Investing your savings is a crucial step toward achieving financial security and building wealth over time. With the right strategies, you can make your money work for you, rather than simply letting it sit idle in a savings account. This article will guide you through the essential steps to effectively invest your savings, considering different options, risk factors, and strategies to maximize your returns.

| Key Concepts | Description |

|---|---|

| Saving | Setting aside money for future use, typically in a low-risk account. |

| Investing | Allocating money into assets with the expectation of generating a profit. |

Understanding Saving vs. Investing

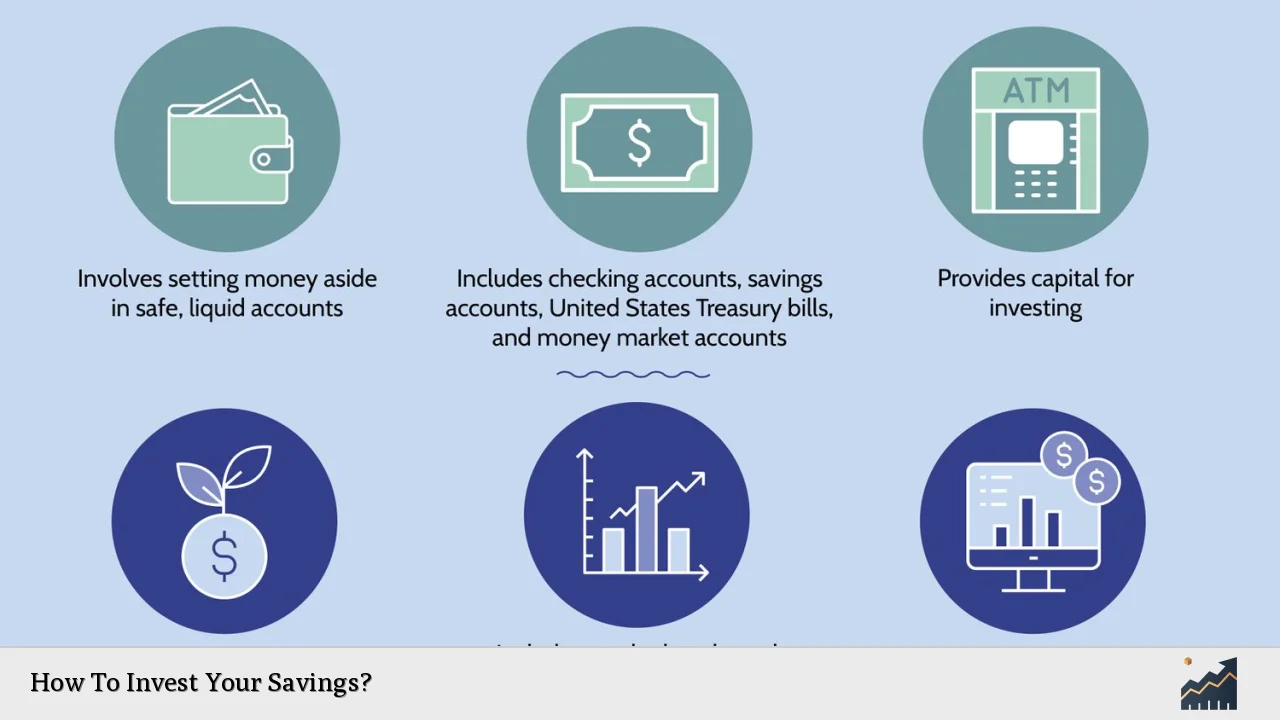

Before diving into investment strategies, it’s important to understand the difference between saving and investing. Saving typically involves putting money into a secure account where it earns minimal interest, while investing involves purchasing assets like stocks, bonds, or real estate with the potential for higher returns.

Savings are generally used for short-term goals or emergencies. It is advisable to maintain an emergency fund that covers three to six months of living expenses. This fund ensures that you have liquidity for unforeseen circumstances without needing to liquidate investments at a potential loss.

On the other hand, investing is aimed at long-term growth and wealth accumulation. Investments can fluctuate in value and come with varying degrees of risk. Understanding your financial goals and risk tolerance is crucial before deciding how much of your savings to invest.

Setting Financial Goals

Establishing clear financial goals is the first step in determining how to allocate your savings. Goals can be categorized as follows:

- Short-term goals: These might include saving for a vacation or a new car within the next few years.

- Medium-term goals: This could involve saving for a home down payment or funding education.

