Smart contracts, self-executing contracts with the terms of the agreement directly written into code, have emerged as a transformative technology in global trade. By leveraging blockchain technology, smart contracts can enhance efficiency, reduce costs, and foster transparency in international transactions. This comprehensive analysis explores how businesses can effectively utilize smart contract platforms to streamline global trade processes, improve operational efficiency, and navigate the complexities of international regulations.

| Key Concept | Description/Impact |

|---|---|

| Efficiency and Speed | Smart contracts significantly reduce transaction times by automating processes that traditionally require multiple intermediaries, leading to near-instantaneous execution of agreements. |

| Cost Reduction | By eliminating intermediaries, smart contracts lower transaction costs associated with legal fees, administrative expenses, and other overheads, making trade more accessible. |

| Transparency and Trust | The immutable nature of blockchain ensures all parties have access to the same information, fostering trust and reducing disputes. |

| Security | Smart contracts are encrypted and decentralized, significantly lowering the risk of fraud and data manipulation. |

| Regulatory Compliance | Smart contracts can be programmed to automatically adhere to international trade regulations, minimizing the risk of legal penalties. |

| Real-Time Tracking | Integration with IoT devices allows for real-time monitoring of goods, enhancing supply chain transparency and accountability. |

| Dispute Resolution | Smart contracts can automate arbitration processes in case of disputes, ensuring quick and impartial resolutions. |

Market Analysis and Trends

The global market for smart contracts is experiencing rapid growth. According to recent reports, the smart contract market was valued at approximately USD 684.3 million in 2022 and is projected to reach USD 7.78 billion by 2030, with a compound annual growth rate (CAGR) of 23.0% from 2024 to 2030. This growth is driven by increasing adoption across various industries including finance, supply chain management, and legal services.

Current Trends

- Integration with AI: The merging of artificial intelligence with smart contracts is a significant trend that enhances their capabilities by allowing them to adapt to complex conditions dynamically.

- Layer 2 Solutions: These solutions improve scalability and efficiency by processing transactions off-chain while maintaining security through blockchain.

- Hybrid Smart Contracts: Combining on-chain and off-chain components allows for greater flexibility and access to external data sources.

Regional Insights

- Asia-Pacific: This region shows the highest growth potential for smart contracts due to rapid technological advancements and increasing digitalization in trade practices.

- North America: The U.S. market is expected to expand at a CAGR of 21.7%, driven by innovations in fintech and blockchain technologies.

Implementation Strategies

To effectively leverage smart contract platforms in global trade, businesses should consider the following strategies:

- Develop Digital Identities: Each participant in a smart contract must have a digital identity secured by public/private key pairs to ensure secure transactions.

- Choose the Right Blockchain Platform: Selecting a blockchain platform that aligns with business needs (e.g., Ethereum for its robust ecosystem or Hyperledger for private networks) is crucial for successful implementation.

- Automate Processes: Identify repetitive tasks within trade operations that can be automated through smart contracts, such as payment processing or compliance checks.

- Collaborate with Technology Providers: Partnering with technology firms specializing in blockchain can provide expertise and resources necessary for successful deployment.

Risk Considerations

While smart contracts present numerous advantages, there are inherent risks that businesses must navigate:

- Legal Recognition: The legal status of smart contracts varies by jurisdiction; businesses must ensure compliance with local laws regarding digital agreements.

- Technical Vulnerabilities: Bugs or vulnerabilities in the code can lead to significant financial losses; rigorous testing and audits are essential before deployment.

- Data Privacy Concerns: Handling sensitive information on public blockchains raises privacy issues; businesses should consider private or permissioned blockchains for sensitive transactions.

Regulatory Aspects

The regulatory landscape surrounding smart contracts is evolving. Key considerations include:

- Compliance with International Trade Regulations: Smart contracts must be designed to comply with various trade laws across different jurisdictions to avoid legal complications.

- Data Protection Laws: Adherence to regulations such as GDPR is vital when handling personal data within smart contracts.

- Evolving Guidelines: Regulatory bodies are beginning to establish frameworks for the use of blockchain technology in trade; staying informed about these changes is crucial for compliance.

Future Outlook

The future of smart contracts in global trade looks promising. As businesses increasingly recognize their potential to enhance efficiency and reduce costs, adoption rates are expected to rise.

Key Predictions

- Increased Adoption Across Industries: More sectors will integrate smart contract technology into their operations as awareness grows regarding its benefits.

- Enhanced Collaboration Between Governments and Tech Firms: Partnerships will emerge to create standardized protocols for using smart contracts in international trade.

