Investing in the Vanguard Total Stock Market Index Fund (VTSAX) is a strategic decision for those looking to gain broad exposure to the U.S. stock market. VTSAX is designed to track the performance of the CRSP U.S. Total Market Index, which encompasses nearly all publicly traded U.S. companies, providing investors with a diversified portfolio that includes small-, mid-, and large-cap stocks. This fund is particularly appealing to both novice and experienced investors due to its low expense ratio and historical performance.

To invest in VTSAX, you need to follow a series of straightforward steps that ensure you are well-prepared for your investment journey. This guide will walk you through the process, from opening an account to making your first investment.

| Step | Description |

|---|---|

| 1 | Open a Vanguard account |

| 2 | Select funding method |

| 3 | Choose account type |

| 4 | Identify investment goals |

| 5 | Make your first investment |

Understanding VTSAX

VTSAX is a mutual fund that allows investors to participate in the overall growth of the U.S. economy by investing in a wide array of companies across various sectors. This fund holds thousands of stocks, which helps mitigate risks associated with individual stock performance.

The minimum investment required for VTSAX is $3,000, making it accessible for many investors. Once this initial amount is met, you can contribute smaller amounts as needed, allowing for flexibility in your investment strategy.

Benefits of Investing in VTSAX

- Broad Diversification: By investing in VTSAX, you gain exposure to nearly the entire U.S. stock market, which reduces the risk associated with investing in single stocks.

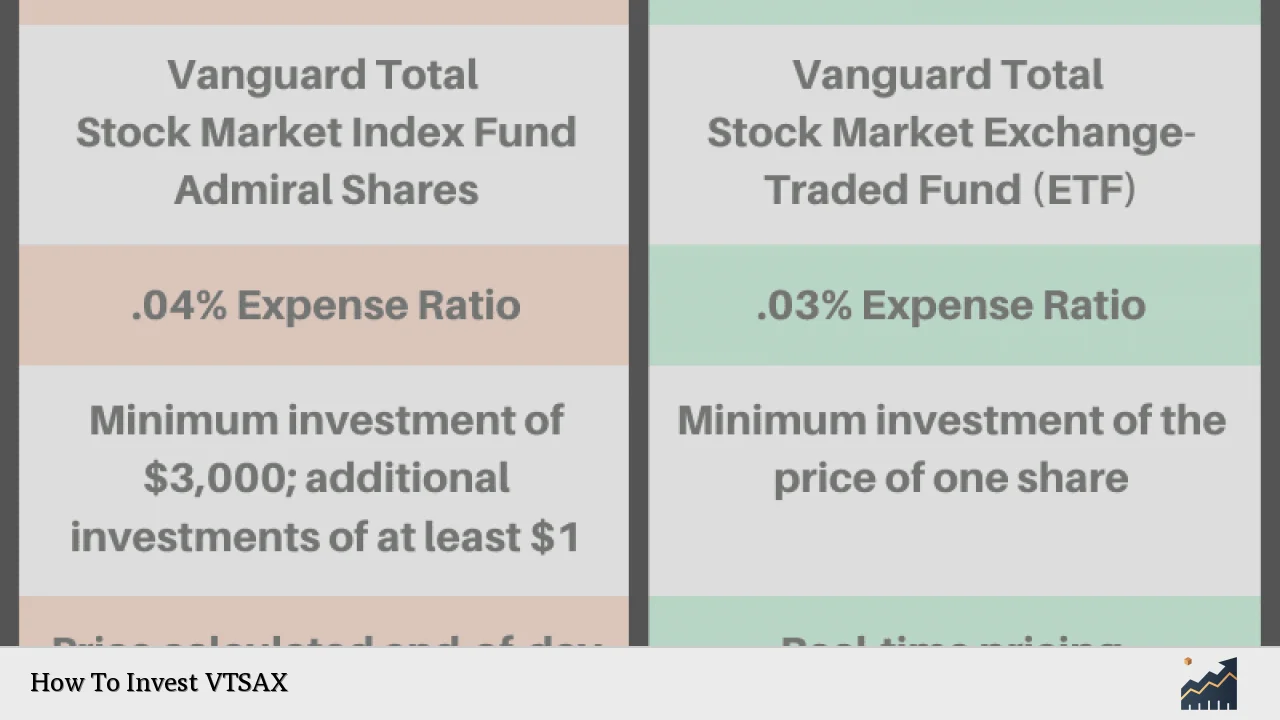

- Low Expense Ratio: VTSAX has an expense ratio of 0.04%, meaning that only a small fraction of your investment goes toward management fees. This is significantly lower than many actively managed funds.

