Decentralized Finance (DeFi) has emerged as a transformative force in the financial landscape, offering innovative solutions that challenge traditional banking systems. However, with its rapid growth comes a complex web of regulatory requirements and compliance challenges. Navigating DeFi reporting and compliance necessitates a comprehensive understanding of market trends, regulatory frameworks, and best practices. This article aims to provide individual investors, finance professionals, and enthusiasts with an in-depth analysis of how to effectively manage compliance within the DeFi ecosystem.

| Key Concept | Description/Impact |

|---|---|

| Decentralized Finance (DeFi) | A blockchain-based form of finance that eliminates intermediaries, allowing users to lend, borrow, and trade directly. |

| Regulatory Landscape | Frameworks established by authorities like the SEC and FATF to govern DeFi activities and protect investors. |

| Know Your Customer (KYC) | Processes to verify user identities to prevent fraud and comply with anti-money laundering (AML) regulations. |

| Tax Compliance | Understanding tax implications of DeFi transactions is crucial for accurate reporting and avoiding penalties. |

| Risk Management | Strategies to identify, assess, and mitigate risks associated with DeFi investments and operations. |

Market Analysis and Trends

The DeFi market has witnessed exponential growth, with total value locked (TVL) in DeFi protocols exceeding $100 billion in 2024. This surge is attributed to increased adoption of blockchain technology and the rise of yield farming and liquidity mining strategies. However, this growth has also attracted regulatory scrutiny due to concerns over investor protection, market manipulation, and the potential for illicit activities.

Recent reports indicate that DeFi platforms are becoming increasingly integrated with traditional financial systems. For example, partnerships between DeFi projects and established financial institutions are emerging, highlighting a trend towards hybrid models that combine decentralized and centralized elements. This integration raises questions about compliance obligations under existing financial regulations.

Current Market Statistics

- Total Value Locked (TVL): Over $100 billion.

- Growth Rate: 200% increase year-over-year.

- User Base: Approximately 10 million active users globally.

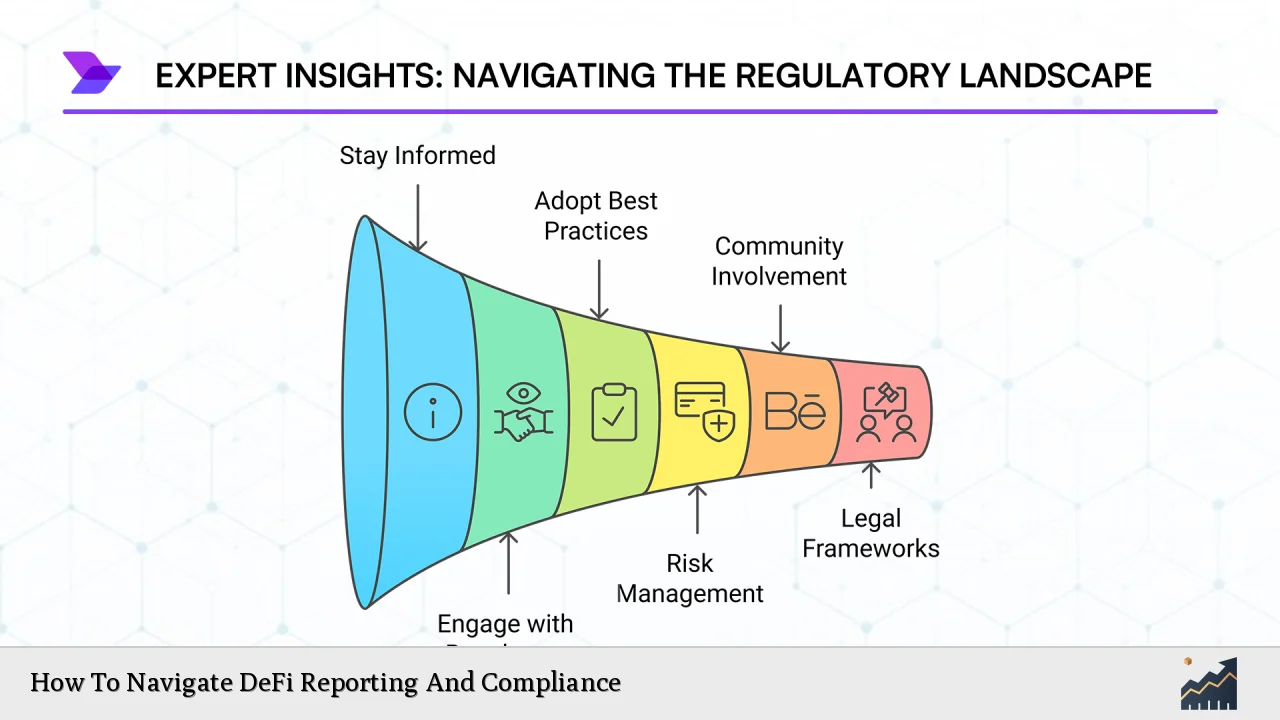

Implementation Strategies

To navigate the complexities of DeFi compliance, platforms must adopt a proactive approach. Here are some key strategies:

