The process of listing exchange-based tokens is a pivotal step for cryptocurrency projects aiming to gain visibility and liquidity in the competitive digital asset landscape. Successfully navigating this process involves understanding market dynamics, regulatory frameworks, and strategic implementation. This comprehensive guide will provide insights into the current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook for token listings.

| Key Concept | Description/Impact |

|---|---|

| Market Demand | Tokens that address real-world problems or offer innovative solutions are prioritized for listing. A strong use case supported by an engaged community increases the likelihood of successful listings. |

| Regulatory Compliance | Compliance with local and international regulations is crucial. Tokens with clear legal status and adherence to regulatory requirements are more likely to secure listings on reputable exchanges. |

| Technical Security | Exchanges favor tokens built on secure and scalable blockchain platforms. Robust technological infrastructure and a focus on security enhance a project’s appeal during the listing process. |

| Community Engagement | A vibrant community can significantly influence exchange decisions. Active participation and support from the community can demonstrate demand and potential for the token. |

| Listing Fees | Different exchanges have varying fee structures for listing tokens, which can impact the decision-making process for project developers. Understanding these costs is essential for budgeting. |

| Liquidity Strategies | Enhancing token liquidity through partnerships with market makers or establishing liquidity pools is vital for successful trading post-listing. |

Market Analysis and Trends

The cryptocurrency market in 2024 has shown a mixed performance regarding newly listed tokens. Despite Bitcoin’s significant price increase, many altcoins have struggled, with over 70% of new tokens experiencing losses since their listings on major exchanges like Binance and Bybit. This trend highlights the importance of strategic planning when seeking listings.

Recent reports indicate that while institutional interest in Bitcoin remains strong, many new projects face challenges due to high fully diluted valuations (FDV) and low liquidity. For instance, StarkNet launched with an FDV of $6.9 billion but faced a drop in price as circulating supply remained limited.

Key trends influencing the market include:

- Institutional Investment: Institutional interest is expected to drive Bitcoin’s price further up, but this has not translated into similar enthusiasm for altcoins.

- Technological Innovation: Projects integrating AI technologies have seen substantial growth, indicating a shift towards utility-driven tokens that solve specific problems within the blockchain ecosystem.

- Regulatory Developments: The introduction of comprehensive regulations such as the Markets in Crypto-Assets Regulation (MiCA) in Europe is set to shape how tokens are listed and traded globally.

Implementation Strategies

To successfully navigate the listing process for exchange-based tokens, project developers should consider the following strategies:

