The Supplementary Retirement Scheme (SRS) is a voluntary savings program in Singapore designed to encourage individuals to save for retirement while enjoying tax benefits. Contributions to an SRS account can be invested in various financial instruments, allowing account holders to grow their retirement savings significantly. However, understanding how to effectively utilize an SRS account for investment purposes is crucial for maximizing returns and achieving long-term financial goals.

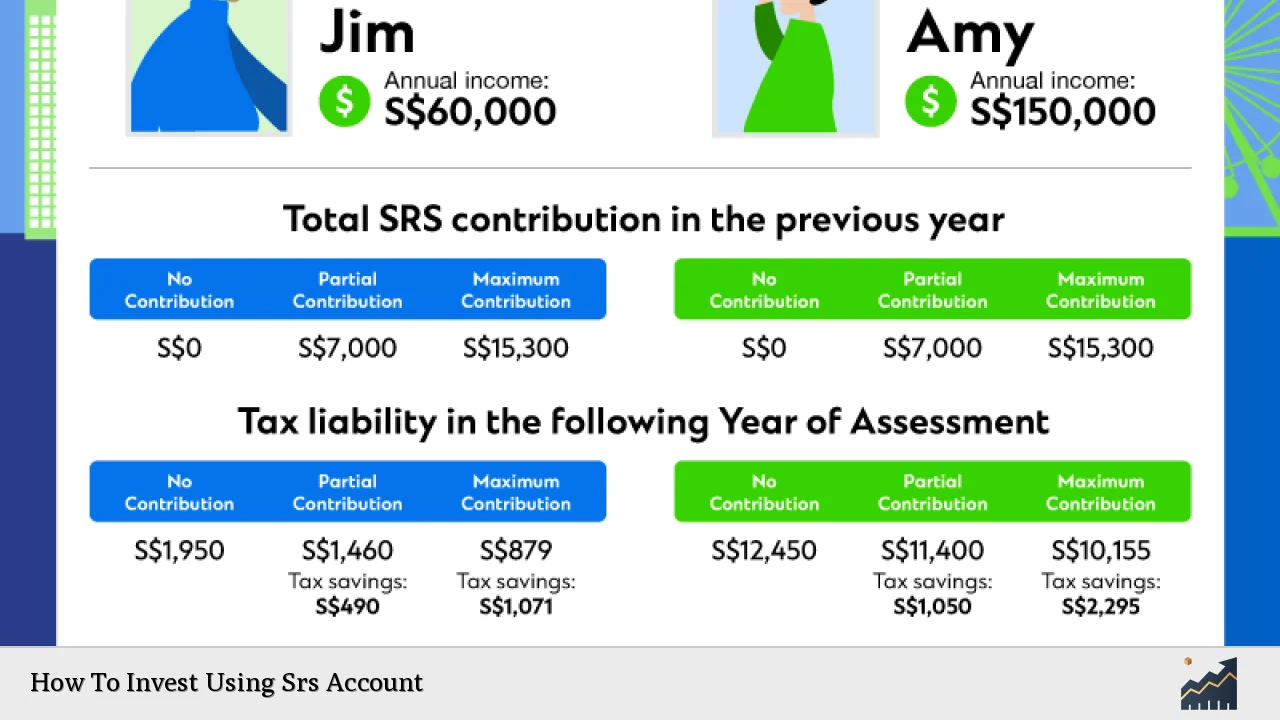

The SRS offers a tax relief of up to $15,300 annually for Singaporeans and Permanent Residents, and $35,700 for foreigners. This tax relief helps lower the taxable income of contributors, making it an attractive option for those in higher tax brackets. However, the interest earned on funds left idle in an SRS account is a mere 0.05% per annum, which is insufficient for long-term growth considering inflation rates. Therefore, investing the funds wisely is essential.

| Key Feature | Description |

|---|---|

| Tax Benefits | Contributions are tax-deductible up to specified limits. |

| Investment Options | Funds can be invested in various approved instruments. |

Understanding the SRS Account

The SRS was introduced to complement the Central Provident Fund (CPF) system by providing additional savings options for retirement. Contributions made to the SRS account can be withdrawn at retirement age or under specific circumstances, such as medical grounds. However, early withdrawals incur penalties and taxes.

Important info: The statutory retirement age affects when you can access your funds without penalties. As of now, individuals can start withdrawing at age 62.

The main advantages of the SRS include:

- Tax Relief: Contributions reduce your taxable income.

- Investment Flexibility: A wide range of investment options is available.

- Tax-Free Growth: Investment gains within the SRS are tax-free until withdrawal.

