Investing in US stocks from India has gained significant traction among Indian investors seeking to diversify their portfolios and tap into the growth potential of some of the world’s largest companies. The US stock market is home to renowned corporations like Apple, Google, and Amazon, making it an attractive destination for investment. This guide will explore various methods for investing in US stocks from India, including direct and indirect investment options, regulatory considerations, and practical steps to get started.

Investors can choose between direct investments, where they buy stocks through brokerage accounts, or indirect investments via mutual funds and exchange-traded funds (ETFs). Each method has its advantages and potential risks. Understanding these options is crucial for making informed investment decisions.

| Investment Method | Description |

|---|---|

| Direct Investment | Buying stocks through a brokerage account. |

| Indirect Investment | Investing in mutual funds or ETFs that hold US stocks. |

Understanding Investment Methods

Investing in US stocks from India can be categorized into two primary methods: direct investments and indirect investments. Each method has unique characteristics that cater to different investor preferences and risk appetites.

Direct Investments

Direct investment involves purchasing individual US stocks through a brokerage account. This method provides investors with complete control over their investment choices. To engage in direct investments, Indian investors have two main options:

- Open an Overseas Trading Account with a Domestic Broker: Many Indian brokerage firms have partnerships with foreign brokers, allowing investors to access US markets. Brokers like ICICI Direct and HDFC Securities facilitate this process by providing the necessary infrastructure and support.

- Open an Account with a Foreign Broker: Investors can also choose to open an account directly with US-based brokers such as Charles Schwab or TD Ameritrade. This option allows for direct access to the US stock market but may involve more complex procedures.

Both options require documentation such as a PAN card, proof of address, and sometimes additional financial documents.

Indirect Investments

Indirect investments involve purchasing mutual funds or ETFs that invest in US stocks. This method is suitable for those who prefer a hands-off approach or lack the expertise to select individual stocks. Key benefits include:

- Diversification: Mutual funds and ETFs typically hold a basket of stocks, reducing the risk associated with investing in individual companies.

- Professional Management: These funds are managed by professionals who make investment decisions based on research and market conditions.

Popular options for indirect investments include:

- International Mutual Funds: These funds invest primarily in US equities, providing exposure to large-cap companies.

- US-focused ETFs: ETFs track specific indices or sectors within the US market, offering investors a way to invest in a diversified portfolio at lower costs.

Regulatory Considerations

Before investing in US stocks from India, it is essential to understand the regulatory framework governing such investments. The Reserve Bank of India (RBI) permits Indian residents to invest up to $250,000 per financial year under the Liberalized Remittance Scheme (LRS). This limit encompasses all foreign investments, including stocks, real estate, and other assets.

Additionally, investors must comply with tax regulations in both India and the US. Income earned from US stocks may be subject to taxation in both countries. However, India has a Double Taxation Avoidance Agreement (DTAA) with the United States that helps mitigate the impact of double taxation on Indian investors.

Tax Implications

Investors should be aware of the following tax implications when investing in US stocks:

- Capital Gains Tax: Profits from selling US stocks are subject to capital gains tax in both countries. Long-term capital gains (held for over one year) typically attract lower tax rates compared to short-term gains.

- Dividend Tax: Dividends received from US companies are subject to withholding tax in the US. Indian investors may claim credit for this tax while filing their income tax returns in India.

Understanding these tax implications is crucial for effective financial planning and maximizing returns on investments.