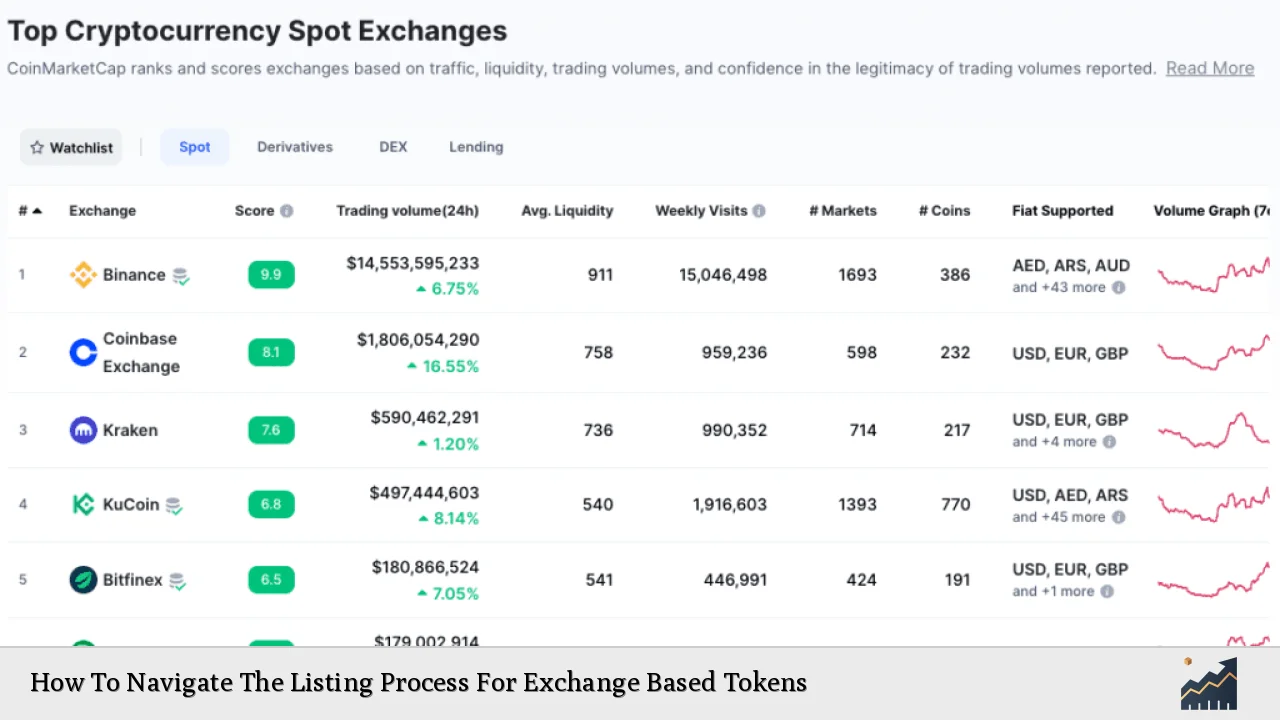

- Conduct Thorough Research: Identify suitable exchanges based on their reputation, user base, trading volume, and specific listing requirements.

- Prepare Comprehensive Documentation: Ensure all necessary documents are ready, including whitepapers detailing technology, use cases, team qualifications, and compliance measures.

- Engage with the Community: Build a strong community around the project through marketing efforts and regular updates. Community support can significantly enhance credibility during the listing process.

- Meet Exchange Requirements: Each exchange has specific criteria that must be met before listing. This includes legal compliance, security audits, and technical specifications.

- Negotiate Listing Terms: Engage in discussions with exchanges to understand their fee structures and negotiate favorable terms that align with project goals.

Risk Considerations

Investing in newly listed tokens carries inherent risks that must be managed effectively:

- Market Volatility: Newly listed tokens often experience significant price fluctuations shortly after listing. Investors should be prepared for potential losses.

- Regulatory Risks: Changes in regulatory frameworks can impact token viability. Projects must stay informed about legal developments in jurisdictions where they operate.

- Liquidity Challenges: Low trading volumes can lead to high volatility and difficulty in executing trades at desired prices. Strategies to enhance liquidity should be prioritized.

- Security Risks: Ensuring robust security measures is critical to protect against hacks or fraud that could undermine investor confidence.

Regulatory Aspects

Navigating regulatory requirements is crucial for successful token listings:

- Compliance Frameworks: Projects must adhere to local laws regarding securities regulations. In many jurisdictions, if a token is deemed a security (e.g., if it was sold during an ICO), it must comply with specific regulatory standards.

- Documentation Requirements: Regulatory bodies often require detailed disclosures about the token’s purpose, technology, team background, and financial projections.

- Ongoing Reporting Obligations: After listing, projects may be required to provide ongoing reports to regulators regarding their operations and financial health.

The International Organization of Securities Commissions (IOSCO) has published recommendations aimed at creating consistent regulatory approaches across jurisdictions. Adhering to these guidelines can facilitate smoother interactions with exchanges.

Future Outlook

The future of exchange-based token listings appears promising yet complex:

- Increased Regulatory Scrutiny: As governments worldwide implement stricter regulations on cryptocurrencies, projects must adapt quickly to maintain compliance while fostering innovation.

- Evolving Market Dynamics: The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) is reshaping investor expectations and market behaviors. Projects must remain agile to capitalize on these trends.

- Technological Advancements: Innovations such as layer 2 solutions and cross-chain interoperability are likely to enhance user experiences and broaden market access for newly listed tokens.

Overall, while challenges persist within the cryptocurrency landscape, strategic planning and adherence to best practices can significantly increase the chances of successful token listings on reputable exchanges.

Frequently Asked Questions About How To Navigate The Listing Process For Exchange Based Tokens

- What are the key factors influencing token listings?

Market demand, regulatory compliance, technical security, community engagement, listing fees, and liquidity strategies are crucial factors influencing whether a token gets listed on an exchange. - How do I choose the right exchange for my token?

Select an exchange based on its reputation, user base size, trading volume, geographical reach, and specific listing requirements that align with your project’s goals. - What documentation is required for listing?

You typically need a whitepaper detailing your project’s technology and use case, legal compliance documents, team information, market analysis data, and financial projections. - Are there costs associated with listing my token?

Yes, many exchanges charge listing fees which can vary widely depending on the platform’s reputation and services offered. - How can I enhance my token’s liquidity post-listing?

Consider partnering with market makers or creating liquidity pools to ensure that your token can be easily bought or sold without significant price impacts. - What risks should I be aware of when listing my token?

Market volatility post-listing can lead to significant price fluctuations; regulatory changes may affect your project’s viability; low liquidity can hinder trading; security risks must also be managed carefully. - How important is community engagement in the listing process?

A strong community can greatly influence an exchange’s decision by demonstrating demand and support for your project. - What role do regulations play in the listing process?

Compliance with local laws is essential; failure to adhere may result in denial of listings or legal repercussions post-listing.

This guide serves as a comprehensive resource for individual investors and finance professionals interested in understanding how to navigate the complexities of getting exchange-based tokens listed effectively. By following these strategies while remaining aware of market conditions and regulatory requirements, stakeholders can enhance their chances of success in this evolving landscape.