Investing with J.P. Morgan offers a range of options tailored to various financial goals and investment styles. As one of the largest financial institutions in the world, J.P. Morgan provides services that cater to individual investors, businesses, and institutions. Whether you are new to investing or have experience, J.P. Morgan can help you navigate the investment landscape effectively.

J.P. Morgan offers two primary avenues for investing: Self-Directed Investing and Advisory Services. The Self-Directed Investing option allows you to manage your investments independently, while the Advisory Services provide personalized guidance from financial experts. This flexibility enables investors to choose a path that best suits their needs.

The following table summarizes the key features of investing with J.P. Morgan:

| Investment Option | Description |

|---|---|

| Self-Directed Investing | Manage your own portfolio with access to thousands of investment options. |

| Advisory Services | Work with financial advisors for personalized investment strategies. |

Types of Investment Accounts

J.P. Morgan offers various types of investment accounts to suit different investor profiles and goals. Understanding these accounts is crucial for selecting the right one for your needs.

- Brokerage Accounts: These accounts allow you to buy and sell securities such as stocks, bonds, and mutual funds. You maintain control over your investment decisions and can execute trades online.

- Retirement Accounts: J.P. Morgan provides options like Traditional IRAs and Roth IRAs, which offer tax advantages for retirement savings. These accounts are designed to help you grow your wealth over time while enjoying potential tax benefits.

- Managed Accounts: For those who prefer a hands-off approach, J.P. Morgan offers managed accounts where professional advisors handle your investments based on your risk tolerance and financial goals.

- 529 College Savings Plans: These accounts are specifically designed for education savings, allowing you to invest for future educational expenses while benefiting from tax advantages.

Each account type has its own features, costs, and benefits, so it is essential to evaluate which aligns best with your investment strategy.

Investment Products Available

When investing with J.P. Morgan, you have access to a wide array of investment products that can help diversify your portfolio and meet your financial objectives.

- Stocks: Invest in publicly traded companies across various sectors.

- Exchange-Traded Funds (ETFs): These funds provide exposure to a basket of securities and can be traded like stocks.

- Mutual Funds: Professionally managed portfolios that pool money from multiple investors to invest in various assets.

- Fixed Income Investments: Options such as bonds and certificates of deposit (CDs) that provide steady income over time.

- Options: Financial instruments that give you the right, but not the obligation, to buy or sell an asset at a predetermined price.

Understanding these products is vital as they each serve different purposes within an investment strategy.

Choosing Your Investment Strategy

Selecting an appropriate investment strategy is crucial for achieving your financial goals. Here are some strategies you might consider when investing with J.P. Morgan:

- Growth Investing: Focus on companies expected to grow at an above-average rate compared to their industry or the overall market.

- Value Investing: Look for undervalued stocks that have the potential for appreciation over time.

- Income Investing: Prioritize investments that generate regular income through dividends or interest payments.

- Diversification: Spread investments across various asset classes to reduce risk.

J.P. Morgan provides tools and resources to help you identify which strategy aligns with your risk tolerance and financial objectives.

Working with Financial Advisors

For those seeking personalized guidance, working with a financial advisor at J.P. Morgan can be beneficial. Advisors offer expertise in crafting tailored investment strategies based on individual circumstances and goals.

- Personal Advisors: These advisors work closely with clients to create customized financial plans that reflect their unique needs and objectives.

- Private Client Advisors: For high-net-worth individuals, these advisors offer exclusive services including estate planning and wealth management strategies tailored for affluent clients.

Engaging with an advisor can enhance your investment experience by providing insights into market trends and helping you make informed decisions.

Getting Started with Investing

To begin investing with J.P. Morgan, follow these steps:

1. Determine Your Goals: Clearly define what you want to achieve through investing—whether it’s saving for retirement, funding education, or building wealth.

