The emergence of Web3 gaming has revolutionized the gaming industry, introducing blockchain technology, cryptocurrencies, and decentralized finance (DeFi) into interactive entertainment. However, this innovation comes with a complex regulatory landscape that individual investors, developers, and finance professionals must navigate. Understanding the regulatory frameworks is crucial for ensuring compliance, fostering innovation, and mitigating risks associated with legal uncertainties. This article explores the current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook for Web3 gaming.

| Key Concept | Description/Impact |

|---|---|

| Market Size | The Web3 gaming market reached USD 26.38 billion in 2023 and is projected to grow at a CAGR of 19.2% from 2024 to 2032. |

| Regulatory Challenges | Web3 gaming faces significant challenges including cryptocurrency regulations, anti-money laundering (AML) compliance, and data privacy laws. |

| Player Dynamics | The player base has seen a decline from 6.03 million in 2023 to approximately 1 million active users in early 2024. |

| Investment Trends | Funding for Web3 gaming titles grew by 17% YoY until Q3 2024, indicating a cautious but optimistic investment climate. |

| Global Regulatory Landscape | Regulators worldwide are establishing guidelines for crypto and gaming sectors, creating both challenges and opportunities for developers. |

Market Analysis and Trends

The Web3 gaming sector has experienced rapid growth and transformation over recent years. As of 2023, the market size reached approximately USD 26.38 billion, driven by the increasing popularity of non-fungible tokens (NFTs) and play-to-earn (P2E) models. However, the player base has fluctuated significantly; from a peak of 21 million players in late 2021 to around 1 million active users as of early 2024. This decline reflects a shift towards more sustainable gaming models that prioritize engaging gameplay alongside earning potential.

Key Trends Impacting the Market

- Shift to Play-and-Earn Models: The industry is moving from purely P2E models to balanced approaches that enhance user engagement.

- Increased Regulatory Scrutiny: Global regulators are focusing on establishing clear guidelines for crypto assets in gaming, which could impact market dynamics significantly.

- Investment Growth: Funding for Web3 games has increased by 17% YoY, although it remains below the peak levels seen during the crypto boom.

Implementation Strategies

Navigating the regulatory landscape requires strategic planning and proactive measures. Here are key strategies for developers and investors:

- Engage with Legal Experts: Collaborate with legal professionals specialized in blockchain technology to ensure compliance with local and international laws.

- Adopt Compliance Technologies: Invest in technologies that facilitate AML/KYC verification and data protection to meet regulatory requirements effectively.

- Develop Flexible Business Models: Adapt tokenomics and revenue strategies to align with evolving regulations while maintaining innovation.

- Foster Community Engagement: Build strong relationships with stakeholders, including players and regulators, to advocate for fair regulations that support growth.

Risk Considerations

Investing in Web3 gaming presents unique risks that must be managed carefully:

- Regulatory Risks: The evolving nature of regulations can lead to sudden changes that impact game operations or token valuations.

- Market Volatility: The crypto market’s inherent volatility can affect the value of in-game assets and tokens significantly.

- Security Risks: Cybersecurity threats pose risks to both developers’ platforms and players’ assets; ensuring robust security measures is essential.

- User Adoption Challenges: The decline in active users highlights potential issues with user retention and engagement that must be addressed.

