USD 7.78 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 23%.

Key trends influencing this market include:

- Increased Adoption of Decentralized Finance (DeFi): The DeFi sector has significantly boosted demand for smart contracts due to their ability to facilitate trustless transactions and automate processes without intermediaries.

- Regulatory Developments: As governments worldwide begin to establish clearer regulations surrounding blockchain technology and smart contracts, platforms must adapt their governance structures to remain compliant.

- Technological Innovations: Advancements in blockchain technology are enhancing the capabilities of smart contracts, making them more efficient and secure.

- Community Engagement: There is a growing emphasis on community-driven projects where users actively participate in governance decisions through voting mechanisms.

Implementation Strategies

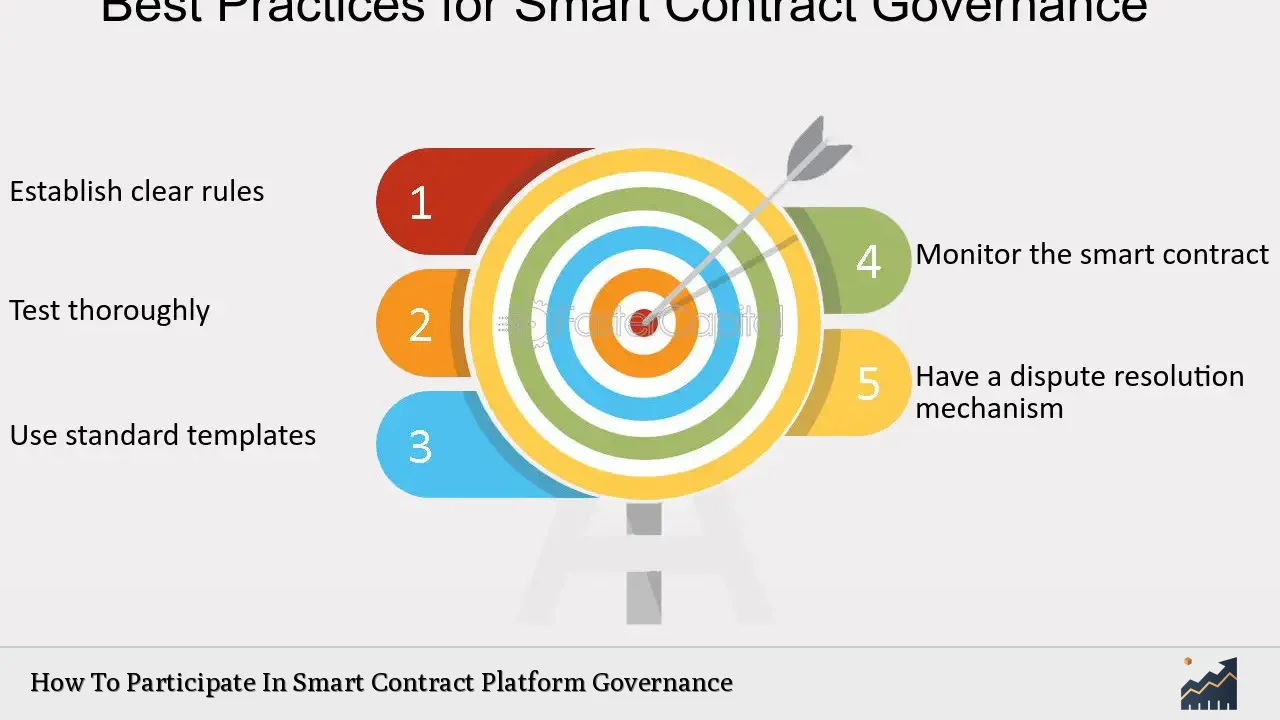

To effectively participate in smart contract platform governance, investors and stakeholders should consider the following strategies:

- Understanding Governance Models: Familiarize yourself with different governance models such as on-chain governance (where rules are embedded in the blockchain), off-chain governance (where decisions are made outside the blockchain), and hybrid models that combine both approaches.

- Active Participation: Engage actively in community discussions and forums. Many platforms have channels for proposal discussions where community input is crucial.

- Token Acquisition: Acquire governance tokens that grant voting rights. The amount of tokens held often correlates with voting power.

- Proposal Submission: Learn how to submit proposals effectively. Clearly articulate your ideas or changes you wish to see implemented within the platform.

- Voting Mechanisms: Understand how voting works within your chosen platform—whether it’s simple majority voting, weighted voting based on token holdings, or quadratic voting which allows users to express preferences more nuancedly.

Risk Considerations

Participating in smart contract governance comes with inherent risks:

- Smart Contract Vulnerabilities: Bugs or vulnerabilities in the smart contract code can lead to exploits. It’s essential to understand the security measures taken by the platform.

- Market Volatility: The value of governance tokens can be highly volatile. Investors should be prepared for price fluctuations that may impact their voting power.

- Regulatory Risks: Changes in regulatory landscapes can affect how platforms operate and govern themselves. Staying informed about legal developments is crucial.

- Centralization Risks: In some cases, despite decentralized intentions, certain platforms may experience centralization where a small number of participants exert disproportionate influence over decisions.

Regulatory Aspects

The regulatory environment surrounding smart contracts is evolving. Key considerations include:

- Compliance with Financial Regulations: Platforms must ensure compliance with regulations set forth by authorities such as the SEC or equivalent bodies in other jurisdictions. This includes adhering to standards related to anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Standardization Efforts: There are ongoing efforts within the industry to standardize smart contract protocols to enhance interoperability and security across different platforms.

- Legal Recognition: The legal status of smart contracts varies by jurisdiction. Understanding local laws regarding digital agreements is essential for participants.

Future Outlook

The future of smart contract platform governance looks promising as technological advancements continue to reshape how decentralized systems operate. Key predictions include:

- Increased Integration with Traditional Finance: As traditional financial institutions explore blockchain technology, there will be greater integration between conventional finance and decentralized platforms.

- Enhanced Governance Tools: The development of more sophisticated tools for governance will enable better decision-making processes and transparency among participants.

- Growing Community Involvement: As awareness about decentralized systems increases, more individuals will likely engage in governance activities, leading to more democratic decision-making processes.

- Focus on Security Standards: With rising concerns about security breaches, there will be an increased focus on implementing robust security standards for smart contracts.

Frequently Asked Questions About How To Participate In Smart Contract Platform Governance

- What is a smart contract?

A smart contract is a self-executing agreement with the terms directly written into code on a blockchain. - How do I get involved in governance?

You can participate by acquiring governance tokens, engaging in community discussions, submitting proposals, and voting on decisions. - What are governance tokens?

Governance tokens are digital assets that grant holders voting rights within a decentralized organization or platform. - What risks should I consider?

Risks include vulnerabilities in smart contract code, market volatility affecting token value, regulatory changes, and potential centralization issues. - How do I submit a proposal?

Each platform has its own process; generally, you will need to draft your proposal clearly and submit it through designated channels. - What types of voting mechanisms exist?

Common mechanisms include simple majority voting, weighted voting based on token holdings, and quadratic voting. - Are there regulations I need to follow?

Yes, compliance with local financial regulations such as AML/KYC requirements is crucial when participating in governance. - What is the future outlook for smart contracts?

The future includes increased integration with traditional finance, enhanced governance tools, greater community involvement, and a focus on security standards.

Engaging in smart contract platform governance not only empowers individual investors but also fosters a more robust ecosystem where collective decision-making leads to innovation and progress. By understanding market dynamics and actively participating in governance processes, stakeholders can contribute meaningfully to the evolution of decentralized technologies.