Investing through E*TRADE can be an empowering experience for both novice and experienced investors. E*TRADE is an online brokerage that provides a comprehensive platform for buying and selling various financial instruments, including stocks, ETFs, mutual funds, and options. With user-friendly tools and resources, E*TRADE allows investors to manage their portfolios effectively and make informed decisions.

To start investing with E*TRADE, you first need to open an account. This process involves providing personal information, verifying your identity, and linking a bank account for easy fund transfers. Once your account is set up, you can access a wealth of resources, including market data, research tools, and educational content to guide your investment decisions.

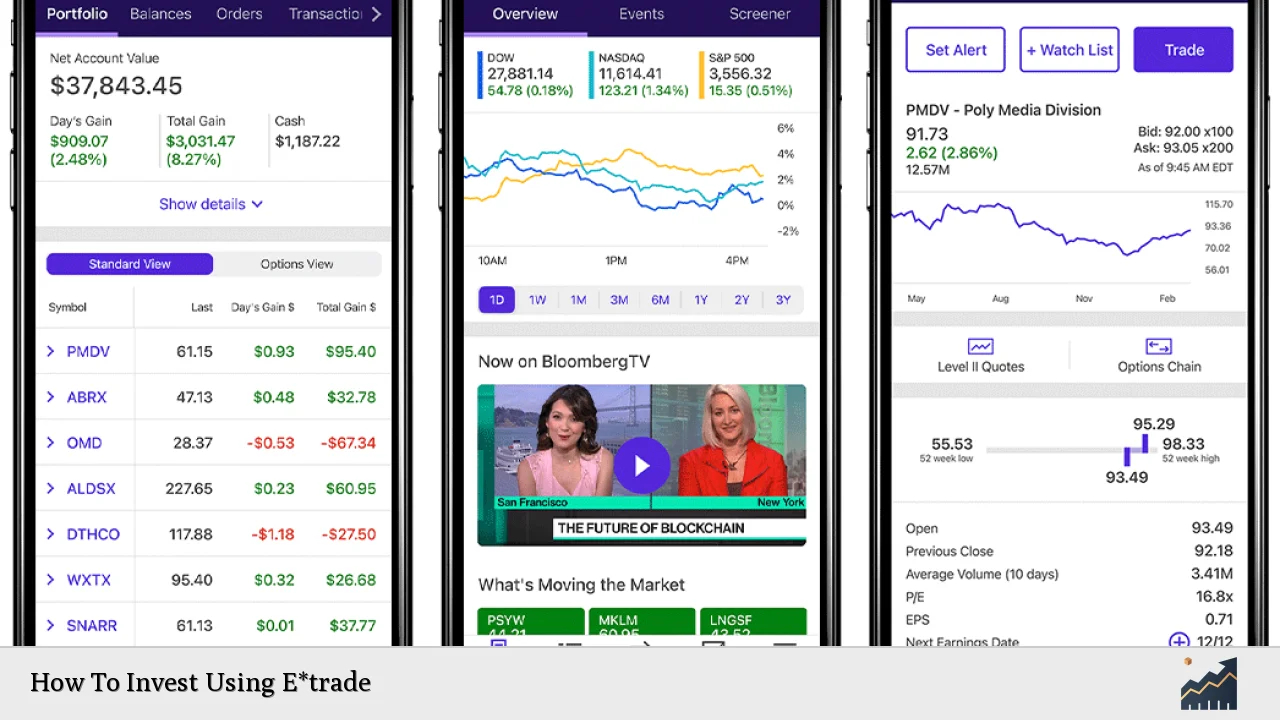

After setting up your account, you can begin exploring the platform’s features. E*TRADE offers a powerful trading interface that allows you to execute trades seamlessly. You can customize your dashboard to prioritize the information most relevant to your investment strategy. Additionally, E*TRADE provides real-time market data and analysis tools that help you stay updated on market trends.

| Step | Description |

|---|---|

| 1 | Open an E*TRADE account by providing personal information. |

| 2 | Fund your account by linking a bank account. |

| 3 | Explore investment options and research tools. |

| 4 | Execute trades using the user-friendly trading interface. |

Opening Your E*TRADE Account

The first step in investing with E*TRADE is to open an account. This process is straightforward and can be completed online. You will need to provide personal information such as your name, address, Social Security number, and employment details. Additionally, you may be required to submit identification documents for verification purposes.

Once you have completed the application form, E*TRADE will review your information. After approval, you will receive confirmation via email. It is essential to ensure that all information provided is accurate to avoid delays in the account setup process.

