Participating in FTX Holdings token offerings can be a strategic move for investors looking to capitalize on the opportunities presented by cryptocurrency markets. FTX, once a prominent cryptocurrency exchange, offered various token-related services, including its native token, FTT. This guide will explore the mechanisms behind participating in FTX token offerings, focusing on market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| FTX Token (FTT) | The native cryptocurrency of the FTX exchange, used for trading fee discounts, collateral for futures positions, and staking rewards. |

| Token Offerings | FTX offered various token offerings that allowed users to invest in new tokens before they became widely available. |

| Market Dynamics | The price of FTT has been highly volatile, influenced by market sentiment and broader economic conditions. |

| Regulatory Compliance | Investors must consider the regulatory landscape surrounding cryptocurrency offerings, which can vary significantly by jurisdiction. |

| Risk Management | Investing in tokens carries inherent risks due to market volatility and potential regulatory changes. |

Market Analysis and Trends

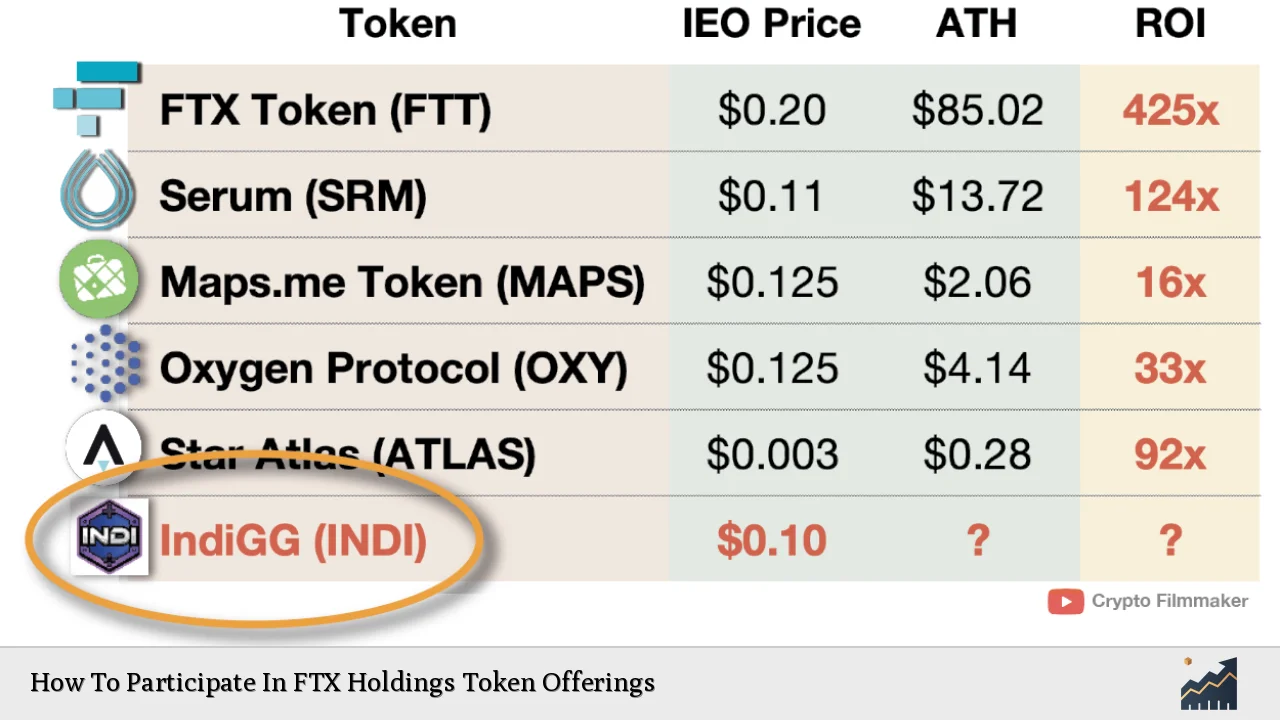

The cryptocurrency market has experienced significant fluctuations over the past few years. Following the collapse of FTX in late 2022 due to liquidity issues and mismanagement of funds, the market has seen a cautious recovery. Current statistics indicate that FTX Token (FTT) is trading at approximately $1.79 with a market capitalization nearing $953 million. This represents a dramatic decline from its all-time high of around $85.10 in September 2021.

