Investing in a Voluntary Provident Fund (VPF) is an excellent way for salaried employees to enhance their retirement savings. It allows individuals to contribute beyond the mandatory 12% of their basic salary towards their Employee Provident Fund (EPF). The VPF is a government-backed scheme that offers attractive interest rates, tax benefits, and a secure investment option. This article will guide you through the process of investing in VPF, its benefits, and key considerations.

| Feature | Description |

|---|---|

| Eligibility | Salaried employees with an EPF account |

| Maximum Contribution | Up to 100% of basic salary + dearness allowance |

| Interest Rate | 8.25% for FY 2023-24 |

| Tax Benefits | Eligible for tax deduction under Section 80C up to ₹1.5 lakh |

Understanding VPF

The Voluntary Provident Fund (VPF) is an extension of the EPF scheme, specifically designed for salaried employees in India. It allows employees to voluntarily contribute additional funds to their provident fund account over and above the mandatory contribution. The contributions made towards VPF earn the same interest as that of EPF, which is currently 8.25% per annum for the financial year 2023-2024. This makes VPF an attractive option for individuals looking to maximize their retirement savings.

VPF contributions are made from pre-tax income, making it a tax-efficient investment avenue. Under Section 80C of the Income Tax Act, contributions up to ₹1.5 lakh are eligible for tax deductions. Additionally, the interest earned on VPF contributions is tax-free until certain limits are exceeded.

The primary advantage of investing in VPF is its safety and stability. Since it is backed by the government, it provides a reliable investment option with guaranteed returns. This makes it particularly appealing for risk-averse investors who prefer secure long-term savings.

How to Invest in VPF

Investing in VPF involves a straightforward process that requires minimal paperwork. Here are the steps to get started:

- Check Eligibility: Ensure you have an active EPF account, as only salaried employees contributing to EPF can invest in VPF.

- Contact HR or Payroll Department: Inform your HR or payroll team about your intention to invest in VPF. You will need to submit a written request specifying the amount you wish to contribute from your salary.

- Decide on Contribution Amount: You can choose to contribute any amount up to 100% of your basic salary and dearness allowance. Keep in mind that contributions up to ₹1.5 lakh per year qualify for tax deductions under Section 80C.

- Complete Necessary Forms: Fill out the required forms provided by your HR department and submit them along with your request.

- Start Contributions: Once approved, your chosen contribution amount will be automatically deducted from your salary every month.

It’s essential to monitor your contributions and stay informed about any changes in interest rates set by the government, as these can impact your overall returns.

