Investing through Fidelity offers a range of options tailored to meet various financial goals, whether you are a novice investor or an experienced trader. Fidelity is known for its robust platform, extensive research tools, and diverse investment choices, making it a popular choice among individuals looking to grow their wealth. This guide will walk you through the essential steps to start investing with Fidelity, covering account selection, funding, investment choices, and ongoing management.

| Step | Description |

|---|---|

| 1. Open an Account | Select the appropriate account type based on your investment goals. |

| 2. Fund Your Account | Transfer funds from your bank or other accounts to start investing. |

| 3. Choose Investments | Select from a variety of investment options available on the platform. |

| 4. Monitor and Manage | Regularly review your investments and adjust as necessary. |

Step 1: Open an Account

The first step in investing through Fidelity is to open an account. Fidelity offers several types of accounts tailored to different needs:

- Brokerage Account: Ideal for general investing, allowing you to buy and sell stocks, ETFs, and mutual funds.

- Retirement Accounts: Options include Traditional IRAs, Roth IRAs, and Rollover IRAs for tax-advantaged retirement savings.

- Education Accounts: Such as 529 plans for saving for educational expenses.

- Fidelity Youth Account: Designed for young investors to learn about investing early.

When selecting an account, consider your financial goals and the level of involvement you want in managing your investments. Some accounts require more active management than others.

Step 2: Fund Your Account

Once you have chosen the appropriate account type, the next step is to fund your account. Fidelity makes this process straightforward:

- Link Your Bank Account: You can link your bank account directly to your Fidelity account for easy transfers.

- Electronic Funds Transfer (EFT): This allows you to transfer money electronically from your bank.

- Wire Transfer: For immediate availability of funds, consider using a wire transfer.

- Checks: You can also deposit checks into your Fidelity account.

It’s essential to ensure that you have sufficient funds available in your account before making any investments.

