Fidelity Investments is a leading brokerage firm that offers a wide range of investment options and tools for both novice and experienced investors. Whether you’re looking to start investing for the first time or expand your existing portfolio, Fidelity provides a user-friendly platform to help you achieve your financial goals. In this comprehensive guide, we’ll walk you through the process of investing using Fidelity, from opening an account to choosing investments and managing your portfolio.

Fidelity offers various account types to suit different investment needs, including individual brokerage accounts, retirement accounts like IRAs, and specialized accounts for education savings. The platform provides access to a diverse range of investment products, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. With its robust research tools and educational resources, Fidelity empowers investors to make informed decisions and build a portfolio tailored to their specific objectives.

| Feature | Description |

|---|---|

| Account Types | Brokerage, IRA, 401(k), 529 plans |

| Investment Options | Stocks, bonds, mutual funds, ETFs |

| Minimum Investment | $0 for most accounts |

| Trading Fees | $0 for stocks and ETFs |

Opening a Fidelity Account

The first step in investing with Fidelity is to open an account. The process is straightforward and can be completed entirely online. Here’s how to get started:

1. Visit the Fidelity website and click on “Open an Account” in the top right corner.

2. Choose the type of account you want to open (e.g., individual brokerage, IRA, joint account).

3. Provide your personal information, including your name, address, Social Security number, and employment details.

4. Set up your login credentials and security questions.

5. Review and accept the account agreements and disclosures.

6. Fund your account by linking a bank account or transferring funds from another investment account.

It’s important to note that Fidelity has no minimum deposit requirement for most of its accounts, making it accessible to investors with varying budgets. Once your account is open and funded, you can start exploring Fidelity’s investment options and tools.

Choosing Your Investments

Fidelity offers a wide array of investment options to suit different risk tolerances and financial goals. Here are some popular choices:

- Individual stocks: Buy shares in specific companies you believe will perform well.

- Exchange-Traded Funds (ETFs): Invest in a diversified basket of securities that trade like stocks.

- Mutual funds: Pool your money with other investors to invest in a professionally managed portfolio.

- Bonds: Lend money to governments or corporations in exchange for regular interest payments.

- Options: Advanced traders can use options contracts for various investment strategies.

To help you choose investments, Fidelity provides extensive research tools and educational resources. These include:

- Stock screeners to filter stocks based on specific criteria

- Analyst reports and recommendations

- Real-time market news and analysis

- Educational articles and videos on various investment topics

Using Fidelity’s Research Tools

Fidelity’s research platform is a powerful resource for investors. To access it:

1. Log into your Fidelity account.

2. Navigate to the “News & Research” tab.

3. Use the search bar to look up specific stocks or funds.

4. Explore different sections like “Stocks,” “ETFs,” or “Mutual Funds” for in-depth analysis.

Building Your Portfolio

Once you’ve chosen your investments, it’s time to build your portfolio. Fidelity offers several tools to help you construct a well-balanced investment mix:

- Portfolio Builder: This tool helps you create a diversified portfolio based on your risk tolerance and investment goals.

- Model Portfolios: Explore pre-built portfolios designed by Fidelity’s experts for different investment objectives.

- Fidelity Go: A robo-advisor service that manages your investments for you based on your goals and risk tolerance.

When building your portfolio, consider the following principles:

- Diversification: Spread your investments across different asset classes to manage risk.

- Asset allocation: Determine the right mix of stocks, bonds, and other securities based on your risk tolerance and time horizon.

- Regular rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation.

