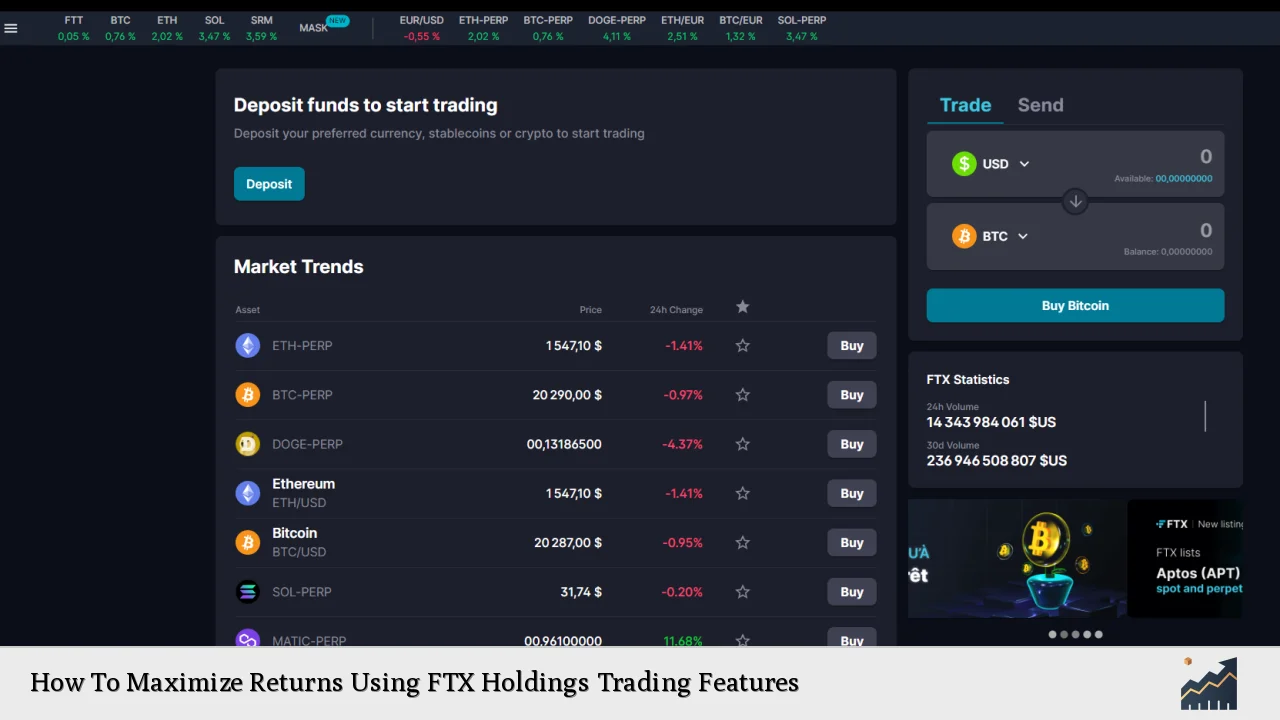

FTX, once a prominent cryptocurrency derivatives exchange, offered a suite of innovative trading features designed to help investors maximize their returns. While FTX is no longer operational due to its bankruptcy in November 2022, understanding its trading features and strategies can provide valuable insights for traders using similar platforms. This comprehensive guide will explore how investors can leverage advanced trading tools to potentially enhance their cryptocurrency trading performance, using FTX’s former offerings as a case study.

| Key Concept | Description/Impact |

|---|---|

| Leveraged Tokens | Tokenized derivatives offering leveraged exposure without liquidation risk |

| Futures Contracts | Agreements to buy/sell assets at a predetermined future date and price |

| Options Trading | Contracts giving the right, but not obligation, to buy/sell at a specific price |

| Volatility Products | Instruments allowing traders to speculate on market volatility |

| Prediction Markets | Platforms for betting on the outcomes of real-world events |

Market Analysis and Trends

The cryptocurrency market has evolved significantly since FTX’s collapse, with increased regulatory scrutiny and a shift towards more transparent and decentralized trading platforms. However, the demand for sophisticated trading instruments remains high. According to a report by Grand View Research, the global cryptocurrency market size is expected to reach $4.94 billion by 2030, growing at a CAGR of 12.2% from 2022 to 2030.

Leveraged tokens, a product popularized by FTX, continue to attract traders seeking amplified exposure to cryptocurrency price movements. These tokens, which automatically maintain a fixed leverage ratio, have seen growing adoption on platforms like Binance and Kraken. The global leveraged token market cap reached approximately $1.2 billion in 2023, indicating sustained interest in these high-risk, high-reward instruments.

Futures and options trading in cryptocurrencies has also experienced significant growth. The Chicago Mercantile Exchange (CME) reported a 43% year-over-year increase in average daily volume for Bitcoin futures contracts in Q2 2023. This trend underscores the increasing sophistication of cryptocurrency traders and their appetite for derivative products.

Implementation Strategies

To maximize returns using advanced trading features similar to those offered by FTX, consider the following strategies:

Leveraged Token Trading

Leveraged tokens provide a way to gain amplified exposure to cryptocurrency price movements without the risk of liquidation. To implement this strategy:

- Choose a reputable exchange offering leveraged tokens.

- Select tokens based on your market outlook (e.g., BULL for bullish sentiment, BEAR for bearish).

- Monitor positions closely, as leveraged tokens can experience significant value decay in volatile markets.