Recent trends show:

- Increased Volatility: The price of FTT has fluctuated significantly, with a recent low of $0.78 and a high of $5.94 within the past year.

- Regulatory Scrutiny: Following the collapse of FTX, regulatory bodies have increased scrutiny on cryptocurrency exchanges and their token offerings. This has led to a more cautious approach among investors.

- Market Recovery: Despite past challenges, there is potential for recovery as broader acceptance of cryptocurrencies continues to grow.

Implementation Strategies

To effectively participate in FTX holdings token offerings, investors should consider the following strategies:

- Research and Selection: Carefully select which tokens to invest in based on thorough research. Look for projects with strong fundamentals and clear use cases.

- Diversification: Avoid putting all funds into a single token offering. Diversifying investments across different tokens can mitigate risks associated with volatility.

- Timing: Monitor market trends and news that may impact token prices. Timing purchases when prices are low can enhance potential returns.

- Utilizing Exchanges: Use reputable exchanges that support FTT and other tokens for buying and trading. Ensure that these platforms have robust security measures.

Steps to Participate

- Choose an Exchange: Select a cryptocurrency exchange that lists FTT or other tokens you wish to invest in.

- Create an Account: Register on the chosen exchange and complete any required KYC (Know Your Customer) processes.

- Fund Your Account: Deposit funds into your account using fiat currency or other cryptocurrencies.

- Place Orders: Use market or limit orders to buy your desired tokens during their offering period.

- Monitor Investments: Keep track of your investments and adjust your portfolio based on market conditions.

Risk Considerations

Investing in cryptocurrency tokens involves several risks:

- Market Volatility: Prices can fluctuate dramatically within short periods due to market sentiment or external events.

- Regulatory Risks: Changes in regulations can impact the legality and viability of certain tokens or exchanges.

- Security Risks: Cryptocurrency exchanges are often targets for hacks; thus, using secure wallets for storage is crucial.

- Liquidity Risks: Some tokens may not have sufficient trading volume, making it difficult to sell without impacting the price significantly.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies is evolving rapidly:

- Global Regulations: Different countries have varying regulations regarding cryptocurrency trading and token offerings. Investors must be aware of their local laws to ensure compliance.

- SEC Guidelines: In the United States, the Securities and Exchange Commission (SEC) has begun scrutinizing crypto offerings more closely, classifying some tokens as securities under certain conditions.

- Future Compliance Requirements: As regulations tighten globally, future token offerings may require more extensive disclosures and compliance measures from issuers.

Future Outlook

The future of participating in FTX holdings token offerings largely depends on several factors:

- Market Recovery: As confidence returns to the crypto market post-FTX collapse, there may be renewed interest in token offerings.

- Technological Advancements: Innovations in blockchain technology could lead to new types of offerings that provide more security and transparency for investors.

- Regulatory Developments: Ongoing developments in regulation will shape how future token offerings are structured and marketed.

Overall, while there are opportunities within FTX holdings token offerings, investors must approach with caution due to inherent risks and uncertainties within the cryptocurrency landscape.

Frequently Asked Questions About How To Participate In FTX Holdings Token Offerings

- What is an FTX Token Offering?

An FTX Token Offering allows investors to purchase new tokens before they are publicly available on exchanges. - How do I buy FTX Tokens?

You can buy FTX Tokens through various exchanges like Binance or KuCoin after creating an account and funding it. - What are the risks associated with investing in tokens?

Risks include market volatility, regulatory changes, security breaches, and liquidity issues. - Can I lose all my investment?

Yes, investing in cryptocurrencies can lead to significant losses due to their volatile nature. - Are there any benefits to holding FTT?

Holding FTT can provide discounts on trading fees and access to exclusive features on the platform. - What should I consider before investing?

You should assess your risk tolerance, conduct thorough research on projects, and stay updated on market trends. - Is it necessary to complete KYC?

KYC is often required by exchanges for compliance purposes; it helps verify your identity before trading. - What happens if I miss an offering?

If you miss an offering, you can still purchase tokens later on exchanges but may pay a higher price.

This comprehensive overview provides insights into participating in FTX Holdings token offerings while addressing key aspects such as market analysis, implementation strategies, risk management, regulatory considerations, and future outlooks. Investors should remain informed about ongoing developments within this dynamic sector to make educated investment decisions.