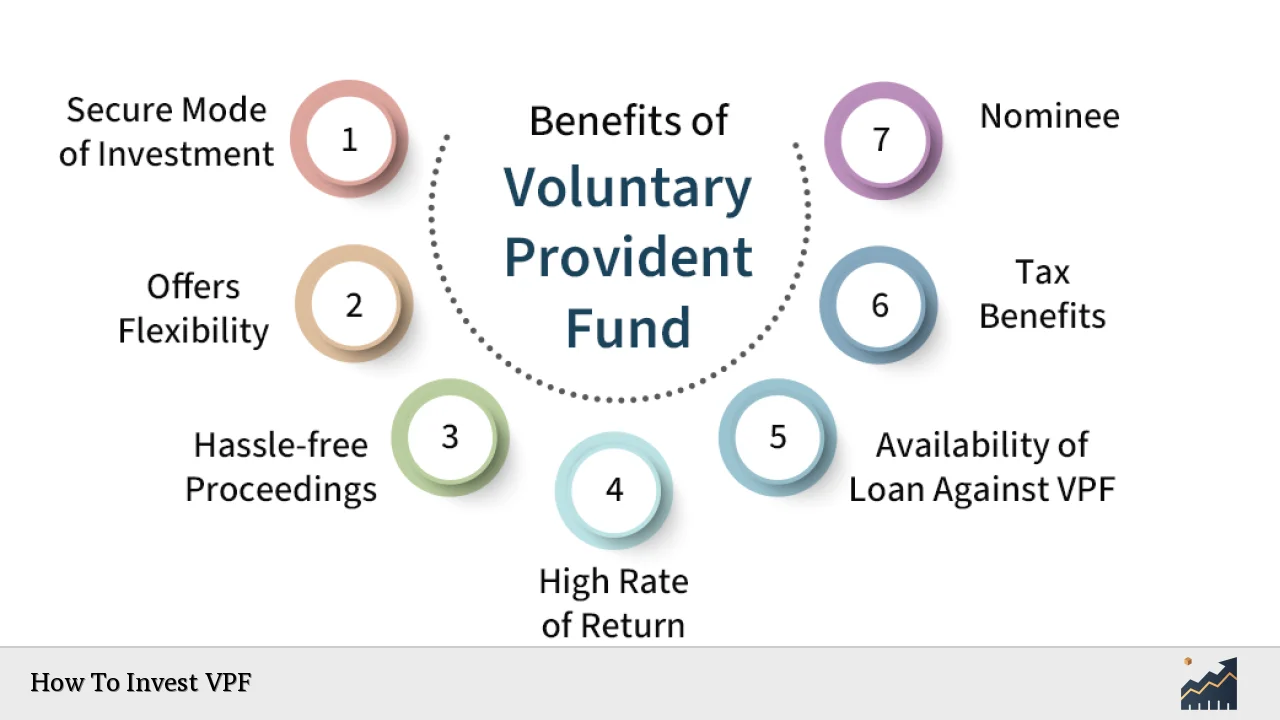

Benefits of Investing in VPF

Investing in VPF offers several significant benefits that make it an attractive option for long-term savings:

- High Interest Rates: The current interest rate on VPF contributions is 8.25%, which is higher than many traditional savings options like fixed deposits or savings accounts.

- Tax Efficiency: Contributions made towards VPF are eligible for tax deductions under Section 80C, allowing you to save on taxes while building your retirement corpus.

- Government Backing: As a government-backed scheme, VPF provides a safe investment avenue with guaranteed returns, reducing market risk exposure.

- Flexibility in Contributions: Employees have the flexibility to decide how much they want to contribute each month, allowing them to tailor their investments according to their financial goals.

- Easy Management: Contributions are automatically deducted from salaries, making it easy for employees to manage their investments without manual intervention.

Key Considerations When Investing in VPF

While investing in VPF has numerous advantages, there are important considerations to keep in mind:

- Lock-in Period: The funds invested in VPF are intended for long-term savings; thus, there is a lock-in period of five years during which withdrawals may be subject to tax implications if taken out early.

- Tax on High Contributions: If your total EPF and VPF contributions exceed ₹2.5 lakh per annum, the interest earned on excess contributions will be taxable as per recent regulations.

- No Employer Contributions: Unlike EPF, where employers also contribute, there are no employer contributions towards VPF. This may affect the overall growth of your retirement corpus compared to EPF.

- Withdrawal Conditions: Withdrawals from VPF can only be made under specific circumstances such as retirement or resignation after five years; early withdrawals may attract taxes.

FAQs About How To Invest VPF

- What is a Voluntary Provident Fund (VPF)?

A VPF is an extension of the EPF scheme that allows salaried employees to voluntarily contribute additional funds towards their retirement savings. - Who can invest in VPF?

Only salaried employees who have an active EPF account can invest in VPF. - What is the maximum contribution allowed for VPF?

You can contribute up to 100% of your basic salary plus dearness allowance. - What are the tax benefits associated with investing in VPF?

Contributions up to ₹1.5 lakh per year are eligible for tax deductions under Section 80C. - Is there a lock-in period for VPF investments?

Yes, there is a lock-in period of five years during which withdrawals may be subject to taxation.

In conclusion, investing in a Voluntary Provident Fund (VPF) presents an excellent opportunity for salaried employees looking to enhance their retirement savings with high interest rates and significant tax benefits. The ease of management and government backing make it a reliable choice for long-term financial planning. By following the outlined steps and considering key factors, individuals can effectively utilize this investment vehicle for securing their financial future.