- Long-term goals: These typically include retirement savings or wealth accumulation for future generations.

Once you have defined your goals, you can create a plan that outlines how much you need to save and invest each month to achieve them. Setting specific targets helps keep you motivated and accountable.

Assessing Your Risk Tolerance

Understanding your risk tolerance is essential when deciding how to invest your savings. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. Factors influencing risk tolerance include:

- Age: Younger investors typically have a higher risk tolerance because they have more time to recover from market downturns.

- Financial situation: Those with stable incomes and fewer financial obligations may be more comfortable taking risks.

- Investment knowledge: Familiarity with different investment types can influence comfort levels with risk.

Once you’ve assessed your risk tolerance, you can choose investments that align with it—whether conservative options like bonds or more aggressive choices like stocks.

Choosing the Right Investment Vehicles

There are several types of investment vehicles available, each with its own characteristics:

- Stocks: Represent ownership in a company and can provide high returns but come with higher volatility.

- Bonds: Debt securities issued by corporations or governments that pay interest over time. Generally considered safer than stocks but offer lower returns.

- Mutual Funds: Pooled investments managed by professionals that allow investors to diversify their portfolios without needing extensive knowledge.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks on exchanges. They often have lower fees than mutual funds.

- Real Estate: Investing in property can provide rental income and potential appreciation but requires significant capital and management effort.

Choosing the right mix of these vehicles depends on your financial goals, timeline, and risk tolerance.

Diversifying Your Portfolio

Diversification is a key strategy in investing that involves spreading your investments across various asset classes to reduce risk. A well-diversified portfolio might include:

- A mix of stocks and bonds

- Investments across different sectors (technology, healthcare, etc.)

- Geographic diversity (domestic vs. international investments)

By diversifying, you minimize the impact of poor performance from any single investment on your overall portfolio. This strategy helps stabilize returns over time.

Automating Your Investments

One effective way to ensure consistent investing is through automation. Setting up automatic transfers from your checking account to your investment accounts can help you stay disciplined in your investment strategy. Here are some automation strategies:

- Automatic contributions to retirement accounts like 401(k)s or IRAs

- Setting up recurring investments in mutual funds or ETFs

- Utilizing robo-advisors that automatically manage and rebalance your portfolio based on your preferences

Automating investments allows you to take advantage of dollar-cost averaging, which reduces the impact of market volatility by spreading out purchases over time.

Monitoring Your Investments

Regularly reviewing your investment portfolio is crucial for ensuring it aligns with your financial goals. You should assess performance at least annually or semi-annually. During these reviews, consider:

- Whether your asset allocation still aligns with your risk tolerance

- The performance of individual investments compared to benchmarks

- Any changes in personal circumstances that may require adjustments to your strategy

If certain investments are underperforming consistently, it may be wise to re-evaluate their place in your portfolio.

Staying Informed About Market Trends

Staying informed about economic conditions and market trends can significantly enhance your investment decisions. Key areas to monitor include:

- Interest rates: Changes can affect bond prices and stock market performance.

- Economic indicators: Metrics like GDP growth, unemployment rates, and inflation provide insight into market health.

- Industry trends: Understanding developments within specific sectors can help identify potential opportunities or risks.

By keeping abreast of these factors, you can make informed decisions about when to buy or sell investments.

Seeking Professional Advice

If you’re unsure about how to invest effectively or feel overwhelmed by choices, consider seeking advice from a financial advisor. A qualified professional can help tailor an investment strategy based on:

- Your financial situation

- Goals

- Risk tolerance

While there may be costs associated with hiring an advisor, their expertise can provide valuable insights and help you avoid costly mistakes.

FAQs About How To Invest Your Savings

- What is the best way to start investing?

The best way to start investing is by setting clear financial goals and determining your risk tolerance. - How much should I invest each month?

A good rule of thumb is to invest at least 10% of your income each month, but this varies based on individual circumstances. - Is it better to save or invest?

It depends on your financial goals; saving is ideal for short-term needs while investing is better for long-term growth. - What types of accounts should I use for investing?

You should consider using retirement accounts like IRAs or 401(k)s as well as brokerage accounts for general investing. - How do I know if my investments are performing well?

You can track performance by comparing returns against relevant benchmarks and reviewing portfolio statements regularly.

Investing wisely requires careful planning, ongoing education, and regular review of strategies. By following these steps and staying informed about market conditions, you can effectively grow your savings into substantial wealth over time.