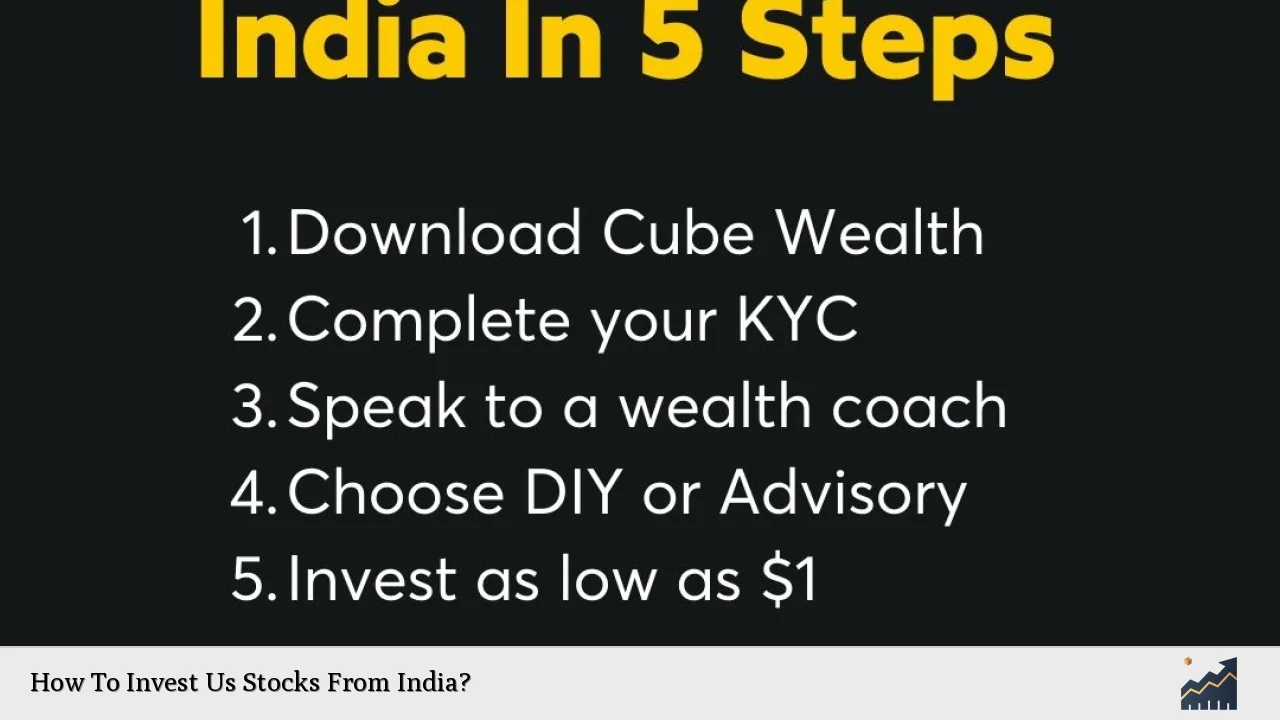

Steps to Start Investing

To begin investing in US stocks from India, follow these practical steps:

1. Research Investment Options: Determine whether you prefer direct or indirect investments based on your financial goals and risk tolerance.

2. Choose a Brokerage Platform: Select a domestic broker with international trading capabilities or open an account with a foreign broker that accepts Indian investors.

3. Complete Required Documentation: Gather necessary documents such as your PAN card, proof of address, bank statements, and any other required financial information.

4. Fund Your Account: Transfer funds into your trading account using authorized remittance channels compliant with RBI regulations.

5. Start Investing: Begin purchasing US stocks or units of mutual funds/ETFs as per your investment strategy.

6. Monitor Your Investments: Regularly review your portfolio performance and stay informed about market trends affecting your investments.

Advantages of Investing in US Stocks

Investing in US stocks offers several advantages for Indian investors:

- Global Diversification: Exposure to international markets helps reduce overall portfolio risk by spreading investments across different economies.

- Access to Leading Companies: The US stock market hosts some of the world’s most successful companies across various sectors, providing opportunities for significant returns.

- Currency Benefits: Returns on investments may be amplified by favorable currency movements if the US dollar appreciates against the Indian rupee.

These benefits make investing in US stocks an attractive option for those looking to enhance their investment portfolios.

Challenges Faced by Investors

Despite the advantages, there are challenges associated with investing in US stocks from India:

- Regulatory Complexity: Navigating regulatory requirements can be daunting for first-time investors unfamiliar with international trading rules.

- Market Volatility: The US stock market can experience significant fluctuations influenced by various factors such as economic data releases and geopolitical events.

- Tax Compliance: Understanding tax obligations in both countries can be complicated but is essential for effective investment management.

By being aware of these challenges and preparing accordingly, investors can mitigate risks associated with international investing.

FAQs About How To Invest Us Stocks From India

- Can I invest directly in US stocks from India?

Yes, you can invest directly by opening an overseas trading account with either a domestic or foreign broker. - What is the maximum amount I can invest under LRS?

You can invest up to $250,000 per financial year under the Liberalized Remittance Scheme. - Are there any tax implications for investing in US stocks?

Yes, you may be subject to capital gains tax and dividend withholding tax in both countries. - Can NRIs also invest in US stocks?

Yes, Non-Resident Indians (NRIs) can invest using their NRE or NRO accounts. - What documents are needed to start investing?

You typically need your PAN card, proof of address, and possibly additional financial documentation.

Investing in US stocks from India presents numerous opportunities for diversification and growth. By understanding the available methods and regulatory requirements, Indian investors can effectively navigate this complex landscape and make informed decisions that align with their financial goals.