After your account is approved, the next step is to fund it. You can link an external bank account for easy transfers or deposit funds via wire transfer or check. Having sufficient funds available is crucial for initiating investments on the platform.

Navigating the E*TRADE Platform

E*TRADE offers a user-friendly platform that simplifies the investing process. The main dashboard provides access to various features, including market data, research tools, and trading options.

To navigate effectively:

- Explore Market Data: Use real-time quotes and charts to track stock performance.

- Research Tools: Access in-depth research reports from reputable sources to inform your investment decisions.

- Watchlists: Create custom watchlists to monitor specific stocks or ETFs of interest.

Customizing your dashboard allows you to prioritize essential features according to your preferences. You can add widgets for news updates, performance metrics, or specific stock alerts.

Executing Trades on E*TRADE

Once you’re familiar with the platform’s layout and tools, you can start executing trades. To buy or sell stocks on E*TRADE:

1. Select Your Asset: Use the search bar to find the stock or ETF you wish to trade.

2. Choose Order Type: Decide between market orders (buy/sell at current price) or limit orders (set a specific price).

3. Enter Trade Details: Specify the number of shares or units you want to trade and review the order details carefully.

4. Confirm Transaction: After ensuring all information is correct, confirm the trade.

It’s crucial to monitor your orders after execution to manage any potential changes in market conditions effectively.

Investing Strategies with E*TRADE

Developing a solid investment strategy is vital for long-term success in the stock market. Here are some strategies you can employ using E*TRADE:

- Diversification: Spread investments across various asset classes to reduce risk.

- Dollar-Cost Averaging: Invest a fixed amount regularly regardless of market conditions to minimize impact from volatility.

- Research-Driven Decisions: Utilize E*TRADE’s research tools to analyze potential investments based on fundamental and technical analysis.

- Set Clear Goals: Define what you want to achieve with your investments—whether it’s growth, income generation, or capital preservation.

By implementing these strategies while using E*TRADE’s resources, investors can enhance their chances of achieving their financial objectives.

Monitoring Your Investments

Regularly monitoring your investments is essential for making informed decisions about buying or selling assets. E*TRADE provides several tools for tracking performance:

- Portfolio Overview: View overall performance metrics including gains/losses and asset allocation.

- Alerts and Notifications: Set up alerts for price movements or significant news related to your investments.

- Market Analysis Tools: Use advanced charting features and technical indicators to analyze trends over time.

By staying informed about market changes and adjusting your strategy accordingly, you can better manage risks associated with investing.

Utilizing Educational Resources

E*TRADE offers a wealth of educational resources designed to help investors improve their knowledge and skills:

- Webinars: Attend live sessions covering various topics from basic investing principles to advanced trading strategies.

- Articles & Guides: Access a library of articles that explain different aspects of investing and trading on the platform.

- Videos & Tutorials: Watch instructional videos that demonstrate how to use specific features within the E*TRADE platform effectively.

Taking advantage of these resources can significantly enhance your understanding of investing and help you make more informed decisions in the stock market.

Advanced Trading Features

For more experienced traders looking for advanced functionalities, E*TRADE provides additional features:

- Power E*TRADE Platform: A more sophisticated trading interface offering advanced charting tools and analytics for active traders.

- Options Trading: Access options trading capabilities with comprehensive tools for strategy development and risk management.

- Futures & Forex Trading: Explore opportunities in futures contracts or foreign exchange markets if you’re interested in diversifying further.

These advanced features cater specifically to those who require more robust tools for managing complex trading strategies effectively.

FAQs About How To Invest Using E*trade

- What types of accounts can I open with E*TRADE?

You can open individual brokerage accounts, retirement accounts (like IRAs), custodial accounts for minors, and more. - Are there any fees associated with trading on E*TRADE?

E*TRADE typically charges no commission on stock trades but may have fees for certain services like options trading. - How do I fund my E*TRADE account?

You can fund your account by linking a bank account for transfers or by depositing checks. - Can I trade options on E*TRADE?

Yes, E*TRADE offers options trading along with educational resources tailored for options investors. - Is there a mobile app for trading on E*TRADE?

Yes, E*TRADE has a mobile app that allows users to trade stocks and manage their portfolios on-the-go.

Investing using E*TRADE provides a flexible approach tailored to individual needs. With its comprehensive platform equipped with various tools and resources, investors are well-positioned to navigate the complexities of financial markets confidently.