Navigating SEC securities compliance within the financial technology (fintech) sector is increasingly complex due to the rapid evolution of digital financial services and the stringent regulatory landscape. Fintech companies must adhere to a myriad of regulations designed to protect investors, maintain market integrity, and ensure transparency. This guide explores the current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook for fintech firms striving to comply with SEC regulations.

| Key Concept | Description/Impact |

|---|---|

| SEC Regulation S-K | Mandates disclosure requirements for public companies, ensuring transparency in financial reporting. |

| Know Your Customer (KYC) | Essential for preventing fraud; requires firms to verify customer identities during onboarding. |

| Anti-Money Laundering (AML) | Regulations that require monitoring and reporting of suspicious activities to prevent financial crimes. |

| Regulation Crowdfunding | Allows startups to raise capital from a large number of investors while ensuring investor protection. |

| Digital Asset Regulations | Guidelines on how digital assets are treated under securities laws, impacting crypto-related fintechs. |

| Consumer Protection Laws | Ensure that fintech companies operate transparently and fairly towards consumers, safeguarding their interests. |

Market Analysis and Trends

The fintech landscape is witnessing significant transformations driven by technological advancements and evolving regulatory frameworks. As of 2024, the global fintech market is projected to grow from $340.10 billion to $1.15 trillion by 2032, at a compound annual growth rate (CAGR) of 16.5%. Key trends impacting this growth include:

- Rise of Central Bank Digital Currencies (CBDCs): Countries are exploring CBDCs to enhance payment systems and reduce transaction costs. This trend necessitates fintech firms to adapt their services accordingly.

- Increased Regulatory Scrutiny: With heightened enforcement actions from the SEC—583 actions reported in FY2024—fintechs must prioritize compliance to avoid penalties and reputational damage.

- Integration of Artificial Intelligence: AI technologies are being utilized for risk management and compliance automation, helping firms streamline operations while adhering to regulations.

- Focus on Sustainability: Consumers prefer fintechs that promote sustainable practices, influencing product offerings and marketing strategies.

Implementation Strategies

To effectively navigate SEC compliance, fintech companies should consider the following strategies:

- Develop a Comprehensive Compliance Program: Establish policies covering all operational aspects subject to regulatory oversight. This includes KYC, AML, data protection, and consumer rights.

- Invest in Technology Solutions: Utilize advanced technologies like AI and machine learning for real-time monitoring of transactions and automated reporting processes.

- Conduct Regular Training: Ensure that all employees understand compliance requirements through ongoing training sessions tailored to their roles within the organization.

- Engage Compliance Experts: Hiring or consulting with legal experts specializing in SEC regulations can help navigate complex legal landscapes and ensure adherence to evolving rules.

Risk Considerations

Understanding and mitigating risks associated with SEC compliance is crucial for fintech firms:

- Cybersecurity Risks: As digital transactions increase, so do vulnerabilities. Implementing robust cybersecurity measures is essential for protecting sensitive data from breaches.

- Reputational Risk: Non-compliance can lead to significant reputational damage. Firms must maintain transparency and adhere strictly to regulations to foster trust among consumers.

- Operational Risks: Changes in regulations may require adjustments in business operations. Regular assessments can help identify potential impacts on compliance frameworks.

