Investing in a Vanguard Roth IRA is a strategic way to save for retirement while enjoying tax-free growth and withdrawals. A Roth IRA allows you to contribute after-tax income, meaning you won’t pay taxes on your investment gains when you withdraw them in retirement. This makes it an appealing option for many investors, especially those who expect to be in a higher tax bracket later in life.

To get started with a Vanguard Roth IRA, you’ll need to understand the steps involved in opening an account, making contributions, and selecting suitable investments. This guide will walk you through the entire process, ensuring you have the knowledge needed to make informed decisions about your retirement savings.

| Step | Description |

|---|---|

| 1 | Open a Vanguard account |

| 2 | Fund your Roth IRA |

| 3 | Select investments |

Understanding Vanguard Roth IRA

A Vanguard Roth IRA is an individual retirement account that offers significant tax advantages. Contributions are made with after-tax dollars, allowing your investments to grow tax-free. Withdrawals of both contributions and earnings are also tax-free if certain conditions are met, such as being over age 59½ and having the account for at least five years.

The primary appeal of a Roth IRA is its potential for tax-free growth. This means that any dividends or capital gains generated within the account will not be taxed when you withdraw them in retirement. Additionally, unlike traditional IRAs, there are no required minimum distributions (RMDs) during your lifetime, allowing your investments to continue growing.

Opening Your Vanguard Roth IRA

To open a Vanguard Roth IRA, follow these steps:

- Visit the Vanguard website: Go to the official Vanguard site and navigate to the retirement accounts section.

- Select “Open an Account”: Click on the option to open a new account and choose “Roth IRA” as your account type.

- Create an account profile: Fill out your personal information, including your name, Social Security number, and contact details.

- Choose funding options: You can fund your Roth IRA through electronic transfer from a bank account, rollover from another retirement account, or by mailing a check.

- Complete the application: Review your information before submitting it. Once approved, you will receive confirmation via email.

Once your account is set up, you can start contributing funds.