However, there are restrictions on certain investments. For instance, direct property investments are not allowed.

Investment Options Available with SRS

Investing through an SRS account opens up various avenues that can enhance your retirement savings. Here are some popular investment options:

- Stocks: You can invest in shares listed on the Singapore Exchange (SGX). This includes blue-chip stocks known for stability and dividends.

- Real Estate Investment Trusts (REITs): These allow you to invest in real estate without directly purchasing property and offer potential dividends.

- Unit Trusts: Professionally managed funds that pool money from multiple investors to invest in a diversified portfolio.

- Exchange-Traded Funds (ETFs): Similar to unit trusts but traded on stock exchanges like individual stocks.

- Bonds: Government securities and corporate bonds provide fixed returns over time.

- Fixed Deposits: While low-risk, they offer minimal returns compared to other investment options.

- Insurance Products: Single-premium endowment plans that provide both insurance coverage and investment returns.

Each investment type comes with its own risk and return profile, so it’s essential to assess your risk tolerance before making decisions.

Strategies for Investing Your SRS Funds

To maximize the potential of your SRS investments, consider these strategies:

Diversification

Diversifying your investments across different asset classes helps mitigate risks. Instead of putting all your funds into one type of investment, spread them across stocks, bonds, and other instruments. This reduces the impact of poor performance from any single investment on your overall portfolio.

Long-Term Focus

Since SRS funds are meant for retirement savings, adopting a long-term investment strategy is advisable. This approach allows you to benefit from compounding returns over time. Investing in growth-oriented assets like stocks or ETFs can yield higher returns compared to fixed deposits or cash holdings.

Dollar-Cost Averaging

Implementing a dollar-cost averaging strategy involves regularly investing a fixed amount into your chosen assets regardless of market conditions. This method reduces the impact of volatility and helps build wealth over time without trying to time the market.

Utilize Robo-Advisors

Robo-advisors like Endowus or StashAway offer automated investment services tailored for SRS accounts. They create diversified portfolios based on your risk profile and investment goals, making it easier for you to manage your investments without needing extensive market knowledge.

Rebalance Regularly

Regularly reviewing and rebalancing your portfolio ensures that it aligns with your financial goals and risk tolerance. As certain investments perform better than others, you may need to adjust your allocations periodically to maintain your desired level of risk.

Tax Implications of Investing with SRS

Understanding the tax implications associated with SRS investments is crucial:

- Investment Gains: Gains within the SRS are not taxed until withdrawal.

- Withdrawals: Only 50% of withdrawals after reaching statutory retirement age are subject to income tax. However, if you withdraw before this age, you will incur a 5% penalty plus full taxation on the amount withdrawn.

- Dividends and Interest: Generally, dividends from shares or unit trusts held in an SRS account are not taxed until withdrawal.

It’s important to plan withdrawals strategically during retirement years to minimize tax liabilities effectively.

Common Mistakes When Investing with SRS

Many investors make common mistakes that can hinder their ability to maximize their SRS accounts:

- Neglecting Diversification: Failing to diversify investments increases risk exposure significantly.

- Short-Term Focus: Treating SRS as a short-term savings account instead of a long-term investment vehicle can lead to missed opportunities for growth.

- Ignoring Fees: High management fees associated with certain investment products can erode returns over time. Always consider cost-effective options like ETFs or robo-advisors that offer lower fees.

- Overlooking Risk Tolerance: Investing aggressively without understanding personal risk tolerance can lead to significant losses during market downturns.

By being aware of these pitfalls, investors can make more informed decisions regarding their SRS accounts.

FAQs About How To Invest Using Srs Account

- What is an SRS account?

An SRS account is a voluntary savings scheme in Singapore that allows individuals to save for retirement while enjoying tax benefits. - What can I invest in using my SRS funds?

You can invest in stocks, REITs, unit trusts, ETFs, bonds, fixed deposits, and certain insurance products. - Are there any penalties for withdrawing from my SRS account early?

Yes, early withdrawals incur a 5% penalty plus full taxation on the amount withdrawn. - How does dollar-cost averaging work with my SRS investments?

Dollar-cost averaging involves regularly investing a fixed amount into chosen assets regardless of market conditions. - Can I use robo-advisors for my SRS investments?

Yes, several robo-advisors offer services tailored specifically for managing SRS accounts.

Investing using an SRS account provides significant opportunities for individuals looking to enhance their retirement savings while benefiting from tax reliefs. By understanding the various investment options available and implementing effective strategies, you can maximize your contributions and secure a comfortable financial future during retirement.