Regulatory Aspects

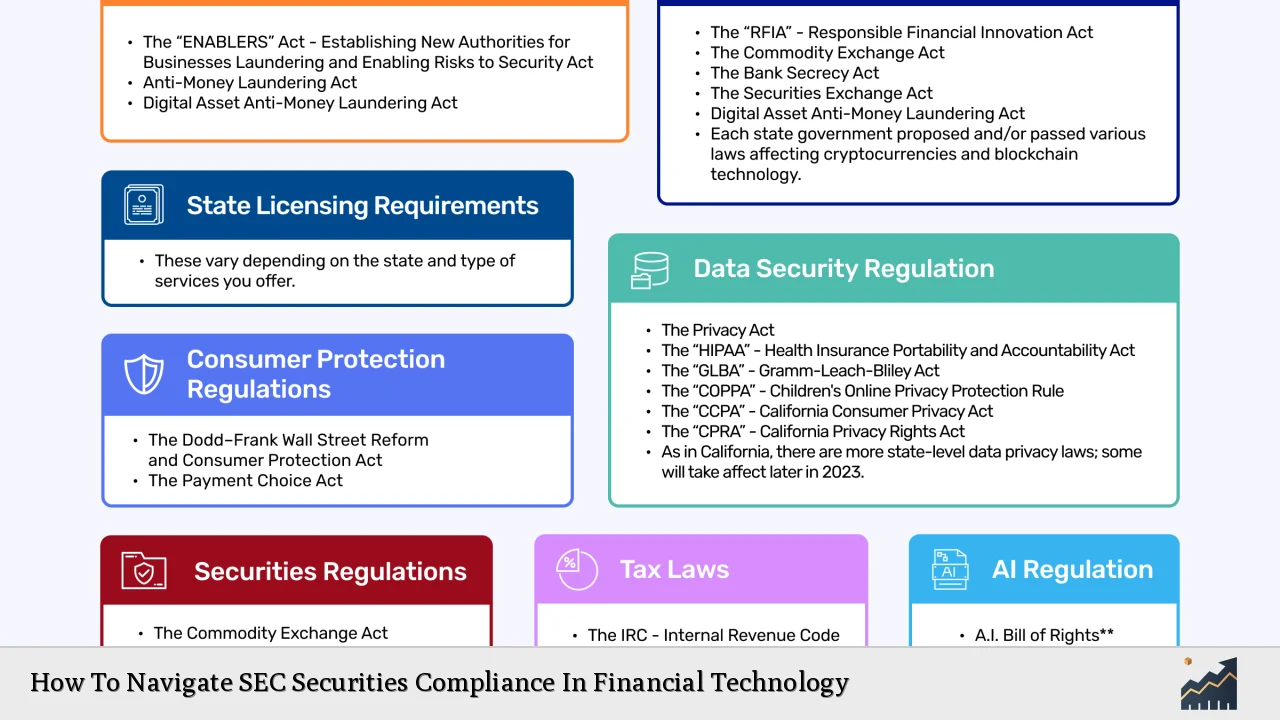

The SEC imposes various regulations that directly affect fintech operations:

- Registration Requirements: Fintechs dealing with securities must register with the SEC or qualify for exemptions under specific regulations like Regulation D or Regulation A+.

- Disclosure Obligations: Companies must provide comprehensive disclosures about their business operations, financial conditions, and risks associated with investments.

- Consumer Protection Regulations: Adherence to laws that protect consumer interests is critical. This includes ensuring fair treatment in advertising and service delivery.

- Digital Asset Regulations: The classification of cryptocurrencies as securities means that firms engaging with these assets must comply with applicable SEC rules.

Future Outlook

The future of fintech compliance will likely be shaped by several factors:

- Evolving Regulatory Landscape: As technology advances, regulators will continue adapting existing frameworks. Fintech companies must stay informed about changes in laws governing digital assets and securities trading.

- Increased Collaboration with Regulators: Fintech firms may benefit from proactive engagement with regulatory bodies to shape policies that foster innovation while ensuring compliance.

- Emergence of New Technologies: Innovations such as blockchain will play a critical role in compliance efforts by enhancing transaction transparency and security measures.

In conclusion, navigating SEC securities compliance in the fintech sector requires a multifaceted approach involving robust internal policies, advanced technology solutions, ongoing education, and active engagement with regulatory bodies. By prioritizing these elements, fintech companies can mitigate risks while capitalizing on growth opportunities within this dynamic industry.

Frequently Asked Questions About How To Navigate SEC Securities Compliance In Financial Technology

- What are the key regulations fintech companies need to comply with?

The main regulations include KYC/AML requirements, SEC registration rules, consumer protection laws, and specific guidelines related to digital assets. - How can fintechs ensure they stay compliant?

By developing comprehensive compliance programs, investing in technology for monitoring transactions, conducting regular employee training, and consulting with legal experts. - What are the consequences of non-compliance?

Non-compliance can lead to severe penalties from the SEC, including fines and legal action, as well as reputational damage that can impact customer trust. - How does AI impact compliance efforts?

AI can automate many compliance tasks such as transaction monitoring and reporting, making it easier for firms to adhere to regulations efficiently. - What role do consumer protection laws play?

These laws ensure that consumers are treated fairly and transparently by fintech companies, fostering trust and accountability in financial transactions. - Why is cybersecurity important for compliance?

A strong cybersecurity posture protects sensitive customer data from breaches that could lead to non-compliance with data protection regulations. - What is the future of fintech regulation?

The future will likely see more tailored regulations as new technologies emerge; ongoing collaboration between fintechs and regulators will be essential. - How can firms prepare for regulatory changes?

Firms should conduct regular assessments of their compliance programs and stay informed about legislative developments affecting their operations.

This comprehensive overview provides insights into navigating SEC securities compliance within the rapidly evolving fintech landscape while addressing current trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.