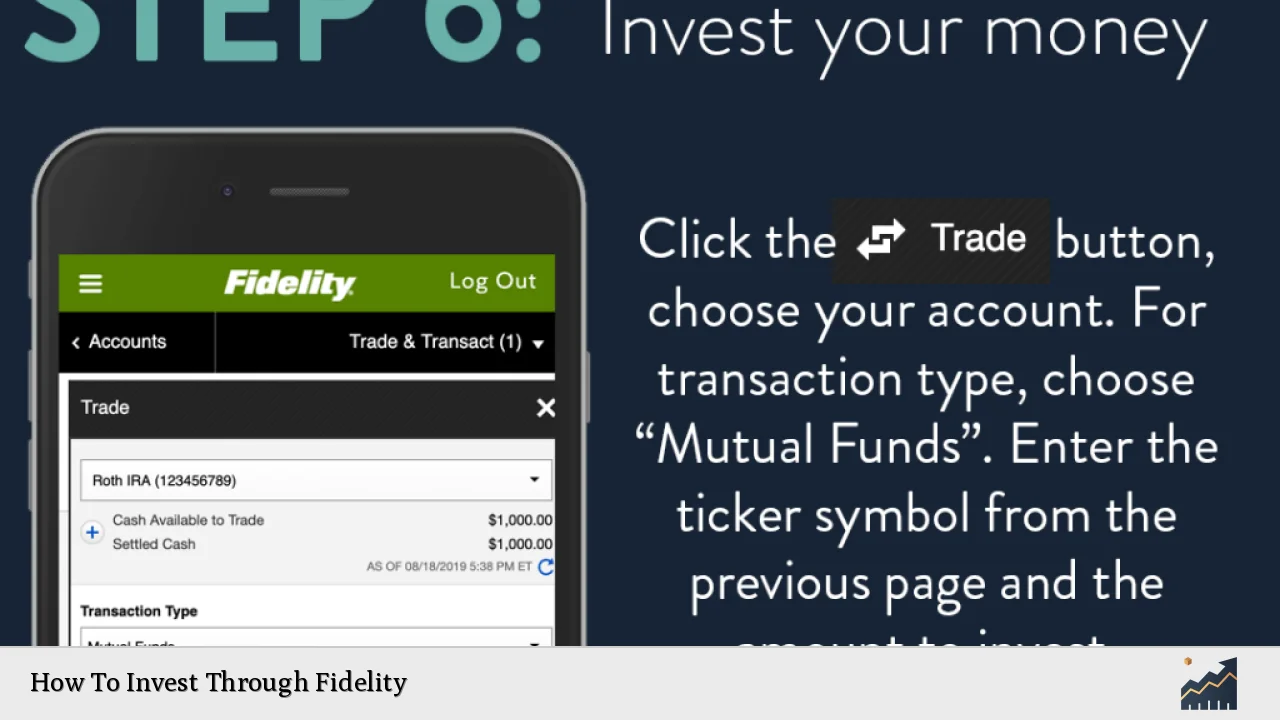

Step 3: Choose Investments

With your account funded, it’s time to choose your investments. Fidelity provides a vast array of investment options:

- Stocks: Invest in individual companies by purchasing shares.

- Exchange-Traded Funds (ETFs): These funds trade like stocks but hold a collection of assets.

- Mutual Funds: Professionally managed funds that pool money from multiple investors.

- Bonds and CDs: For those seeking fixed income investments.

- Options Trading: For more advanced investors looking to leverage their positions.

- Cryptocurrency: Fidelity also allows trading in Bitcoin and Ethereum.

When selecting investments, consider factors such as risk tolerance, investment timeline, and personal financial goals. Research tools provided by Fidelity can help you analyze potential investments effectively.

Step 4: Monitor and Manage Your Investments

Investing is not a one-time action; it requires ongoing attention. Regularly monitor and manage your investments:

- Review Performance: Check how your investments are performing relative to market benchmarks.

- Rebalance Your Portfolio: Adjust your asset allocation based on changing market conditions or personal circumstances.

- Stay Informed: Keep up with market news and trends that may impact your investments.

Fidelity offers various tools and resources to help you stay informed about your portfolio’s performance and make necessary adjustments.

Additional Features of Fidelity Investing

Fidelity provides several features that enhance the investing experience:

Automated Investing

Fidelity allows you to set up automated investments into funds or stocks based on your preferences. This feature helps in building wealth over time without needing constant oversight.

Research Tools

Fidelity’s platform includes industry-leading research tools that provide insights into market trends, stock performance, and investment strategies. These tools can help you make informed decisions about where to allocate your funds.

Customer Support

Fidelity offers robust customer support through various channels including phone support, online chat, and extensive educational resources on their website. This ensures that you have access to assistance whenever needed.

Educational Resources

Fidelity provides a wealth of educational materials designed to help investors understand the complexities of investing. From articles to webinars, these resources can enhance your knowledge and confidence in making investment decisions.

FAQs About Investing Through Fidelity

- What types of accounts can I open with Fidelity?

You can open brokerage accounts, retirement accounts like IRAs, education savings accounts like 529 plans, and youth accounts. - How do I fund my Fidelity account?

You can fund your account via electronic transfer from a linked bank account, wire transfer, or by depositing checks. - What investment options are available at Fidelity?

Fidelity offers stocks, ETFs, mutual funds, bonds, options trading, and cryptocurrency. - Can I automate my investments with Fidelity?

Yes, Fidelity allows for automated investments into selected funds or stocks. - What resources does Fidelity provide for new investors?

Fidelity offers educational resources including articles, webinars, and research tools to help new investors.

Investing through Fidelity is designed to be user-friendly while offering a comprehensive suite of tools and resources for both novice and experienced investors alike. By following these steps—opening an account, funding it appropriately, selecting suitable investments, and actively managing your portfolio—you can effectively work towards achieving your financial goals with confidence.