Regulatory Aspects

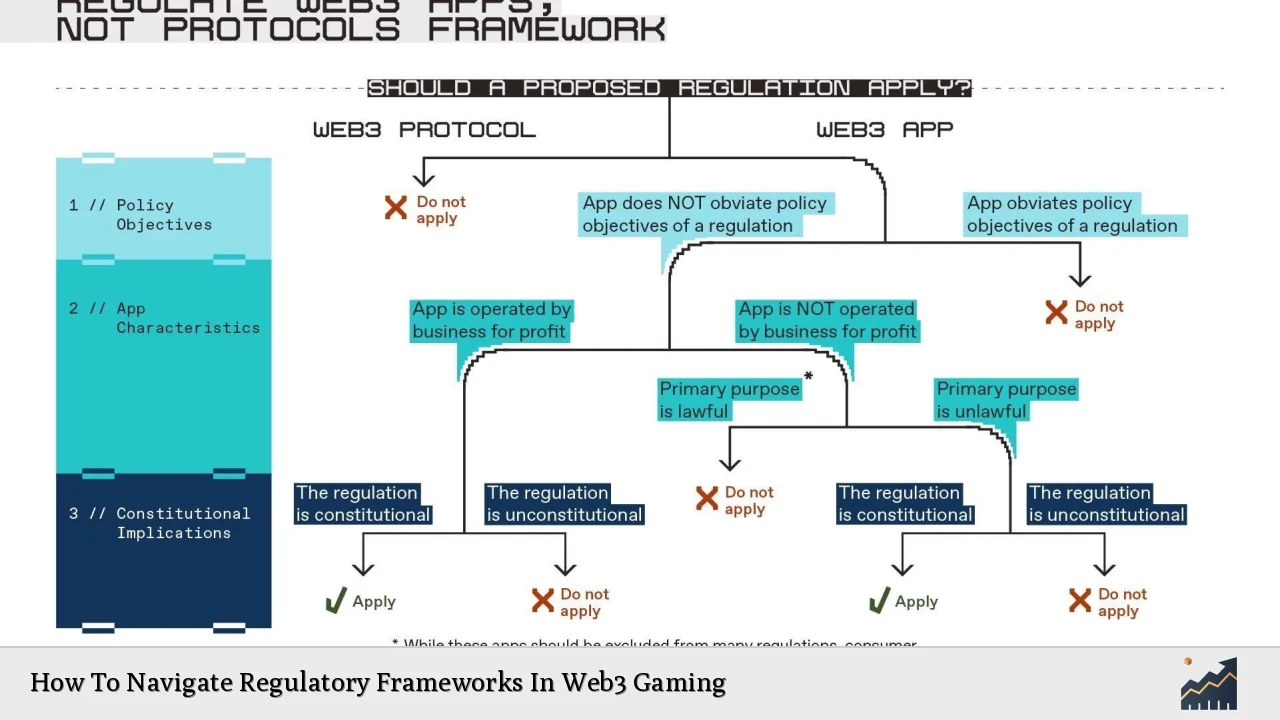

The regulatory landscape for Web3 gaming is complex and varies significantly across jurisdictions. Key areas of concern include:

- Securities Regulations: Many jurisdictions classify blockchain-based tokens as securities, which subjects them to stringent regulatory frameworks regarding their sale and distribution.

- AML Compliance: Developers must implement effective AML measures to prevent financial crimes associated with cryptocurrency transactions.

- Data Privacy Laws: Compliance with data protection regulations like GDPR is critical as games often collect personal data from users.

- Taxation Issues: Understanding tax obligations related to cryptocurrency transactions is essential for both developers and players.

Global Regulatory Landscape

Regulatory bodies worldwide are increasingly scrutinizing the intersection of gaming and blockchain technology. This scrutiny can create both hurdles—such as compliance costs—and opportunities—like attracting institutional investment through clearer guidelines.

Future Outlook

The future of Web3 gaming will likely be shaped by ongoing technological advancements and regulatory developments. As the sector matures:

- Increased Collaboration with Regulators: Developers will need to engage more actively with regulators to shape favorable policies that encourage innovation while protecting consumers.

- Focus on Sustainable Models: The industry will likely continue shifting towards sustainable business models that prioritize user experience over speculative earning potential.

- Emergence of New Technologies: Innovations such as decentralized finance (DeFi) integration within games may offer new avenues for revenue generation while adhering to regulatory frameworks.

Frequently Asked Questions About How To Navigate Regulatory Frameworks In Web3 Gaming

- What are the primary regulatory challenges facing Web3 gaming?

The main challenges include navigating cryptocurrency regulations, ensuring AML compliance, adhering to data privacy laws, and managing tax obligations. - How can developers ensure compliance?

Developers should engage legal experts specializing in blockchain law, adopt compliance technologies, and stay informed about evolving regulations. - What impact do regulations have on investment in Web3 gaming?

Clear regulations can attract investment by providing a stable framework but may also impose constraints that could stifle innovation. - How important is community engagement in navigating regulations?

Engaging with the community helps developers understand player concerns while advocating for fair regulatory practices. - What role do securities laws play in Web3 gaming?

Securities laws affect how game tokens can be sold or distributed; non-compliance can lead to significant legal repercussions. - What are some best practices for risk management in this space?

Best practices include implementing robust security measures, staying updated on market trends, diversifying investments, and developing flexible business strategies. - How does market volatility affect Web3 games?

Market volatility can lead to fluctuating values of in-game assets or tokens, impacting player investment decisions and game economics. - What is the future outlook for Web3 gaming?

The future will likely see increased collaboration between developers and regulators, a focus on sustainable business models, and continued technological innovation.

Navigating the regulatory frameworks in Web3 gaming requires a comprehensive understanding of both market dynamics and legal obligations. By adopting proactive strategies and engaging with stakeholders across the industry, developers and investors can position themselves effectively within this rapidly evolving landscape.