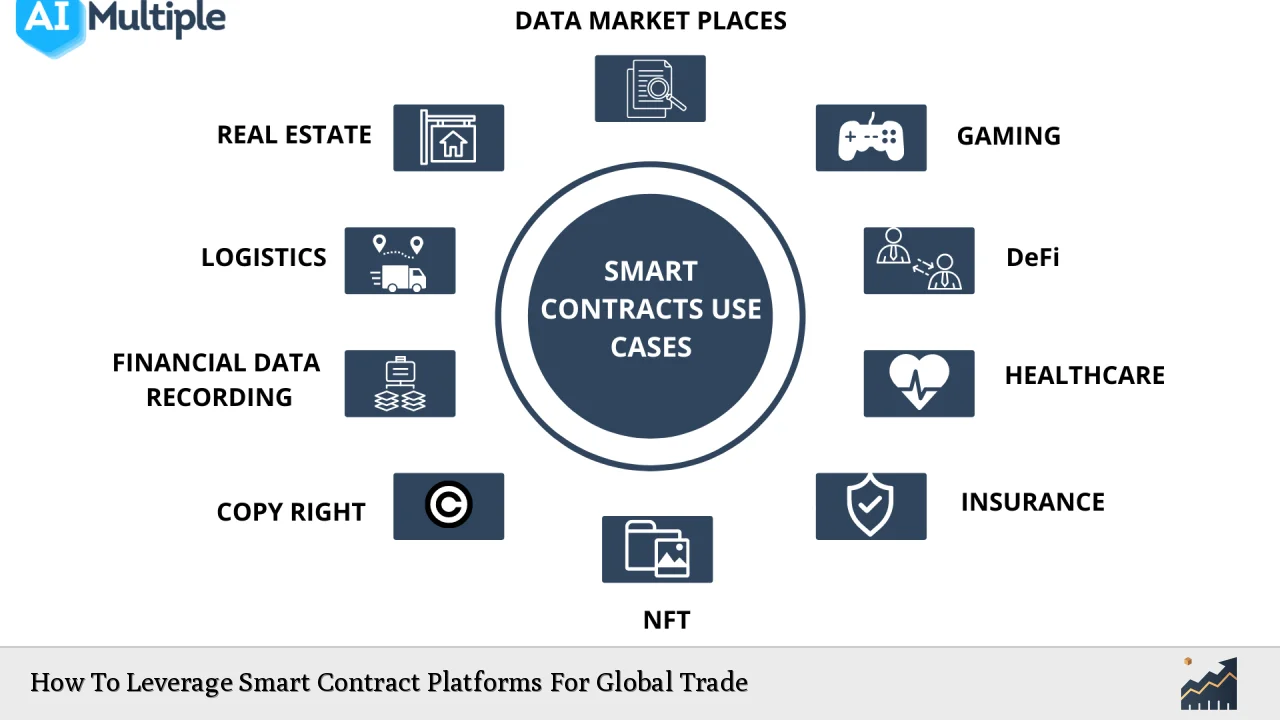

- Broader Use Cases: Beyond traditional applications in finance and supply chain management, new use cases will emerge as technology evolves.

Frequently Asked Questions About How To Leverage Smart Contract Platforms For Global Trade

- What are smart contracts?

Smart contracts are self-executing agreements where the terms are written into code on a blockchain platform. - How do smart contracts improve global trade?

They enhance efficiency by automating processes, reduce costs by eliminating intermediaries, and increase transparency through immutable records. - What industries can benefit from smart contracts?

Industries such as finance, supply chain management, real estate, healthcare, and legal services can all leverage smart contract technology. - What are the risks associated with using smart contracts?

The primary risks include legal recognition issues, technical vulnerabilities in code, and data privacy concerns. - How do I implement smart contracts in my business?

Begin by developing digital identities for participants, choosing an appropriate blockchain platform, automating relevant processes, and collaborating with technology providers. - Are there regulatory challenges related to smart contracts?

Yes, businesses must navigate varying legal frameworks regarding digital agreements and ensure compliance with data protection laws. - What does the future hold for smart contract technology?

The market is expected to grow significantly as more industries adopt this technology for its efficiency gains and cost reductions. - How can businesses ensure the security of their smart contracts?

Conduct thorough testing and audits before deployment and consider using private blockchains for sensitive transactions.

In conclusion, leveraging smart contract platforms presents an unprecedented opportunity for businesses engaged in global trade. By understanding market trends, implementing effective strategies, managing risks appropriately, complying with regulatory requirements, and anticipating future developments, companies can position themselves advantageously in an increasingly digital trading landscape.