- Historical Performance: Over time, VTSAX has demonstrated strong returns, closely mirroring the performance of the overall market while providing resilience during downturns.

Steps to Invest in VTSAX

Step 1: Open a Vanguard Account

To begin investing in VTSAX, you first need to open an account with Vanguard. Visit their website and navigate to the “Open an Account” section. You will need to provide personal information such as your name, address, Social Security number, and employment details.

Step 2: Select Your Funding Method

Once your account is established, you will need to choose how you want to fund it. The most common method is through an electronic bank transfer from your checking or savings account. This process typically takes a few days for the funds to be available for investment.

Step 3: Choose Your Account Type

Vanguard offers various account types, including individual brokerage accounts, retirement accounts (like IRAs), and joint accounts. Select the type that best fits your financial goals and situation.

Step 4: Identify Your Investment Goals

Before investing, it’s crucial to define your financial objectives. Are you saving for retirement, a major purchase, or simply looking to grow your wealth? Understanding your goals will help guide your investment decisions.

Step 5: Make Your First Investment

After funding your account and identifying your goals, you can proceed to invest in VTSAX. Navigate to the “Buy Funds” section on Vanguard’s website, select VTSAX from the list of funds available, and enter the amount you wish to invest (minimum of $3,000). Confirm your transaction and monitor your investment regularly.

Key Considerations When Investing in VTSAX

Investing in VTSAX requires consideration of several factors that can impact your overall financial strategy.

Risk Tolerance

Understanding your risk tolerance is essential when investing in any mutual fund. While VTSAX offers diversification across many sectors and companies, it is still subject to market volatility. If you are uncomfortable with fluctuations in value or potential losses during market downturns, consider adjusting your investment strategy accordingly.

Investment Horizon

Your investment horizon plays a significant role in determining how much risk you can take on with VTSAX. If you are investing for long-term goals such as retirement that are several decades away, you may be more comfortable with higher volatility compared to someone nearing retirement who may prefer more stable investments.

Dollar-Cost Averaging

One effective strategy when investing in mutual funds like VTSAX is dollar-cost averaging. This involves consistently investing a fixed amount over regular intervals regardless of market conditions. This strategy can help mitigate the impact of market volatility by spreading out your purchase price over time.

Comparative Analysis: VTSAX vs Other Investment Options

When considering investments similar to VTSAX, it’s beneficial to compare it with other options such as exchange-traded funds (ETFs) or actively managed mutual funds.

| Feature | VTSAX |

|---|---|

| Minimum Investment | $3,000 |

| Expense Ratio | 0.04% |

| Diversification Level | High (over 3,500 stocks) |

| Liquidity | Lower (end-of-day trading) |

| Trading Flexibility | Limited (mutual fund) |

VTI (Vanguard Total Stock Market ETF) is another option that mirrors VTSAX but trades like a stock on exchanges throughout the day. It has no minimum investment requirement beyond the share price and offers greater liquidity but may incur trading costs due to bid-ask spreads.

FAQs About How To Invest VTSAX

- What is VTSAX?

VTSAX is a mutual fund that tracks the performance of the CRSP U.S. Total Market Index. - How much do I need to invest initially?

The minimum initial investment for VTSAX is $3,000. - What are the fees associated with VTSAX?

The expense ratio for VTSAX is 0.04%, which is quite low compared to many other funds. - Can I invest in VTSAX through an IRA?

Yes, you can invest in VTSAX through various types of retirement accounts including IRAs. - Is it better to invest in VTI or VTSAX?

This depends on your preference; VTI offers more trading flexibility while VTSAX provides ease of management.

Investing in VTSAX can be a wise choice for those looking for long-term growth through exposure to the entire U.S. stock market while benefiting from low fees and diversified holdings. By following these steps and considering key factors such as risk tolerance and investment horizon, investors can effectively incorporate this fund into their financial strategy.