KYC Integration

Implementing robust KYC procedures is essential for compliance. Platforms can utilize third-party services that respect user privacy while ensuring adherence to regulatory standards. This includes verifying identities through government-issued documents and conducting ongoing monitoring of user activity.

Regular Audits

Conducting regular audits of smart contracts is critical to ensure compliance with evolving regulations. Independent third-party audits can help identify vulnerabilities and ensure that protocols remain secure.

Compliance by Design

Developers should integrate compliance considerations into the design phase of smart contracts. This includes embedding KYC and AML checks directly into the code to streamline compliance processes.

Collaboration with Regulators

Engaging with regulatory bodies can help shape future regulations that consider the unique aspects of DeFi. By participating in discussions, platforms can advocate for reasonable regulations that foster innovation while protecting investors.

Risk Considerations

DeFi investments carry inherent risks that require careful management:

- Market Volatility: The cryptocurrency market is highly volatile, which can lead to significant losses.

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can result in loss of funds.

- Regulatory Risks: Changes in regulatory frameworks can impact operations and profitability.

- Liquidity Risks: Some DeFi projects may face liquidity challenges during market downturns.

Risk Mitigation Strategies

- Diversification across different DeFi protocols.

- Utilizing insurance products designed for DeFi investments.

- Regularly reviewing the security posture of chosen platforms.

Regulatory Aspects

The regulatory landscape for DeFi is rapidly evolving. Key considerations include:

Anti-Money Laundering (AML) Compliance

DeFi platforms are increasingly required to implement AML measures in line with recommendations from bodies such as the Financial Action Task Force (FATF). This includes transaction monitoring and suspicious activity reporting.

Tax Implications

Investors must be aware of tax obligations related to DeFi transactions. As regulations tighten, platforms may be required to report user transactions to tax authorities. Understanding taxable events—such as trades or liquidity provision—is crucial for accurate reporting.

Global Regulatory Variations

Different jurisdictions have varying approaches to regulating DeFi. For instance:

- The EU is working on comprehensive legislation for crypto-assets.

- The U.S. SEC emphasizes investor protection but lacks clear guidelines specifically for DeFi.

Future Outlook

As the DeFi sector matures, we can expect several trends:

- Increased Regulation: More jurisdictions will likely introduce specific regulations governing DeFi activities.

- Enhanced Interoperability: Cross-chain solutions will facilitate easier movement of assets between different blockchains.

- Institutional Participation: Continued interest from institutional investors will drive further innovation and compliance efforts within the space.

In conclusion, navigating DeFi reporting and compliance requires a multifaceted approach that balances innovation with regulatory adherence. By implementing robust compliance frameworks, engaging with regulators, and understanding market dynamics, stakeholders can position themselves effectively within this rapidly evolving landscape.

Frequently Asked Questions About How To Navigate DeFi Reporting And Compliance

- What are the main compliance challenges in DeFi?

The main challenges include adhering to KYC/AML regulations, managing tax obligations, and responding to evolving regulatory frameworks. - How do I report my DeFi earnings for tax purposes?

You must track all transactions meticulously, including trades and liquidity provisions, as these may trigger taxable events. - Are all DeFi platforms required to implement KYC?

While not universally mandated yet, many jurisdictions are moving towards requiring KYC for all platforms operating in their territories. - What should I do if my DeFi platform doesn’t comply with regulations?

You should consider withdrawing your funds and reporting the platform to relevant authorities. - How can I protect myself from risks associated with DeFi?

Diversifying investments, using audited platforms, and staying informed about market conditions are effective strategies. - Will regulatory changes affect my existing investments in DeFi?

Yes, changes in regulation could impact the operation of platforms you invest in or your ability to withdraw funds. - What role do audits play in ensuring compliance?

Regular audits help identify vulnerabilities in smart contracts and ensure adherence to regulatory standards. - How do I stay updated on changes in DeFi regulations?

Following industry news sources, joining relevant forums or groups, and subscribing to updates from regulatory bodies can keep you informed.

This comprehensive guide aims to equip readers with the necessary knowledge to navigate the complexities of reporting and compliance within the dynamic world of decentralized finance effectively.