2. Choose an Account Type: Based on your goals, select the appropriate account type (brokerage, retirement, managed).

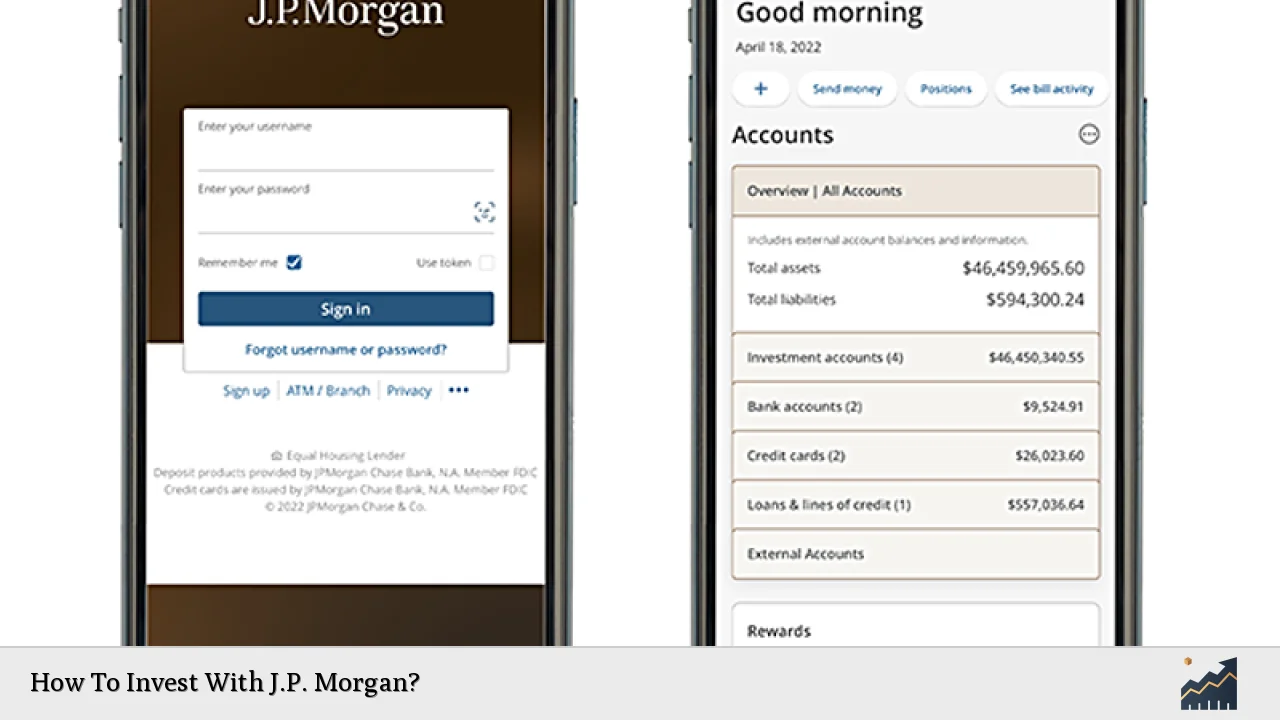

3. Open Your Account: You can easily open an account online through the Chase website or app by providing necessary personal information and funding details.

4. Fund Your Account: Transfer funds from existing accounts or make contributions directly into your new investment account.

5. Select Investments: Research available investment products and choose those that align with your strategy and risk tolerance.

6. Monitor Your Portfolio: Regularly review your investments and adjust as needed based on performance or changes in your financial situation.

By following these steps, you can effectively start your investment journey with J.P. Morgan.

Understanding Fees and Costs

Investing involves costs that can impact overall returns; thus, understanding fees associated with J.P. Morgan’s services is essential:

- Trading Fees: While many trades may be commission-free, certain transactions could incur fees depending on the product type or account structure.

- Advisory Fees: If working with an advisor, be aware of management fees based on assets under management (AUM).

- Expense Ratios: Mutual funds and ETFs often have expense ratios that cover management costs; these are deducted from fund returns.

Carefully review all fee structures before committing to ensure they align with your budget and expected returns.

FAQs About How To Invest With J.P. Morgan

- What types of accounts can I open with J.P. Morgan?

You can open brokerage accounts, retirement accounts like IRAs, managed accounts, and 529 college savings plans. - How do I start investing online?

Open an account on the Chase website or app by providing personal information and funding it. - What investment products does J.P. Morgan offer?

They offer stocks, ETFs, mutual funds, fixed income investments, options, and more. - Can I work with a financial advisor at J.P. Morgan?

Yes, you can choose between personal advisors or private client advisors for tailored guidance. - Are there fees associated with investing at J.P. Morgan?

Yes, there are trading fees, advisory fees based on AUM, and expense ratios for mutual funds/ETFs.

Investing with J.P. Morgan provides a comprehensive platform designed to meet diverse investor needs through self-directed options or personalized advisory services. By understanding account types, available products, strategies for success, and associated costs, investors can make informed decisions that align with their financial goals.