- Rebalance positions regularly to maintain desired exposure levels.

Futures Trading for Hedging and Speculation

Futures contracts allow traders to hedge against price fluctuations or speculate on future price movements. Effective futures trading strategies include:

- Contango and backwardation analysis to identify potential arbitrage opportunities.

- Implementing a dynamic hedging strategy to protect spot holdings.

- Using calendar spreads to profit from changes in the futures curve.

Options Strategies for Risk Management

Options provide flexible tools for managing risk and generating income. Consider these strategies:

- Covered call writing to generate additional income on long-term holdings.

- Protective puts to safeguard against potential downside risks.

- Straddles or strangles to profit from significant price movements in either direction.

Volatility Trading

Volatility products allow traders to speculate on market turbulence. Strategies include:

- Long volatility positions during periods of market calm to prepare for potential turbulence.

- Short volatility trades during high-volatility periods, anticipating a return to normalcy.

- Volatility arbitrage between different cryptocurrency pairs or markets.

Risk Considerations

While advanced trading features offer potential for enhanced returns, they also come with significant risks:

Leverage Risk: Leveraged products can amplify losses as well as gains. Traders should carefully manage position sizes and use stop-loss orders.

Liquidation Risk: In futures trading, positions can be forcibly closed if maintenance margins are not met. Maintain adequate collateral and monitor positions closely.

Volatility Decay: Leveraged tokens and some options strategies can suffer from value erosion during periods of high volatility.

Counterparty Risk: Centralized exchanges carry the risk of insolvency or hacking. Consider using decentralized platforms or implementing robust security measures.

Regulatory Risk: The evolving regulatory landscape for cryptocurrencies can impact the availability and legality of certain trading products.

Regulatory Aspects

The regulatory environment for cryptocurrency derivatives has tightened significantly since FTX’s collapse. Key developments include:

- Enhanced scrutiny of exchanges offering leveraged products, with some jurisdictions imposing restrictions or outright bans.

- Increased reporting requirements for large traders and positions.

- Stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures for derivative trading platforms.

Traders must stay informed about the regulatory status of their chosen trading platforms and products in their jurisdictions. Consulting with a legal professional specializing in cryptocurrency regulations is advisable for high-volume or institutional traders.

Future Outlook

The future of cryptocurrency trading features looks promising, with several trends emerging:

Decentralized Derivatives: Platforms like dYdX and Perpetual Protocol are gaining traction, offering similar features to centralized exchanges without counterparty risk.

Synthetic Assets: Tokenized versions of traditional financial products are becoming more prevalent, potentially bridging the gap between crypto and traditional finance.

AI-Driven Trading: Machine learning algorithms are increasingly being employed to optimize trading strategies and risk management.

Cross-Chain Liquidity: Innovations in blockchain interoperability may lead to more efficient and liquid markets across different cryptocurrency networks.

Regulatory Clarity: As regulations evolve, we may see more standardized and regulated cryptocurrency derivative products, potentially attracting institutional investors.

In conclusion, while FTX’s specific trading features are no longer available, the strategies and concepts they pioneered continue to influence the cryptocurrency trading landscape. By understanding these advanced trading tools and implementing them judiciously, traders can potentially enhance their returns while navigating the unique risks of the cryptocurrency market. As always, thorough research, risk management, and ongoing education are crucial for success in this dynamic and complex field.

Frequently Asked Questions About How To Maximize Returns Using FTX Holdings Trading Features

- What were the key advantages of FTX’s leveraged tokens?

FTX’s leveraged tokens offered amplified exposure to cryptocurrency price movements without the risk of liquidation, automatic rebalancing to maintain target leverage, and the ability to trade them like regular tokens without managing complex positions. - How can traders replicate FTX’s futures trading strategies on other platforms?

Traders can use similar futures trading strategies on platforms like Binance, Kraken, or CME by focusing on contract selection, leverage management, and implementing hedging techniques. It’s important to understand each platform’s specific features and risk parameters. - What are the main risks associated with using advanced trading features like those offered by FTX?

The main risks include potential for amplified losses due to leverage, volatility decay in leveraged products, counterparty risk with centralized exchanges, and regulatory uncertainties surrounding cryptocurrency derivatives. - How has the regulatory landscape for cryptocurrency derivatives changed since FTX’s collapse?

Regulations have tightened significantly, with increased scrutiny on exchanges offering leveraged products, stricter reporting requirements, and enhanced KYC/AML procedures. Some jurisdictions have imposed restrictions on certain types of cryptocurrency derivatives. - Are there decentralized alternatives to the trading features FTX offered?

Yes, decentralized finance (DeFi) platforms like dYdX, Perpetual Protocol, and Synthetix offer similar features including leveraged trading, futures, and synthetic assets, often with reduced counterparty risk compared to centralized exchanges. - What strategies can be used to manage risk when trading cryptocurrency derivatives?

Effective risk management strategies include setting strict stop-loss orders, diversifying across different assets and strategies, using options for hedging, maintaining adequate collateral, and regularly monitoring and adjusting positions based on market conditions. - How can investors stay informed about new trading features and opportunities in the cryptocurrency market?

Investors can stay informed by following reputable cryptocurrency news sources, participating in trading communities, attending industry conferences, and regularly reviewing updates from major exchanges and regulatory bodies. Continuous education and networking within the crypto space are crucial for staying ahead of market developments.