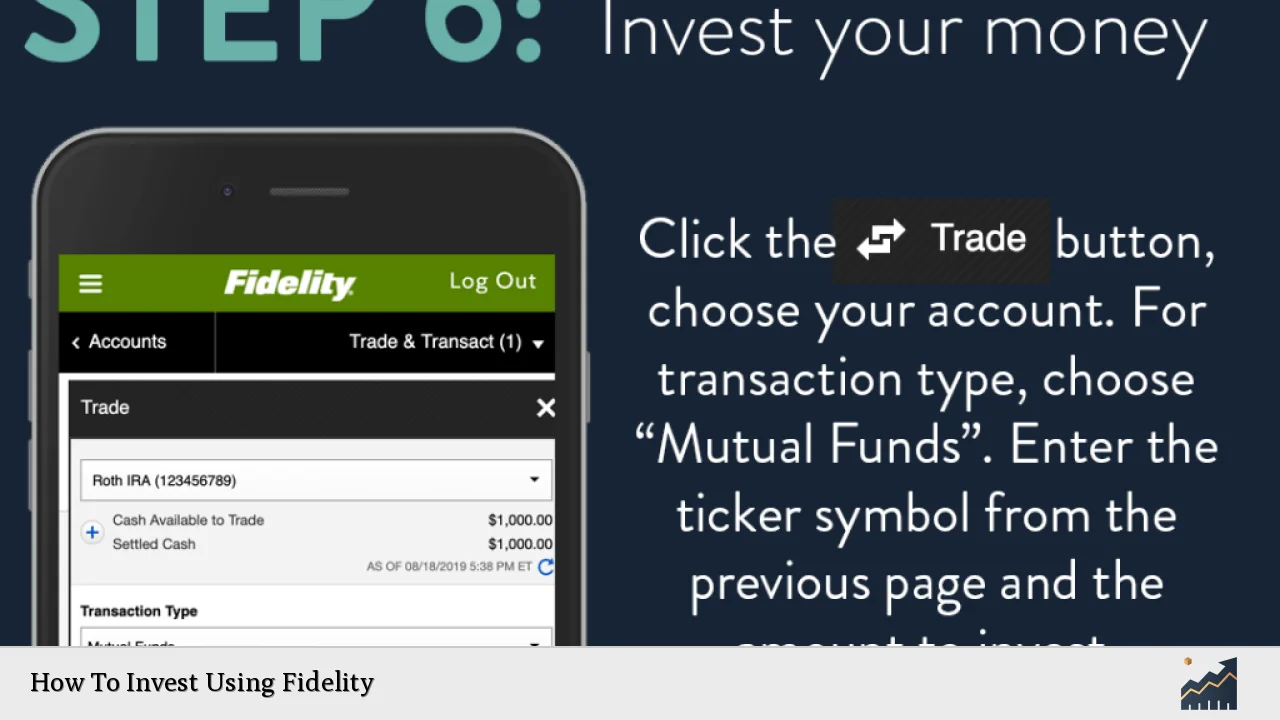

Placing Trades on Fidelity

Once you’ve decided on your investments, placing trades on Fidelity is a straightforward process:

1. Log into your Fidelity account.

2. Click on “Trade” in the top navigation menu.

3. Select the type of security you want to trade (e.g., stocks, ETFs, mutual funds).

4. Enter the symbol of the security you wish to buy or sell.

5. Specify the number of shares or dollar amount you want to invest.

6. Choose your order type (e.g., market order, limit order).

7. Review and confirm your trade.

Fidelity offers commission-free trading for stocks, ETFs, and options, making it cost-effective for frequent traders and long-term investors alike.

Managing Your Fidelity Portfolio

Effective portfolio management is crucial for long-term investment success. Fidelity provides several tools to help you monitor and manage your investments:

- Portfolio Analysis: Get a detailed breakdown of your asset allocation, performance, and potential risk factors.

- Watchlists: Create custom lists to track specific securities or sectors of interest.

- Alerts: Set up notifications for price movements, news, or other events related to your investments.

- Mobile App: Access your account, place trades, and monitor your portfolio on-the-go with Fidelity’s mobile app.

Regular Portfolio Review

It’s important to regularly review your portfolio to ensure it remains aligned with your investment goals. Consider the following steps:

1. Assess your asset allocation and rebalance if necessary.

2. Review the performance of individual investments.

3. Consider tax implications of any potential trades or rebalancing.

4. Adjust your strategy based on changes in your financial situation or goals.

Advanced Features for Experienced Investors

For more experienced investors, Fidelity offers advanced tools and features:

- Active Trader Pro: A powerful desktop platform for active traders with real-time analytics and advanced charting tools.

- Options trading: Access to complex options strategies and analysis tools.

- Margin trading: Borrow money from Fidelity to increase your buying power (use with caution).

- International trading: Invest in foreign markets and currencies.

These features allow sophisticated investors to implement more complex strategies and access a broader range of investment opportunities.

FAQs About How To Invest Using Fidelity

- What is the minimum amount required to start investing with Fidelity?

There is no minimum amount required to open most Fidelity accounts or start investing in many of their products. - Can I invest in fractional shares on Fidelity?

Yes, Fidelity offers fractional share investing, allowing you to buy portions of stocks with as little as $1. - Does Fidelity offer automatic investment plans?

Yes, you can set up automatic investments for stocks, ETFs, and mutual funds on a recurring basis. - How does Fidelity’s robo-advisor service work?

Fidelity Go is a robo-advisor that creates and manages a diversified portfolio based on your goals and risk tolerance. - What educational resources does Fidelity provide for new investors?

Fidelity offers a wide range of educational articles, videos, webinars, and interactive tools to help investors learn about investing.

Investing with Fidelity provides access to a comprehensive platform with a wide range of investment options, powerful research tools, and educational resources. Whether you’re a beginner or an experienced investor, Fidelity offers the features and support needed to help you achieve your financial goals. By following the steps outlined in this guide and taking advantage of Fidelity’s resources, you can build and manage a portfolio tailored to your unique needs and objectives. Remember to regularly review your investments, stay informed about market trends, and adjust your strategy as needed to ensure long-term success in your investment journey with Fidelity.