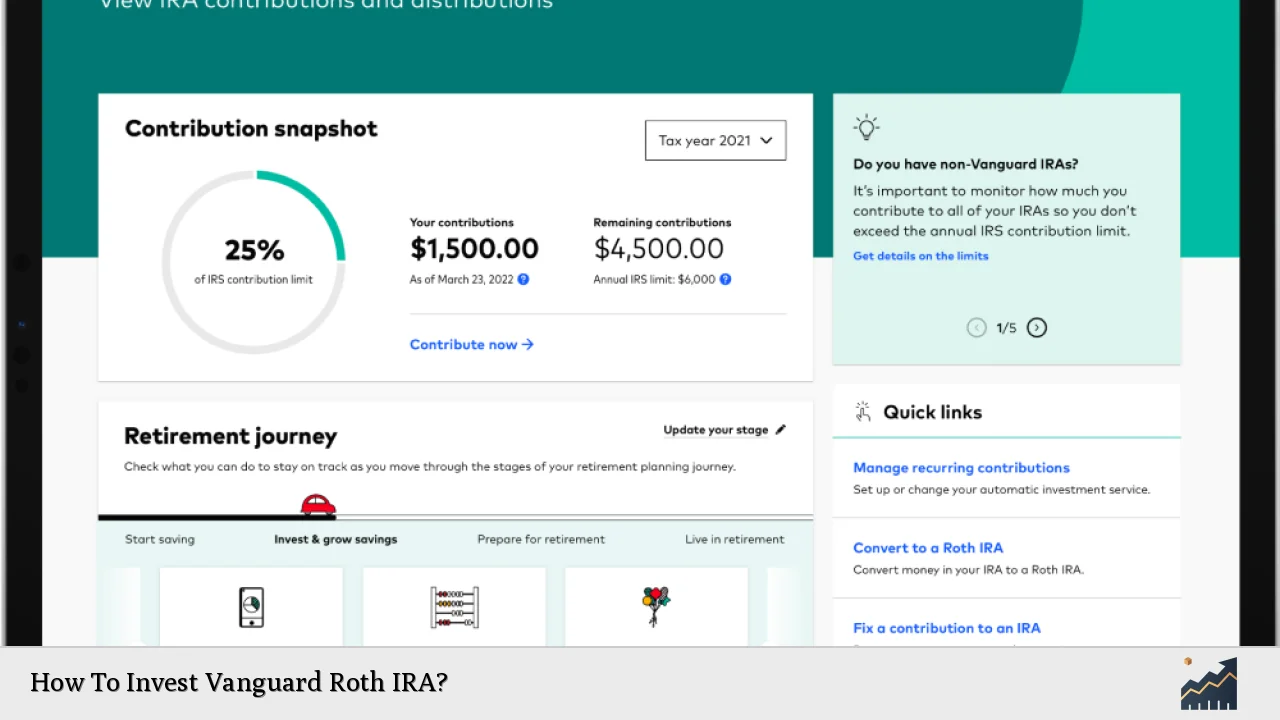

Funding Your Roth IRA

Funding your Vanguard Roth IRA involves making contributions within the annual limits set by the IRS. For 2024, the contribution limit is $7,000 for individuals under age 50 and $8,000 for those aged 50 and older.

To fund your account:

- Link a bank account: Ensure that you have linked your bank account to facilitate transfers.

- Make contributions: You can contribute either as a lump sum or through regular deposits throughout the year.

- Be mindful of income limits: If your modified adjusted gross income (MAGI) exceeds certain thresholds ($146,000 for singles and $230,000 for married couples filing jointly), your ability to contribute directly may be limited.

Selecting Investments

Once your Roth IRA is funded, it’s time to choose how to invest your money. Vanguard offers a wide range of investment options that cater to different risk tolerances and investment goals.

Investment Options

- Vanguard Mutual Funds: These are professionally managed funds that pool money from many investors to purchase securities. They offer diversification across various asset classes.

- Vanguard ETFs: Exchange-traded funds that track specific indexes and can be bought or sold like stocks throughout the trading day.

- Target Retirement Funds: These funds automatically adjust their asset allocation as you approach retirement age. They are ideal for investors who prefer a hands-off approach.

When selecting investments, consider factors such as your risk tolerance, investment horizon, and financial goals. A diversified portfolio typically includes a mix of stocks and bonds to balance risk and return.

Managing Your Investments

After selecting your investments, it’s important to regularly review and manage your portfolio. This includes:

- Monitoring performance: Keep an eye on how your investments are performing relative to market benchmarks.

- Rebalancing: Periodically adjust your asset allocation back to your target levels if certain investments grow faster than others.

- Staying informed: Keep up with market trends and economic indicators that may impact your investments.

Contributing Regularly

To maximize the benefits of your Vanguard Roth IRA, consider making regular contributions throughout the year rather than waiting until the deadline. This strategy allows you to take advantage of dollar-cost averaging, which can reduce the impact of market volatility on your investments.

Tax Considerations

One of the major benefits of a Roth IRA is its favorable tax treatment:

- Contributions are made with after-tax dollars.

- Qualified withdrawals are tax-free after age 59½ and if the account has been open for at least five years.

However, it’s crucial to keep track of contributions and withdrawals to ensure compliance with IRS rules. For instance:

- You can withdraw contributions at any time without penalty.

- Earnings withdrawn before age 59½ may incur taxes and penalties unless certain conditions are met.

FAQs About Investing in Vanguard Roth IRA

- What is a Vanguard Roth IRA?

A Vanguard Roth IRA is a retirement savings account that allows tax-free growth on contributions made with after-tax dollars. - How do I open a Vanguard Roth IRA?

You can open one by visiting the Vanguard website and following their step-by-step application process. - What are the contribution limits for 2024?

The contribution limit is $7,000 for individuals under 50 and $8,000 for those aged 50 or older. - What investment options are available in a Vanguard Roth IRA?

You can invest in mutual funds, ETFs, or target retirement funds tailored to different risk levels. - Can I withdraw my contributions anytime?

Yes, contributions can be withdrawn at any time without penalty; however, earnings may be subject to taxes if withdrawn early.

By following these guidelines on how to invest in a Vanguard Roth IRA effectively, you can take significant steps toward building a secure financial future while enjoying the benefits of tax-free growth on your investments.